What is MEV? Maximal Extractable Value explained

Miners and validators help make the blockchain world go round. They validate network transactions and earn rewards through block rewards and transaction fees.

But did you know that these block producers earn profits beyond the standard block reward?

Maximal Extractable Value (MEV) represents the additional profit that block producers can obtain by reordering pending transactions on the blockchain network.

While this may sound overly technical and boring, MEV transactions have recently attracted attention and scrutiny. You may have even heard the news of how an MEV bot has taken thousands of dollars from crypto traders.

While maximal extractable value is a byproduct of blockchain decentralization, it also has implications for various stakeholders.

This article seeks to demystify MEV’s role within the blockchain industry by:

- Discussing what MEV is

- Examining how MEV extraction works

- Differentiating Miner Extractable Value vs. Maximal Extractable Value

- Revealing MEV opportunities

Read on and be educated about this new phenomenon.

What is Maximal Extractable Value (MEV) and How Does it Work?

When financial markets began embracing technology, profits shifted to players with better technology and faster information. The better the edge, the higher the profits. Even a few seconds can make a major difference.

The best technology is essential for detecting profitable transactions; players invest heavily in MEV bots to identify such opportunities.

A Brief History of Maximal Extractable Value (MEV)

Miner Extractable Value (the predecessor to maximal extractable value) first gained prominence in 2019. A group of researchers published a paper titled “Flash Boys 2.0: Frontrunning, Transaction Reordering, and Consensus Instability in Decentralized Exchanges.”

The paper detailed how MEV bots (autonomous programs) exploited economic inefficiencies in Decentralized Exchanges (DEXes). These attacks were contrary to blockchain’s promise of a fair and transparent ecosystem.

Where Does MEV Come From?

Blockchain is a decentralized, distributed digital ledger that securely records and verifies transactions. A blockchain network comprises a series of blocks that store validated and pending transactions from users; hence the term blockchain.

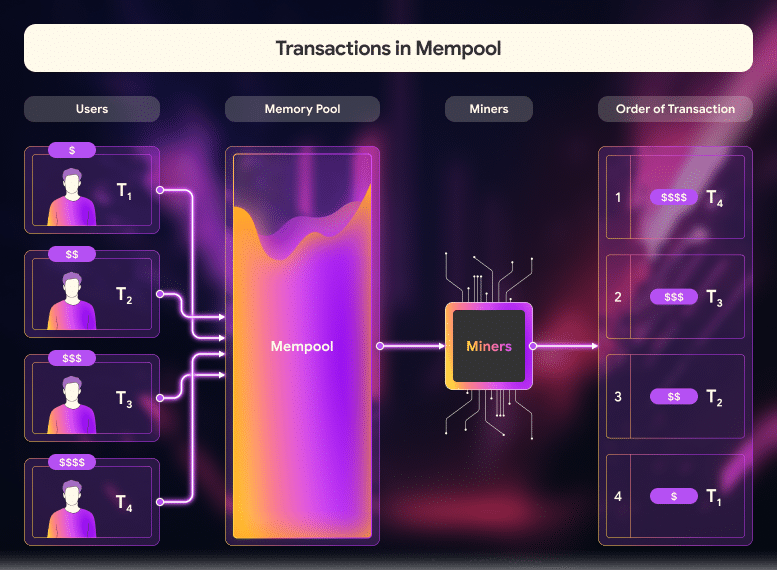

Unconfirmed transactions wait in the memory pool (or mempool), a staging room for transactions not yet placed in a block. As blockchains are publicly available, block producers can see and choose which transactions in the mempool to process first.

Block producers can influence the sequence of user transactions to include in a block. Motivated by profit, they often select transactions with the highest gas prices (transaction fees).

Take Ethereum as an example: a typical cryptocurrency transfer can cost $0.5 to $1 in gas fees. A sender may opt to increase the gas fee to $10, which validators will surely prioritize.

