Exploring Cosmos Staking: A Guide to Staking ATOM

With its vibrant ecosystem of decentralized applications (DApps), the Cosmos blockchain offers a promising venue for investment. Unlike solo staking on Ethereum, which requires a minimum of 32ETH in staked crypto, Cosmos staking is accessible to most investors.

Cosmos, a Delegated-Proof-of-Stake (DPos) blockchain, allows anyone holding ATOM (the native token) to stake on the network.

In this article, we discuss how to stake Cosmos:

- Introduction to Cosmos

- Basic ATOM staking guide

- ATOM staking optimization

- Pros and cons of ATOM staking

Let’s start staking!

What is the Cosmos Network?

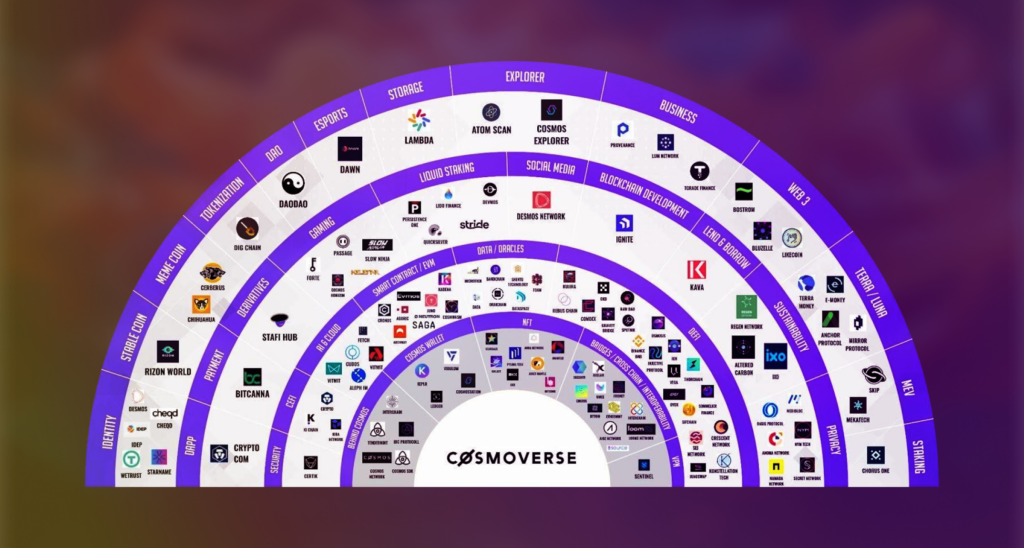

The Cosmos network brands itself as the Internet of Blockchains. It is a decentralized ecosystem of independent blockchains that can interact with each other. It was designed to overcome the limitations of traditional blockchains, such as scalability, usability, and interoperability.

Think of the dozens of email systems.

Your Gmail uses a different code than your Microsoft Outlook. However, they have been made interoperable, allowing users of both email platforms to send and receive emails.

The Cosmos ecosystem contains chains focused on specific use cases, such as wallets, storage applications, and non-fungible tokens (NFTs).

How Does Staking Work on the Cosmos Network?

The Cosmos Hub is designed to connect with other blockchains (zones) using the Inter-Blockchain Communication (IBC) protocol. IBC enables different blockchains to communicate and transfer data and tokens between each other.

The Cosmos Hub relies on a Delegated Proof-of-Stake (DPoS) consensus mechanism to secure the blockchain. You need to get ATOM, the native token, and delegate it to a validator. These validators confirm transactions and add new blocks. One hundred eighty validators secure the network.

By delegating your ATOM to a validator, you help maintain the network’s security and earn a share of its staking rewards.

As of writing, ATOM is the 17th-largest network by staking market capitalization, with $566 million in ATOM staked.

Best ATOM Staking Platforms

There are several platforms where you can stake your ATOM. You can do this through self-custody or custodial methods.

A self-custody method allows you to hold your keys and, ultimately, your crypto. Meanwhile, the custodial method involves depositing your crypto into a platform that controls your assets.

