Where to Stake Solana: Top Platforms

As the sixth-largest cryptocurrency by market capitalization, the Solana blockchain has emerged as one of the top networks. It offers lightning-fast transactions, low fees, and an expansive builder network.

As investors hold Solana tokens (SOL), they become curious about maximizing the returns on their digital assets. By staking Solana, you can contribute to the network’s security and efficiency while earning rewards for your efforts.

But with so many platforms available, it can take time to figure out where to stake your SOL for the best returns.

This guide will help you navigate where to stake Solana and how to make the best choice based on your goals.

Introduction to Solana Staking

Staking Solana (SOL) offers a great way to earn passive income by helping secure the Solana network.

As a delegated proof-of-stake (DPoS) blockchain, Solana relies on validators who process transactions and maintain the network’s integrity. SOL token holders then delegate their Solana tokens to these validators.

By staking SOL tokens, you contribute to the network’s security and earn rewards.

With Solana’s increasing popularity, several platforms exist where you can stake your SOL tokens. These platforms range from sell-custody crypto wallets to centralized exchanges and Decentralized Finance (DeFi) staking platforms, each offering unique benefits.

What to Consider When Choosing a Solana Staking Platform

Consider these essential factors when selecting a platform for staking Solana to maximize your rewards while minimizing risks.

Security

Security should be your top priority when choosing a Solana staking platform.

Since staking involves locking up your SOL tokens, you’ll want to protect your assets from threats like hacks or fraud. Consider the platform’s history. Platforms with a long and solid security track record are generally safer bets.

For this reason, some Solana stakers may consider a top-tier centralized exchange such as Coinbase or Kraken. While these exchanges hold your tokens in custody, they offer a long operational history and excellent customer support. This experience may appeal to stakers who would rather not be responsible for their seed phrases and maintaining hardware wallets.

Remember, no reward is worth risking the loss of your assets, so prioritize platforms with robust security protocols.

Platform UX (User Experience)

A platform’s user experience (UX) can significantly impact your staking journey.

An intuitive, well-designed interface makes the staking process more accessible and enjoyable, especially for those new to crypto. Please look for platforms with precise instructions and user-friendly dashboards that allow you to monitor your staking rewards effortlessly.

A well-designed platform should make it easy to start staking and managing your staked SOL without confusion.

