Crypto Staking Versus Crypto Vaults: A Comparative Guide

Crypto markets offer investors various ways to earn asset returns, but not all strategies are equal.

You can hold crypto and engage in staking to generate yield. However, this strategy becomes hard to scale. For each blockchain ecosystem like Ethereum, Solana, or Cosmos, you’ll have to buy their native tokens, create wallets, and store seed phrases, among other requirements.

While you can stick to one or two ecosystems, this practice can result in significant losses if the network isn’t successful.

To cater to more conservative investors, developers have created Crypto Vaults, a new crypto product that allows investors to capture returns across various tokens. You minimize volatility and downside by diversifying your holdings across several cryptocurrencies and asset classes.

If these investment approaches interest you, then read on.

What is a Crypto Vault?

Think of the vault as the crypto equivalent of a mutual fund.

In traditional finance, investors pool funds and deposit into mutual funds to access the returns of a diversified set of securities and assets. Professional managers handle the fund and decide which assets to place inside.

A crypto vault is an investment product where users deposit crypto, such as stablecoins, to gain exposure to varied crypto assets contained in the vault. Professional investment teams or automated strategies manage these vaults to optimize returns while minimizing risk.

Some vaults rebalance periodically, adjusting asset allocations based on trends. Other companies design vaults for specific purposes, such as investing in real-world assets (RWA).

Ultimately, vaults offer a hands-off way for investors to gain exposure to multiple crypto assets.

Differences Between Vaults and Traditional Staking

While crypto vaults and staking allow participants to earn passive income, they serve different purposes and function differently.

Blockchain Consensus Mechanism

Modern blockchains rely on staking for transaction validation. In Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS) systems, users stake their tokens to support network security and receive staking rewards. This process is fundamental to blockchain operation.

Vaults, on the other hand, are investment vehicles rather than consensus mechanisms. Vaults focus on maximizing returns through various investment strategies. Specific vaults may also allocate their holdings towards staking activities. However, vaults remain an investment-focused strategy.

Investment Strategy

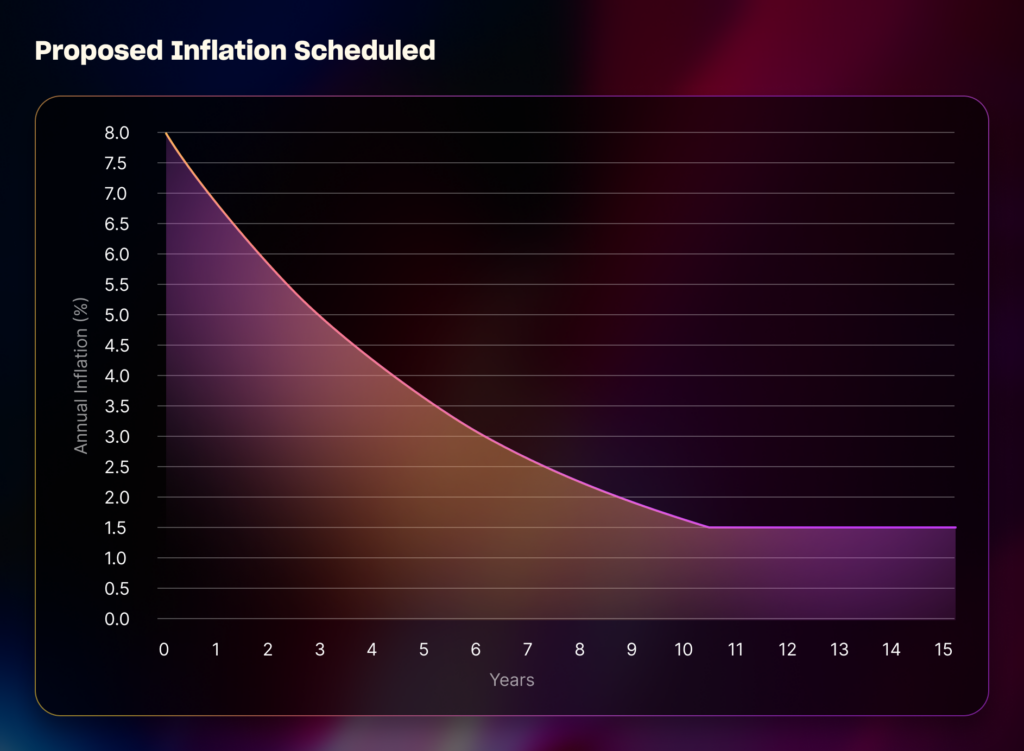

Staking rewards are determined by network parameters, making them relatively predictable. For example, Solana operates a predetermined staking and inflation schedule set at 8.0% per annum with a long-term target of 1.5%. As a Solana staker, you know what staking return you will get for the foreseeable future.

Crypto vaults employ flexible investment strategies. These can include:

- Yield Farming: Allocating funds to liquidity pools to earn transaction fees.

- Lending & Borrowing: Depositing assets into lending protocols to generate interest.