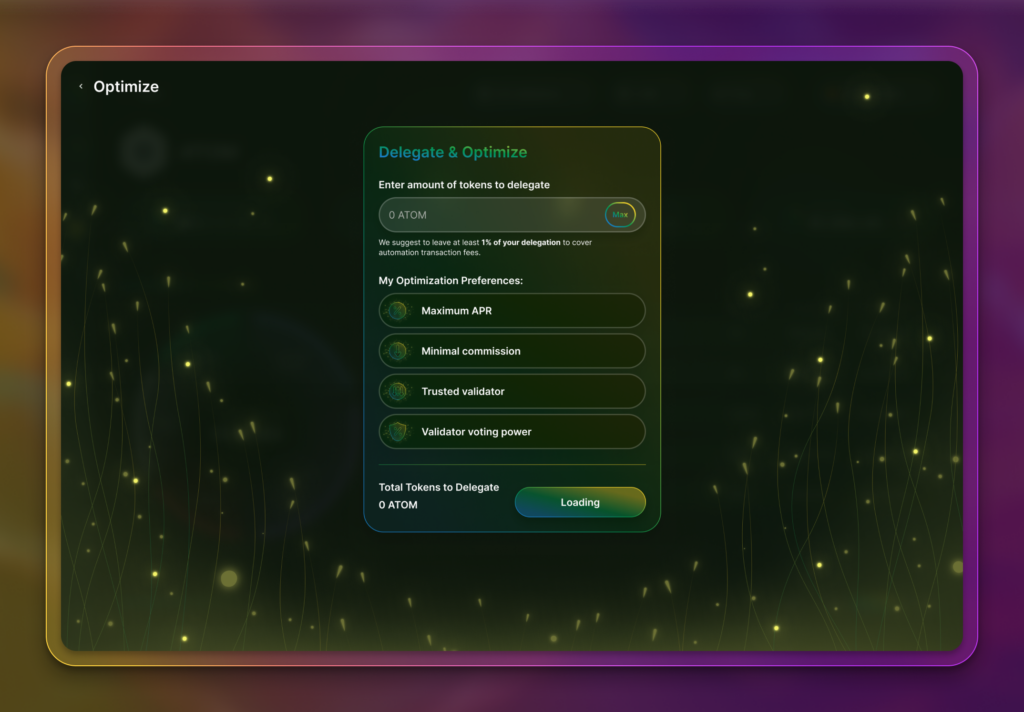

Polli.co – Platform for Cosmos Staking Optimization

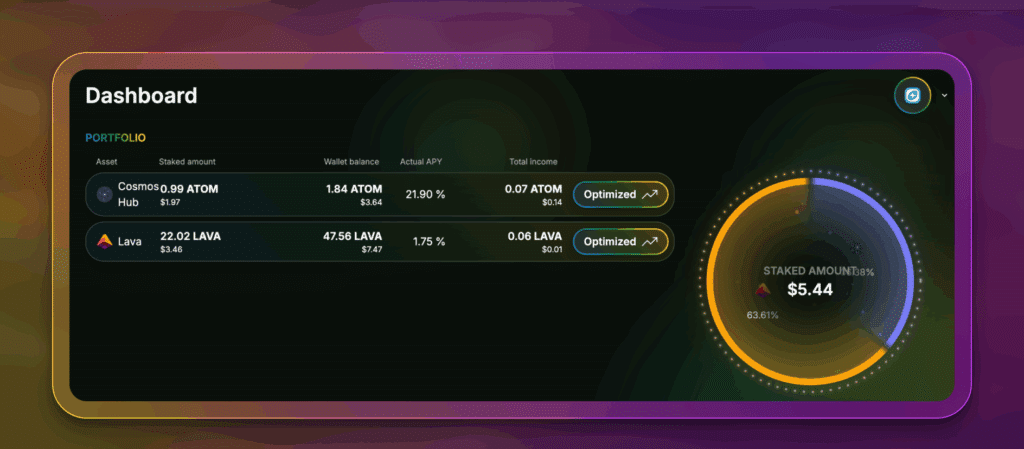

Polli.co is an AI-driven staking optimization platform that promises above-market returns on Cosmos staking. You can automatically compound your staking rewards to increase yield and stake to new validators to avoid slashing.

The platform integrates with Keplr, Leap, and Cosmostation wallets. You can connect to Polli using these wallets and maintain full custody of your tokens.

Polli also supports staking with a Ledger hardware wallet, offering maximum security. Stakers can connect their Ledger to Polli via the Keplr extension.

