Restaking Solana: A Comprehensive Guide to Maximizing Your SOL

Staking has become one of crypto’s most popular passive income sources. Investors eagerly seek ways to generate yield on their digital assets, whether it’s on Solana or Ethereum.

Now, a new opportunity emerges for stakers with restaking. What started as a way for Ethereum stakers to earn additional yield has spilled over to Solana.

With Solana restaking, you can earn additional rewards on top of your existing staking returns, all while supporting the next wave of decentralized applications.

In this guide, we’ll break down:

- What is restaking

- The Solana restaking landscape

- How to your SOL with restaking

- FAQs about restaking

Overview of Solana and Network Staking

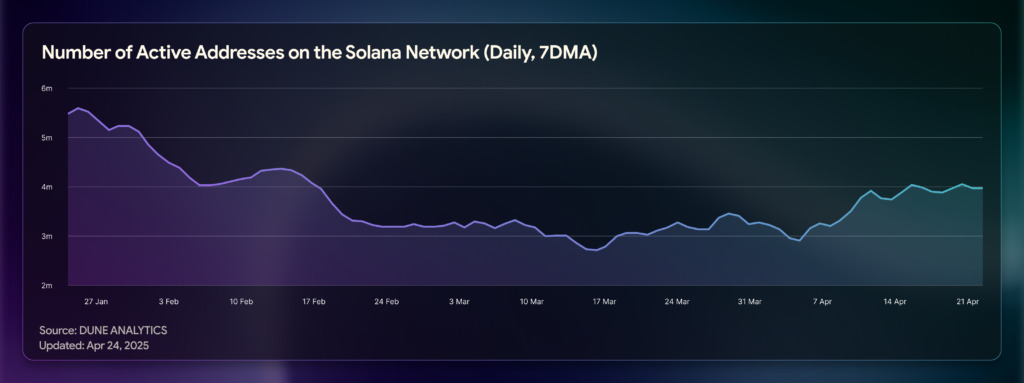

Solana exploded in popularity and usage for its speed, low transaction costs, and scalability. Its high performance made it a favorite among crypto traders, especially for memecoin trading.

Beyond its high adoption, crypto investors also favor Solana, as its token price significantly rose from 2023 to 2025. There is no better way to compound earnings than by staking the SOL tokens.

Unlike Bitcoin, which relies on Proof of Work, or Ethereum, which utilizes solo staking with Proof of Stake, Solana uses Delegated Proof of Stake. This consensus model allows anyone holding minimal SOL to delegate their tokens to validators to help validate the network.

Crypto investors have favored Solana with its staking APY of 8% and relatively short unstacking or unbonding period of 2 days. As of writing, investors have staked $57.7 billion worth of SOL tokens.

Solana Restaking and Its Growing Relevance

First appearing on the Cosmos and Ethereum networks, restaking on Solana has risen to nearly $300 million in total value locked in Solana. Crypto is a game of adoption, and it was only a matter of time before Solana developers caught on.

How Does Restaking on Solana Work?

Jito Network started the most popular Solana restaking service in August 2024. This concept allows users to take already-staked assets and re-deploy them to secure services within the ecosystem.

Here’s how Solana Restaking works on Jito:

