The Best Crypto to Stake in 2026

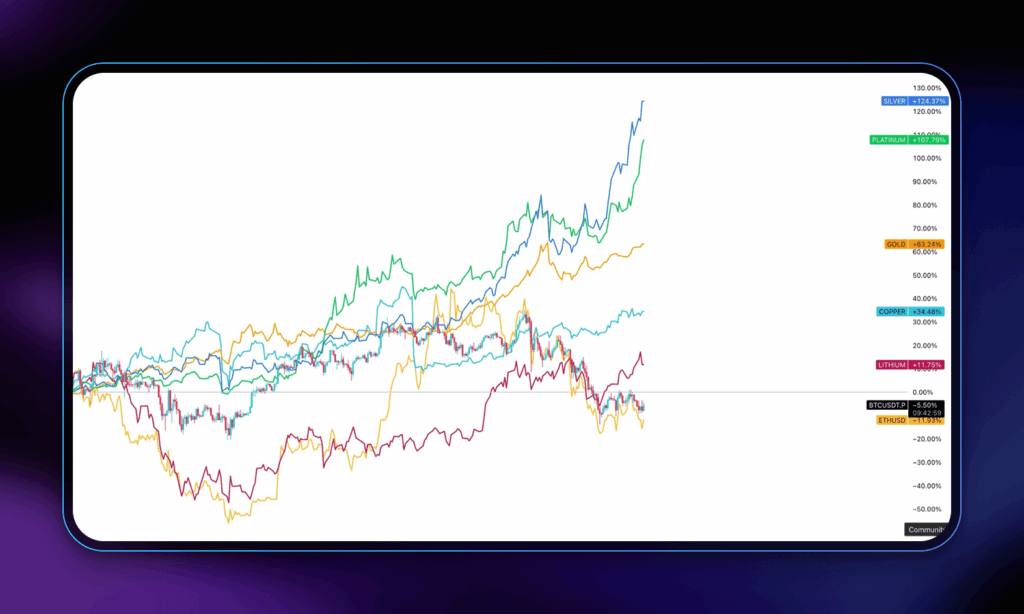

Crypto has never looked more legitimate, yet many token prices tell a different story.

2025 has been a banner year for the crypto industry. Institutional crypto adoption has surged, driven by record ETF inflows and the approval of staking ETFs.

Still, despite this wave of institutional adoption, many large-cap altcoins have failed to deliver meaningful price appreciation. The result is a growing disconnect between institutional appetite and market performance.

For long-term crypto participants who stake their assets for passive income, this divergence can be unsettling.

As we head into 2026, it’s the right moment to reassess which cryptocurrencies offer the best staking opportunities.

We examine the following:

- Reviewing the previous factors in selecting staking projects

- Outlining new factors to consider

- The top crypto to stake

- Key narratives to look forward to in 2026

Let’s start!

What Should You Consider When Choosing Staking Projects?

When we first analyzed high-yield staking opportunities in early 2024, the crypto market was in a different place.

The industry was just emerging from a deep cyclical downturn.

Risk appetite had returned, and it made sense to view staking projects through an optimistic, upside-driven lens. Investors were positioning for a broad altcoin season, in which any major crypto project could rise in price.

The 2024 Framework: What We Used to Look For

At the time, we evaluated staking projects using three core criteria:

- Market Capitalization: We prioritized projects with larger market caps, treating this as a signal of market validation and survivability. Established networks like Polkadot and Avax offered a balance of credibility and potential upside.

- Team Quality: Founder credibility mattered. As the industry matured, anonymous teams became harder to justify. Projects with visible leadership had a clear advantage.

- Network Governance: Strong governance frameworks, whether highly decentralized or more centralized, helped ensure that developers worked on the best protocol upgrades.

These factors still matter in 2026. But they’re no longer enough.

The 2026 Reality: New Filters for a Harder Market

Today’s market is more selective. When allocating your staking capital, you need to dig even deeper into the fundamentals.

Here’s what now matters most:

- Institutional Adoption: Crypto has entered a new phase where institutions dictate price action. Retail interest remains muted, as evidenced by near-cycle lows in Google search trends. The strongest staking projects are those attracting capital via ETFs, Digital Asset Treasuries (DATs), or enterprise integrations.

- Revenue Generation: Investors now assess blockchains like businesses. Staking networks must demonstrate real usage, fee generation, and sustainable demand for blockspace.

