Start Your Solostaking Journey: How to Set Up a Validator

Now that you’re determined to become a solostaker, it’s time to set up a validator. By running a validator node, you not only contribute to the security and infrastructure of the blockchain but also receive staking rewards.

By staking independently, you help achieve the true vision of blockchain decentralization.

For this article, we’ll be focusing on solo staking:

- Defining what a validator does

- How to set up your validator

- How to manage staking operations

…and many more!

What is a Validator?

Validators participate in blockchains that operate on a staking consensus mechanism.

Validators run hardware and software as nodes that help the blockchain’s infrastructure. They then stake the required cryptocurrency to validate and verify transactions. As compensation, validators earn rewards from the network.

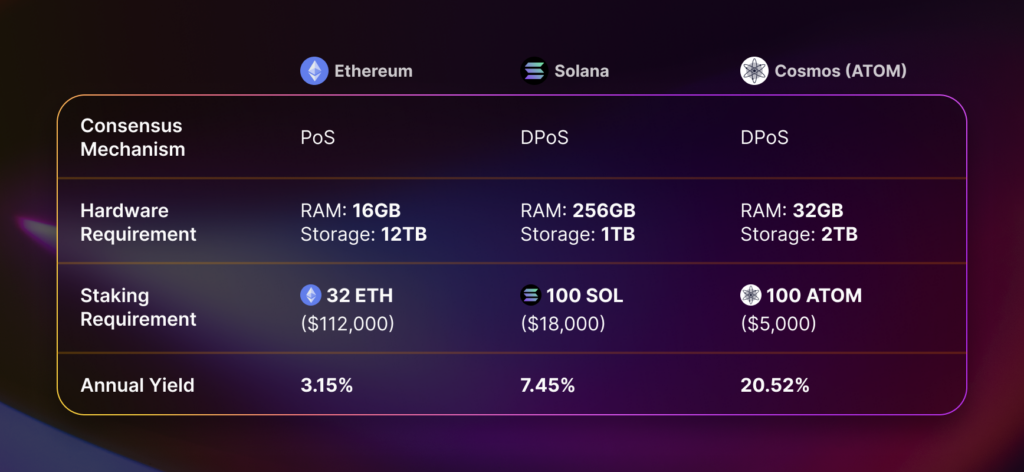

Blockchains like Ethereum operate on the Proof-of-Stake (PoS) consensus, whereas Solana and Cosmos employ a Delegated Proof-of-Stake (DPoS) consensus.

PoS differs from DPoS as the latter allows a staker to delegate votes to a validator. Traditionally, in PoS, validators operate alone with their staked crypto. This standalone process is called solo staking.

With the advancements in PoS, stakers can now also delegate and pool their assets with other validators. You can do this through liquid staking.

How to Set Up a Validator Node

Before committing to a validator node, make sure you’re aware of the pros and cons of staking. You will have complete control of your cryptocurrency while receiving crypto rewards. However, you will have to commit time, effort, and capital.

Building your validator node is a highly technical process. We’ve simplified the steps to guide you through it.

1. Choose the Blockchain

You’ll have to choose which network to stake on. The network determines the consensus mechanism, hardware requirements, minimum number of votes, and staking capital. Here’s a simple comparison of different staking requirements per network:

*Cosmos has a maximum of 180 validators based on the total staked amount. The indicated staking requirement is the minimum amount to rank within the top 180 validators as of July 19, 2025.

Intuitively, ATOM staking provides the best return on investment. With a low staking requirement and high annual yield, you can get the best returns. However, this is not always the case.

Capital or Principal Loss is one of the significant staking risks. If the price of your staked tokens decreases, you will lose the Dollar value of your investment. The ATOM price has struggled to grow in recent years, dropping to its lowest point since 2020.

2. Choose a Hosting Provider

Given the heavy computer requirements, many stakers choose to host the node on a cloud server. Google Cloud and Amazon Web Services (AWS) allow stakers to run a node from their respective cloud accounts. Such companies guarantee higher staking uptime while reducing the computer requirements of the validator software.

Aside from traditional cloud services, companies such as All That Node offer a dedicated node through their node-as-a-service program.