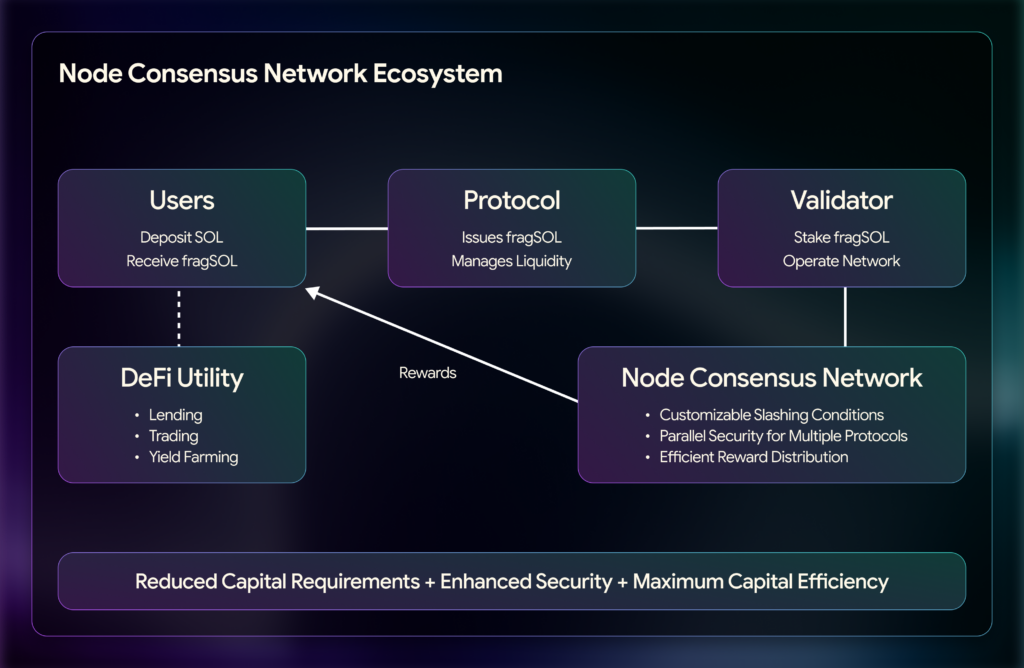

- Users deposit an accepted Solana-based token into a Vault. In this case, the restaking protocol accepts JitoSol, Jito’s liquid staking token (LST).

- The restaking protocol issues a Vault Receipt Token (VRT). Think of the VRT as a liquid restaking token, representing the user’s restaking position. In the diagram, the protocol issues fragSOL.

- Validators stake fragSOL to secure the restaking network, the Node Consensus Network (NCN).

- NCN members use the staked assets to secure their projects.

- NCN members pay the restakers rewards.

By depositing a liquid staking token (LST), users can continue to accrue staking rewards while receiving a VRT. Users then use the VRT across the decentralized finance (DeFi) landscape for additional rewards.

Comparison with Ethereum Restaking

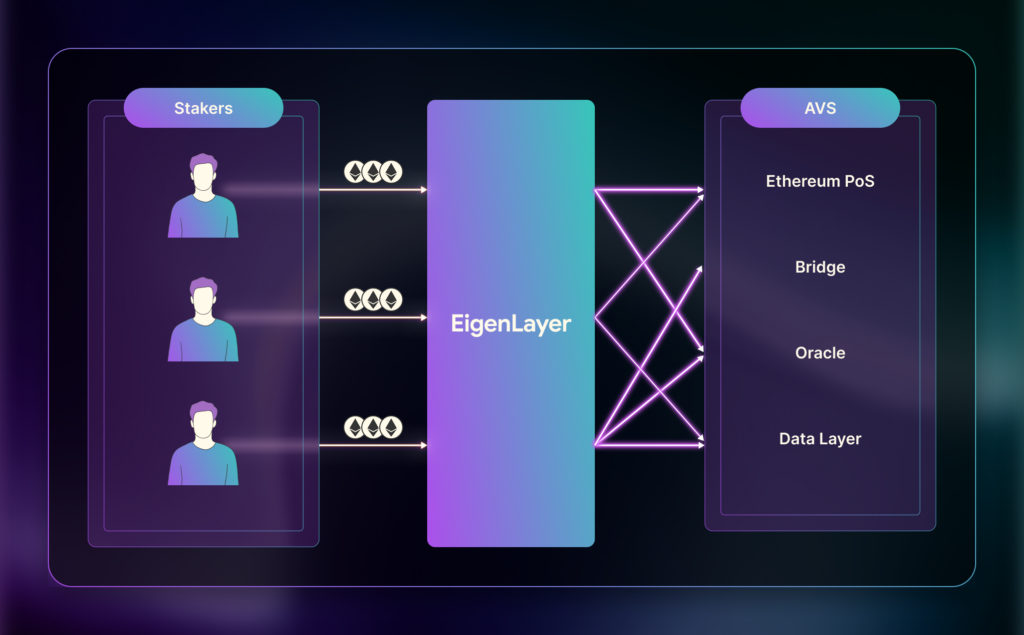

Ethereum restaking gained traction through EigenLayer. The restaking protocol allows ETH stakers to restake their ETH to provide security for middleware and other infrastructure.