MEV extraction occurs during block production.

Validators, in their role as block producers, have the discretion to select and organize transactions. By doing so strategically, they can gain additional value beyond traditional block rewards and transaction fees.

What is MEV in Staking?

Bitcoin’s consensus mechanism relies on miners; thus, the term “miner extractable value.”

Ethereum previously relied on mining to validate transactions but has since shifted to staking. Stakers validate transactions by locking cryptocurrency into the network.

The term Maximal Extractable Value evolved from Miner Extractable Value as many blockchains, such as Ethereum, shifted from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus.

Maximal Extractable Value also encompasses the broader concept of potential value extraction within the entire blockchain ecosystem.

Whereas Bitcoin transactions relate mostly to payments and transfers, newer blockchains support various use cases:

- Non-Fungible Token (NFT) minting

- Cryptocurrency lending

- Decentralized exchanges

These new use cases, often enabled by smart contracts (self-executing code), constitute the Decentralized Finance (DeFi) industry. DeFi transactions present more opportunities to extract MEV.

What is an MEV Searcher?

While block producers should be capitalizing on lucrative MEV opportunities, in practice, MEV searchers stand to gain the most.

MEV searchers actively identify profitable MEV opportunities. MEV searchers often use sophisticated algorithms and tools to analyze pending transactions in the mempool and identify opportunities to gain a financial advantage.

MEV searchers program MEV bots to execute and capture profit across the crypto landscape.

Once a searcher identifies an MEV opportunity, the participant will submit the same transaction at a higher gas fee to be prioritized by block producers.

MEV searchers aim to capitalize on the time-sensitive nature of transaction processing in decentralized networks, such as Ethereum, to front-run trades, perform arbitrage, or engage in other activities that exploit the sequential execution of transactions.

How do Validators and Stakers Profit from MEV?

A staker, whether through third-party staking or as a solo staker, can earn extra income through MEV. Because validators control block production, searchers work with block producers to prioritize their transactions.

MEV on Ethereum

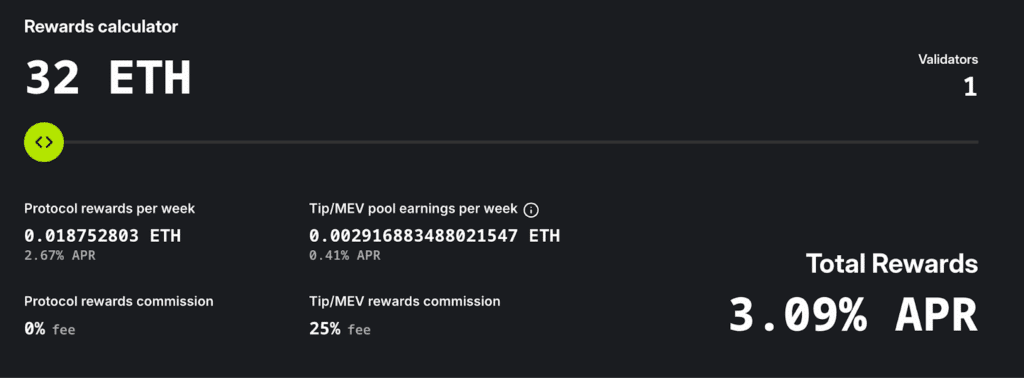

On Ethereum, Flashbots has created an auction tool called “mev-boost” which allows searchers and validators to communicate with one another. Validators process searchers’ transactions and earn extra profit from these.

Validators must have good standing, as they are more likely to be selected by the network to propose blocks.

Stake.fish, a staking-as-a-service (Saas) provider, gives its stakers an extra 0.41% APR in addition to the regular 2.67% APR of Ethereum staking.

