What is Bitcoin Staking?

Since the launch of Ethereum staking in late 2020, users have deposited over $186 billion in ETH. Similarly, investors have placed $111 billion of total value locked (TVL) into decentralized finance (DeFi).

While most crypto staking occurs on Ethereum and Proof-of-Stake networks, the DeFi industry has evolved to include Bitcoin investors as well.

Now, Bitcoin holders can participate in yield-bearing opportunities and earn staking rewards.

In this article, we answer the following:

- Staking cryptocurrencies versus mining

- How can Bitcoin holders participate in staking?

- What are the benefits and risks of Bitcoin staking?

Continue reading to explore Bitcoin staking.

Crypto Staking vs. Mining

Before we jump into Bitcoin staking, it’s essential to understand how blockchains operate and verify transactions. Network participants primarily engage in two types of consensus mechanisms:

Crypto Mining

Bitcoin relies on a consensus mechanism called Proof-of-Work (PoW), also known as mining. In PoW, a miner assembles computer hardware to solve complex mathematical equations, thereby validating transactions. Miners then earn block rewards and network fees.

As the difficulty of solving these puzzles increased, so did the computational power and investment cost of the hardware. Mining became costly and fell into the hands of a few players, thereby defeating the decentralization of blockchain.

Crypto Staking

To address the issues of crypto mining, developers have created Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS) protocols. A staking consensus mechanism requires stakers to deposit a certain amount of crypto. The staked tokens then verify transactions, and stakers earn staking rewards.

Ethereum dominates the staking industry, but other staking-consensus networks, such as Solana, Cosmos, and Lava, have attracted significant interest.

What is Bitcoin Staking?

Bitcoin relies on mining to validate transactions on its network. Hence, you cannot use staking for the Bitcoin network. However, you can use Bitcoin staking to secure other PoS blockchains.

Babylon Labs created the first Bitcoin staking protocol.

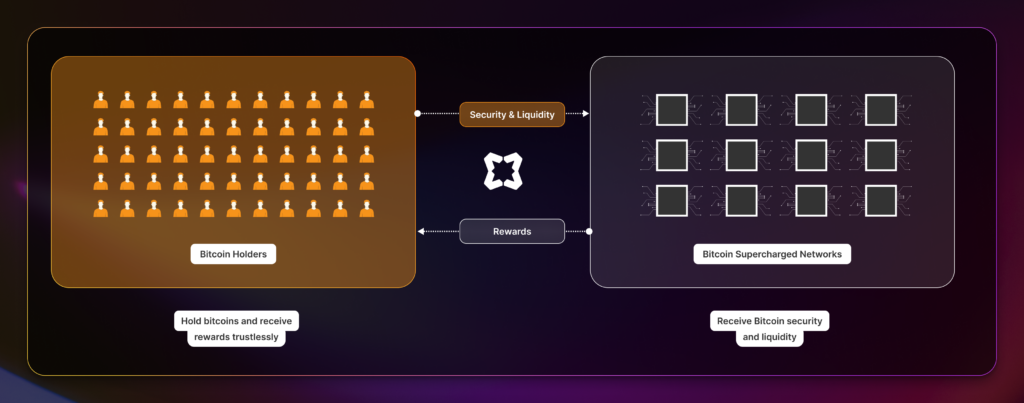

Through Babylon, Bitcoin staking allows Bitcoin holders to utilize their capital to provide validation services to PoS chains.

Here’s a summary of how it works with Babylon:

- A Bitcoin holder delegates their Bitcoin to a Finality Provider, much like a staker delegates tokens to a validator in DPoS.

- The Finality Provider utilizes staked Bitcoin to validate staking networks, called Bitcoin Supercharged Networks (BSNs).

- The BSNs leverage the staked Bitcoin to enhance their network security.

- The Finality Provider receives the staking rewards and redistributes them to the stakers.

Bitcoin Staking vs. Restaking

If the Bitcoin staking process looks familiar to you, it’s because the concept works similarly to Solana Restaking and Ethereum Restaking. In restaking, protocols enable you to deposit your staked ETH and SOL to validate other projects, thereby earning rewards.

The key difference is that you utilize the Bitcoin assets for the very first time. In restaking, the assets involved have already been staked or used.

How to Stake Bitcoin

Let’s assume you’re prepared with some Bitcoin on hand, whether on an exchange like Coinbase or a hardware wallet like Ledger.

