Maximising Gains: How Often to Claim Staking Rewards

Staking offers a great way to earn passive income. It’s easy to stake and forget your crypto until a time when prices boom. However, your staking rewards-claiming practices can impact your overall returns.

Claiming too often may incur unnecessary transaction fees, while claiming too infrequently might miss out on compounding opportunities.

Understanding the optimal rewards claim schedule is essential for maximizing gains.

In this guide, we break down the following:

- A brief explainer on staking rewards

- Claiming staking rewards vs. auto-compounding

- Factors to consider when claiming staking rewards

- Optimal staking rewards claiming period

- How different networks handle reward claims

…and many more!

What are Staking Rewards?

When you stake crypto, you lock your assets to help validate transactions and secure the network. Whether it’s a proof-of-stake (PoS) or delegated-proof-of-stake (DPoS) consensus mechanism, you receive staking rewards.

Think of these rewards as earning interest on a savings account or dividends from stocks.

The amount you earn depends on several factors, including:

- The amount of crypto staked

- The staking duration

- The overall staking rate of the network

These rewards often come in the form of the underlying native token. For example, Solana staking rewards stakers with Solana (SOL) tokens.

However, recent staking innovations generate rewards in other forms.

Liquid Staking Tokens

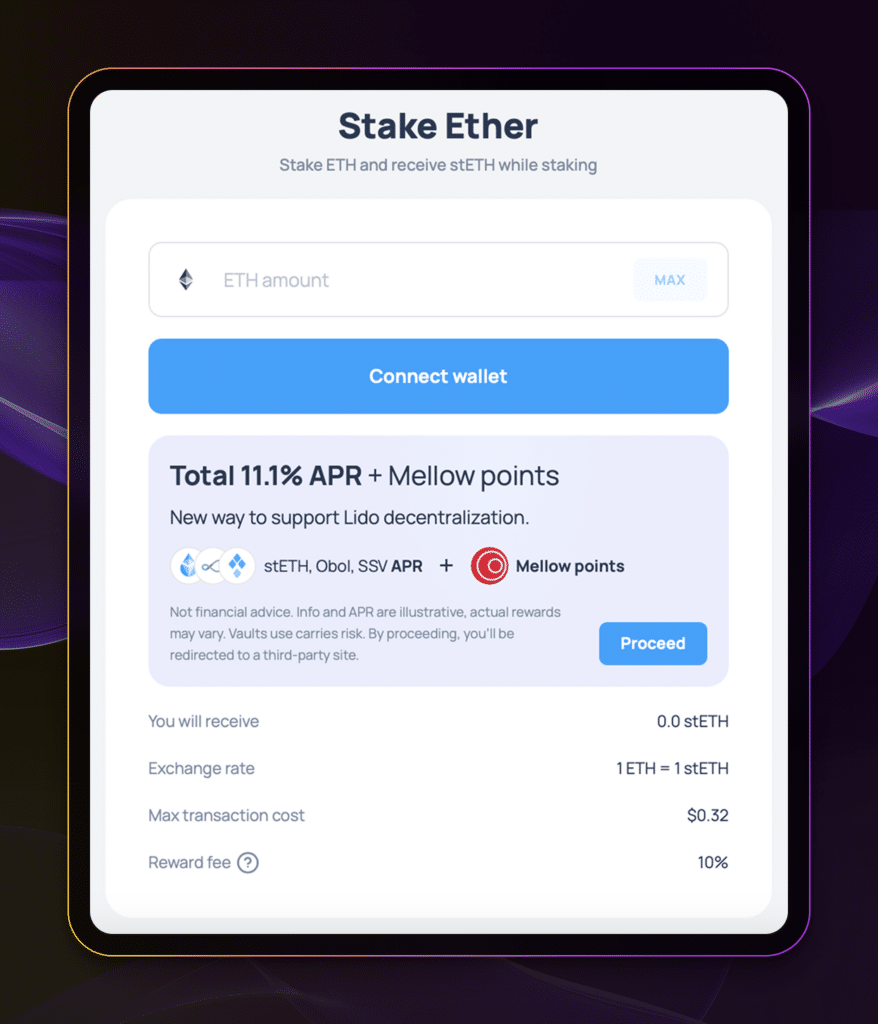

In liquid staking, you deposit your cryptocurrency, such as Ethereum (ETH), on a third-party platform like Lido Finance. In return, you receive liquid staking tokens (LST), equivalent to your staking capital. These LSTs represent the staked assets in a blockchain network. You earn staking rewards also in the form of LSTs.

You can utilize LSTs in decentralized finance (DeFi) protocols to earn a higher yield.