- Token Buybacks: Protocols are expected to manage token supply responsibly. Whether through buybacks, burns, or strategic treasury deployment, projects that actively support token value stand out from those that inflate supply.

The bar has never been higher for crypto projects.

Where are the Best Staking Rewards?

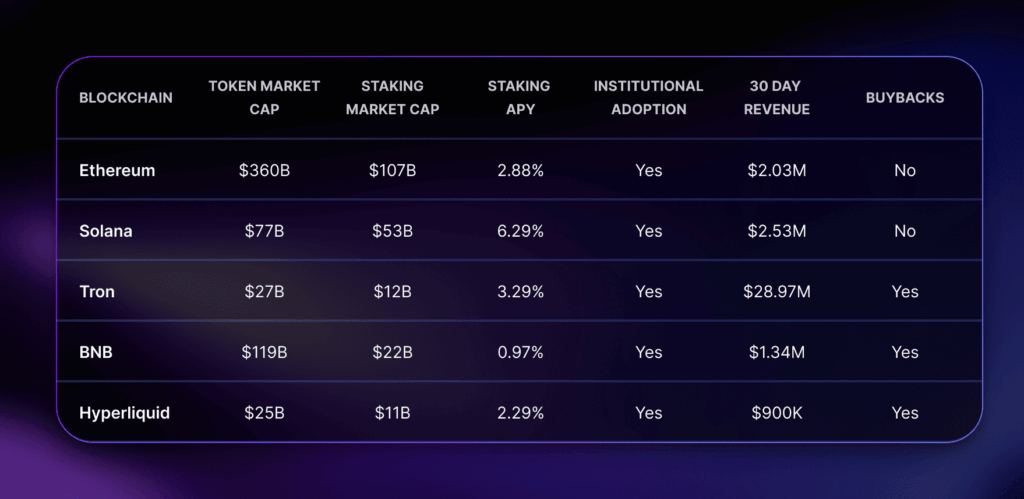

Using the criteria outlined above, we curated a shortlist of blockchains that are best positioned in 2026. These networks stand out not just for staking returns, but for institutional relevance, revenue generation, and token economics:

Data sourced from CoinMarketCap, Staking Rewards, and DeFiLlama.

Networks with Strong Institutional Flows

Ethereum and Solana, dominate staking in terms of staking market cap. While neither network currently employs token buyback mechanisms, both benefit from institutional adoption.

With spot ETFs, staking ETFs, and growing Digital Asset Treasury (DAT) participation, ETH and SOL remain the primary beneficiaries of institutional inflows. If your staking thesis is centered on ETF-driven demand and long-term price appreciation rather than raw APY, these two assets rise to the top.

Blockchains with Revenue and Token Discipline

Smaller networks like Hyperliquid, BNB, Tron offer a different value proposition.

While their staking APYs may not be eye-catching, these networks have demonstrated strong revenue generation and active token buyback programs. From 2024 to 2025, this combination of cash flow and supply discipline contributed to relatively strong token price performance.

If you value sustainable economics over narrative-driven growth, these networks deserve close attention.

Key Narratives For 2026

In 2026, staking performance will be increasingly shaped by institutional trends rather than isolated protocol upgrades. The following narratives are worth monitoring closely.

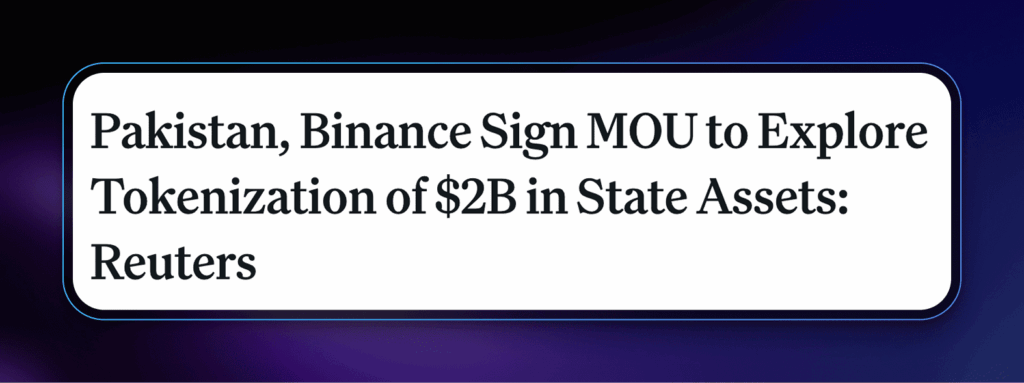

National Tokenization Initiatives

Tokenization means creating blockchain tokens to represent real-world like real estate, stocks, art, or even bonds. By removing intermediaries, tokenization improves liquidity, accessibility, and settlement efficiency.