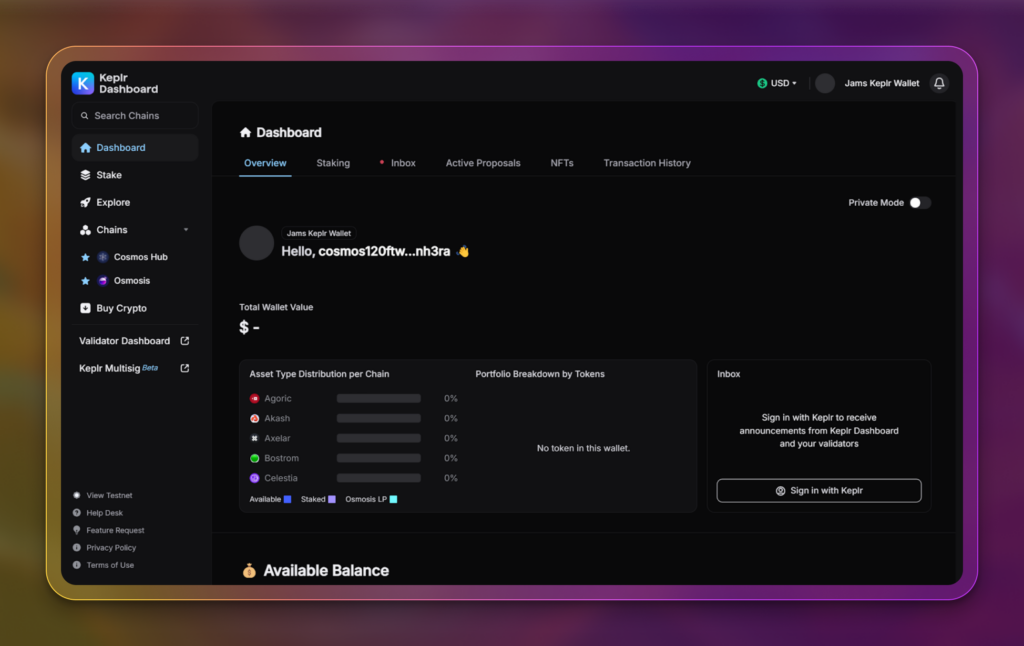

Keplr – Top Wallet for Cosmos Staking

The popular self-custodial wallet supports multiple Cosmos-based assets like Osmosis, Celestia, and Injective, and allows you to stake ATOM directly from the wallet interface. Users may access Keplr via the Android/iOS app or a desktop browser.

Aside from ATOM staking, Keplr supports various features, including voting on governance proposals, sending and receiving crypto, and swapping. One may also explore the various decentralized apps (DApps) within the Cosmos ecosystem.

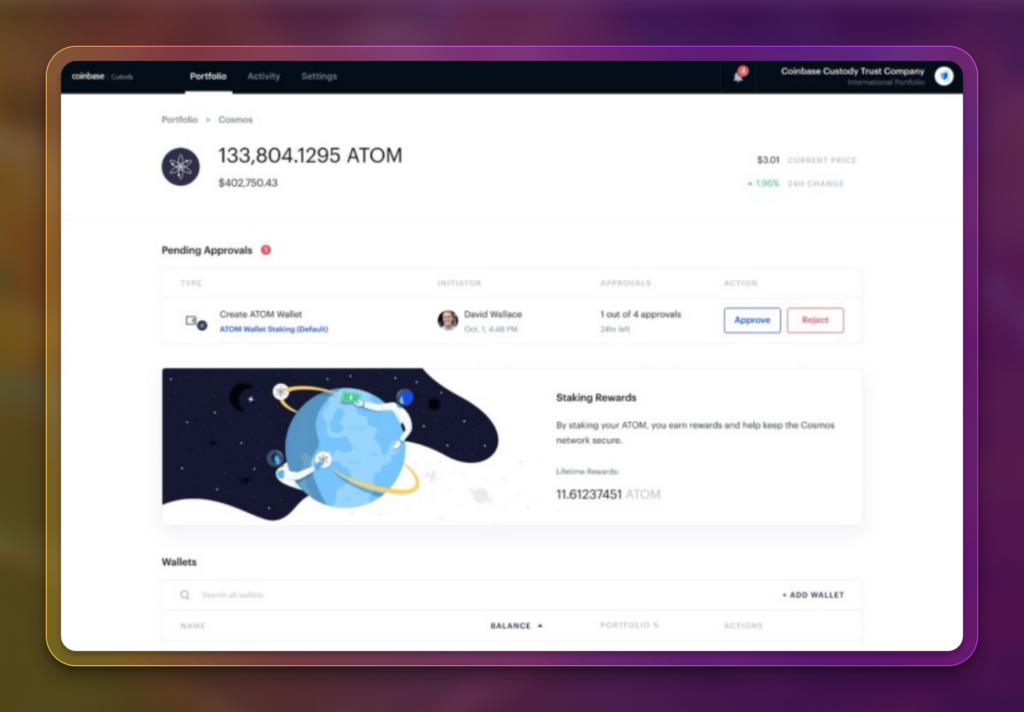

Coinbase – Trusted Centralized Exchange

Coinbase is a centralized cryptocurrency exchange (CEX) recognized for its extensive history and adherence to government regulations. It excels as an all-in-one platform for trading crypto and generating passive income.