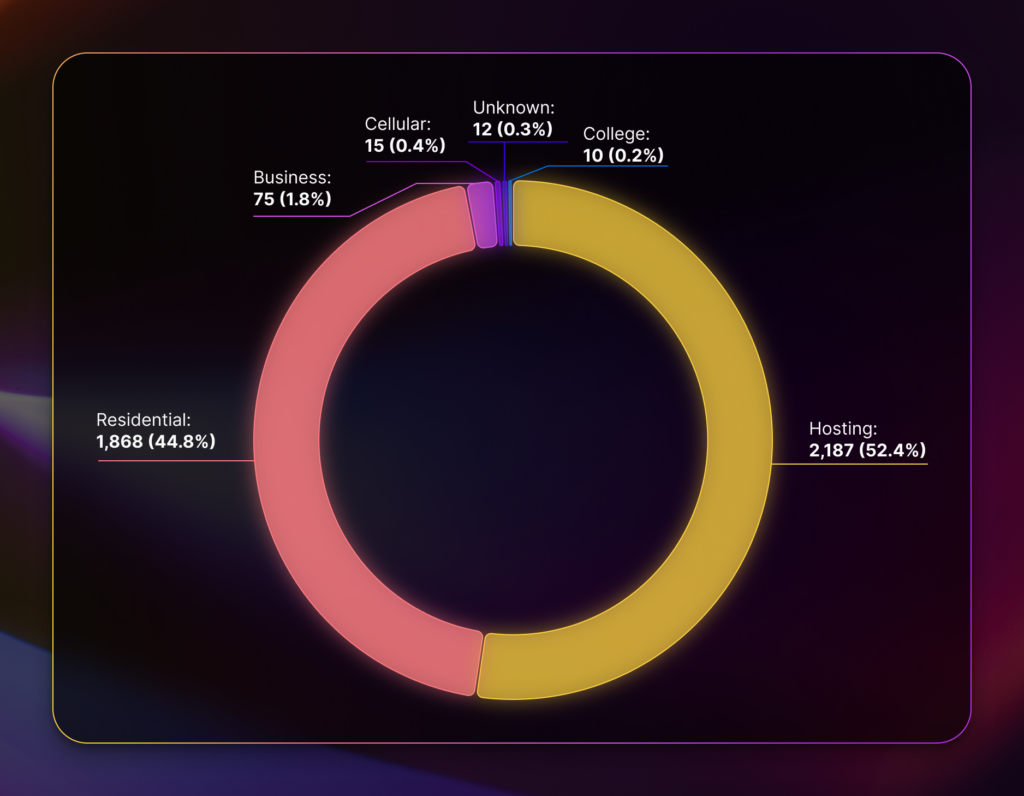

Nodes per network type, from Ethernodes

Over 55% of nodes operate through cloud services such as AWS. To have a decentralized network, more validators are needed. However, if everyone is operating through the same centralized services, then there’s a concern about centralization.

Ethereum co-founder Vitalik Buterin has criticized node centralization, arguing that it creates a single point of failure. If AWS shuts down, then many nodes would also shut down.

Moving forward, we’ll be discussing how to set up a validator on a local computer.

3. Set up a node

A blockchain node is a physical computer that maintains the software of a blockchain network. Furthermore, a node is connected to other similar computers, forming a decentralized network infrastructure.

To set up a node, a staker needs a physical machine that meets the corresponding technical requirements. Then, they download and install the client (network software). Depending on the blockchain, a staker may need more than one client.

Ethereum validator nodes require two clients: an execution client and a consensus client.

The execution client facilitates transactions and implements smart contracts. Meanwhile, the consensus client verifies and validates the transactions. The two work together to make the Ethereum network operate properly.

Cosmos nodes require only one client, called the Gaia Client.

4. Acquire Tokens to Deposit Into the Validator Node

Once you have the software running, you need to acquire the crypto to deposit into the node. This deposit is required to turn your node into a validator. As a validator, you will validate transactions and earn rewards.

The various methods have their advantages and disadvantages.

Centralized Exchanges

A staker can open an account with crypto exchanges such as Coinbase and Kraken. Customers should be able to complete the KYC (Know Your Customer) process and access their accounts on the same day.

Customers can fund their exchange accounts using bank accounts or credit cards. Afterward, customers send the crypto to the designated staking wallet (typically a hardware wallet such as Ledger).

Please note that cryptocurrency held with an exchange is at risk. Exchange operators can act maliciously and freeze your funds.

Over-the-counter (OTC)

Crypto exchanges also offer OTC trading for institutions and premium clients.

OTC trading provides a single quote for large orders, ensuring the best pricing. OTC also comes with personalized 1:1 service and settlement flexibility. Customers can choose to transact using bank accounts and receive crypto directly into their staking wallet.

Kraken Exchange offers OTC trading for single quotes of $100,000 to $1,000,000. You can utilize these services to acquire substantial amounts of ETH for institutional staking purposes.

Decentralized Exchanges

Crypto stakers may choose to retain complete control over their crypto through a decentralized exchange.

