Institutional Crypto Staking: A Turning Point for Crypto Adoption

The approval of the spot Bitcoin Exchange-Traded Fund (ETF) in January 2024 marked a historic turning point for crypto adoption.

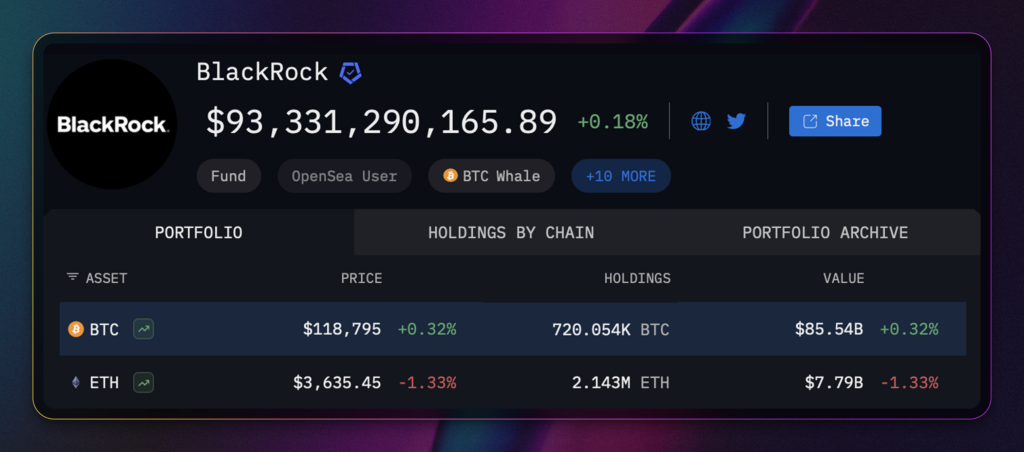

Within a year and a half, BlackRock’s iShares Bitcoin Trust (IBIT) surged to over $85.5 billion in assets under management (AUM). IBIT became the youngest ETF to enter the top twenty-five in terms of AUM.

But buying and holding crypto is just the beginning. We’ve all been there. The question now is, what’s next?

Institutions will want to maximize their returns. The most straightforward way to achieve those returns is through readily available staking consensus mechanisms.

This brings us to the next stage of adoption: institutional crypto staking.

Setting the Stage for Institutional Staking

Institutional staking isn’t a new concept. Crypto-native platforms, such as centralized exchanges (CEXes), have offered staking services to their customers. These institutions run their validator infrastructure.

The Current Institutional Staking Landscape

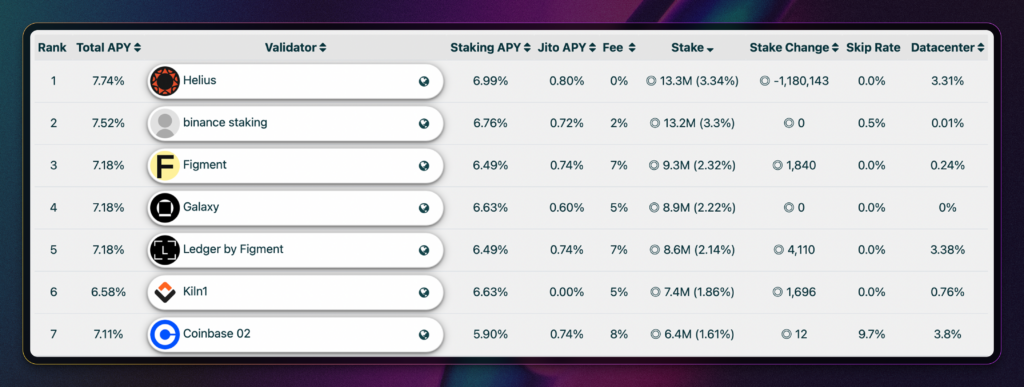

If you glance at the top validators of blockchains, such as Solana and Cosmos, you will see significant institutional interest.

Solana staking’s top validators include major crypto exchanges like Binance and Coinbase, as well as enterprise-grade staking services like Figment and Kiln. Enterprise services, such as Figment, offer validator-as-a-service platforms that other entities can utilize.

Open your Ledger hardware wallet app, and you’ll see a staking service, powered by Figment.

Many of the staking assets flowing to these validators belong to crypto native institutions and retail clients.

A Wave of Positive Regulatory Developments

With President Donald Trump winning the latest U.S. national election, a wave of pro-crypto regulations has also been passed.

Here are a few key developments:

- Strategic Bitcoin Reserve (March 2025): The reserve mandates the national government to acquire and manage Bitcoin and select cryptocurrencies. This directive puts crypto on a list of highly investable assets.

- SEC Statement on Staking Activities (May 2025): The U.S. Securities and Exchange Commission (SEC) clarified that regular staking activities are not securities. Staking had been in a gray zone, especially after enforcement actions like the Kraken settlement in 2023. With the latest statement, staking receives a green light.

- SEC Drops Enforcement Suit (2025): Throughout 2025, the SEC dropped several securities-related enforcement actions against cryptocurrency organizations. ConsenSys, the organization behind the crypto wallet MetaMask, announced that the SEC had stopped its pursuit. This development is significant because the SEC had alleged that MetaMask’s staking services violated securities laws.

Institutional investors are hunting for real yield. The infrastructure is ready, and the rules have never been clearer.

This is just the beginning, and more developments can happen in the next few years. Stay updated and follow our X account for the latest information.