Governments are beginning to explore tokenization as a way to modernize capital markets.

Pakistan has signed a memorandum of understanding with Binance to explore tokenizing government bonds and treasury bills. Initiatives like this could materially increase usage and fee generation on networks such as BNB Chain.

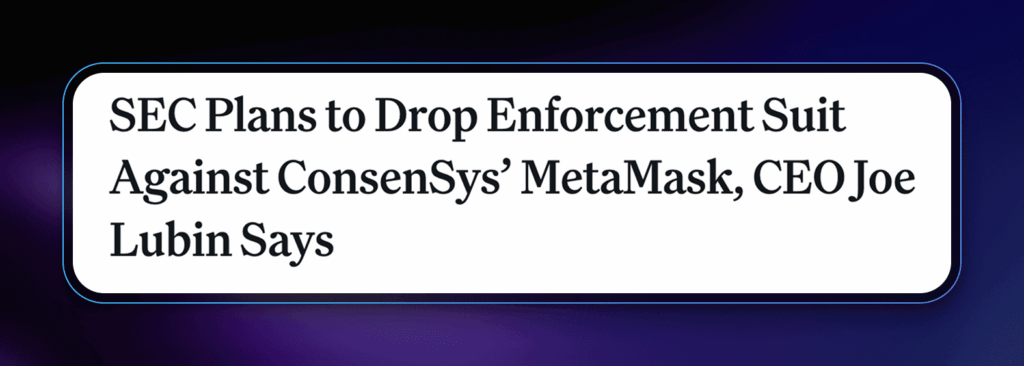

Upcoming Regulations

Regulation remains one of the most powerful forces in crypto markets.

Following President Donald Trump’s election win, the U.S. SEC dropped investigations into crypto companies, triggering a market-wide rally. Attention has now shifted to a pending U.S. crypto market structure bill that would clearly define the roles of the SEC and CFTC.

Clear rules would enable crypto companies and institutional investors to deploy capital with greater confidence. This increased risk appetite directly impacting staking demand and network activity.

Digital Asset Treasury (DAT) Strategy

Digital Asset Treasuries emerged as a major force in 2025, with corporations allocating billions of dollars to Bitcoin, Ethereum, and Solana.

While DATs have been a net positive for prices so far, how will they behave in a prolonged downturn? Will they unstake and sell into the market, or maintain long-term exposure despite drawdowns?

The answer will play a significant role in shaping staking dynamics and price stability in the years ahead.

Final Thoughts on the Best Crypto to Stake in 2026

Staking in 2026 is about more than high APYs. The strongest opportunities will come from networks with real usage, sustainable revenue, and growing institutional demand.

Ethereum and Solana remain core long-term bets due to ETF and DAT inflows, while networks like Tron, BNB Chain, and Hyperliquid stand out for revenue generation and buybacks.

For long-term participants, the best staking assets will be those that combine steady rewards with strong fundamentals in a more selective crypto market.

Frequently Asked Questions (FAQs)

Which Crypto is Most Profitable to Stake?

From a crypto staking reward rate and token appreciation potential, Solana would make a great case. The network is widely adopted by both institutions and retail participants.

With a staking APY above 6%, stakers can also enjoy passive income.

What Cryptocurrency Will Grow the Most in 2026?

It’s difficult to know which cryptocurrency will rise the most in 2026. However, applying a good set of filters and diversifying across a handful of tokens can help you hedge against market volatility and capture upside.

What is the Best Tool to Automate Staking?

Staking optimization and automation have become more popular in recent years.

In an industry where returns dry up quickly, squeezing out extra gains from staking yields can make a big difference.

In some networks like Cosmos, developers have created platforms to fill the need for staking optimization.

Polli.co exists as a non-custodial staking optimization platform for Cosmos, Osmosis, and Lava Network. The platform’s AI agents optimize your staking positions based on proprietary factors such as validator commissions and decentralization.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

December 27, 2025

December 28, 2025