Uniswap is the largest decentralized exchange, offering trading for Ethereum-based tokens. Customers need to connect via a non-custodial wallet such as Metamask or Phantom Wallet. Once connected, the platform executes the trade and sends the tokens directly to the wallet.

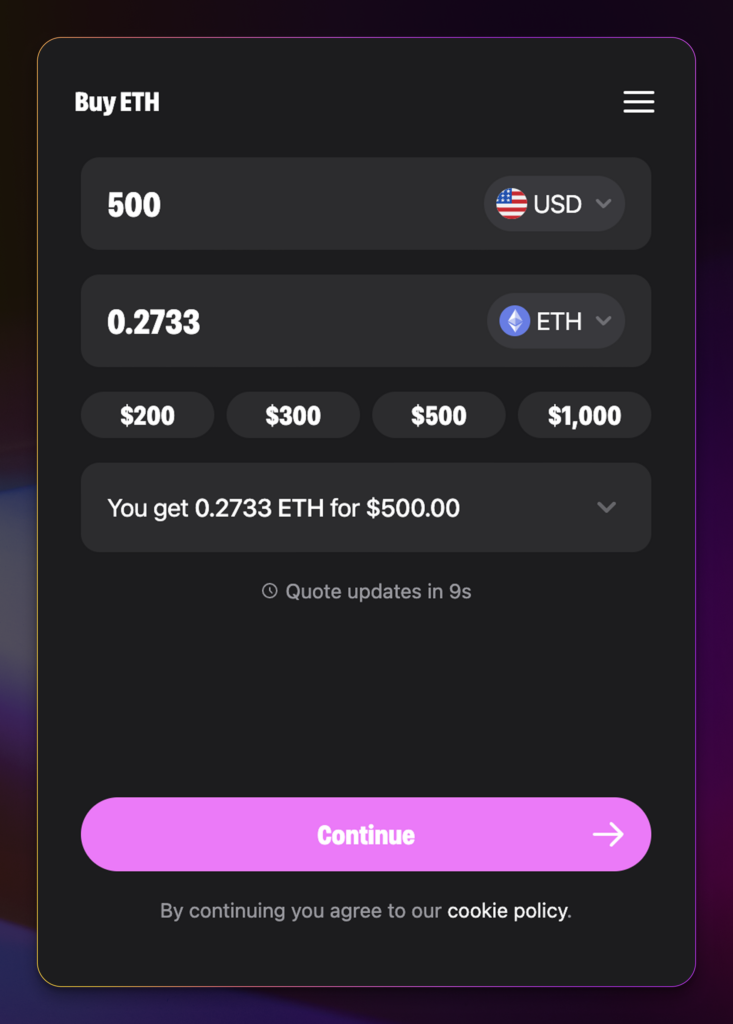

Decentralized exchanges can also facilitate trades from a user’s bank account. Uniswap integrates with Moonpay, a cryptocurrency service that enables users to purchase crypto directly from their bank account or credit card.

MoonPay service, as found on Uniswap.