1. Create a Crypto Wallet

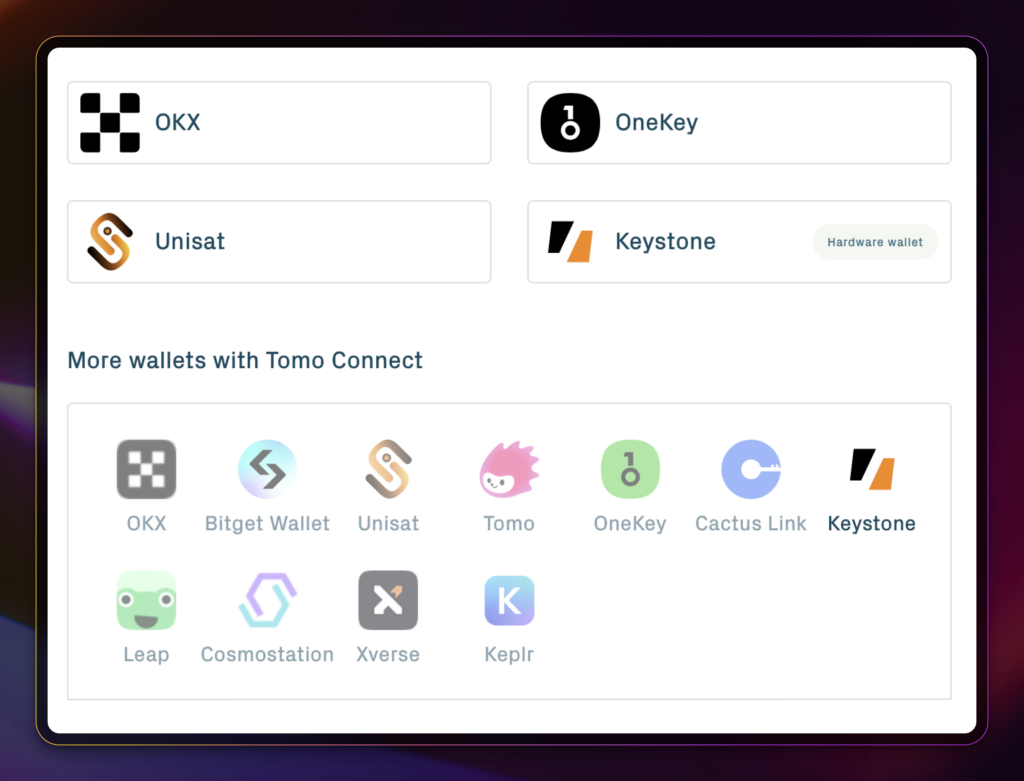

You will need to create a crypto wallet that supports both Bitcoin and the Babylon Genesis Chain. When you click on the “Connect Wallets” button in the Babylon interface, you can view and choose from several wallets.

Some wallets, such as Cosmostation, Leap, and Keplr, will be familiar as they’re highly used for Cosmos staking.

Send your Bitcoin to the applicable wallet.

