What is Liquid Staking: A Comprehensive Guide

With numerous crypto terminologies, such as staking, liquid staking, and multi-asset staking, it can be challenging to differentiate one from the other.

So, what is liquid staking?

Liquid staking branches out from the staking operation of consensus blockchains.

Stakers deposit their cryptocurrency on a third-party platform. The deposited token is pooled and then undergoes network validation.

Stakers receive liquid staking tokens (LST), equivalent to their staking capital. These LSTs represent the staked assets in a blockchain network. You can use these LSTs on other protocols for trading or generating more yield.

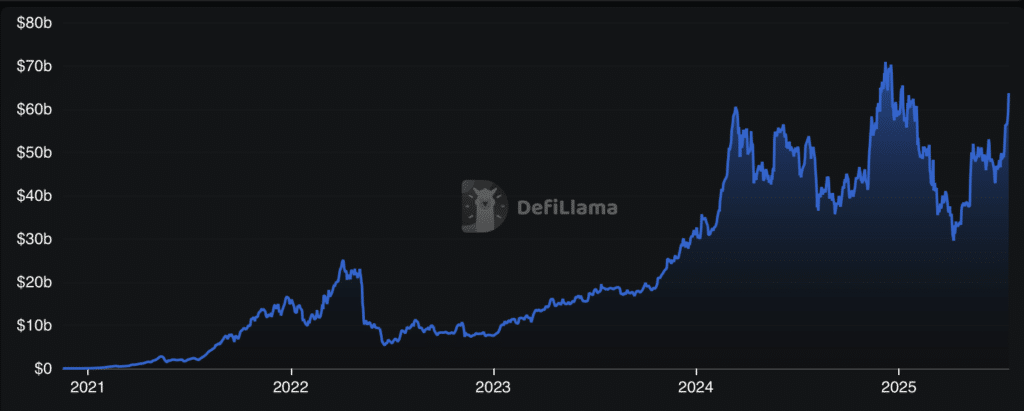

This available liquidity has made liquid staking a popular method for investing in cryptocurrencies. As of the time of writing, the total value locked (TVL) in liquid staking tokens has grown to $60 billion.

If this has gotten you interested, then let’s dive in!

How Does Liquid Staking Differ From Traditional Staking?

Liquid staking and traditional staking earn you rewards and contribute to the security and operations of a blockchain. However, there are key differences in how the staking process takes place.

Third-party providers

In a Proof-of-Stake (PoS) consensus network, such as Ethereum, solo staking refers to setting up a computer that connects to the blockchain. The computer, referred to as a node, contributes to the network infrastructure.

The staker deposits cryptocurrency to the network, turning their node into a validator. This setup enables the verification of transactions on the network. In return, you receive staking rewards, determined by the amount and duration of the coins staked.

Liquid staking occurs through third-party platforms known as liquid staking platforms.

Centralized exchanges such as Coinbase provide liquid staking services. Furthermore, decentralized finance (DeFi) applications such Lido (Ethereum) and Jito Finance (Solana) offer liquid staking through smart contract execution.

Delegated Validation

Under Ethereum’s traditional staking, you directly connect to a blockchain network and perform transaction validation.

As liquid staking utilizes liquid staking providers, the staked tokens continue to form a pool alongside other stakers. The platform operator uses these staked assets on their respective network and performs the validation process.

Note that, outside of Ethereum and in Delegated-Proof-of-Stake (DPoS) consensus blockchains like Solana and Cosmos, staking naturally occurs through the process of delegation.

Centralization

Ideally, a blockchain operates in a decentralized manner, with numerous independent nodes and validators. These parties scatter around the world, mitigating single points of failure. Global users perform transaction validation and hold equal voting power.

In reality, blockchain has become much more centralized.

Institutions and wealthy individuals dominate staking. Big players pool vast amounts of staked assets or invest in high-end mining equipment, the predecessor of staking.

