What is Stablecoin Yield Farming: Earning with Stablecoins

Stablecoins are the “safer” corner of the crypto market. These digital assets maintain a stable value pegged to a real-world currency, such as the US dollar or the Euro.

By holding stablecoins, you can weather market downturns or make transactions that don’t fluctuate in value.

But what if you could earn interest on those stablecoins, too?

That’s where stablecoin yield farming comes in. This DeFi strategy offers lower volatility and risk compared to holding traditional crypto tokens.

In this article, we’ll do a deep dive into stablecoins

- What are stablecoins

- How yield farming works

- Where to put your digital dollars to work

- Criteria for selecting stablecoin yield platforms

…and many more.

What are Stablecoins?

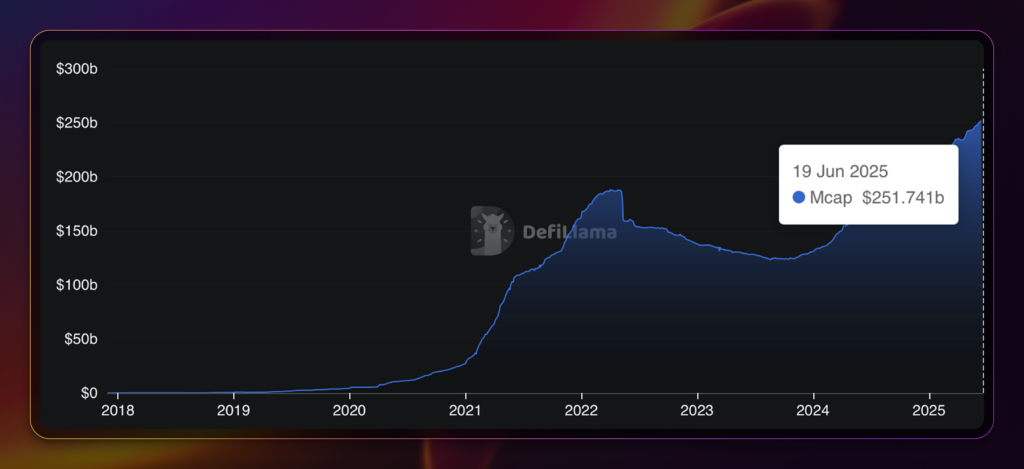

Stablecoins are cryptocurrencies tied to the value of a real-world currency. Stablecoins have become so popular that the market cap of all stablecoins reached an all-time high of $251.7 billion.

Fiat reserves typically back stablecoins. If a stablecoin has a market capitalization of $1.0 million, then the issuing entity must also allocate $1.0 million of dollar-backed assets such as cash deposits, government treasuries, and commercial paper.

Some stablecoins utilize algorithms that enable smart contracts to maintain the stablecoin’s value to the U.S. dollar. Unlike typical stablecoins that utilize fiat reserves, major cryptocurrencies like Bitcoin and Ethereum collateralize their tokens.

Major Stablecoins in Existence Today

Interestingly, stablecoins like USDT and USDC rank among the top ten cryptocurrencies by market capitalization. Here’s a list of other significant stablecoins:

- USDT: The third-largest crypto with a $155.7 billion market capitalization. Tether, a private company established in 2014, manages USDT.

- USDC: Issued by Circle and Coinbase in 2013. USDC is the oldest stablecoin and seventh-largest crypto with a $61.4 billion market cap. Circle (CRCL) made its public debut on the New York Stock Exchange (NYSE) in June 2025.

- DAI (rebranded to USDS): Issued by MakerDAO. DAI is one of the most prominent algorithmic stablecoins. As smart contracts maintain their peg to the U.S. dollar, it remains decentralized. DAI uses major crypto like Bitcoin, Ethereum, and Basic Attention as reserves.

- USD1: Launched by World Liberty Financial, the Trump-family crypto organization. Like USDT and USDC, cash and cash equivalents serve as reserves.

What is Yield Farming?

Yield farming involves utilizing cryptocurrency assets, such as stablecoins, to generate a yield. You can leverage either centralized or decentralized finance (DeFi) protocols. Think of yield farming as depositing cash into a high-interest savings bank, where you earn interest.

To generate crypto yield, you can deploy your assets for lending, staking, or providing liquidity in decentralized exchanges (DEXs). For example, you can stake your Ethereum on Lido Finance, a liquid staking platform, and earn 2.7%.

For stablecoin yield farming, AAVE stands as a popular option. It is the largest DeFi platform, with a total value locked (TVL) of $23.8 billion. Over 30% of the platforms’ TVL comes from stablecoin pools such as USDT and USDC.

Yield Farming Vs. Crypto Staking

If you’ve been reading our blogs for a while, you would have read about crypto staking. Both yield farming and crypto staking enable you to earn passive income in cryptocurrency. However, there are key differences:

A significant difference lies in the source of the rewards.

Yield farming earnings come from supporting the DeFi platform’s operations. For example, when you deposit crypto assets into a lending platform, the platform lends them out to borrowers. The platform earns from the spread of the rewards it pays you and from the interest it collects from borrowers.

Meanwhile, most blockchains rely on staking to secure their network. You commit native tokens to the network, which go to validate transactions.

3 Top Strategies for Stablecoin Yield Farming

Yield farming isn’t one-size-fits-all. There are multiple ways to earn with stablecoins, each with its unique levels of risk, return, and complexity.

1. Centralized Exchanges

Centralized exchanges (CEXes), such as Coinbase or Kraken, offer simple stablecoin yield products. Users deposit USDC or USDT and earn fixed or flexible APYs.

CEXes excel with their user-friendly interface and regulated platforms (in some instances). Investors who prefer not to deal with the complexities of DeFi and want to work with a trusted platform will rely on CEXes.