Ethereum restaking works similar to Solana. The only difference is that Ethereum restaking uses the term Actively Validated Services (AVS) instead of Node Consensus Network.

As EigenLayer restaking emerged at an earlier time, its TVL at $7.7 billion remains well ahead of Solana and any other ecosystem.

Benefits of Restaking SOL Tokens

1. Yield Amplification for SOL Holders

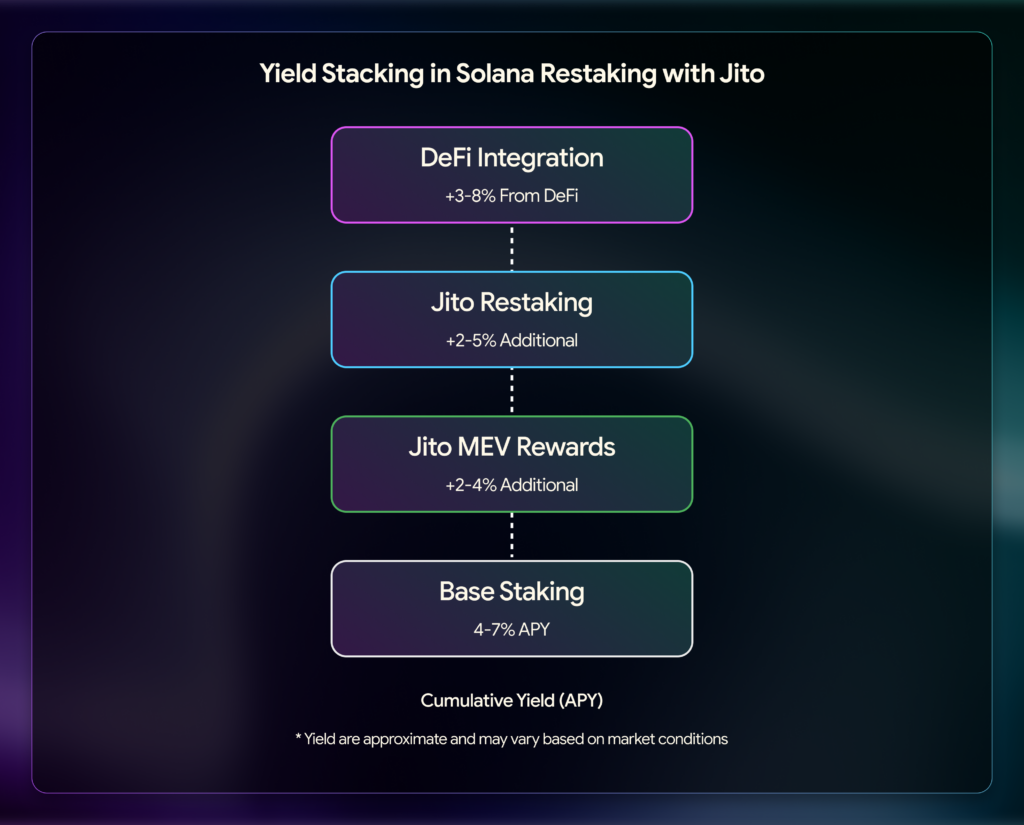

Restaking Solana amplifies yield by allowing staked SOL to secure additional protocols. This restaking model enables stakers to earn rewards on top of their base staking APY. The diagram above illustrates this.

From a standard 4-7% APY, Jito restakers benefit from Jito’s Maximal Extractable Value (MEV)-boosted rewards and restaking and integrating the VRTs into DeFi.

2. Expanding Solana’s Security Layer Without New Capital

Restaking on Solana introduces a solution for protocols that need additional security but lack native token incentives or user traction. Instead of sourcing fresh capital to bootstrap trust, protocols can borrow the security from existing SOL validators and stakers.

This model mirrors what Ethereum’s EigenLayer introduced. New applications can inherit security from the main chain without diluting token economics.

TipRouter, a Solana-based MEV rewards distribution network, benefits from the shared security offered by Solana restaking.

