What Is Liquid Looping? DeFi Strategy and Liquid Looping Tokens Explained

Have you ever watched the movies Groundhog Day or Edge of Tomorrow, where the main characters repeat the same event repeatedly? Each time, they learn from their experience and come back stronger.

In crypto staking, you can repeat staking multiple times to compound your staking rewards. This process is called liquid looping. By combining staked assets with borrowing and staking mechanisms, liquid looping enables you to amplify staking rewards.

While the staking returns can be impressive, this strategy isn’t without complexity.

In this guide, we’ll break it down to keep it simple:

- What is liquid looping

- How does liquid looping work

- Simplifying liquid looping with tokens

- FAQs about the process

Let’s get looping!

What is Liquid Looping?

DeFi Looping is a strategy originating from decentralized finance (DeFi). In this strategy, you repeatedly borrow against your crypto for a yield farming opportunity. The strategy became popular in 2020 on Ethereum-based lending protocols like Compound.

You would deposit native assets like Ethereum (ETH) on Compound as collateral, borrow stablecoins (DAI), buy more ETH, and repeat the process. The goal was to increase ETH holdings and farm the rewards of Compound by using the platform.

Liquid Looping vs DeFi Looping

Liquid looping came to the forefront with the popularity of liquid staking through decentralized applications like Lido Finance. The platform is the largest liquid staking protocol with $23 billion total value locked (TVL).

Liquid staking is a process where you deposit crypto on a third-party platform. The platform pools the tokens and utilizes them for network validation. Then, you receive liquid staking tokens (LST), equivalent to your staking capital. You can transfer the LSTs to other platforms for further yield-bearing opportunities.

DeFi looping utilizes native tokens like Ethereum (ETH) or Solana (SOL) while liquid looping maximizes liquid staking tokens (LSTs) as collateral. Furthermore DeFi looping leverages on borrowing and lending platforms while liquid looping combines liquid staking platforms to generate the extra yield.

How Does Liquid Looping Work

Liquid Looping primarily exists to increase the yield on your digital assets. It relies on three key processes. Once these processes take place, you decide how many times to repeat or “loop” it.

You can also perform liquid looping on almost any crypto ecosystem like Ethereum, Solana, or Cosmos. For this guide, we’ll be using Ethereum.

