Is Staking Crypto Safe? A Complete Guide to Risks and Rewards

With its potential to generate passive income, cryptocurrency staking has attracted billions of dollars worth of staked digital assets. Crypto users can participate in numerous options, including solo staking on Proof-of-Stake networks, delegating on Delegated Proof-of-Stake chains, and engaging in liquid staking.

However, while staking offers an opportunity to earn rewards, it also comes with risks. Where money flows, bad actors and potential mistakes tend to follow.

This comprehensive guide will explore the following:

- Pros and cons of staking crypto

- Best practices for crypto staking

- Situations where crypto staking makes sense

…and many more!

Benefits of Crypto Staking

Crypto staking isn’t just a method for earning staking rewards and contributing to network security. You can benefit from an investment mindset perspective or earn new tokens, leading to outsized returns.

Here are some of the other pros that stakers can benefit from:

1. Long-term Holding

By enticing stakers with passive income and implementing unbonding periods, staking encourages longer holding periods. Crypto investors can leave their investments and sleep knowing their staked assets will continue earning rewards.

The staking rewards can help investors during market declines. Investors can liquidate rewards to pay for expenses or compound staking rewards for even higher returns.

This long-term mindset can lead to immense returns.

Over the past decade, Bitcoin’s price has gone from $1 to $90,000. However, the price doesn’t move in a straight line. It has dropped 90% numerous times, causing investors to sell their investments.

Only the patient can benefit from large market returns.

2. Airdrop Farming

New crypto projects reward early stakers and participants with their native tokens. Centralized Exchanges, such as Kraken or Coinbase, add these tokens to their trading platforms, causing a price surge.

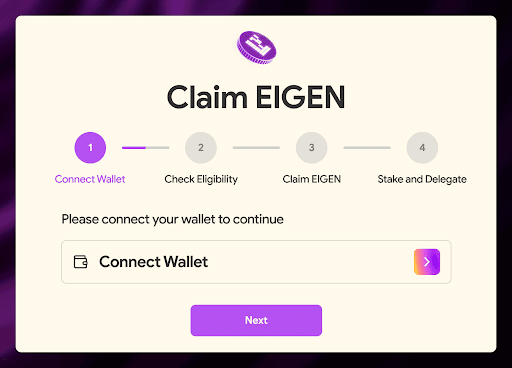

EigenLayer is an Ethereum restaking protocol allowing stakers to use their staked ETH to validate other crypto projects. Early users who restaked ETH before March 15, 2024, got EIGEN tokens.

Most exchanges listed the token on the first day of the EIGEN airdrop, offering restakers potentially thousands of dollars in profits.

3. Community Building

By staking and committing to a crypto project long-term, you help build the community. This practice enables you to get to know other community members.

By becoming a well-known member of your crypto ecosystem, you can get into paid contributor roles. Crypto projects frequently hire team members from those in the community. If you’re interested in working in the crypto industry, this could be your way in.

Crypto Staking Risks

While staking has its benefits, it’s not all roses and sunshine.

Aside from the usual risks (i.e., staking in scams or clicking a malicious link), stakers can experience significant risks. Understanding the risks is crucial for protecting your investment.

1. Market Volatility Risk

Cryptocurrencies are highly volatile, and the value of your staked assets can fluctuate significantly. A sharp drop in token price can offset the staking rewards earned. Consider this example:

- Project A has a token called XYZ with a value of $10

- The staking annual percentage yield (APY) for XYZ is 10%

- XYZ loses 50% of its value in a year

You would be down significantly as the staking APY cannot cover the loss in the token’s value.

As of this writing, many staking cryptocurrencies, such as Cosmos or Polkadot have yet to recover from their previous high prices. Depending on the price you got into the project and started staking, your investments could be at a steep loss.

2. Technical Risks

Solo staking requires setting up your hardware and connecting directly to the blockchain. You are responsible for validating transactions by operating a validator. Any misconfiguration or downtime can lead to penalties, known as slashing, or even the loss of your staked assets.

