The Rise of Crypto Staking Exchange-Traded Funds (ETFs)

Imagine investing in assets like crypto without creating centralized exchange accounts or wallets. That’s what crypto Exchange-Traded Funds, or ETFs, allow you to do.

ETFs represent a basket of assets and combine them into a product that anyone can buy or sell on the stock market.

Since 2021, financial institutions have offered ETFs for major cryptocurrencies such as Bitcoin.

Now, the finance world is waking up with crypto staking ETFs. These new investment products combine the structure of ETFs with crypto staking.

These funds give investors a way to participate in crypto staking without managing private keys, selecting validators, or running technical infrastructure.

In other words, it’s crypto staking, simplified.

What Is an Exchange-Traded Fund?

An Exchange-Traded Fund (ETF) is a regulated financial product that pools investors’ money to purchase assets. These assets can include stocks, bonds, or even digital assets.

Subsequently, the ETFs’ performance reflects that of their underlying assets.

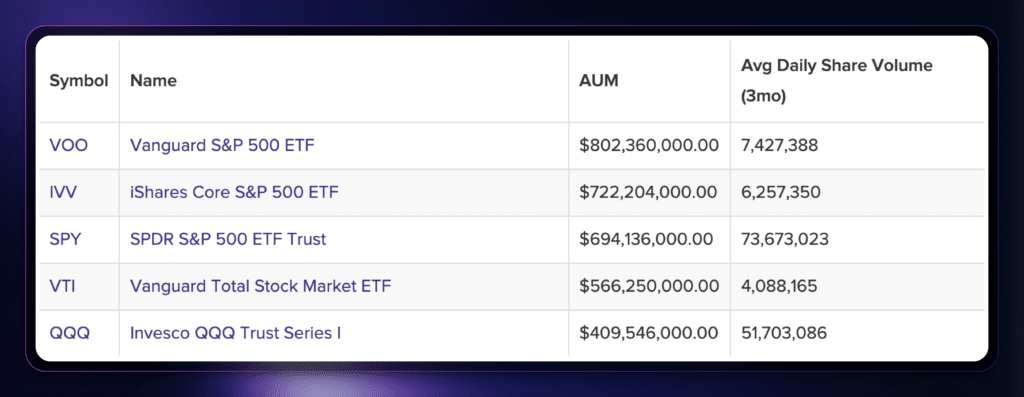

For example, the Vanguard S&P 500 ETF is the world’s largest ETF with over $800 billion in assets under management (AUM). It tracks the S&P 500, which comprises 500 stocks like Nvidia, Apple, and Microsoft, each with different weights.

To individually recreate the S&P 500, you would have to purchase the 500 stocks and manage their weights in your portfolio. With an ETF, you simply have to buy the ETF, and the investment management company handles the rest.

How ETFs Make Investing Easy

ETFs serve several key purposes:

- Diversification: Investors gain exposure to a wide range of assets through a single purchase.

- Liquidity: You can trade ETFs on major stock exchanges like the New York Stock Exchange during market hours.

- Cost efficiency: Fees are often lower than those charged by mutual funds or hedge funds.

- Regulation: In the U.S., the Securities and Exchange Commission (SEC) oversees ETFs.

With crypto ETFs, these same benefits extend to crypto assets.

Crypto Staking ETFs vs. Digital Asset Treasuries (DATs)

You may have heard of digital asset treasury companies (DATs), such as Strategy (formerly MicroStrategy) or Tesla.

A DAT allocates a portion of its corporate treasury reserves into digital currencies such as Bitcoin or Ethereum. They may also deploy their assets for crypto staking.

Investing in crypto could be their primary focus, as in the case of Strategy. For others like Tesla, which operates as an electric vehicle manufacturer, they allocate a portion of their assets to crypto while maintaining regular operations.

DATs may sound like crypto staking ETFs, as both invest in cryptocurrency and participate in crypto staking. However, their structures, goals, and risk profiles differ significantly.

Based on the comparison above, DAT appears riskier than its crypto staking ETF counterpart. However, the upside is greater as well. Investors are willing to bet on the higher potential upside offered by DATs.

Top Crypto Staking ETFs

Crypto staking ETFs are still in their infancy, with the first approved staking ETF appearing in mid-2025.

As of writing, there are only a handful of crypto staking ETFs. However, with institutional appetite growing, we can expect more staking ETFs in the near future.