3. High Liquidity and Flexibility

Solana restaking offers flexibility without compromising earnings.

Often paired with liquid staking, it allows you to maintain liquidity, enabling trading and participation in financial activities. This flexibility could become valuable as you can still participate in new protocols to generate returns.

As the Solana restaking ecosystem grows, you could farm new protocols and potentially earn airdrops.

Top Platforms for Solana Restaking

Only a handful of Solana restaking players exist as restaking has been in existence for less than a year. Here are some existing platforms that have caught investor interest.

Jito.Network

Prior to entering the restaking field, Jito made its name as a liquid staking platform. It maximized its expertise in that field to lead the Solana restaking movement.

Jito Vaults accept a variety of restaking assets, from liquid staking tokens, Jito (JTO), and native Solana.

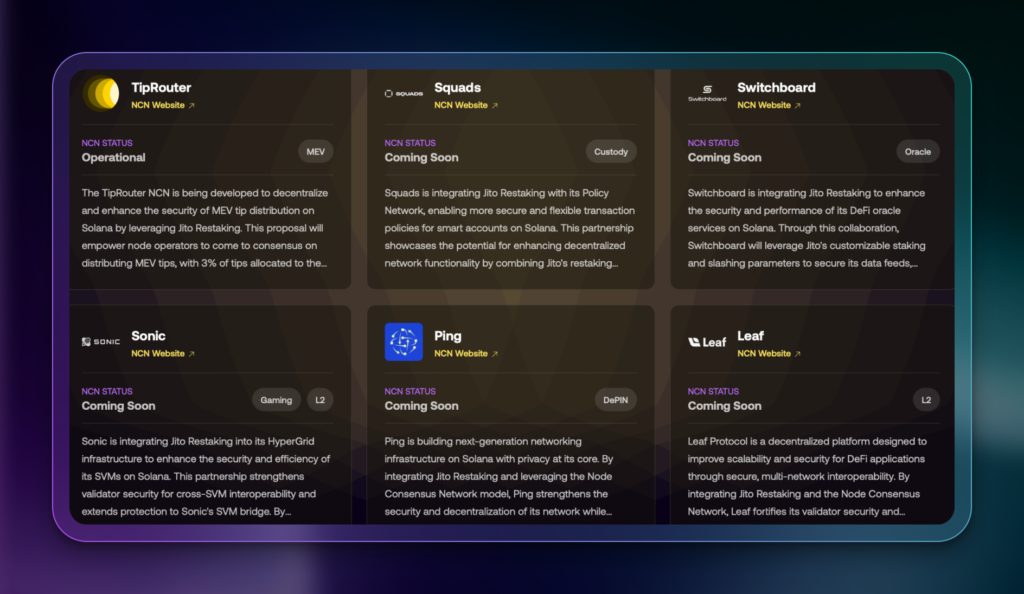

While only one participant, TipRouter, is utilizing Jito’s restaking network, it’s only a matter of time before more NCNs take notice. Other notable NCNs include Sonic, a gaming-focused platform on Solana.