- Automated Rebalancing: Adjusting asset allocation based on market conditions.

Vaults appeal to investors who want exposure to diverse assets without actively managing their portfolios.

Reward Structure

Staking provides rewards in the form of the same token that was staked. If you’re staking ETH on Ethereum or SOL on Solana, you’ll earn rewards in ETH or SOL, respectively. These rewards are generated through network inflation and transaction fees.

Crypto vaults do not distribute rewards in the form of the same asset deposited. They may distribute a mix of tokens or a vault-specific asset that appreciates. This difference in rewards makes vaults appealing to investors who want to diversify their holdings.

Sample Platforms for Vault Products

Fyde Liquid Vault

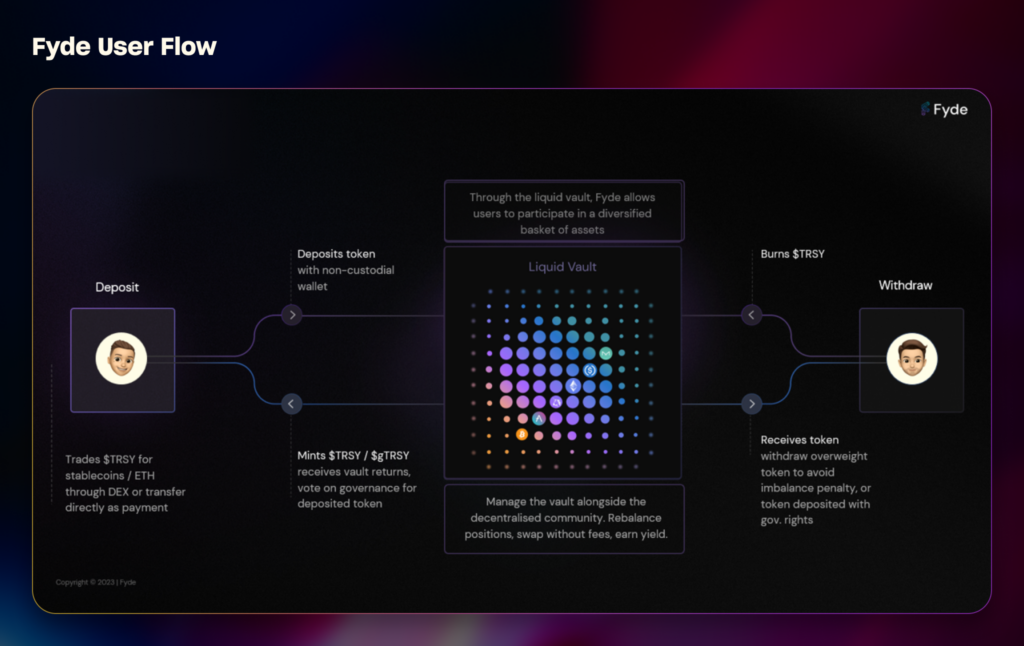

Fyde Treasury Protocol empowers crypto participants to grow their holdings while minimizing volatility. Fyde’s Liquid Vaults provides exposure to a diversified portfolio of crypto assets through AI-driven portfolio management.

Here’s how the Liquid Vault works:

- Users can deposit stablecoins or ETH in exchange for $TRSY, representing a share of the vault’s assets.

- $TRSY’s value fluctuates based on the vault’s holdings, and users can redeem their share anytime.

- Fyde’s AI-driven model determines asset allocation and rebalances the portfolio to optimize returns.