The leading American-based CEX incentivizes users to stake ATOM directly from their accounts. The platform’s staking dashboard also enables investors to quickly monitor ATOM staking rewards.

Note that Coinbase takes a 20% commission of staking rewards to help maintain its services.

How to Stake ATOM

Staking ATOM is straightforward.

Unlike solo staking Ethereum, which requires you to set up a computer and learn technical code, you can perform Cosmos staking directly from your smartphone. This simplicity removes the barriers that prevent more people from staking.

Here’s a step-by-step process:

1. Choose a Staking Platform

Decide whether to use a self-custodial wallet like Keplr, an optimization platform like Polli, or a centralized exchange like Coinbase or Kraken. This flexibility allows you to tailor your staking experience to your preferences and needs, empowering you to make the best choice.

Many die-hard crypto participants will tell you, “Not your keys, not your crypto.” However, some people choose to keep their investments on trusted platforms.

You might prefer access to dedicated customer support. In addition, only some people can secure their seed phrases or manage hardware wallets, such as a Ledger.

2. Acquire ATOM

Once you’ve set up your exchange account, you can purchase ATOM on the exchange’s spot market. Depending on where you’re based, you can fund your exchange account through a credit card, debit card, or bank transfer.

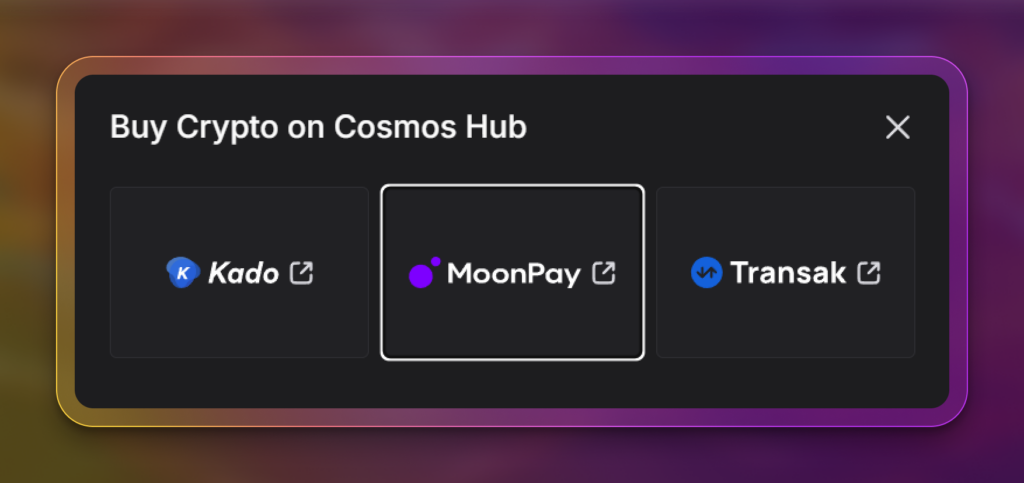

Those opting to use self-custodial wallets can use fiat on-ramp services like MoonPay. This integration can execute crypto purchases directly from the wallet.

3. Delegate Your ATOM

If you’re staking via a centralized exchange, you have no choice but to use the exchange’s validator. On the other hand, if you’re using a wallet like Keplr, you can choose from dozens of validators.

For higher staking rewards, you can connect to Polli.co with Keplr.

4. Monitor Your Staked ATOM

Using the respective platform dashboards, you can quickly check your ATOM rewards and the performance of your chosen validator.

Staking Optimization With Cosmos

Staking your ATOM is just the first time. Cosmos also offers various ways to earn even more from your staked assets.

The extra yield can make a big difference over time, and this potential should motivate you to explore staking optimization strategies.

Maximizing earnings from Cosmos staking involves selecting the proper validator, understanding the staking mechanics, and actively managing your staked tokens.