These technical risks make running a node more suitable for advanced users or organizations with technical resources.

3. Regulatory Risks

Governments or regulatory bodies may impose restrictions on staking services. While this doesn’t harm you in the short term, it eventually forces you to withdraw and transfer funds to search for new yield-generating opportunities.

In July 2024, the United States Securities and Exchange Commission charged Consensys for engaging in the unregistered offer and sale of securities through the latter’s MetaMask Staking service. This unclear regulatory stance has prevented MetaMask from offering its staking services in the US.

Crypto Staking Best Practices

Like in any investment, performing due diligence on the crypto project and the staking platform will help you avoid landmines. Beyond this standard practice, you can take extra steps to secure your digital assets.

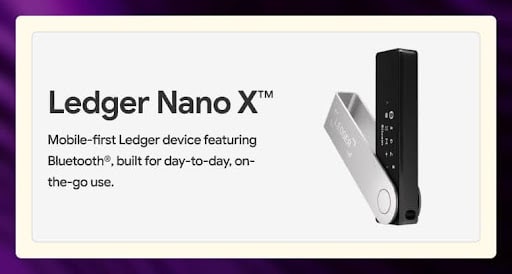

1. Use a Hardware Wallet

You can now stake directly from a browser wallet like MetaMask or Phantom. While this removes the complexities of solo staking, it also exposes your crypto to security risks.

While surfing the web, you’re clicking links and downloading files, one of which could be malicious. Before you know it, a malicious actor has infiltrated your computer and taken your crypto.

To counter this, use a Ledger. You can stake directly from Ledger or connect to staking platforms. Before confirming transactions, you must trigger an approval on your physical Ledger wallet, adding a layer of security to your digital assets.

2. Stay Updated

It is easy to stake crypto, forget it, and then check back in a few years. What can go wrong?

While having a long-term mindset is respectable, pay attention to market updates. Cryptocurrency moves fast, and the project you staked in could experience many changes:

- Change in Leadership: The people driving the cryptocurrency could step down or leave the organization. New leadership could alter the project’s roadmap or values.

- Decline in High APY: The staking rewards rate declines as networks grow and more stakers participate. The returns may no longer satisfy your investment criteria. Take Ethereum staking as an example. Staking rates have fallen from 6% to 3%.

- Airdrop Opportunities: New crypto projects potentially generate massive returns. For example, Jito emerged as a new Solana liquid staking platform. Instead of staking Solana, you could have staked on the Jito platform, giving you JITO tokens.

3. Diversify Staked Assets

No matter your conviction in a particular crypto project, never go all in. You could lose all your assets if something goes wrong with the project.

In May 2022, investors of Luna and its stablecoin UST lost everything in days as token prices plunged to zero. Stakers couldn’t withdraw their funds immediately due to the unbonding period on the project.

Aside from risk mitigation, diversification can also lead to good returns. You can benefit from different APYs and price appreciation by spreading capital across various crypto projects.

When Should You Stake?

Given all the benefits, staking seems like a good idea. However, staking is not for all crypto users. Staking is a long-term game, so you’ll have to be able to ride out the high volatility.

If you are staking, you must believe in the project concept, the team, and blockchain technology. Use your research to develop a solid belief that will allow you to lock staked assets.

Aside from your conviction on the project, consider the lock-up period and time you intend to stake and earn rewards. In the worst-case scenario, the project ties up your assets for a month. Should you need immediate liquidity, consider liquid staking rather than on-chain staking, which may have long unbonding periods.

Is Crypto Staking for You?

Staking has become so popular that billions of dollars have entered the industry. It can offer steady rewards over a long horizon, but not everyone should participate.

Now that you’re more knowledgeable about crypto staking reflect on whether this is something for you. Crypto staking has benefits, but rewards, like all financial products, come with risks. Take time to do due diligence, and most importantly, reflect on your situation.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

December 26, 2024

August 4, 2025