Step 1: Liquid Staking

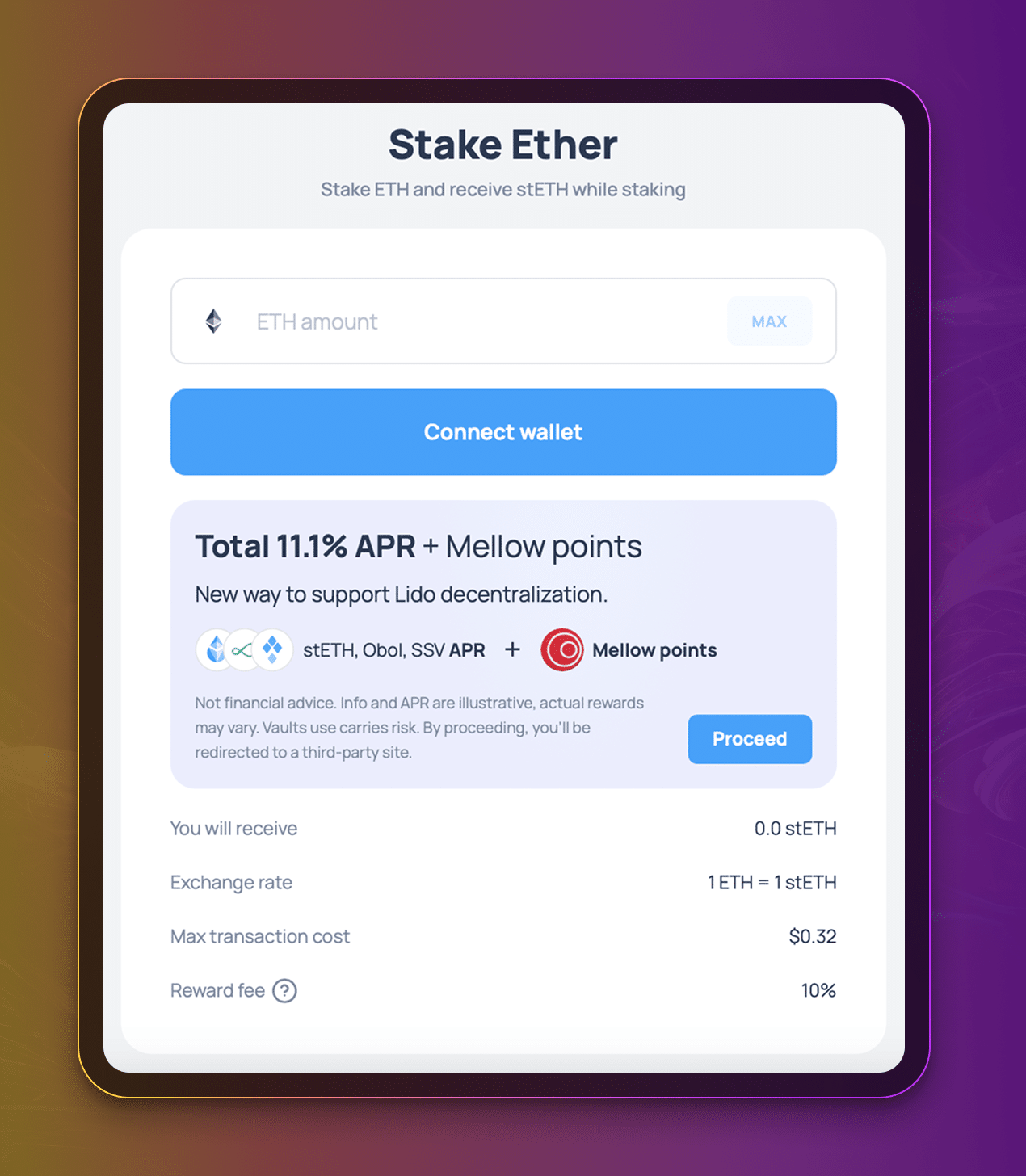

Start by staking a cryptocurrency (like ETH) through a liquid staking protocol like Lido. In return, you receive an LST (e.g., stETH) representing your staked tokens. While holding the LST, you will earn staking rewards.

You’ll first have to wrap your token before you can deploy your stETH into DeFi applications. You can do so using Lido’s complimentary wrap and unwrap tool.

Borrowing

Next, deposit your LST into a DeFi lending platform that accepts it as collateral. You can use stETH as collateral on Aave to borrow Ethereum.

Observe that the borrowing cost for ETH is at 2.63% APY while staking yields 3.1% APY. Even after taking away Lido’s 10% commission, you can still earn 2.79%. The difference makes liquid looping appealing.