MEV on Solana

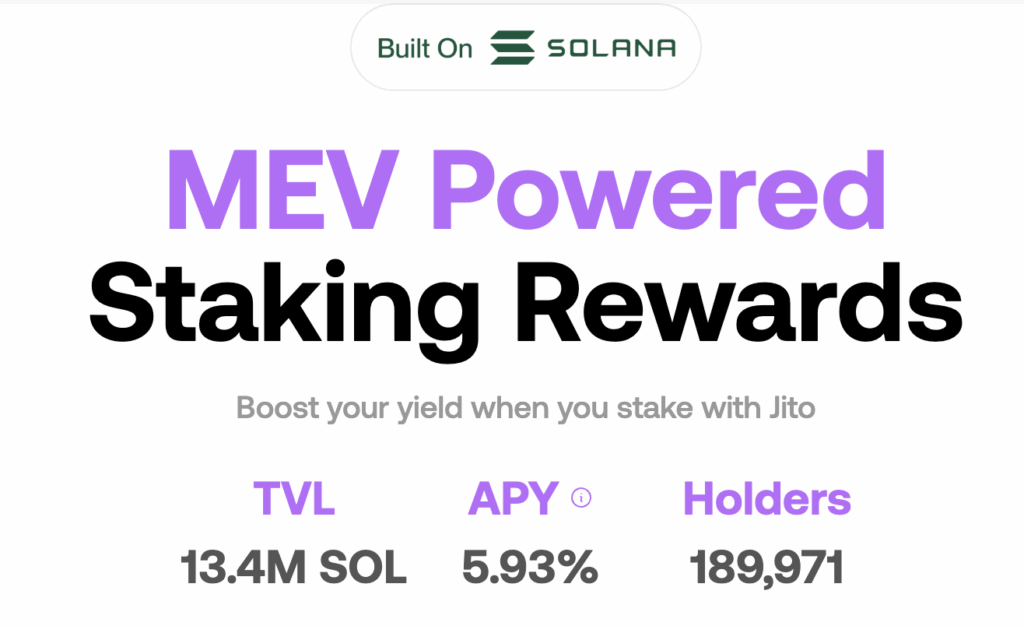

Solana, as the second-largest network by staking market cap, has also attracted significant MEV interest. As with Ethereum, validators extract additional value from MEV, which they can pass on to delegators.

Liquid staking and restaking platform Jito allows validators and their stakers to receive MEV rewards.

MEV Examples

Whether it’s by exploiting time-sensitive information or disrupting transactions, players have found ways to detect MEV opportunities. The blockchain industry’s growing use cases present a lucrative environment for MEV profits.

Sandwich Attacks

Sandwich attacks involve strategically placing a high-value transaction between two lower-value transactions. This tactic aims to exploit the market impact of the high-value trade, allowing the attacker to capitalize on price discrepancies.

A sandwich attack typically occurs on trades involving Decentralized Exchanges (DEX). A trader is negatively affected by the price received for cryptocurrency, while the attacker benefits from the price difference.

Here’s a high-level example of a sandwich attack: a trader makes an order to buy $10,000 of Solana on Jupiter, a decentralized exchange. The transaction lines up in the mempool.

- An MEV bot executes an order to buy Solana, raising the token price.

- The trader’s buy order gets done at a higher token price.

- The MEV bot sells the token, profiting from the price difference.

The trader ends up paying higher token prices due to slippage, the price difference between their order price and the final executed price.

DEX functionality allows users to set a slippage percentage. Traders may use high slippage settings to execute highly volatile trades or those with illiquid markets. Unfortunately, these are susceptible to MEV bot attacks.

In two months in 2024, a Solana MEV bot called “arsc” generated $30 million from users.

Front-Running

A front-running attack constitutes market manipulation in which an MEV bot exploits advanced knowledge of pending transactions to gain an unfair advantage. This process is relevant in decentralized networks, where transactions are visible to the public before they are confirmed.

Front-running is common in the non-fungible token (NFT) space, with MEV bots that identify profitable transactions and execute them instantly.

Take, for example, Bored Ape Yacht Club (BAYC), a highly popular NFT listed on the Opensea marketplace.

