Understanding Lido: The Gateway to Ethereum Liquid Staking

If you believe in crypto long-term, staking is a smart way to earn passive income. You receive staking rewards and contribute to the security and operations of a blockchain. The Ethereum network is the most popular staking option, with $114 billion ETH staked.

However, Ethereum staking comes with challenges. You must lock 32ETH in staked tokens (over $100,000 in today’s prices) and manage staking infrastructure.

Liquid staking addresses these challenges by reducing the required staked tokens and providing instant liquidity.

Lido has emerged as the top liquid staking solution with $33 billion in staked tokens.

In this blog article, we explore the Lido platform

- What is Lido and Lido DAO

- How to stake with Lido

- Which wallets support the Lido protocol

- Key statistics

…and more.

Let’s learn all about Lido!

What is Lido?

Lido is one of the largest liquid staking protocols, enabling Ethereum holders to stake ETH without locking it up.

In traditional staking, staked assets become illiquid. You can only use or trade your staked digital assets once they are unstaked through unbonding. This unstaking process can last from a few days to a month. Your assets do not accrue staking rewards during this time.

With liquid staking, you receive a liquid staking token (LST) representing your staked assets. For Lido, you get stETH (staked ETH), which corresponds to your staked Ethereum. You can use stETH for trading, in decentralized finance (DeFi) protocols, or for holding, all while earning staking rewards.

What is Lido DAO?

Over 200 decentralized node operators run on Lido. The Lido DAO elects these nodes. A DAO is a “decentralized autonomous organization” and typically manages and governs crypto projects.

For Lido, holders of the LDO tokens (the Lido ecosystem token) can vote in Lido DAO for the various governance proposals. Past proposals include grants under the Lido Ecosystem Grants Organization (LEGO).

The Lido DAO ensures transparency and security, as decisions are holder-driven rather than centralized.

How to Stake on Lido

Staking on Lido is very simple. You can even stake from your mobile phone, provided the proper crypto wallet application is installed.

Here’s how to get started:

1. Acquire ETH

First, purchase ETH on any major exchange like Coinbase or Kraken.

Depending on your location, you can use a bank transfer to cash into the exchange and convert it to ETH. Chase Bank is a popular choice for wire transfers to fund your exchange account in the United States.

2. Transfer ETH to a Wallet

While you can get ETH through a centralized exchange (CEX), they do not support staking with Lido staking. They have their own ETH staking pools and services. You will have to transfer your acquired ETH to a non-custodial wallet.

Wallets such as MetaMask or a hardware wallet like Ledger enable you to control your crypto assets fully.

3. Access Lido

Go to the Lido Finance website and connect a compatible wallet. Alternatively, you can access Lido staking directly from the wallet’s interface.

Accessing liquid staking from your wallet removes the risk of clicking and connecting to malicious links and websites. The rewards for staking directly on Lido or from your wallet are the same.

4. Stake ETH

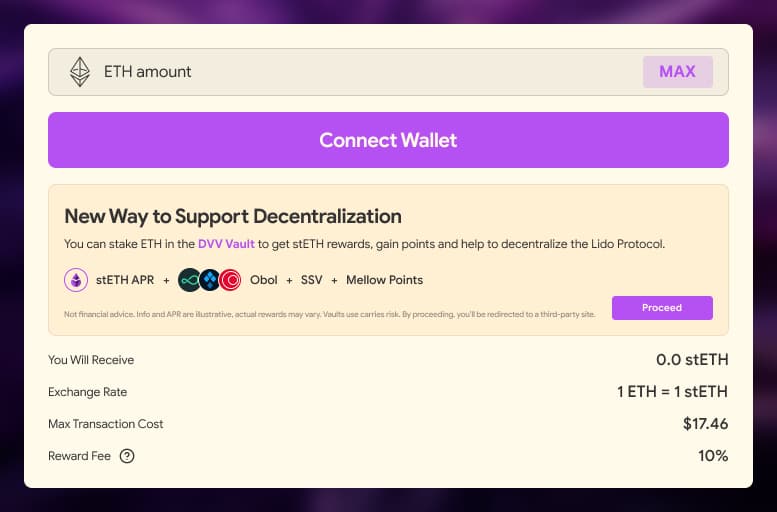

Enter the amount of ETH you wish to stake, and Lido will generate stETH in return. Make sure to check all the details, including the transaction costs. While there’s no minimum ETH required, high transaction costs can eat into your staking rewards.

5. Monitor Staking Rewards

You can track your rewards and transactions directly through your wallet. Lido automatically compounds staking rewards, a big advantage over solo staking.

Is Lido Staking Taxable?

In many jurisdictions like the USA, staking rewards are taxable income. Once you receive the staking rewards in your wallet, you’re considered to have dominion and control over the income. The U.S. Internal Revenue Service (IRS) taxes you based on an income bracket ranging from 10% to 37% tax rate.

In addition to taxing staking services, you’re subject to capital gains tax once you sell the rewards.

Tax regulations for staking are still evolving, so stakers need to consult local tax laws or seek advice from a tax professional. Lido does not automatically provide tax reports, so users may need to manually track their transactions for tax purposes.