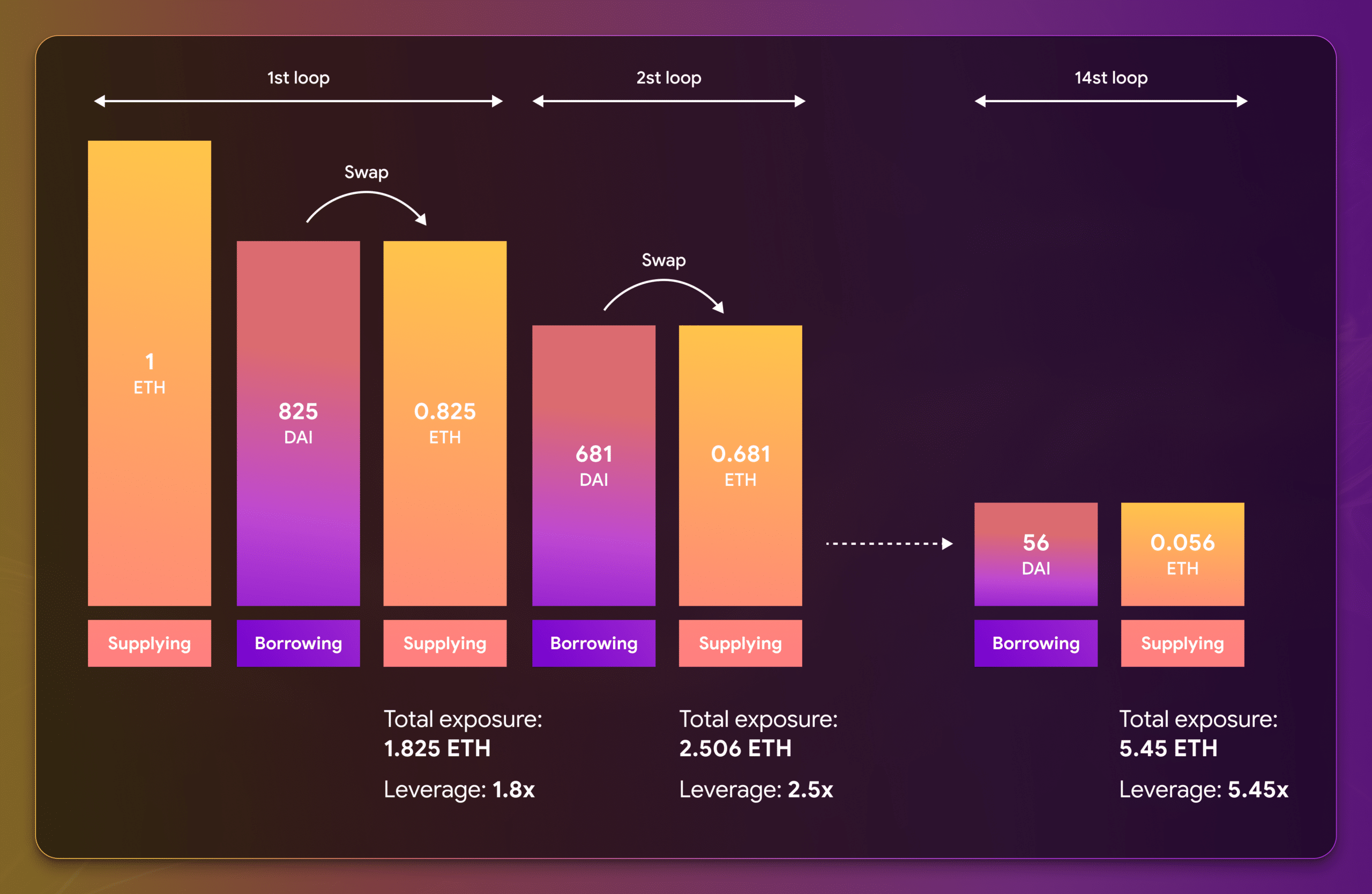

Note that stETH has a loan-to-value (LTV) ratio of 93%. For every one stETH you use as collateral, you can only get 0.93 ETH. On your second loop you would get 0.8649 ETH, so on and so forth.

This reduction in assets borrowed will play a significant role down the line as the ETH you can loop becomes smaller and smaller.

Restaking (Staking Again)

Finally, you take the borrowed ETH and restake it on Lido. You can use these new LSTs to repeat the process, hence the term “looping.”

Each loop increases your exposure to staking rewards, effectively amplifying your yield.

The act of staking again in liquid looping shouldn’t be confused with restaking with the likes of EigenLayer. In the latter, you utilize staked tokens to further validate blockchain projects. While in the former, you are restaking to maximize yield.

What is a Liquid Looping Token?

A liquid looping token automates liquid looping. The token does it for you instead of manually executing the three processes above. All you need to do is deposit cryptocurrency to acquire the token.

The protocol handles staking optimization and risk management and reduces the risk of user error. If you manually performed liquid looping, you could have connected to a malicious site and lost all your crypto.

Introducing Looped Hype (LHYPE)