Liquid Looping Tokens

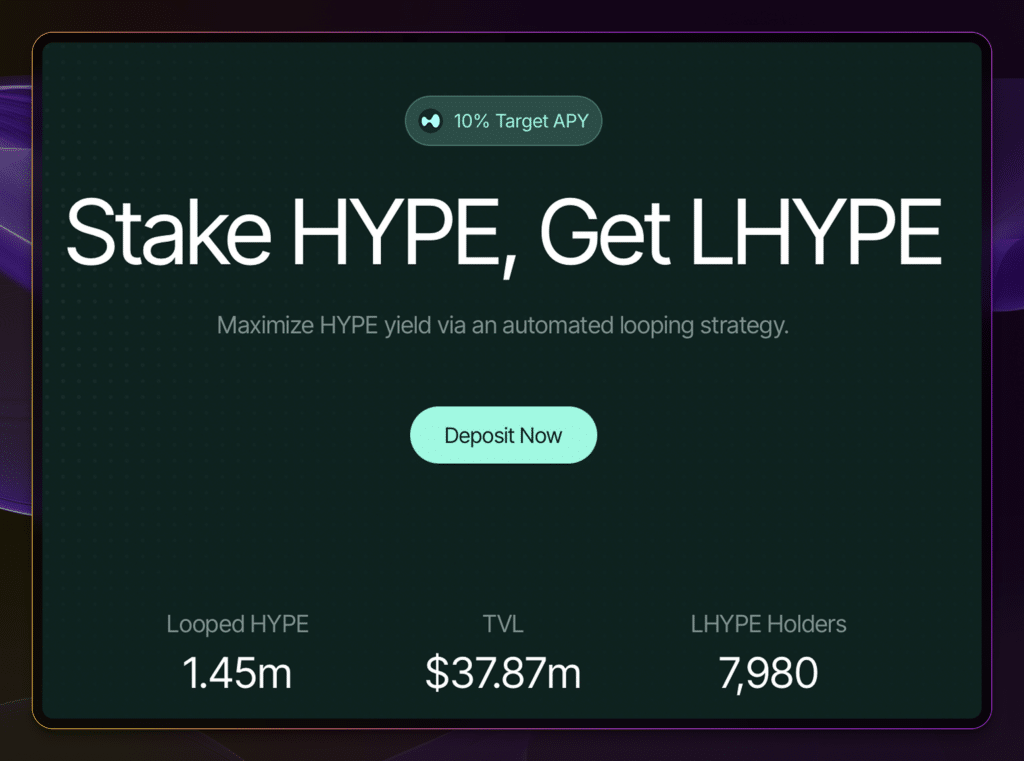

Liquid Looping is where you repeatedly stake and borrow against your crypto to increase yield. However, instead of manually staking and borrowing crypto, you need to purchase a liquid looping token. Institutions handle background processes such as staking, borrowing, and risk management.

Looped HYPE is a new liquid looping token that leverages the yield of the Hyperliquid ecosystem. You deposit HYPE for LHYPE. Similarly, you earn staking rewards in the form of liquid looping token.

Multi-Chain Staking Rewards

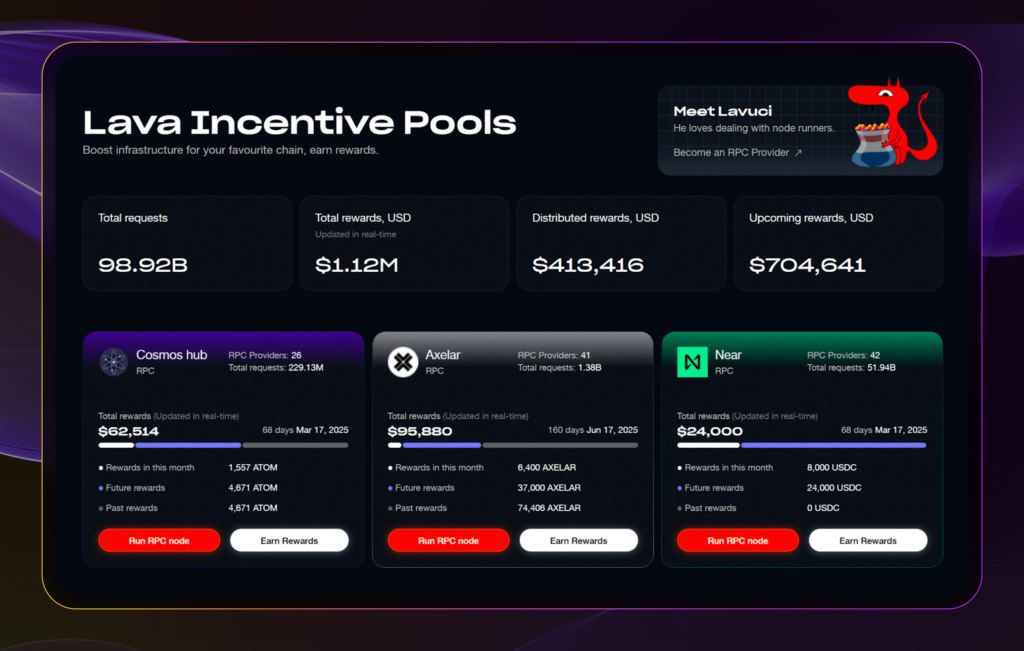

With multi-chain staking, you stake on one blockchain, such as Cosmos, and earn tokens across other blockchains, like Ethereum. This innovative staking design allows you to diversify crypto holdings.