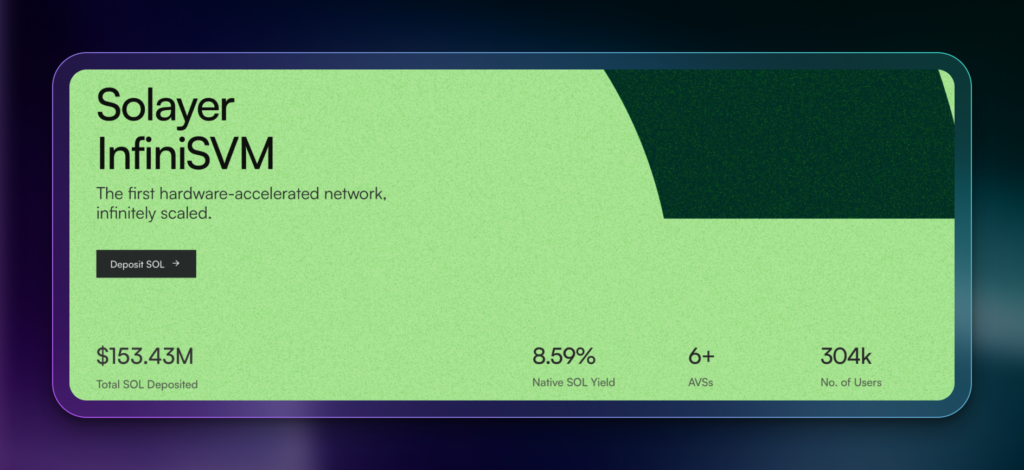

Solayer

Solayer is another Solana restaking platform that has taken the ecosystem by storm. Its native token, LAYER, rose over 300% in 2025, defying the correction in the crypto markets. Its token price performance naturally attracted interest in the platform.

Like EigenLayer, Solayer utilizes the “AVS” terminology for projects that use its restaked assets.

The platform accepts native Solana and USDC. The acceptance of USDC from the Wormhole bridge enables cross-chain staking. Users from other ecosystems can bridge their assets and receive USDC to restake on Solayer.

How to Restake Your SOL Tokens Using Jito

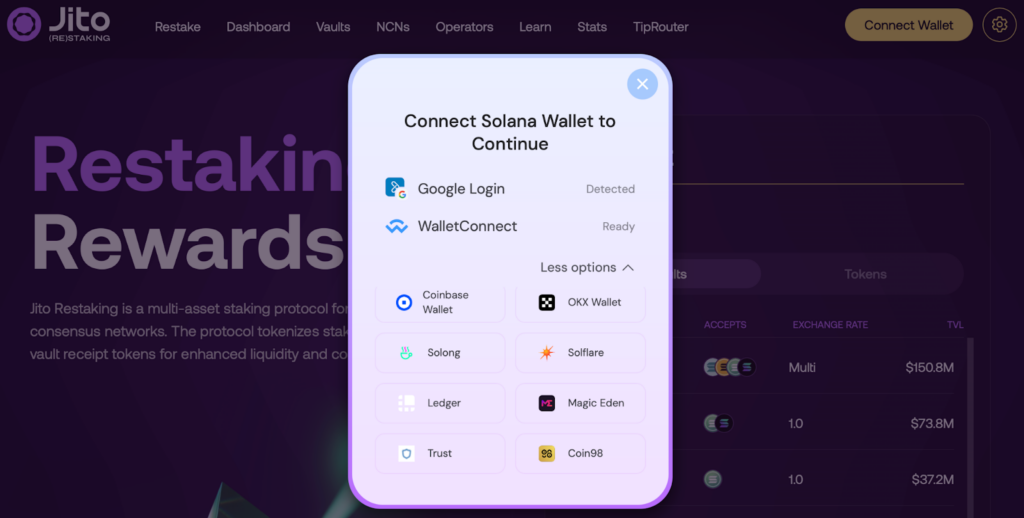

1. Connect Wallet

Head over to Jito’s restaking website and click connect wallet.

You can select from a variety of Solana wallets like Solflare. If you don’t have a crypto wallet, Jito made it easy for users by allowing a Google Login. If selected, you will automatically receive a crypto wallet address with your Google account.