Validator Reputation

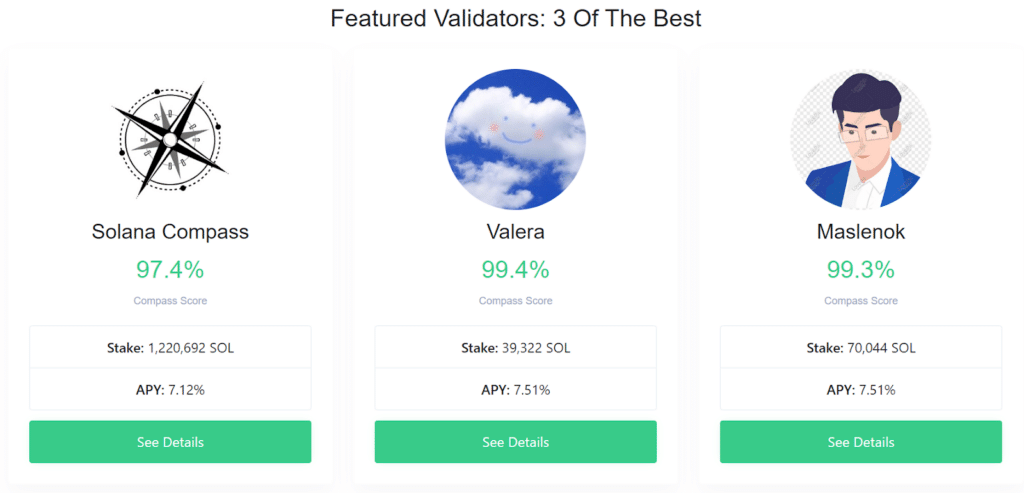

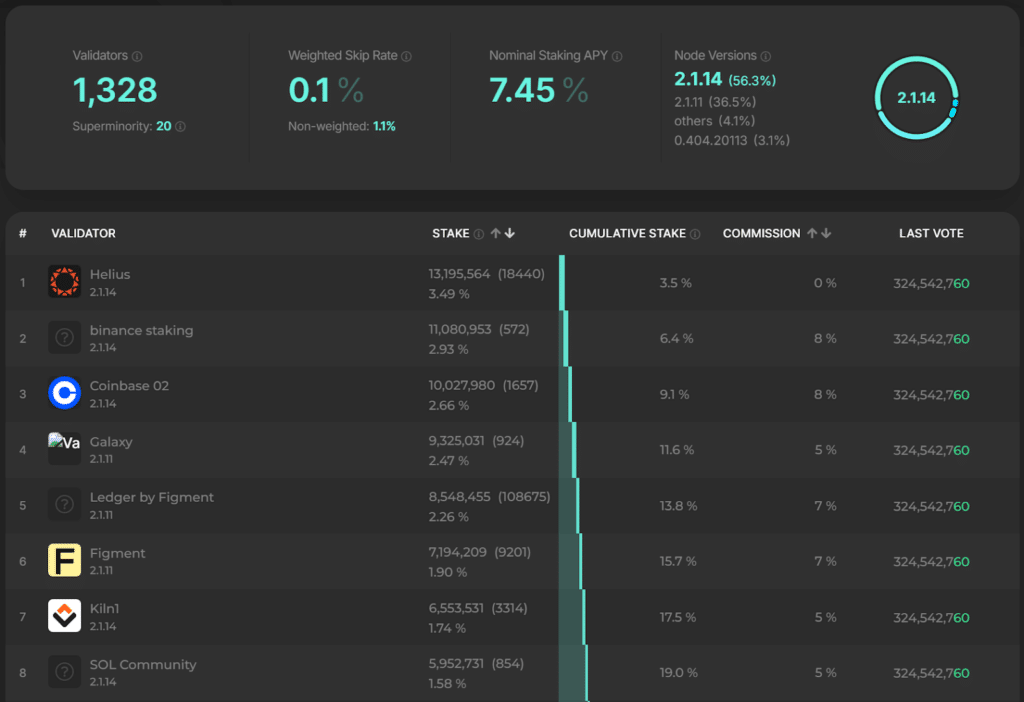

Stakers should consider validators’ reputations when choosing Solana staking platforms.

Validators are responsible for processing transactions and securing the network, and their performance directly affects your staking rewards. Poorly performing validators can lead to lower rewards or, in extreme cases, the slashing of your staked tokens, so choose wisely.

Websites such as Solana Compass provide a score for Solana validators. Beyond sites, you can research a validator on search engines and crypto-dominant social media such as X.

Considering these three factors: security, platform UX, and validator reputation, you can select Solana staking platforms that align with your needs and offer the best potential for safe and rewarding staking.

Top Platforms for Staking Solana in 2025

As the Solana ecosystem grows, so do the options for staking your SOL tokens.

Whether you’re looking for convenience, high returns, or enhanced security, there’s a staking platform tailored to your needs. Below, we’ll explore some top platforms for staking Solana and examine emerging platforms gaining traction.

Solana Native Wallets

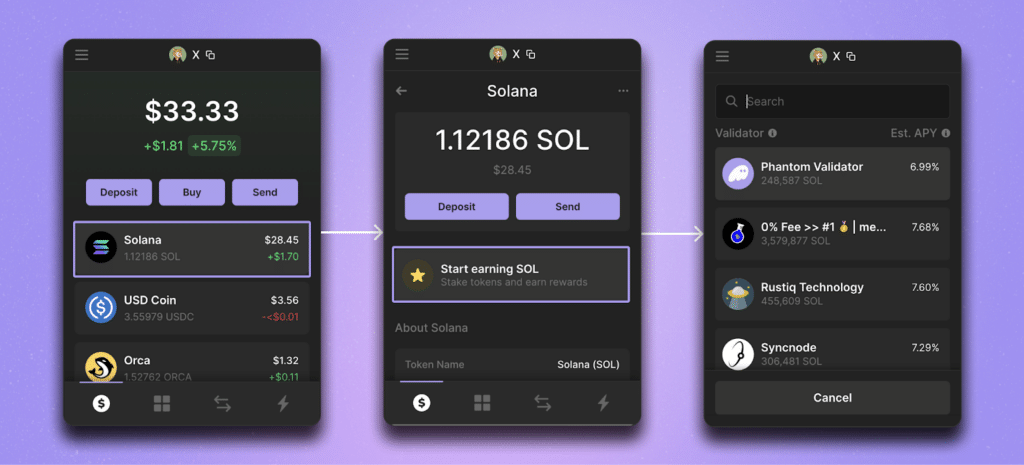

Phantom is a popular non-custodial wallet with integrated Solana staking features. Inside the wallet, you can stake with a validator of your choice.

Phantom is a top choice for staking SOL due to its ease of use, broad compatibility, and robust security features. This wallet integrates staking directly into its user interface, making the process straightforward. Additionally, Phantom allows users to swap tokens, manage non-fungible tokens (NFTs), and engage with Solana’s DeFi ecosystem.

In addition to Phantom, you should consider wallets like Solflare and Backpack. Like Phantom, these wallets allow you to perform staking and other crypto activities within the wallet interface.

If you’re engaged in other crypto activities, this is perfect. All the apps are accessible from inside the wallet or directly linked by Phantom. Accessing apps within the wallet protects you from clicking and connecting to malicious links.