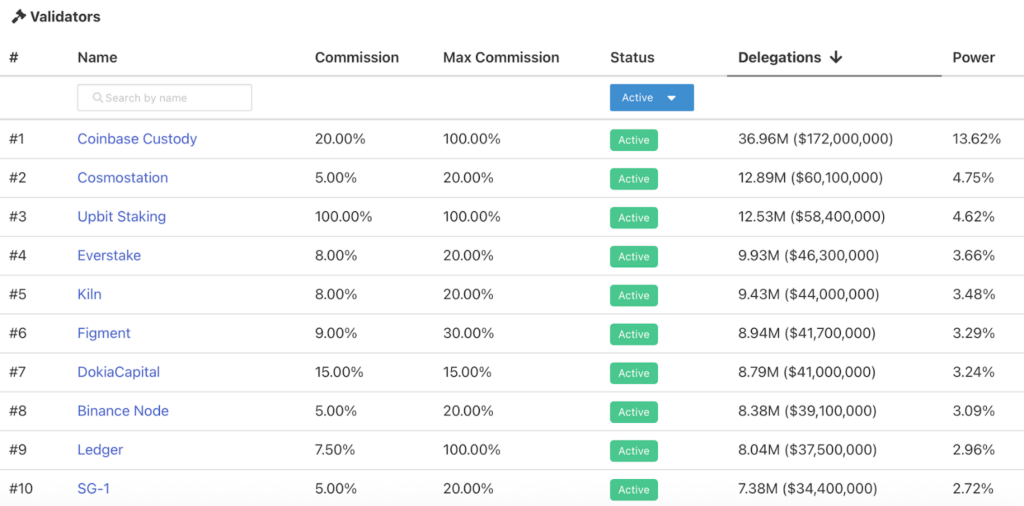

The top 10 validators on the Cosmos network

Take a look at the Cosmos network, a DPoS blockchain.

Large centralized exchanges, such as Coinbase and Upbit, control substantial amounts of staked tokens. Everstake and Klin, well-known staking-as-a-service companies, also hold a big portion of the staked assets.

Top Liquid Staking Platforms

Liquid staking has blossomed across all major blockchains. Often, you will find three to five major protocols taking the lion’s share of the TVL. However, most of DeFi and liquid staking still takes place on Ethereum or Solana.

Here are the top liquid staking platforms by TVL:

- Lido Finance (Ethereum) – $61.1 billion

- Binance (Ethereum) – $9.94 billion

- Jito (Solana) – $2.95 billion

- Rocket Pool (Ethereum) – $2.26 billion

- Sanctum (Solana) – $1.89 billion

Pros of Liquid Staking

In regular staking, you generate yield on your idle crypto assets.

Liquid staking takes this a step further by creating secondary markets for the staked assets. You can then trade or deploy these assets into decentralized finance (DeFi) protocols.

Low Barriers to Entry

Solo staking is an expensive and technical process.

A solo staker must provide the hardware, software, and the full value of the required cryptocurrency. Hardware costs up to $1,000, while software installation requires coding and a background in computer science.

The required staked tokens will also be costly. Ethereum solo staking requires a deposit of 32 ETH, approximately $94,000, as of the time of writing.