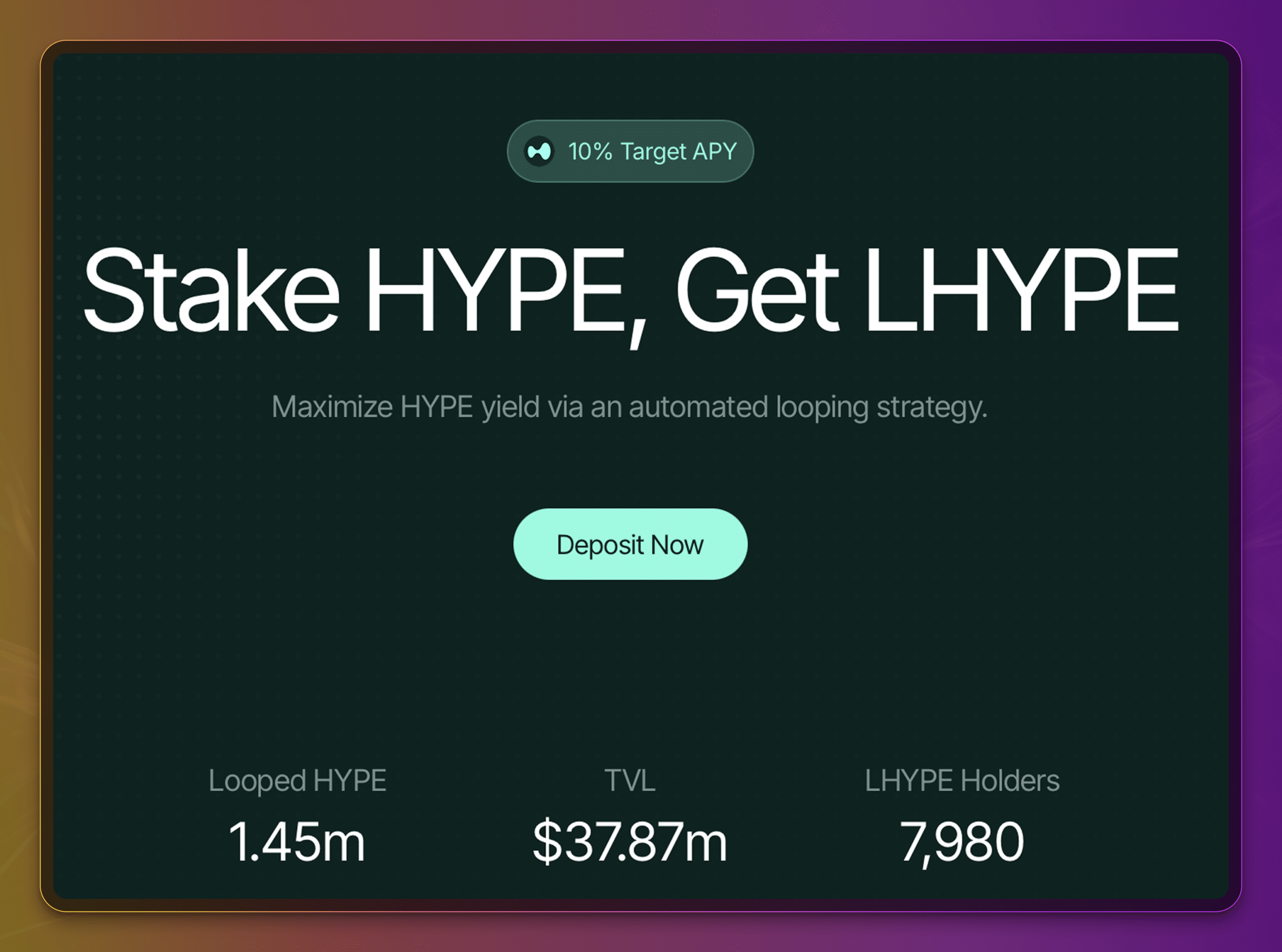

Looped Hype is the first liquid looping token. Created by Staking Rewards and Nucleus Earn, you simply need to purchase and deposit HYPE on the Looped Hype platform. From there, you’ll receive LHYPE and gain access to the liquid looping yield.

HYPE is the native token of Hyperliquid, a high-performance blockchain built for perpetual futures trading, a crypto derivatives market. Hyperliquid combines the speed and efficiency of centralized exchanges like Coinbase with the transparency and self-custody of decentralized platforms.

Simplifying Liquid Looping with LHYPE

While everything has been simplified, Staking Rewards and Nucleaus Earn work in the background to make the liquid looping magic happen. They handle looping by curating DeFi platforms and managing the risk strategy.

Here’s a brief overview of how LHYPE generates liquid looping yield:

Liquid Staking HYPE

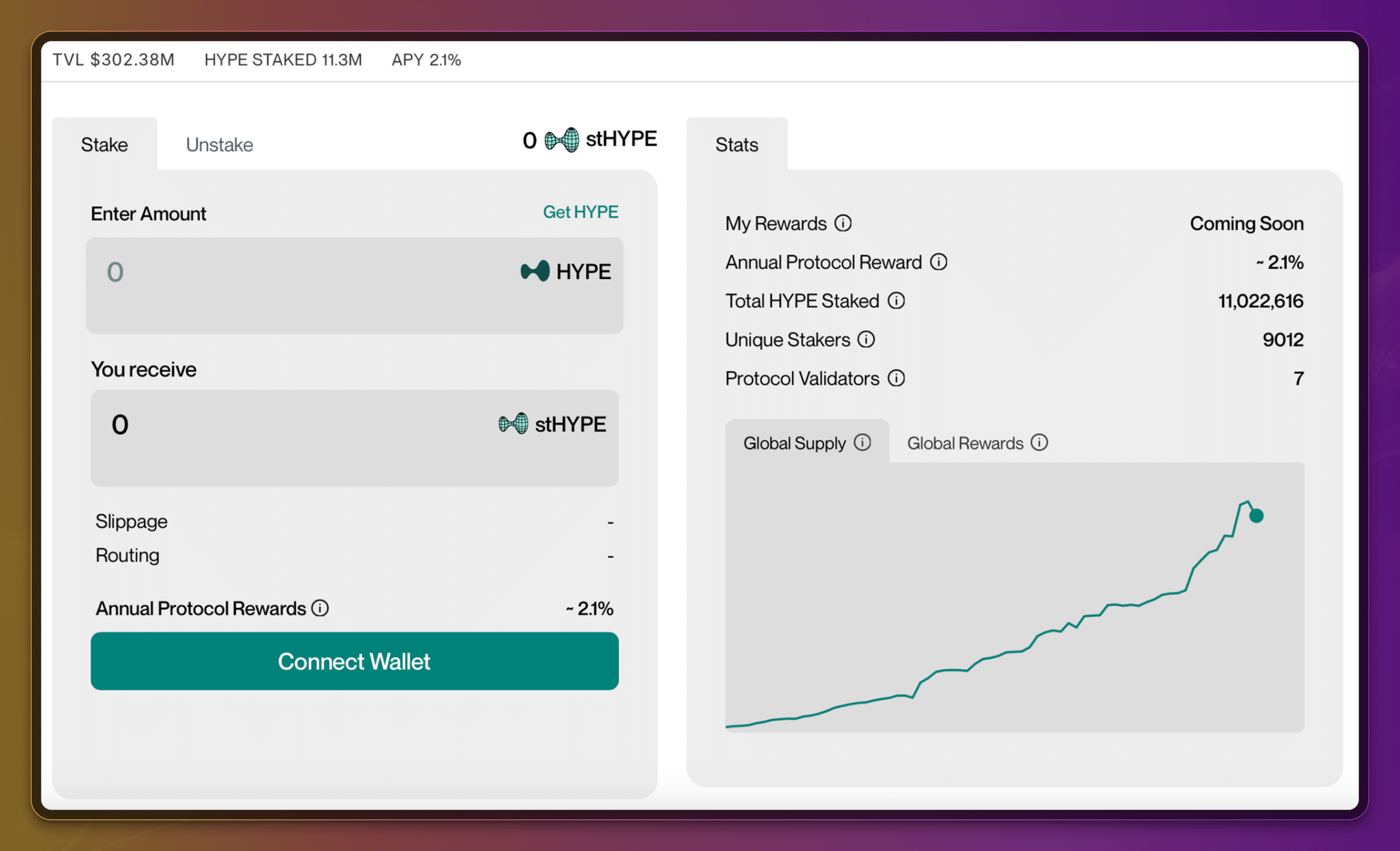

The protocol deposits the user’s HYPE tokens into a liquid staking protocol like StakedHype. In return, they get the LST stHYPE. The annual liquid staking yield is at 2.1%.

The stHYPE is wrapped to wstHYPE for DeFi purposes.