2. Decentralized Finance (DeFi)

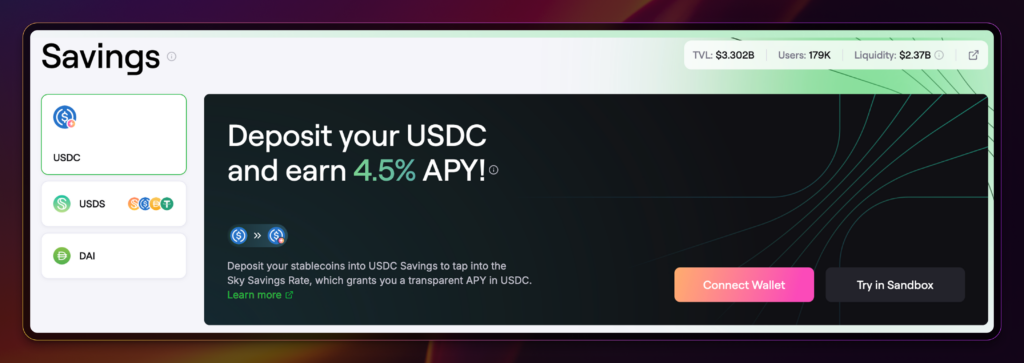

Platforms, such as Aave and Spark, cater to users who prefer self-custodial options. With self-custody, you can use a hardware wallet, such as Ledger, or an online wallet, like Phantom.

With self-custody, you can maintain control of your unutilized assets. In the worst case, if the platform goes down, your unutilized crypto will remain unharmed in your wallet.

Spark is an emerging stablecoin yield platform with a total value locked (TVL) of $5.8 billion. It is the 5th largest DeFi platform in terms of TVL.

3. Looping

In more advanced yield strategies, you can engage in looping.

DeFi looping, also known as liquid looping, utilizes a set of decentralized finance (DeFi) processes, including liquid staking, lending, and borrowing. By combining these steps, you can repeat the strategy multiple times (the loop). The more iterations you perform, the higher yield you can earn.

While it sounds complicated, fortunately, some platforms automate the process of looping.

Euler Finance is an emerging DeFi platform with $1.05 billion in TVL. Euler dubs itself “The Lending Super App,” where users can effortlessly lend, borrow, and swap crypto assets. Its USDC and RLUSD (Ripple Labs USD) loop offers up to 82.39% APY when maxed out.

Criteria for Selecting a Stablecoin Yield Farming Platform

Not all yield farming platforms are created equal. To protect your capital and maximize rewards, consider the following factors:

Security and Reputation.

Since stablecoin farming involves depositing assets, choose platforms with a proven track record of security. Look for protocols that have undergone third-party audits and have a decent level of usage. As a basic filter, look for platforms with at least $500 million in total value locked (TVL).

In centralized platforms, regulatory compliance adds another layer of trust. Select exchanges that have obtained licenses in their respective regions.

Coinbase has obtained a license in almost all U.S. states. The holding company is also listed on the New York Stock Exchange. With its licenses and publicly listed status, the company is required to comply with various regulations and reporting requirements.

Yield Sustainability and Transparency

Many platforms promise high annual percentage yields (APYs), but not all of them are sustainable in the long term. Check the source of the yield. Are rewards generated through lending activity, trading fees, or incentive campaigns?

Going back to Euler Finance and RLUSD, Ripple Labs has been running a campaign to boost incentives. You can find such information through thought leaders on X or through the platform’s blog page.

Understanding the source of yield will help you gauge whether the rewards are likely to last or if they’re just short-term incentives.

Flexibility and User Experience

Yield farming can be overwhelming. Choose platforms that offer intuitive interfaces and responsive customer support. Some protocols now offer “one-click” farming or auto-compounding features, significantly simplifying the process of looping.

Also consider how flexible the farming strategy is: Can you withdraw at any time, or is there a lock-up period? Are there high gas fees for claiming rewards? Platforms that enable easy fund management are often safer and more scalable in the long run.

Frequently Asked Questions

What are the Best Stablecoin Yield Farming Strategies?

The best strategy depends on your risk appetite and level of experience. However, for the highest yield, you should check DeFi looping strategies.

What are the Risks of Yield Farming?

Despite DeFi’s existence since 2020, several risks persist. In particular, a malicious actor could drain the DeFi platform that you’re using, causing severe losses for investors.

In May 2025, a hacker exploited Cetus Protocol, a decentralized exchange (DEX) on the Sui Network. The bad actors stole over $220 million from the platform.

What are the Top Platforms for Stablecoin Yield Farming?

In terms of TVL, the top stablecoin yield platforms are:

- Aave Network: Aave is a leading decentralized lending protocol that enables users to deposit stablecoins, such as USDC or DAI, to earn interest or borrow against them.

- Spark: Spark is a MakerDAO-affiliated lending platform focused on generating stablecoin yield, primarily through DAI-based strategies.

- Ethena: Ethena offers synthetic stablecoin yield through its USDe product. It combines derivatives and delta-neutral strategies to generate returns.

- Pendle: Pendle enables users to separate and trade the yield and principal of yield-bearing assets.

- Sky: Sky Protocol is a modular DeFi platform offering simplified yield strategies across stablecoin and ETH vaults.

Making the Most of Stablecoin Yield Farming

Stablecoin yield farming provides a means to earn passive income without exposing oneself to the volatility of crypto tokens. Whether you choose to earn through centralized exchanges, decentralized platforms, or looping strategies, the key is to understand the risks and pick platforms that suit your profile.

As the stablecoin ecosystem continues to grow, so will the opportunities to put your digital dollars to work. Start small, stay informed, and let your stablecoins do more than just sit in your wallet.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

June 30, 2025

July 29, 2025