Generate a Validator Key Pair

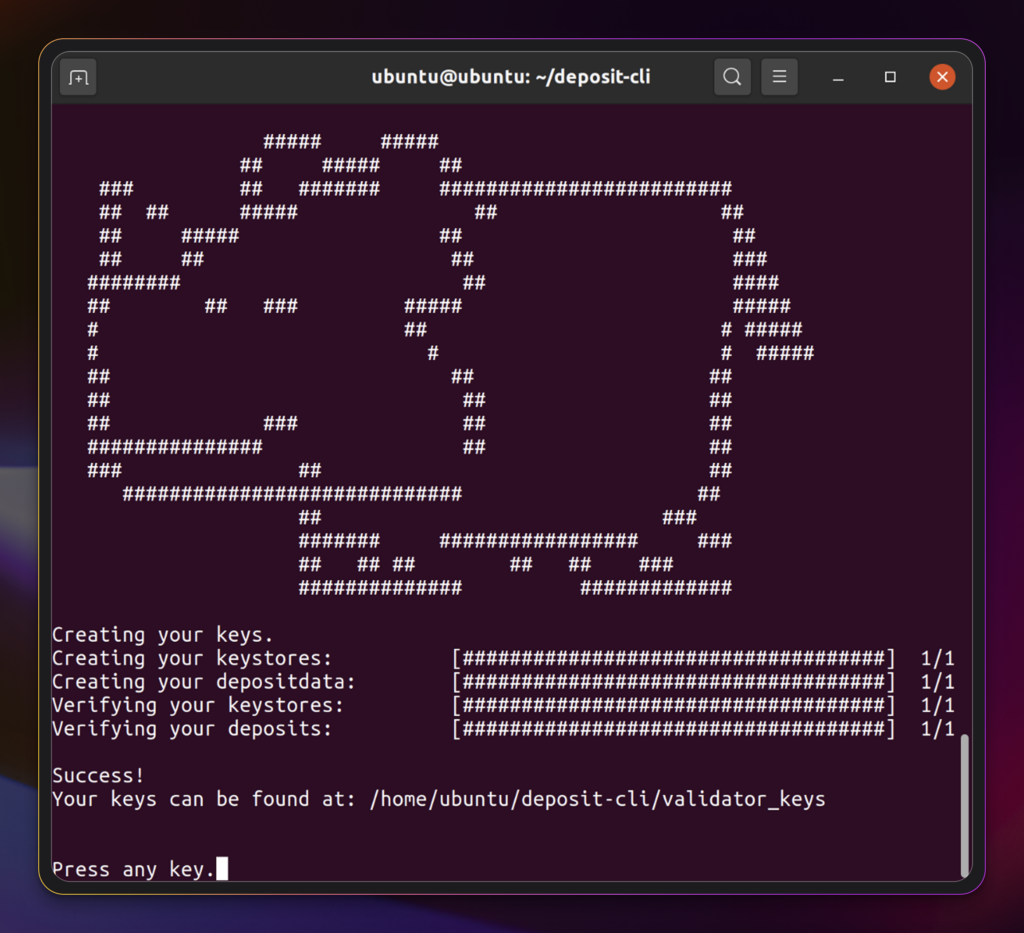

Stakers can use software and command-line prompts to generate the validator key pairs. You have two types of keystore files, which dictate the validator’s ability to sign transactions. On the other hand, the deposit data file contains public information about your validator.

Sample Key Generation Success

Note: This is a simplified process for generating keys. Ensure that you research how to generate and store keys and key phrases securely. Should a malicious actor access your keys, they can steal your staked cryptocurrency.

How to Manage Ongoing Operations

Once your validator is up and running, you will need to manage operations to ensure your validator node is running correctly.

Monitoring and Alerts

Staking requires platforms and software to make sure they’re fully synced to the network. Keep an eye on both connections to the blockchain and hardware performance.

Prometheus and Grafana monitor node performance, regardless of which blockchain your validator runs on.

Prometheus is a free and community-driven software that collects and stores data. Stakers and developers frequently use it for monitoring systems. Meanwhile, developers often use Grafana in conjunction with Prometheus. Grafana is an open-source data visualization tool.

Sample monitoring dashboard, from Grafana

Stakers set up notifications in case their validator goes offline. Grafana can provide such alerts through Telegram and Discord.

Backup and disaster recovery

Your node hardware or software may encounter issues. These problems would cause your validator node to go offline. While it’s pretty easy to build a node again, there are a few items that you should keep secure:

- Crypto wallet seed phrase – You will deposit your staked crypto and staking rewards here.

- Validator key mnemonic – The validator key is responsible for validator operations. Furthermore, it allows you to exit your crypto from the validator.

- Keystore and deposit data files – The JSON files contain essential information regarding your validator.

As an initial disaster recovery practice, equip your physical node with an uninterruptible power supply (UPS). A UPS powers your equipment for a few minutes until your provider restores power. Frequent electricity failures can also damage your hardware.

How to Attract More Delegators into Your Staking Operation

Anyone with the proper technical skills and capital can stake in Ethereum. However, some of you may want to run a node on a Delegated Proof-of-Stake (DPoS) blockchain. If so, you’ll have to grow your reputation within the community. You must rank highly among other validators to attract a sufficient amount of voting power.

Active Community Involvement

Coinbase Custody runs the largest validator on Cosmos with $180M worth of Atom staked. Other players in the top 10 include Binance, Stakefish, and Kraken. As a solo staker, you cannot compete with the name recognition of such big players. However, you can crack the ranks of other validators.

Participate in online discussions on forums, Discord servers, and social media such as X. You won’t be the top validator on the blockchain. Still, you can be in the top hundred or so validators.

Marketing and Branding

To enhance your reputation within the community, consider branding yourself as a professional validator. Marketing efforts can involve creating a website or landing page, establishing a corporate entity, and developing content.

The community will recognize you through your publication and educational material. As a thought leader in the industry, you will build trust. Eventually, you’ll attract the delegators.

Take Control and Become a Validator

By becoming a validator and staking, you can earn income on your crypto investments. Furthermore, you can participate in a blockchain network’s operations and become a valuable community member.

Editor’s Note: This article was originally published in November 2023 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

July 24, 2025

July 29, 2025