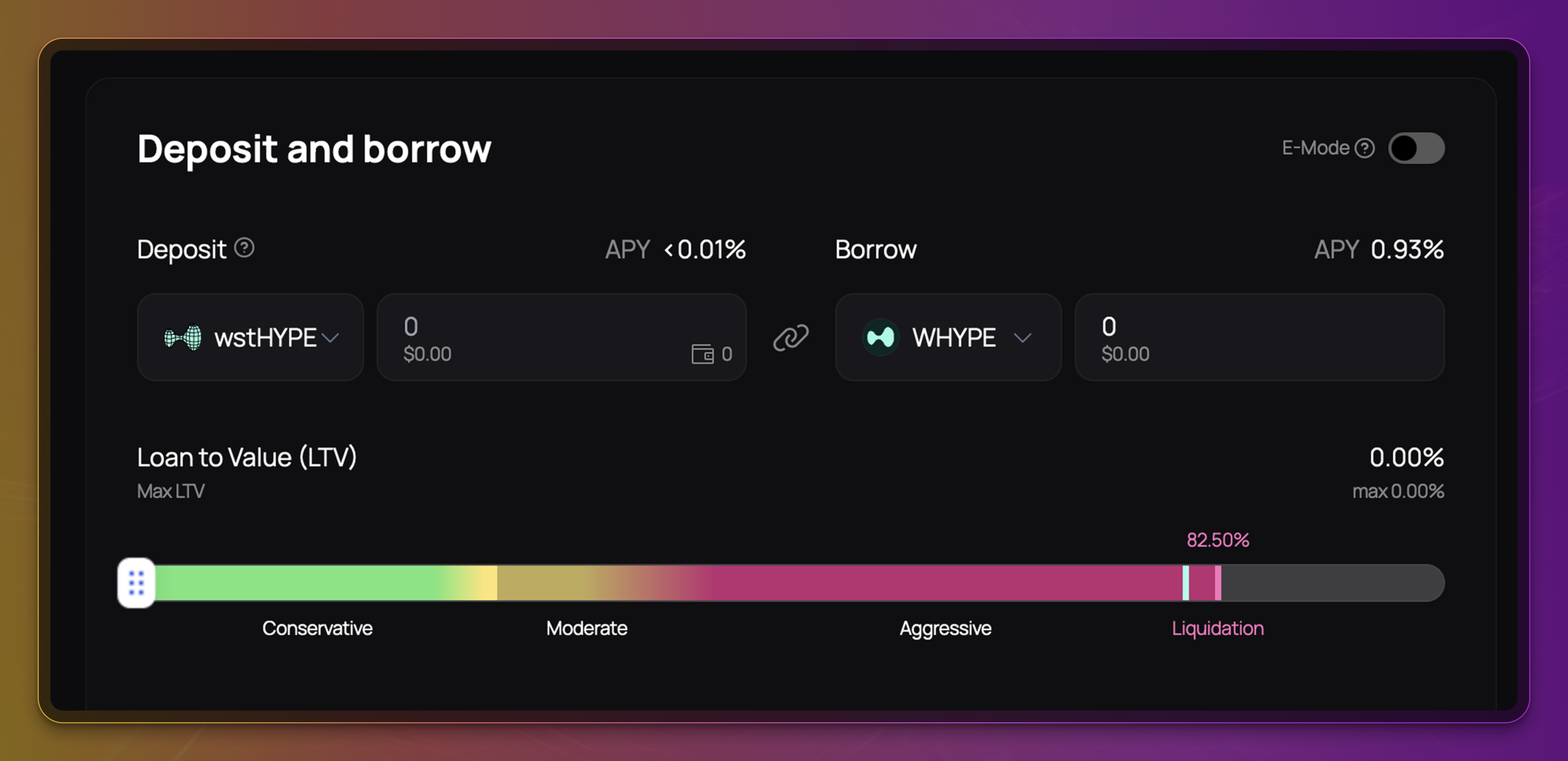

Borrowing HYPE

The protocol deposits the wstHYPE on a lending platform such as HypurrFi and obtains HYPE tokens in return. Borrowing HYPE costs 0.93% APY, creating a spread between the liquid staking rewards of 2.1% and the borrowing cost.

Restaking

The protocol takes the HYPE and performs liquid staking again, forming the first loop. The protocol manages the number of loops based on the staking APY and borrowing rate. According to Looped HYPE’s documents, loops can range from 3x to 15x.

FAQs About Liquid Looping

Curious to learn more about liquid looping? Here are some FAQs:

How many APY can I return?

Looped HYPE aims to generate 10% APY, five times higher than the regular HYPE staking rate. As the technology is new, it remains to be seen what kind of returns the looping strategy can generate long-term.

What are the risks?

As liquid looping relies on leverage and borrowing assets repeatedly, the loans will get liquidated if the token price drops drastically. While the risks of looping strategies aren’t fully understood, historical cases have shown that looping strategies can lead to total loss.

In May 2022, Terra Luna infamously collapsed, leaving investors with nothing. The Terra ecosystem featured borrowing and lending platforms like Anchor Protocol, which allowed users to deploy looping strategies with TerraUSD (UST), the Terra stablecoin.

What Platforms Support Liquid Looping?

While you can do liquid looping on almost any crypto ecosystem, only a handful of platforms support liquid looping tokens.