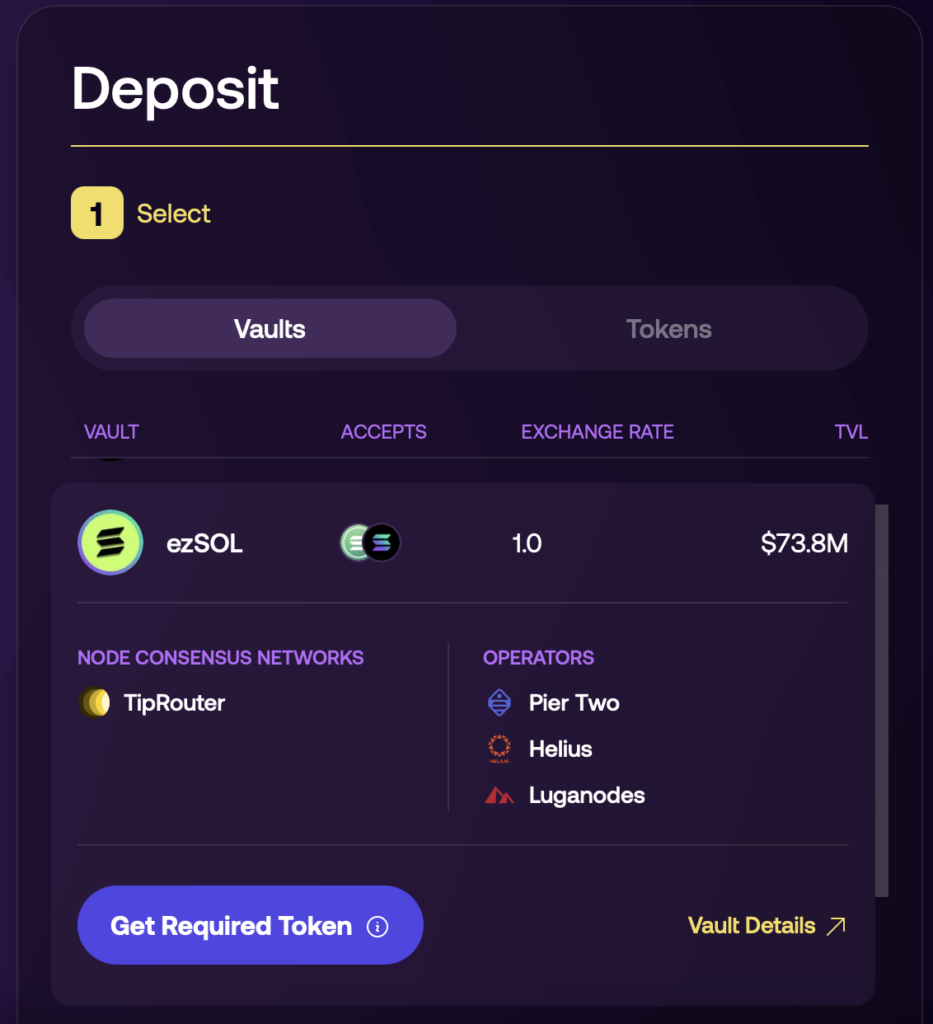

2. Select a Vault

Choose a vault that you wish to restake to. There are over nine vaults but for this example we’ll use the ezSOL vault. This specific vault accepts native Solana and Jito staked SOL, the LST of Jito Finance.

Enter the number of tokens that you would like to restake and in return you should get the Vault Restaking Token, ezSOL.

3. Engage in Decentralized Finance

With your ezSOL VRT, head over to a DeFi platform like Kamino Finance which offers lending services. You can supply your ezSOL to the platform and earn an additional 0.65% on top of your liquid staking yield.

Solana Restaking Frequently Asked Questions (FAQs)

Interested in Solana restaking? Here are some FAQs about the topic:

What Does Restake Mean in Crypto

Broken down into “re” and “stake,” restake means to do the crypto staking process again. With restaking, you can redeploy staked assets into other protocols to generate extra staking rewards.

Restaking protocols typically accept liquid staking tokens (LSTs) versus natively staked tokens. LSTs give users liquidity and flexibility to deploy into other protocols. Natively staked tokens on the other hand, remain locked onto a network’s staking program.

What is the Solana Restaking Protocol

Jito operates the most adopted Solana restaking protocol.

On the Jito website, you can stake a variety of Solana-based tokens to contribute to restaking.

What is Solayer

Solayer is an emerging solana restaking platform and competitor to Jito. It is the second largest Solana restaking service with $108 million in TVL.

In addition to Solana restaking, Solayer also operates as a Solana Virtual Machine (SVM), the execution layer for Solana transactions and smart contracts. At 1,000,000 transactions per second, Solayer significantly helps scale the Solana ecosystem.

The Future of Solana Restaking is Bright

Restaking on Solana is barely a year old, yet investors have begun depositing SOL tokens and adopting restaking platforms. As the Solana ecosystem grows in popularity, expect more developers to come and create more services.

The demand for restaking is huge, evidenced by Ethereum’s restaking TVL. Solana can surely attract a similar amount of TVL once its community warms up to the restaking innovation.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

April 30, 2025

September 3, 2025