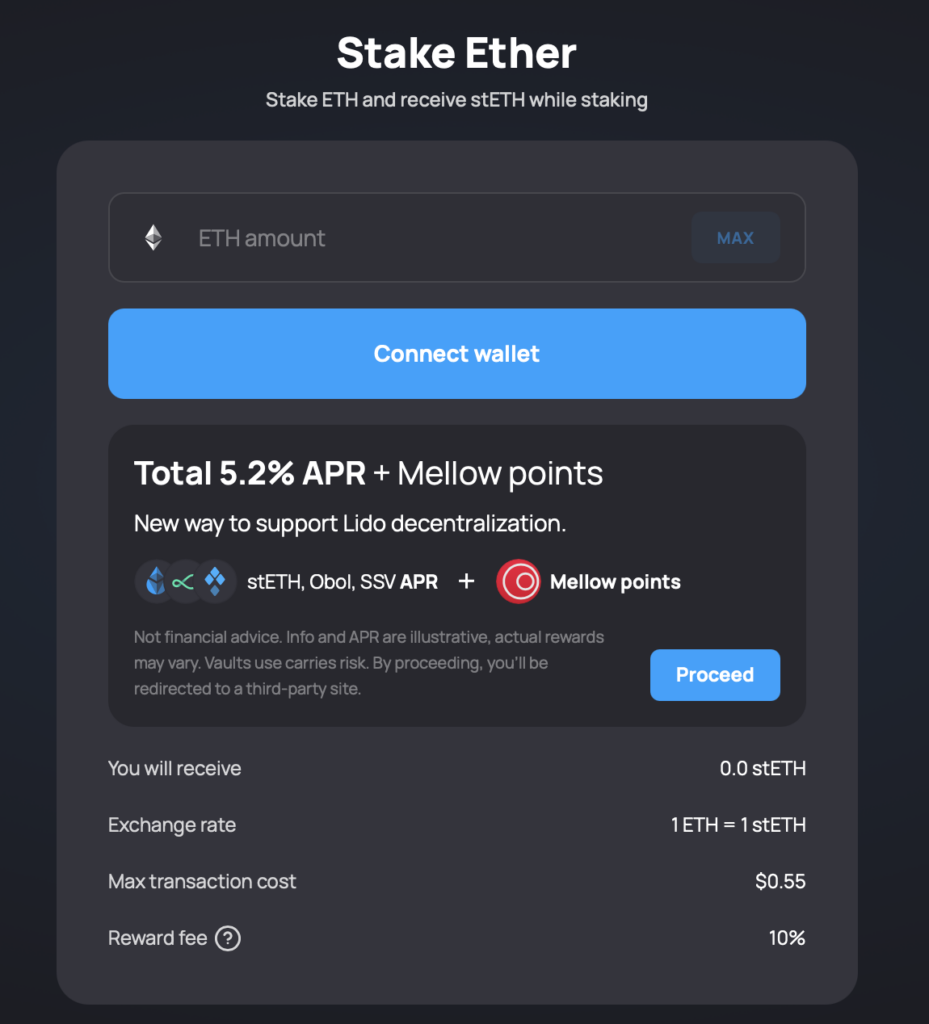

Lido Finance, a liquid staking protocol, does not require a minimum staked token amount. Furthermore, you can access the liquid staking service using just a smartphone.

This ease of use has enabled Lido to grow to $28.8 billion in TVL.

Increased Yield

Liquid staking platforms often offer high yields versus their native staking counterparts. They offer additional tokens or yield to entice stakers to deposit crypto assets.

Lido Finance offers a 5.2% annual percentage rate (APR) for staking on their platform. This rate is almost double the 3.04% Ethereum staking rate. Furthermore, Lido has partnered with Mellow Finance and offers “Mellow points.” These points may convert to a token airdrop in the future, which would further boost yield.

Market Opportunities

Users can deploy liquid staking tokens to capitalize on market opportunities.

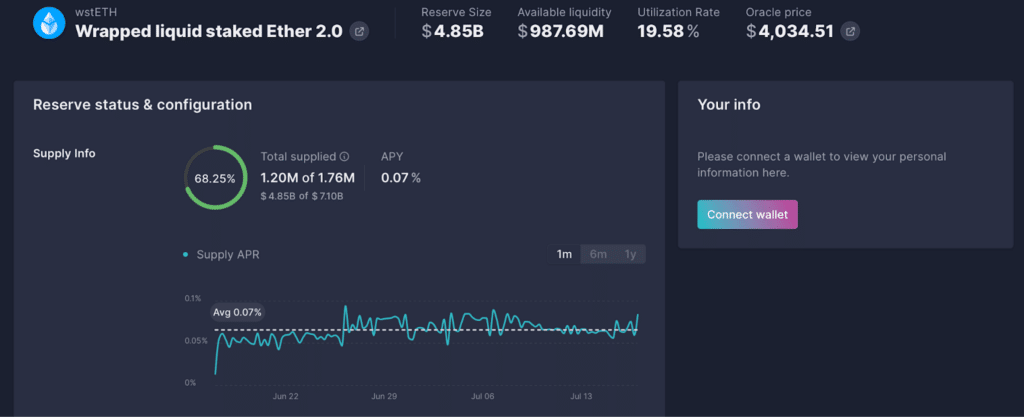

A staker on Lido Finance can bring their stETH, Lido’s LST, to a lending marketplace like Aave. Once the user deposits the stETH onto Aave, they earn an additional 0.07% annual percentage yield (APY).

Cons of Liquid Staking

Liquid staking sounds very enticing. A user can increase their rewards versus traditional staking.