Lava Network is a Cosmos-based protocol that manages the data traffic for several blockchains. You can delegate your Lava tokens to data providers and earn rewards in Cosmos (ATOM), Axelar (AXL), and Near (NEAR), to name a few.

Claiming vs. Auto-Compounding Staking Rewards

There are many types of staking programs and staking rewards, each carrying its rewards-claiming process.

You can either claim rewards manually or have them auto-compounded.

Manual Claiming

In some staking programs such as Cosmos, you must actively claim your staking rewards. The rewards move to your designated cryptocurrency wallet, like Leap, or a hardware wallet, like Ledger. You can stake these rewards to compound earnings.

When you claim or stake your rewards, you will incur transaction fees, also known as gas fees.

Auto-Compounding

Staking programs like liquid staking and liquid looping tokens automatically reinvest your staking rewards, increasing your staked amount. You don’t have to pay any transaction fees.

This method amplifies the compounding effect and can result in higher returns over time.

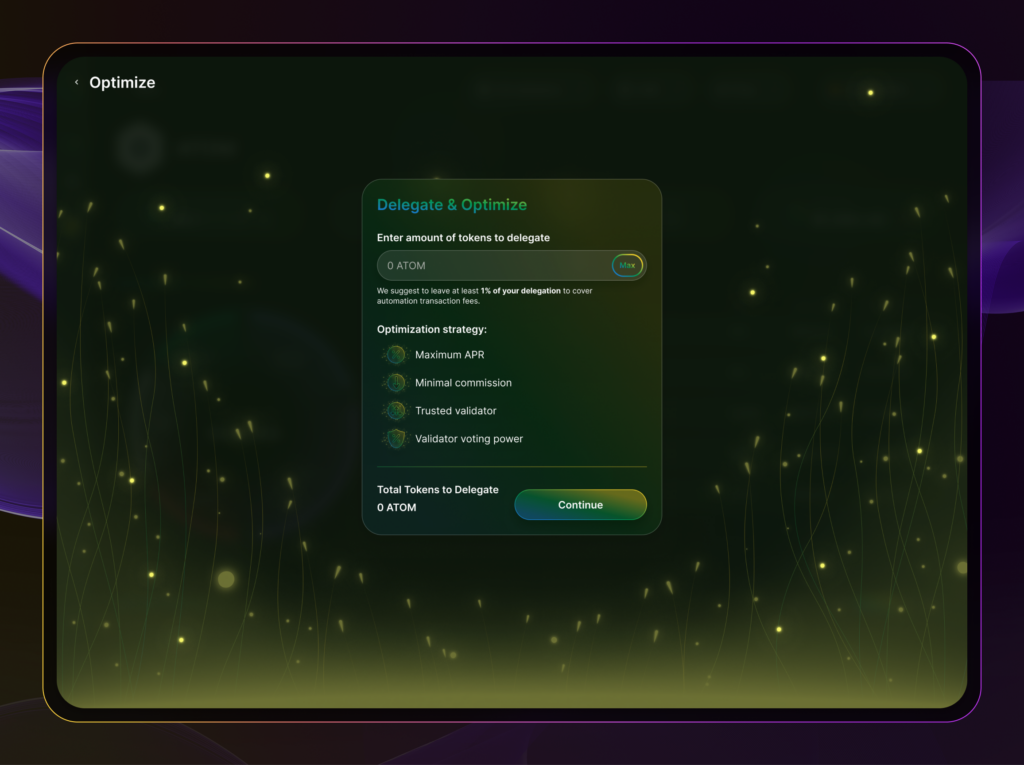

You can also also use staking optimization platforms to turn manual claims into auto-compounding. Polli.co is a staking optimization platform for Cosmos and Lava Network. The platform auto-compounds your rewards.

Imagine that you’ve invested $1,000 worth of cryptocurrency with a 5% annual yield. The blockchain pays rewards every quarter. This quarterly payout period means that you receive $ 12.50 every quarter.

Without compounding, your investment will grow to $1,050 after one year. With compounding, however, your investment will reach $1,050.95. While this difference may seem small, it scales up with larger amounts and grows over time.