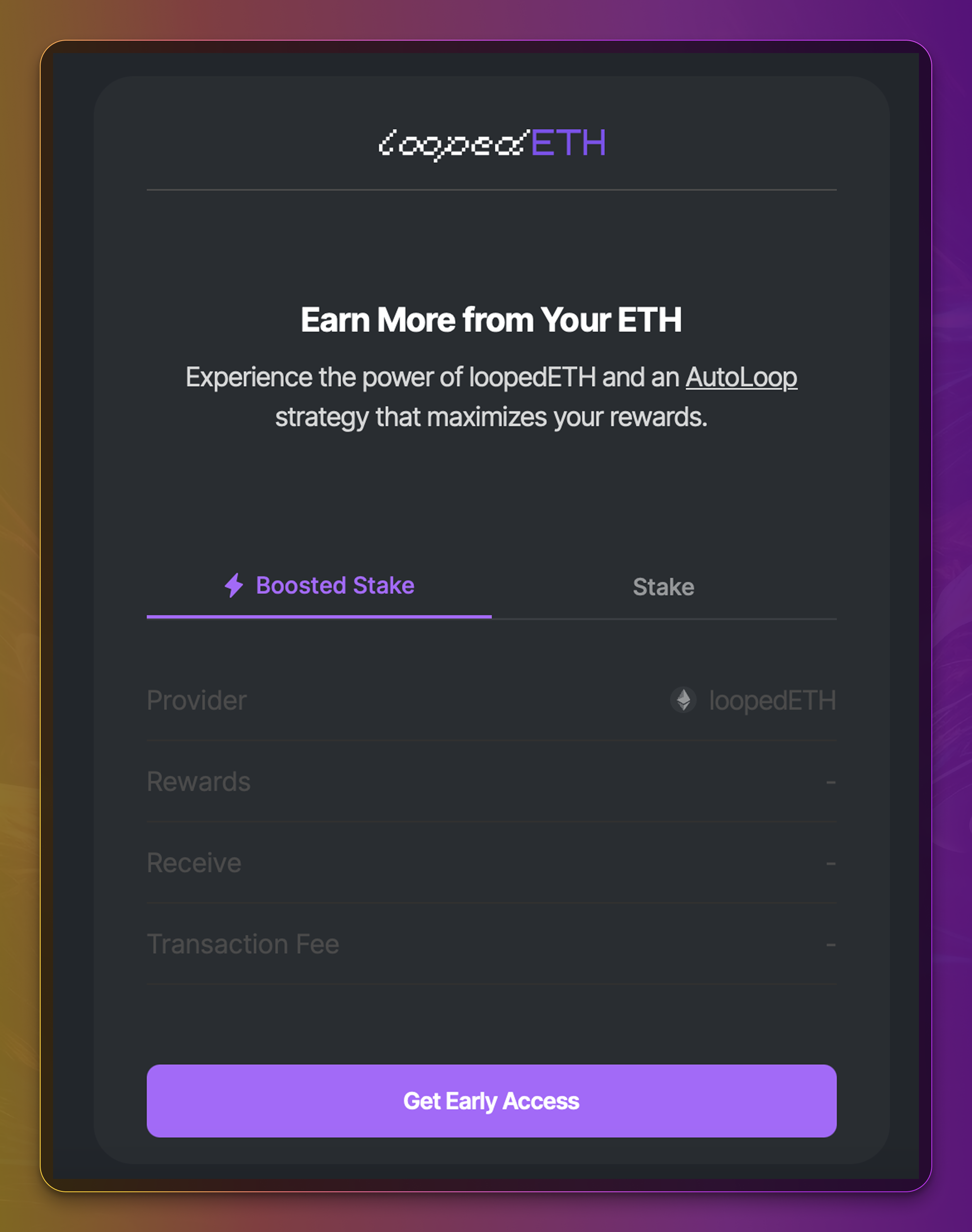

Aside from Looped Hype, you can visit their maker, Staking Rewards. The popular staking platform is spearheading the liquid looping token revolution. You can liquid loop HYPE directly from their platform or sign-up for early access to ETH liquid looping.

Step Into a Higher Yield With Liquid Looping

Liquid looping is an advanced strategy that showcases what’s possible when staking and DeFi combine. By utilizing staking, borrowing, and restaking, users can amplify their yields without deploying fresh capital.

With the entry of liquid looping tokens, the strategy has become simpler for participants to deploy. It’s possible that these tokens serve as the gateway for mass adoption of looping strategies.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

May 21, 2025

September 3, 2025