Optimizing Staking Rewards with stETH tokens

Lido’s liquid staking solution offers several key benefits, from unlocking liquidity to reducing the financial and technical entry barriers. However, the most significant advantage is your ability to gain more yield and staking rewards using stETH.

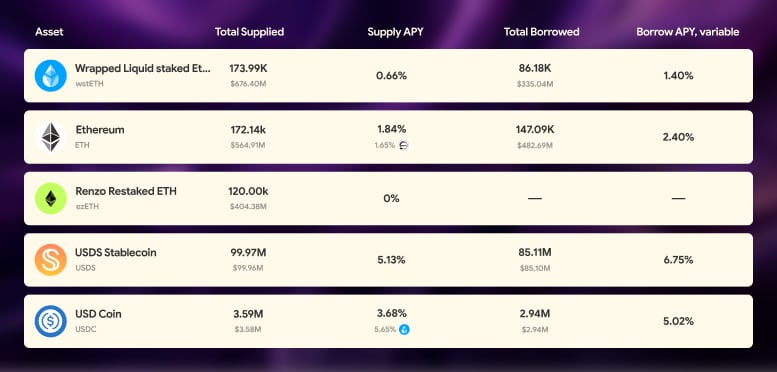

Lido users can deposit stETH tokens in Aave, a DeFi protocol for borrowing and supplying crypto tokens. By supplying stETH tokens, you can earn an additional 0.66% APY on top of your staking position.

You can also engage in restaking activities with platforms like Eigenlayer that allow you to contribute to the security of other blockchain projects.

Lido Key Statistics

Here’s some key information to accompany you in your staking journey with Lido:

Lido Staking Reward Rate

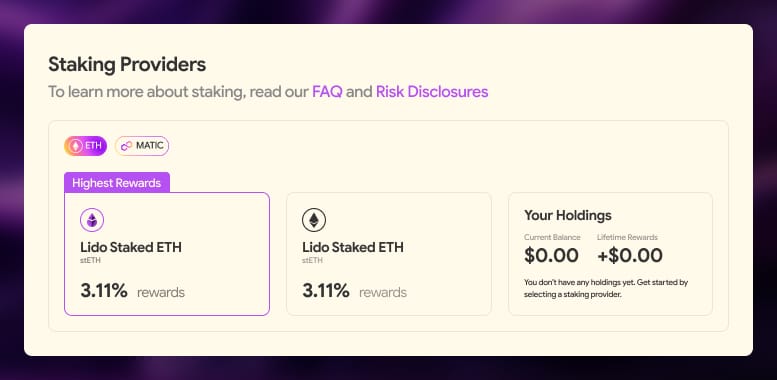

You can currently earn 3.0% per annum with Lido. This staking reward is net of the liquid staking platform’s 10% commission rate. This return is slightly lower than the 3.3% per annum as an Ethereum solo staker.

Percentage of Ethereum Staked Through Lido Finance

Approximately 29% of staked ETH is locked onto Lido. You can estimate this figure based on Lidos’s total locked value (TVL) of $33 billion divided by the total market cap of staked ETH at $114 billion.

Growth of Lido TVL

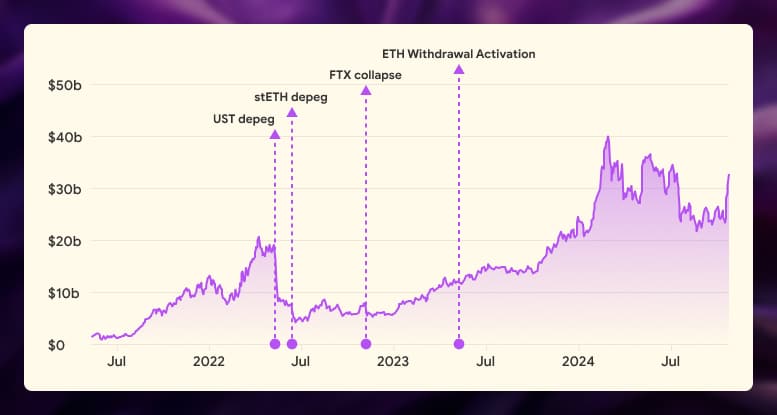

Lido has grown impressively over the past two years and has survived several catastrophic crypto events. Many crypto veterans will remember the Terra Luna collapse, its stablecoin UST, and the crypto exchange FTX shutdown.

While Lido is slightly off its highest TVL in 2024, it looks well on the way to surpassing this figure.

Is Lido Liquid Staking Worth It?

Liquid staking with Lido enables greater flexibility and allows you to earn rewards while retaining liquidity over your assets. This liquidity unlock lets you optimize your staking yields through DeFi protocols and restaking activities.

Lido has survived downturns in the crypto industry, so its platform will likely be safe to use. It has also become so popular that it’s climbed to the top of the DeFi industry regarding TVL.

Lido staking is an attractive option for investors interested in maximizing their Ethereum assets and taking advantage of DeFi protocols.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

November 18, 2024

August 4, 2025