Here are several methods to help you achieve the best returns:

Choose Validators With High APR

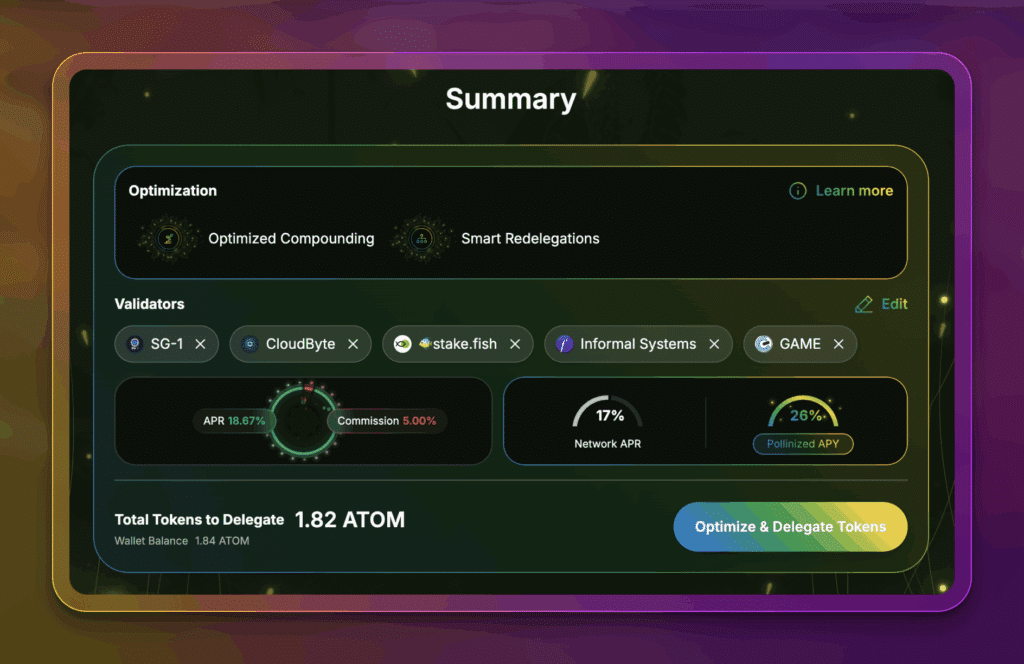

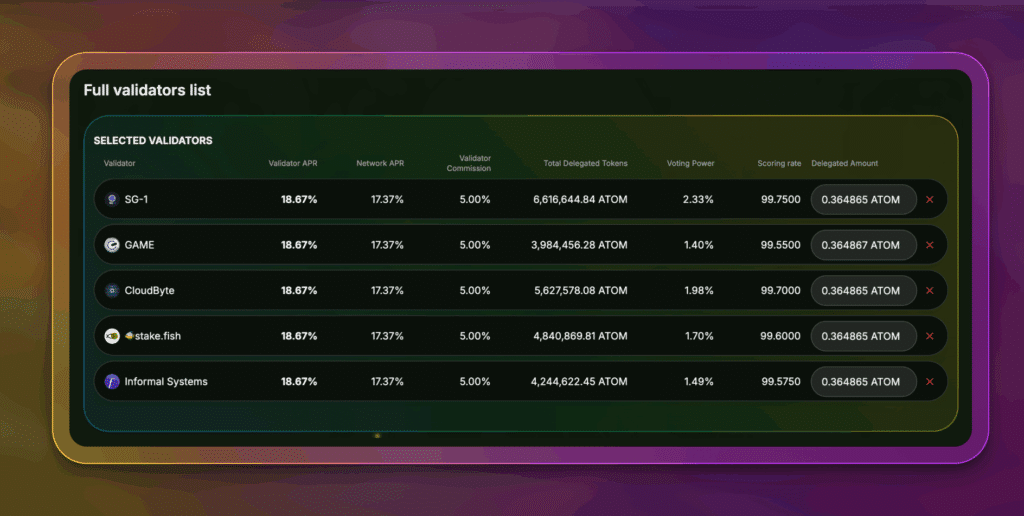

If you’re staking through Polli, the platform automatically chooses the best validators for you. Polli’s proprietary AI Agents optimize validators based on several factors, including Maximum APR and Validator Score, among others.

With Polli, you’re assured to be staking with the best market rates.

Compound Staking Rewards

Reinvesting your rewards compounds staking returns. This process can increase your earnings over time. By compounding your staking rewards, you can take advantage of exponential growth.

As Cosmos staking does not have a cap on ATOM assets, you can choose to keep staking your rewards to compound.

When you stake with Polli, you can choose to opt in to their automatic compound feature.