2. Select a Finality Provider

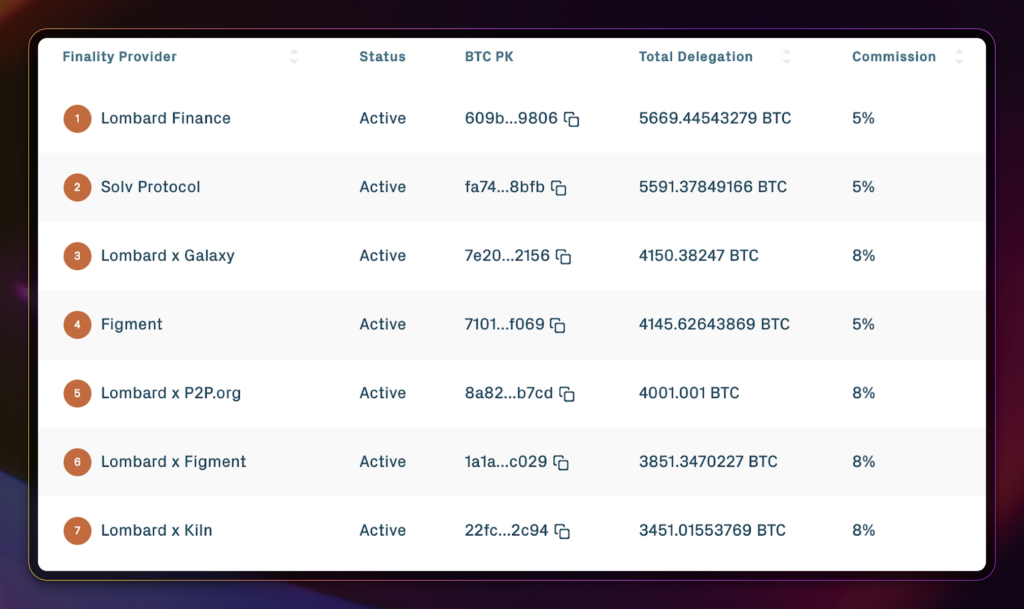

Once your wallet is funded, connect it to the Babylon staking interface.

On the interface, you can view the amount of Bitcoin delegated to the provider, as well as their commission rate. Commission fees range from 5% to 8%.

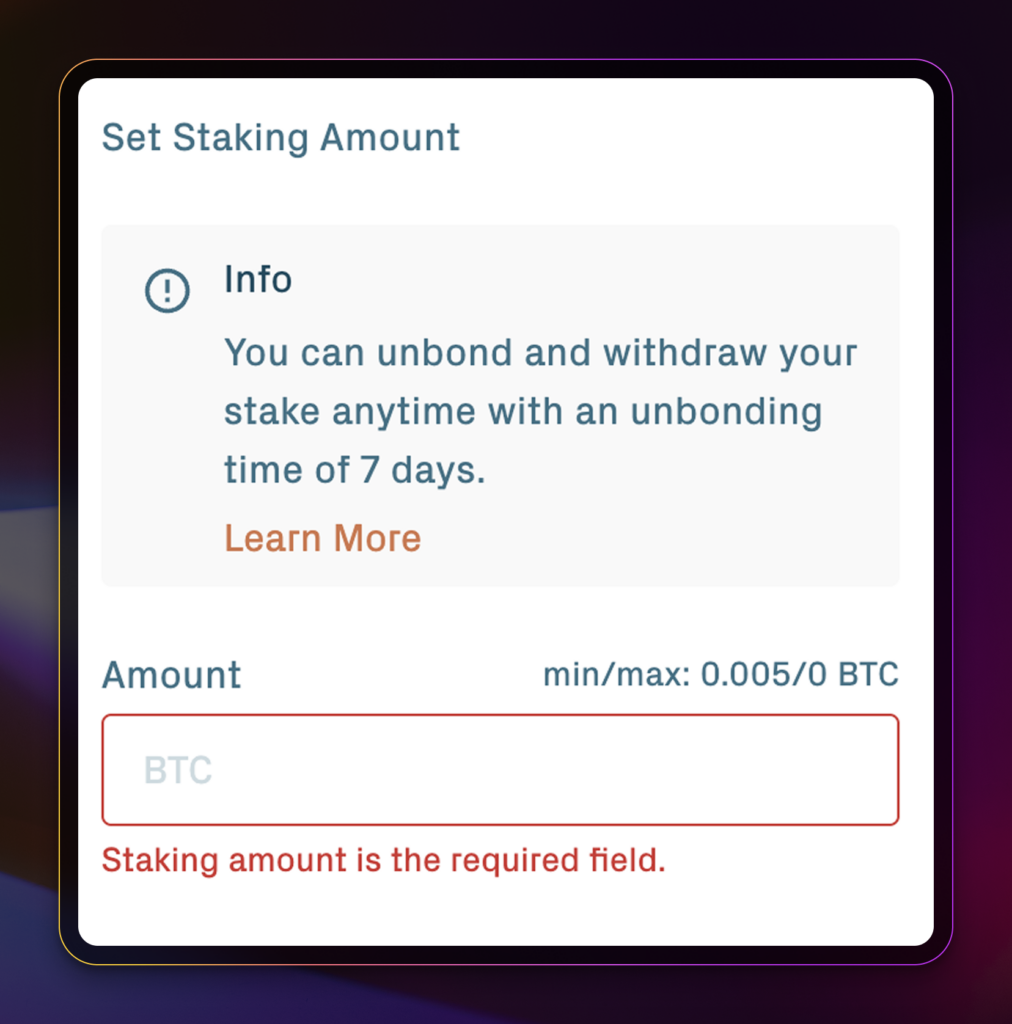

3. Enter the Bitcoin Staking Amount

Type how many Bitcoin you’re interested in staking. Note that there’s a 7-day unbonding period. You will be unable to move your Bitcoin or earn rewards during this time.