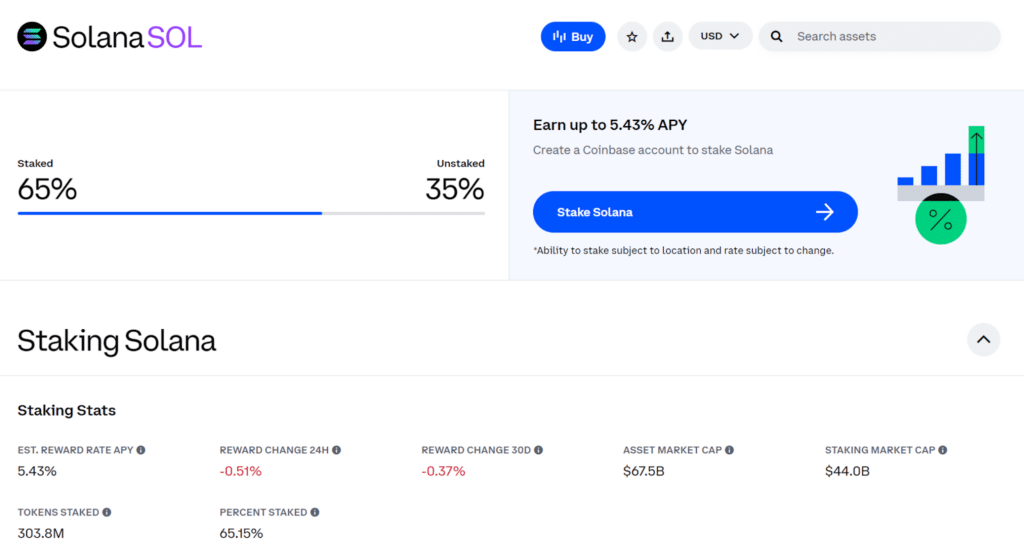

Centralized Exchange

Coinbase and Kraken offer a straightforward staking experience. You can earn staking rewards without worrying about the complexities of selecting validators. However, the rewards may be slightly lower than on other platforms.

A centralized exchange often charges a hefty commission of more than 20% of staking rewards instead of natively staking that offers zero commissions.

Liquid Staking Platforms

Marinade Finance and Jito Network are leading DeFi staking platforms on Solana that offer liquid staking. When you stake SOL with Marinade or Jito, you receive mSOL and JitoSOL, respectively. These two tokens are the networks’ liquid staking tokens (LSTs), representing your staked SOL. You can use the LSTs in various DeFi applications to earn passive income additional yield.

This liquid staking concept allows you to enjoy staking rewards while maintaining liquidity. Marinade prioritizes security by distributing staked SOL across multiple validators, reducing centralization risks. Meanwhile, Jito maximizes MEV to boost your rewards.

The two platforms are highly flexible and secure options for maximizing your earnings within the Solana ecosystem.

Emerging Platforms

Sanctum is a liquid staking platform on the Solana blockchain. Users deposit Solana and receive Infinity tokens (INF), the protocol’s liquid staking token. Sanctum provides a unified liquidity layer for Solana’s LSTs, allowing easy swaps between various LSTs. This feature supports the decentralization of the Solana network by making staking more accessible.