Commission-less Staking

Cosmos Validators take a percentage fee to help maintain their operations.

Unlike other blockchains, such as Solana, Cosmos does not have commission-free validators. You’ll have to choose ones with minimal commission and a high reputation.

While Polli automatically selects the best validators, you can also manually choose which ones you think are the best. With its full validator view, you can see all validators offering their services.

Aside from Polli, free websites like Mint Scan let you view Cosmos’s top validators and their commission rates and uptime.

Diversify Validators

Consider delegating your ATOM to multiple validators to mitigate the slashing risk, which is the penalty for a validator’s misbehavior, and maximize your staking rewards. This diversification can help spread the risk and improve overall returns.

Given that the minimum required ATOM tokens are negligible, at less than 0.1 ATOM, you should be able to choose more than one validator.

Furthermore, staking optimization platforms like Polli automatically redelegate your stake to avoid penalization.

Stay Informed

Stay updated with the latest developments in Cosmos and the performance of your chosen validators. Being informed allows you to make timely decisions, such as switching validators or taking advantage of unique economic opportunities, such as airdrops.

New blockchains may award their initial tokens to early users and stakers across the Cosmos ecosystem.

Pros and Cons of Staking Cosmos Tokens

Like any other blockchain network, Cosmos staking comes with its rewards and risks. Make sure to take note of the following pros and cons before deploying capital:

Passive Income

Staking ATOM tokens is a potential avenue for passive income. Stakers can earn annual yields that can be more attractive than those from traditional financial instruments. As of writing, stakers can earn over 17% per annum.

Network Security

By staking your ATOM, you contribute to the Cosmos network’s operations. This decentralized approach helps prevent attacks and ensures the integrity of the blockchain.

Market Volatility

The value of ATOM can fluctuate significantly, impacting the overall returns from staking. Therefore, it’s essential to consider market volatility when staking your tokens.

Lock-Up Periods

Some staking platforms may require a lock-up period during which your staked ATOM cannot be withdrawn. This delay can limit your liquidity and flexibility.

Time to Start Staking Cosmos!

Stake your ATOM to earn passive income and help secure the network. Cosmos also has a growing ecosystem of apps that you can explore. You can maximize Cosmos’ opportunities by understanding which platforms provide ATOM staking.

Before deploying any resources, however, study the risks and benefits. The last thing you’d like to happen is to experience losses on your crypto assets and not understand what happened.

To learn more about the overall staking process, visit Solo Stakers.

FAQs about Cosmos Staking

Interested in getting into Cosmos Staking? Read these frequently asked questions and their answers:

Is Cosmos Good for Staking?

Cosmos is one of the oldest crypto projects available. Having been released in 2017, it’s a contemporary of Ethereum, the second-largest cryptocurrency. While you’re assured that the project won’t disappear overnight, this doesn’t guarantee that staking will be profitable for you.

Staking is a hedge against market volatility and a way for you to accumulate more tokens over time. If the ATOM price rises significantly, you’ll make substantial profits. However, if the price drops and outweighs the staking rate, then you’ll lose out.

How Much Can You Make Staking Cosmos?

At the current ATOM staking APY of 17%, if you have 100 ATOM tokens, then after a year of staking without compounding, you’ll earn 17 additional ATOM tokens. Your rewards can compound by staking on platforms like Polli.co.

By staking with Polli, your 100 ATOM tokens would earn 26 ATOM after a year.

That’s the power of staking optimization.

Why is Cosmos Staking So High?

Cosmos staking offers a relatively high APY when compared to Solana staking (6.5% APY) and Ethereum staking (3% APY). The high staking rewards encourage validators and crypto investors to acquire more ATOM instead of other networks’ tokens.

How to Stake Cosmos with Atomic Wallet?

The Atomic Wallet is a non-custodial browser extension and mobile app that allows users to buy, sell, and hold crypto.

The wallet also lets users stake crypto, such as ATOM. Once you’ve acquired ATOM tokens and placed them in your Atomic Wallet, you can click on the asset and stake directly in the wallet.

How Long Do You Have to Stake Cosmos?

While there is no minimum staking period for Cosmos, take note that the unstaking period is 21 days. Also called unbonding, unstaking is the process of disconnecting your assets from the Cosmos validators and network. You will be unable to use your assets during this period, and you will not earn any rewards.

Given the lengthy unbonding period, try to avoid quickly staking and unbonding your assets.

Editor’s Note: This article was originally published in November 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

December 21, 2025

December 28, 2025