Once you’ve entered the amount, you can finalize staking with Babylon. You will need Babylon’s native token $BABY to register your stake.

It takes approximately one hundred minutes for the Bitcoin network to activate your stake.

4. Monitor Your Rewards

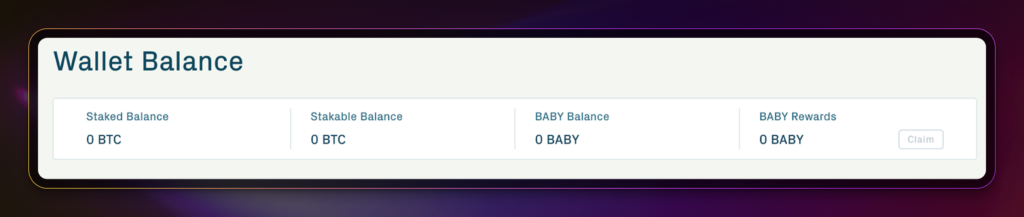

You will receive rewards in the form of $BABY tokens. You can monitor this through the platform’s dashboard.

There’s a small “Claim” button beside your $BABY rewards. Please note that when you claim rewards, a corresponding $BABY gas fee will be applied.

What are the Benefits of Bitcoin Staking?

Bitcoin investors have wondered how to earn rewards on their holdings. Fortunately, the DeFi industry has evolved to cater to these holders.

Here are some additional benefits of utilizing Bitcoin through Bitcoin Staking.

Economic Security

Bitcoin stakers play a significant role in securing the cryptocurrency ecosystem.

Consider how a new network would have to create its own staking rewards pool from scratch. This would require a considerable amount of time, effort, and capital to incentivize stakers to join the program.

Crypto Holdings Diversification

Bitcoin Staking allows Bitcoin holders to diversify their cryptocurrency portfolio.

Stakers earn rewards in $BABY tokens. You can use $BABY tokens for trading on both centralized and decentralized exchanges, as well as depositing them into liquidity pools.

Risks of Staking with Bitcoin

Bitcoin staking is relatively simple and involves connecting your wallet to one or two sites. However, the technology is new. Some risks come with this novelty.

Technological Risks

Unlike Ethereum, Bitcoin does not support smart contracts (self-executing code). As such, Babylon Labs uses advanced cryptography, Bitcoin scripting language, and other innovations.

While the Babylon team is highly capable of executing on Bitcoin staking, the platform has been live for less than a year. It has yet to be battle-hardened by multiple crypto cycles similar to the DeFi platforms on Ethereum.

Regulatory Risk

In May 2025, the United States Securities and Exchange Commission (SEC) declared that protocol staking activities are not securities. Staking service providers welcomed the announcement.

While the current regulatory environment favors cryptocurrency and staking, previous administrations took a hard stance on crypto. In July 2024, the US SEC charged ConsenSys and MetaMask for offering securities through its ETH staking service.

As administrations change, so could regulatory environments, which could deter your staking activities.

Frequently Asked Questions

What is the Staking Rate for Bitcoin?

At the time of writing, the Bitcoin staking rate with Babylon is at 0.38% per year. Please see their website for the up-to-date rate.

How Big is the Bitcoin Staking Industry?

The Bitcoin staking market capitalization is $6.3 billion, representing 0.29% of the total Bitcoin available. With the low staking ratio, there’s a lot of upside for Bitcoin staking.

What are the Best Platforms for Bitcoin Staking?

Babylon Labs is the best place to start staking. Aside from Babylon, you can stake directly with their Finality Providers such as Lombard Finance and Solv Protocol.

Conclusion

With the rise of Bitcoin Staking and DeFi, Bitcoin holders may earn passive income and receive rewards similar to those of PoS holders.

While the technology is new, Bitcoin staking presents opportunities to not only earn yield but also participate in the security of other chains. By strategically engaging in Bitcoin Staking, investors can optimize their earnings while actively contributing to the growth and functionality of the broader crypto ecosystem.

Editor’s Note: This article was originally published in December 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

June 30, 2025

July 1, 2025