Factors to Consider When Claiming Rewards

If you’re manually claiming rewards, you’ll need to balance several factors.

- Compounding Benefits: If you’re staking with an auto-compounding protocol, delaying claims will allow rewards to compound. However, if you need to claim rewards manually, the quicker you claim and stake the rewards, the higher your potential staking reward rate.

- Transaction Fees: Frequent claims can lead to higher cumulative fees. Transaction fees are negligent on networks like Solana but can cost a few dollars on Ethereum.

- Token Price Volatility: Market fluctuations can affect the value of your rewards. Timing claims during favorable market conditions is beneficial if you want to liquidate the rewards.

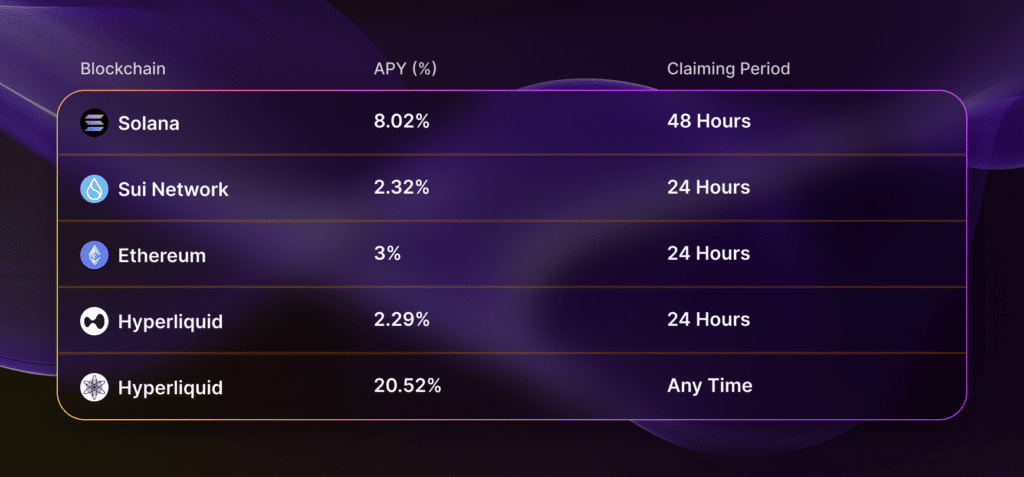

How Different Networks Handle Reward Claims

Claiming rewards is a straightforward and instantaneous process. However, to withdraw rewards, you have to wait for the network’s reward claiming period.

How Often Should You Claim Rewards?

if you’re staked in an auto-compound program, you should leave the rewards to grow.

If you’re staked in a manual rewards program, you should claim and stake rewards as soon as they’re available. This quick claiming process compounds your staking rewards. However, you also need to check if it’s feasible to claim.

Rewards Claiming Feasibility

Let’s say you’ve staked $100 of crypto in a staking program that pays 5% per year with the additional details:

- The network pays the staking rewards weekly.

- The transaction fee comes out at $1.

- You earn $5 every year.

- Claiming rewards weekly costs $52 per year.

While you could claim the rewards every week, you would end up losing overall. You need to increase your staking size or reduce your claiming frequency.

Alignment to Investment Goals

Beyond costs and optimization, the claim frequency should align with your investment goals.

Some stakers may claim and liquidate rewards to pay for necessities. Others may hold and compound rewards for years. There is no right or wrong answer as long as it follows your investment strategy.

FAQs About How Often to Claim Staking Rewards

How are Staking Rewards Paid Out?

Staking rewards are distributed based on the network’s protocol. Some networks auto-compound rewards, while others require manual claiming.

Are Staking Rewards Paid Daily or Monthly?

The frequency of reward distribution varies by network. For example, Solana distributes rewards every 2-3 days, while Ethereum rewards are earned daily.

Do Staking Rewards Expire?

Staking rewards generally do not expire and can be claimed anytime after you earnt them. However, it’s important to check the network you’re staked on.

In Polkadot, rewards expire after 84 days.

Is it Better to Auto-Compound or Claim Manually?

Auto-compounding simplifies the process and can enhance returns over time. Manual claiming offers more control but requires active management and may incur additional fees.

What’s the Best Time to Claim Rewards for Solana/Cosmos/Ethereum?

In both Solana and Ethereum, rewards auto-compound so there’s no need to claim them. For Cosmos, it’s best to claim rewards when the accumulated rewards exceed the transaction fees.

Final Thoughts on Claiming Staking Rewards

Maximizing staking rewards involves understanding the nuances of the claim process. You need to study each network’s mechanics, specifically regarding manual or auto-compounding rewards and transaction costs. You must also align your claiming strategy with your investment goals.

By staying informed and proactive, you can enhance your staking returns and contribute effectively to the network’s security.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

June 5, 2025

September 3, 2025