Like any investment method, risk accompanies rewards. Make sure to study the cons of liquid staking before proceeding to commit capital.

Capital Loss Risks

With more power comes more responsibility.

With liquid staking the opportunities are endless. You can trade your LSTs and deposit them into yield-bearing platforms. That being said, chasing higher returns can lead to loss of capital.

One wrong trade or one wrong click can lead you to lose your entire investment.

Security Risks

Unfortunately, many malicious actors have targeted DeFi applications and liquid staking services. These attackers swoop in to drain the liquidity and tokens from the platform.

Raft Finance lost $3.3 Million in ETH after an attacker drained 1,577 ETH from the platform. Raft Finance offers yield on stETH, Lido’s liquid staking token. Users earn R stablecoin (Raft Finance’s stablecoin) in rewards.

In some attacks, users may not get their crypto refunded by the platform.

Technological Risks

While liquid staking protocols offer potentially higher returns, technological flaws could lead to financial losses.

In June 2021, liquid staking platform StakeHound filed a case against crypto custody company Fireblocks. The lawsuit detailed how Fireblocks lost the keys to $70 million of StakeHound’s cryptocurrency. Fireblocks explained how StakeHound’s staking generated keys that were not supported by the former’s infrastructure.

Other times, projects make a mistake in the code and lock out themselves and their customers from accessing their funds.

In addition, crypto stakers must be wary of projects with low liquidity.

Newer platforms have limitations on how quickly one can access the staked assets or convert them to other forms of cryptocurrency. Illiquid markets make it challenging to exit positions when needed.

Liquid Staking Statistics

Lido Finance emerged as the first liquid staking service in December 2020. Since then, numerous liquid staking providers have risen to serve users. Other large players include Jito (Solana liquid staking), Lista (for BNB), and Suilend (for Sui).

The industry now accounts for 50% of the total value locked in the decentralized finance space. Other statistics similarly attest to the strength of the industry.

Percentage of Total Crypto Assets Currently Staked in Liquid Form.

Liquid staking displays huge growth potential. Stakers have deposited an estimated $63.6 billion in liquid staking protocols.

Growth Rate of Liquid Staking Platforms in the Past Year.

Liquid staking has steadily grown over the past four years.

Lido Finance staked ETH, DefiLlama

The liquid staking industry has recovered from the bottom last May 2022 after the Terra Luna crash.

Current Trends in the Field of Liquid Staking?

In May 2025, the U.S. Securities and Exchange Commission (SEC) clarified that staking as part of the network’s consensus mechanism is not a security.

This regulatory clarity opens the floodgates for institutional investors to chase yields via staking and liquid staking.

One can only imagine how decentralized finance and liquid staking would grow even bigger if large investment funds participated.

Frequently Asked Questions

How Does Liquid Staking Work?

With liquid staking, you deposit and delegate your staking tokens such as ETH and SOL to a provider. In return, you receive liquid staking tokens (LST) which represent your staked assets. By holding the LST, you can earn staking rewards also in the form of the LST.

In addition to earning staking rewards, you can trade and deploy the LSTs into exchange and protocols to earn more yield.

Is Liquid Staking Worth It?

Liquid staking allows investors to maximize the yield on their staked assets. However, the cryptocurrency industry remains nascent and has many risks.

Make sure to assess the risks of the liquid staking platforms, the underlying promise and volatility of the staked tokens, and the organizations behind the services.

What is an Example of a Liquid Staking Token?

There are several liquid staking tokens generated by their respective platforms. Here are the top tokens from the most used liquid staking protocols:

- Lido Finance – stETH

- Binance – BETH

- Jito – JitoSOL

- Rocket Pool – RETH

- Sanctum – INF

Final Thoughts on Liquid Staking

Liquid staking, especially for ETH, has low barriers to entry with no minimum staked assets. At the same time, liquid staking protocols are offering staking rewards even greater than native staking.

This mix of better returns and low capital requirements, represents a new opportunity for crypto participants to contribute to network security and earn rewards.

However, with higher rewards often come higher rewards. Make sure you’ve done your due diligence on the various risks as well as the reputability of the staking platform before depositing any funds.

Editor’s Note: This article was originally published in December 2023 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

July 18, 2025

November 14, 2025