What Happens When Big Money Enters Crypto

As traditional finance firms build crypto exposure, new asset classes and products emerge to meet their needs. The result? Greater legitimacy and the acceleration of innovation in crypto.

The Institutionalization of Crypto Asset Classes

Institutional interest is already reshaping how crypto assets are categorized.

Bitcoin has firmly established its place as a digital strategic reserve, like gold, for the 21st century. Nations like El Salvador have been storing Bitcoin in their national treasuries. Corporations like Strategy and Figma have adopted a similar approach through a corporate treasury.

Ethereum and Solana have emerged as the next frontier, what you may call a “second-tier” of crypto assets. These networks possess strong fundamentals and generate yield through staking.

Institutions have been eyeing Ethereum, with ETFs registering $300 million in daily inflows in July 2025.

The establishment of these asset classes helps separate the speculative from the investable. For the average crypto buyer, you can now determine which crypto has undergone due diligence.

Welcoming Innovation and New Products

Once institutions hold crypto, the next question becomes, what can they do with it?

Staking provides the most direct answer. It’s a straightforward and accessible path to generating yield on crypto assets. The infrastructure already exists, and innovation is on the horizon.

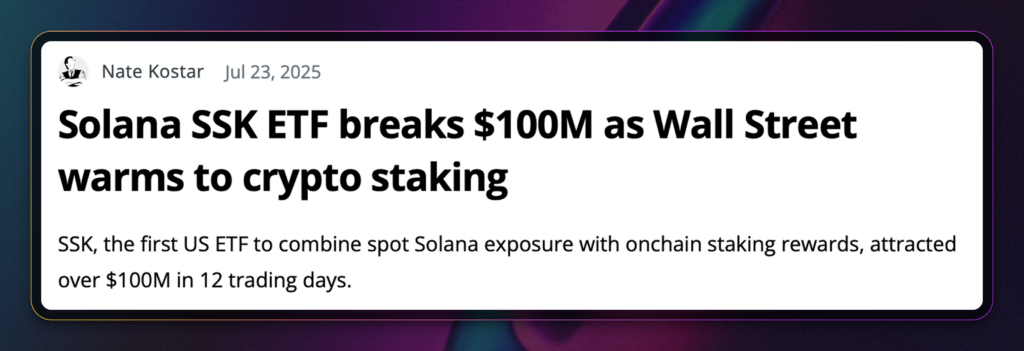

SSK, the Solana staking ETF, launched on July 2, 2025, and surpassed $100 million in AUM within its first 12 trading days. SSK is the first US-listed ETF that combines Solana exposure with staking rewards.

But it doesn’t stop there. After achieving the $100 million milestone, SSK is now integrating Solana liquid staking with Jito Finance.

Meanwhile, Coinbase’s Bitcoin Yield Fund offers institutional clients annual returns of 4% to 5% on their BTC holdings through basis trading. While not staking, it signals an appetite for yield farming products for institutional crypto exposure.

Expect more products, such as liquid staking tokens packaged into traditional wrappers, to staking pools designed for regulated funds.

Bringing Legitimacy and Liquidity

Institutional adoption brings much legitimacy and liquidity to the crypto market.

Bitcoin started as a challenge to the traditional finance industry. Early users and proponents included tech enthusiasts. Now that big players are on board, everyone else will view this as a stamp of approval and follow suit.

Picture your stock market investor who grew up on high-quality stocks with dividends. They examine crypto staking ETFs and find a level of familiarity.

Think of your everyday workers. They may not be investing in crypto directly, but they are indirectly through state pension funds and tax-funded national treasuries.

The Trade-Offs of Institutional Adoption

Institutions entering the crypto space are a significant development. However, with any advancements, it also raises concerns.

Institutional Capital Versus the Bitcoin Ethos

Decentralization. Censorship Resistance. User Sovereignty. The Bitcoin whitepaper outlined these principles.

The entry of institutional capital, often channeled through custodial products such as centralized staking solutions and ETFs, dilutes these values.

ETFs like IBIT enable investors to gain price exposure to Bitcoin without holding the asset or interacting with its network. As institutions gravitate toward trusted, regulated service providers, the likelihood of validator centralization increases, consolidating power and weakening network diversity.

As with the entry of many newcomers, there’s a struggle to balance the past and present.

What Happens When Markets Drop?

Crypto isn’t for the faint of heart. Bitcoin and major cryptos like Ethereum and Solana have dropped in price by 90% on several occasions since their inception. While the assets have matured, there’s no telling what can happen in a downturn.

How will institutions and regular investors react to these drawdowns?

It is one thing when individuals with firm crypto convictions invest. It is another thing when institutions and asset managers invest on behalf of taxpayers and shareholders.

Voters and policymakers can demand that the favorable crypto regulations be reversed.

The Road Ahead: Institutional Capital and the Future of Staking

Institutional crypto adoption is happening in real time.

As institutions seek yield and position themselves for long-term exposure, staking presents a natural entry point. Staking aligns with traditional investment strategies while tapping into the unique advantages of blockchain.

The effects are profound, ranging from the emergence of new asset classes to product innovation. However, this growth is not without its trade-offs. As centralized players gain influence, the original ethos of decentralization and user sovereignty is being tested.

Lastly, we have yet to witness what happens in a crypto market downturn. Many of these institutions invest on behalf of stockholders, investors, and taxpayers. Institutions will have to balance the promise of potential gains with the risk of drawdowns on their stakeholders.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

July 25, 2025

July 29, 2025