1. REX-Osprey (SSK)

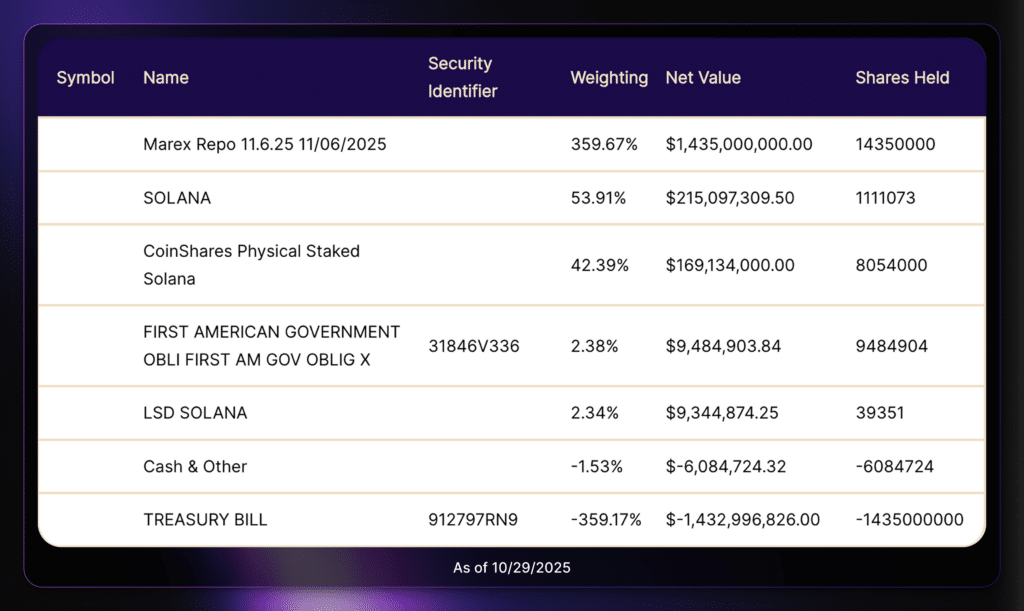

Launched in July 2025, REX-Osprey SOL + Staking ETF (SSK) broke ground as the first U.S.-listed ETF to give investors exposure to Solana (SOL) and its staking rewards. SSK participates in Solana native staking, ensuring that rewards come from Solana’s staking mechanisms.

SSK also invests in other Solana staking ETFs and liquid staking derivatives (LSD) via Jito.

Investors have poured in over $400M since the launch.

2. Grayscale Investments (ETHE and ETH)

In early October 2025, crypto asset manager Grayscale activated staking for its U.S. Ethereum Trust ETF (ETHE) and the Ethereum Mini Trust ETF (ETH).

The crypto community welcomed the news, as Grayscale operates the second-largest Ethereum ETF. ETHE and ETH manage nearly $5 billion in combined assets.

3. Bitwise (BSOL)

Bitwise Solana Staking ETF (BSOL) launched in late October 2025 and has been off to a great start with $220M in AUM.

BSOL is the first U.S.-listed Solana staking spot ETF. Unlike SSK, which invests in other Solana-derivative assets, BSOL is fully allocated to SOL and in native SOL staking.

Pros and Cons of Crypto Staking ETFs

Like any investment, crypto staking ETFs offer both opportunities and trade-offs. Understanding these will help you decide whether such funds fit your portfolio goals and risk tolerance.

Pro #1: Ease of Access

You can gain exposure to cryptocurrency and staking rewards by buying the ETFs on a stock exchange. You don’t have to worry about acquiring crypto or performing self-custody via hardware wallets.

Pro #2: Regulated Environment

ETFs operate within a robust regulatory framework, offering investor protection that self-managed crypto staking cannot guarantee.

Furthermore, through ETFs, you are placing your investments via regulated brokers. Often, acquiring crypto assets requires depositing funds into unregulated centralized crypto exchanges and in decentralized systems with no customer support or investor protection.

Con #1: Reduced Yield

Management fees, while minimal at 0.5% or less, reduce the net staking rewards distributed to ETF holders compared to direct staking.

Con #2: Lower Innovation

Crypto has often been the Wild West when it comes to your potential returns (and losses). Aside from returns, crypto has attracted participants due to the industry’s various innovations.

By investing in an ETF with clearly defined investment rules, you limit your ability to explore crypto activities such as decentralized finance, yield farming, or even restaking.

The Institutionalization of Crypto Staking

The bigger impact of staking ETFs is that it changes how the world views crypto.

Years ago, to perform staking, you had to get comfortable with wallets and validator setups. Now, investment managers package crypto and staking into financial products accessible to any investor with a brokerage account.

The door is open to institutional capital inflows into proof-of-stake and delegated proof-of-stake networks.

If more crypto staking ETFs gain SEC approval, they could:

- Bring new liquidity and legitimacy to staking-based blockchains and tokens.

- Birth a new wave of institutional-grade staking infrastructure.

- Integrate staking rewards into existing non-staking crypto ETFs.

As it stands, all crypto staking ETFs represent a single network and token, like Ethereum or Solana. Over time, staking ETFs could evolve to include multi-asset products, such as traditional ETFs.

These new crypto ETFs would blend staking across Ethereum, Solana, and Cosmos into a single investment vehicle.

Final Thoughts on Crypto Staking ETFs

Crypto staking ETFs represent an essential step in attracting institutional and retail capital into the cryptocurrency market. For years, the crypto industry has cried out for institutions to notice them. Now, the interest and capital have arrived.

As more regulators clarify the rules, more issuers will launch staking-enabled ETFs. Staking could become a mainstream yield category in global finance, much like dividends or bond yield today.

Frequently Asked Questions about Crypto Staking ETFs

What is a Crypto Staking ETF?

A crypto staking ETF invests in cryptocurrencies and stakes them to earn rewards. Investors gain staking exposure without managing tokens or validators themselves.

How is a Crypto Staking ETF Different From Native Staking?

With native staking, you need to purchase your own crypto and stake it on the blockchain. A staking ETF handles everything for you but charges fees and may offer slightly lower yields.

Are Crypto Staking ETFs a Good Investment?

They’re great for convenience and regulated exposure, but they offer slightly lower returns and the same market risks as holding crypto directly.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

October 31, 2025

November 5, 2025