- Given that the floor price (bottom price) of 1 BAYC NFT is 25 ETH.

- A holder wants to list their NFT for sale.

- Instead of a listing price of 25 ETH, the holder mistakenly executes at 2.5 ETH.

- Before the holder can cancel the transaction, an MEV bot successfully conducts a buy order.

A similar trade took place in December 2021.

A BAYC sold for $3,000 instead of $300,000, representing a 90% loss. The owner made a typographical error when listing the NFT. Before the owner could cancel the listing, an MEV bot had already bought it.

This practice raises concerns about fairness, trust, and the integrity of financial transactions within decentralized systems.

Human users can only do so much when paired against an MEV bot.

Preventing front-running attacks is an ongoing challenge for blockchain developers and security experts.

Pros and Cons of MEV

MEV exists as a byproduct of blockchain technology. Consider it a sub-industry and innovation within the industry. Others may view MEV as a threat to traditional market participants.

You can evaluate how MEVs are used and their impact on the ecosystem in different ways:

Potential Benefits of MEV Extraction

1. Profit Incentive for Block Producers: MEV provides an additional incentive for miners and validators, potentially enhancing their revenue beyond traditional block rewards and transaction fees.

2. Market Efficiency: In some cases, MEV activities can enhance market efficiency by enabling participants to respond quickly to market movements and arbitrage opportunities. For example, if the market price on one DEX differs significantly from that on another, an MEV arbitrage transaction can help address this.

3. High Transaction Priority: A user can increase the gas fee (transaction fee) on their transaction to ensure it is executed. Users are willing to pay high gas fees to participate in highly anticipated market opportunities such as NFT minting and token presales.

Concerns and Drawbacks of MEV Extraction

1. Unfair Advantage: MEV strategies, such as front-running, can give certain actors an unfair advantage, undermining the principle of fair and equal access to market opportunities.

2. Market Manipulation: Participants view certain MEV tactics, such as sandwich attacks, as a form of market manipulation, potentially distorting natural market forces and causing undue losses to regular traders.

3. Erosion of Trust: MEV opportunities can erode trust in the decentralized ecosystem, potentially further dissuading users from participating in the market.

MEV Revenue Generated in the Ethereum Network

Whether fair or unfair, the MEV industry has been growing.

A 2023 report by Galaxy Research found that MEV on Ethereum generated $133 million in 2022. In 2025, analysts estimate this value at $562 million.

MEV has been extremely profitable, with MEV revenue growing year by year. However, given MEV’s polarizing nature, certain industries have also emerged to shed light on MEV.

Flashbots is a research and development organization formed to mitigate the negative consequences of MEV occurring. Their focus is to highlight MEV opportunities and enable a sustainable MEV ecosystem.

Is MEV Good or Bad?

Whether MEV is good or bad often depends on one’s perspective. Some see it as an inherent part of market dynamics. In contrast, others view it as a potential source of manipulation and unfair practices.

The blockchain community needs to continue addressing MEV-related challenges and work toward solutions that maintain fairness, security, and the overall integrity of decentralized systems.

Frequently Asked Questions

Is MEV Legal in Crypto?

MEV itself is not illegal, as it exploits publicly visible blockchain data. However, certain strategies, such as front-running and sandwich attacks, raise ethical concerns and may be subject to regulatory scrutiny in the future.

Who Makes Money from MEV?

MEV profits primarily go to validators (or miners) and MEV searchers who use bots to identify and execute profitable transactions. Stakers can also benefit when validators share MEV rewards.

How Can Traders Protect Themselves from MEV Attacks?

Traders can reduce risk by lowering slippage settings, using private transaction relays (like Flashbots Protect), and trading on platforms designed to minimize MEV exposure, such as CoW Swap.

Editor’s Note: This article was originally published in February 2024 but has been updated with new information

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

February 19, 2026

February 19, 2026