Mantra Real-World Asset (RWA) Vault

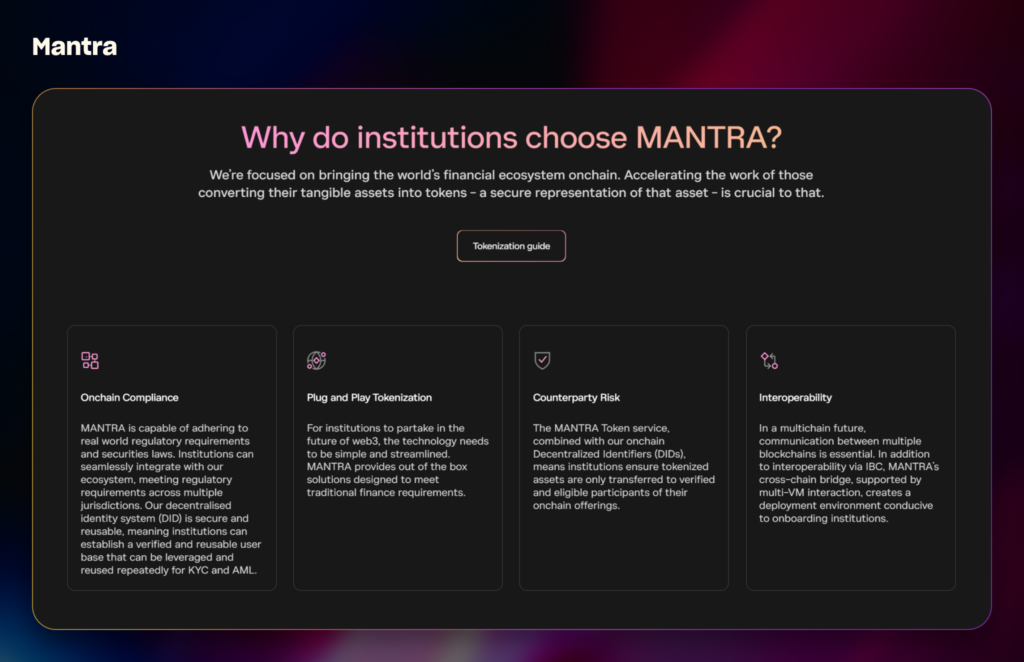

Mantra is a purpose-built Real-World Asset blockchain focusing on global regulatory compliance. In 2024, its native token, $OM, became one of the top-performing cryptocurrencies.

Mantra partnered with Ondo Finance to create an RWA savings vault:

- Users deposit stablecoins and receive USDY, a yield-bearing stablecoin backed by short-term US Treasuries and cash deposits.

- This vault provides exposure to traditional financial markets while keeping assets within the crypto ecosystem.

How to Get Started with Vaults

Investors can easily access vaults as they would in a Delegated-Proof-of-Stake consensus.

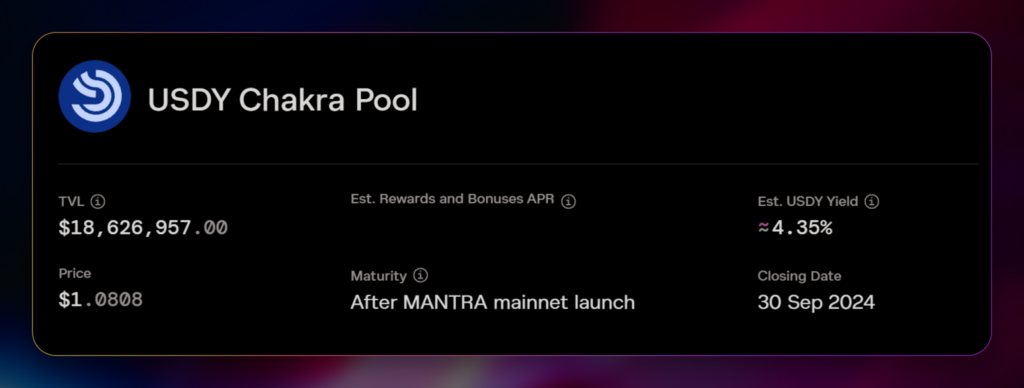

For Matnra’s RWA savings vault:

- Users will need a Cosmos-compatible wallet, such as Leap or Keplr.

- Participants deposit USDC and receive USDY in return.

- USDY yields an estimated 4.35% per annum.

- In addition to the yield, Mantra rewards participants with OM (Mantra tokens) and ONDO (Ondo’s token) as a bonus.

Pros and Cons Involved in Vaults

Crypto vaults offer unique advantages but also come with risks. You’ll notice that a few risks mirror staking with decentralized finance (DeFi), such as Liquid Staking.

Diversified Exposure

Unlike staking, which locks funds into a single blockchain, crypto vaults offer cross-chain exposure. Users gain access to a basket of tokens by depositing stablecoins or other crypto assets, reducing the volatility impact on any single asset.

On the positive side, having exposure to many tokens also puts investors in a position to capture outsized returns on one of the digital assets.

Note that a few blockchains, such as Lava Network provide stakers with cross-chain rewards. However, this is more the exception than the rule.

Automated Portfolio Management

Vaults use automated strategies, often powered by smart contracts or AI-driven algorithms, to optimize returns. These strategies can include yield farming, arbitrage trading, and portfolio rebalancing. Without automation, these processes require manual effort on the investor’s end.

In the staking scene, innovative companies such as Polli.co have also created automated solutions to help optimize the staking experience. The Polli platform enables auto-compounding of staking rewards and redelegation to validators through their AI Agents.

Smart Contract Risk

Vaults operate through smart contracts and automated code. While efficient, they are susceptible to exploits and vulnerabilities. A single bug or security flaw can result in significant losses.

Traditional staking does not carry any smart contract risk as it’s performed through a direct connection to the blockchain. However, these risks exist for liquid staking with platforms such as Lido Finance.

Users must carefully assess the security measures and audits of any vault or DeFi protocol before investing.

Wrapping Up

Both crypto staking and vaults offer unique benefits for investors, depending on their risk tolerance and financial goals. Staking provides a more predictable, blockchain-native way to earn rewards by securing networks, while vaults offer a diversified investment strategy that can leverage automation.

For long-term believers in a specific blockchain, staking may be the better option. However, crypto vaults provide an alternative for those seeking a diversified approach with exposure to multiple assets.

As with any investment, assessing the risks, security measures, and overall market conditions is essential before choosing between staking and vaults.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

March 11, 2025

August 5, 2025