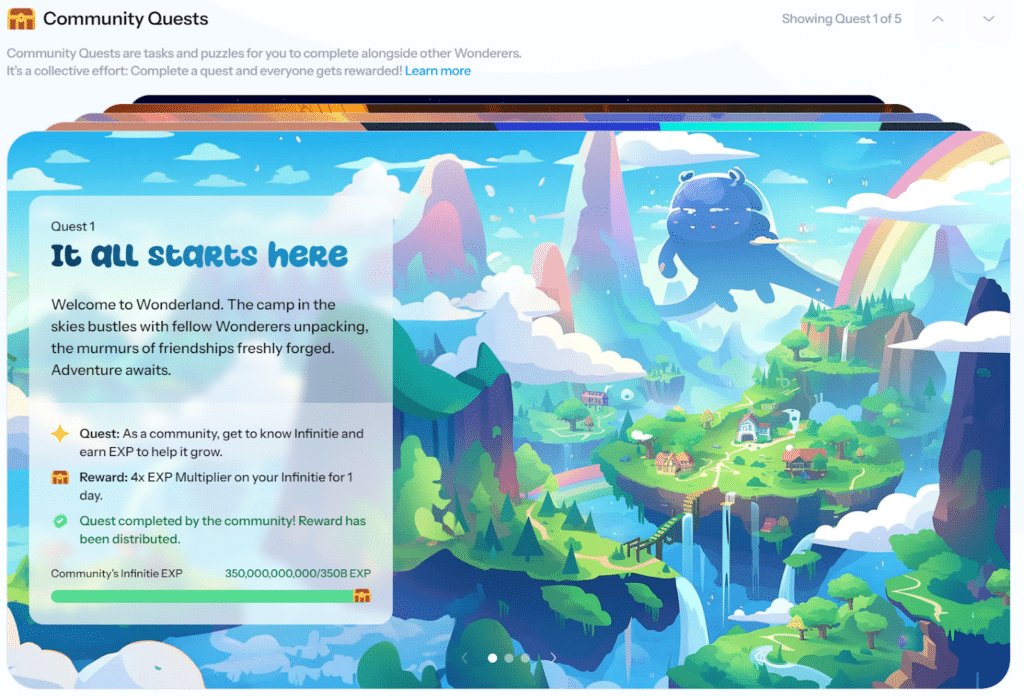

Users have praised the platform’s colorful design, which contrasts with other liquid staking platforms’ dark and sleek designs.

After conducting a community quest called Wonderland, Sanctum recently concluded its token genesis event. Participants were encouraged to hold INF and other Solana-based liquid staking tokens.

How to Optimize Staked SOL?

Optimizing your Solana staking journey involves selecting strategies and platforms that increase your staking rewards while keeping risks low.

Study these options while staking.

Choosing Commission-free Validators

Choose validators that offer zero or minimal commission rates.

These validators do not take a cut from your staking rewards, allowing you to earn the total potential yield. Examples include Helius, the number one validator by staked SOL, and Jupiter, from the popular decentralized exchange.

Some of these validators may offer commission-less staking as part of a promotion program or through subsidies from one of their other business arms.

You can use free websites such as Solana Beach to search for commission-free validators.

Utilizing Liquid Staking Platforms

Liquid staking platforms like Marinade, Jito, or Sanctum enable you to stake SOL while retaining liquidity. By converting your staked SOL into Liquid Staking Tokens (LSTs) like mSOL, you can continue to earn staking rewards and use these LSTs in various DeFi protocols to generate additional yield.

For example, you can deposit your JitoSOL into Kamino Finance, a Solana-based borrowing and lending protocol. Kamino liquidity pools support trading on its platform. You can deposit into the JitoSOL pool for yield farming.

Liquid staking’s dual-earning potential allows you to maximize your returns without sacrificing liquidity.

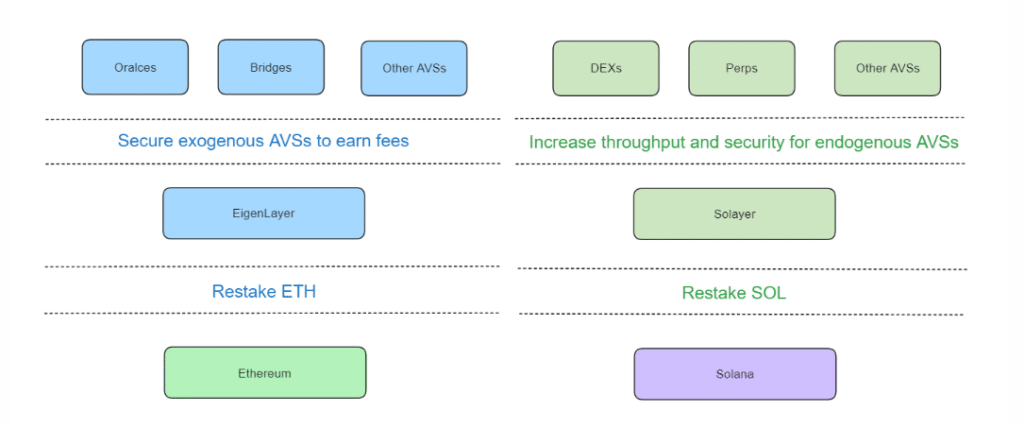

Solana Restaking

Restaking is an emerging trend that enables you to reuse your staked tokens to support other protocols and earn more rewards. Popularized by Eigenlayer, a restaking protocol on Ethereum, restaking has started to take root in the Solana blockchain.

While Eigenlayer focuses on securing off-chain applications, Solana restaking via Solayer focuses on shared security for Solana-based applications.

Is Solana Worth Staking?

The short answer is Yes.

Staking Solana can be a highly rewarding venture for those looking to earn passive income while participating in the staking process. You can earn rewards by staking SOL, which is often higher than large blockchains like Ethereum.

Solana has also withstood several downward market cycles, recovering from the 2022 lows and emerging as a top-five cryptocurrency. With all the developments happening in Solana, the blockchain will likely maintain or improve its market standing.

Staking is worth considering if you’re committed to holding SOL long-term and want to maximize your returns.

Editor’s Note: This article was originally published in September 2024 but has been updated with new information

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

March 6, 2025

August 4, 2025