Top Cosmos Staking Platforms with High APY

The Cosmos ecosystem, powered by its native token ATOM, is one of the most dynamic crypto networks. It gained popularity in 2017 alongside notable projects like Ethereum. You can find die-hard Cosmos community members on X (formerly Twitter), promoting its technology.

ATOM holders are known to engage in crypto staking, which Cosmos has excelled in.

Most stakers remember the liquid staking frenzy in 2021 and the stake-to-airdrop play with Celestia in 2023.

As such, Cosmos investors constantly look out for platforms offering the best yields and highest annual percentage yield (APY). However, not all platforms are secure and sustainable.

In this article, we’ll explore the following:

- What to consider in choosing a high APY staking platform

- Types of Staking Platforms

- The Top Platforms to Choose From

- Frequently asked questions on high APY staking

…and more. Let’s dive in and get that high staking yield with Cosmos.

What to Consider in Choosing a Staking Platform

Choosing where to stake ATOM isn’t just about chasing the highest APY.

While high yield is essential, it must be weighed against several factors. Crypto staking is a long-term game. Aligning with a reliable platform can make the difference between losing your hard-earned investments and maximizing your rewards.

Team and Track Record

Before staking your ATOM with any validator or platform, take a close look at who’s running it. Long-standing validators and staking platforms with consistent performance often provide better results.

Consider the following:

- Are they publicly known developers or anonymous?

- Who are the investors backing the platform?

- Does the validator have good uptime?

Conduct a thorough search of the validators and staking platforms on their websites, as well as news articles and social media sites, such as X and Reddit.

In 2022, Celestia raised $55 million from Bain Capital Crypto and Polychain Capital. The presence of distinguished professional investors gives retail investors peace of mind that prior due diligence has been performed.

Usage and Liquidity

How many people are staking with the platform or validator?

High usage is often a vote of confidence from the community. While this isn’t a guarantee of quality, a well-used platform is generally more trustworthy than a brand-new one.

Use these trusted sources to check usage:

- DeFiLlama: Perfect for decentralized finance (DeFi) applications. You can view the website and check a platform’s total value locked (TVL) or liquidity. The more liquid a platform, the easier it is to use for yield farming strategies. A TVL of a few hundred million dollars is generally a good indication of platform liquidity.

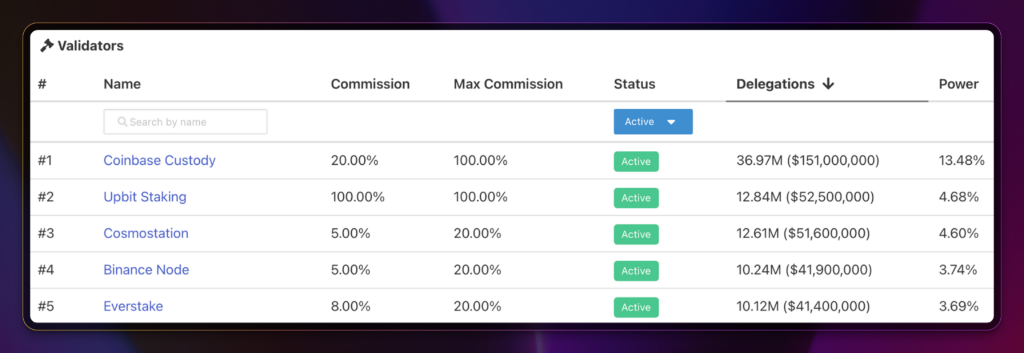

- AtomScan: More for native Cosmos stakers. AtomScan informs you of the amount stakers have delegated to a validator, as well as their corresponding commission rates. As a basic rule, stake with a validator that has at least $1 million delegated to it.

- Observatory: Also for native Cosmos stakers. Observatory assigns a proprietary score for each validator. Their score takes into account metrics such as whether a validator’s nodes are centralized in a single country.

Platform Security

Staking on a validator with poor security can result in slashing, where a portion of your staked funds is penalized. Even worse, staking with a DeFi platform could result in total loss of assets in the event of a smart contract exploit.

Check the platform’s website to see if they’ve undergone third-party audits or have insurance mechanisms in place. Platforms with open-source code and active bug bounty programs also offer more transparency and trust.

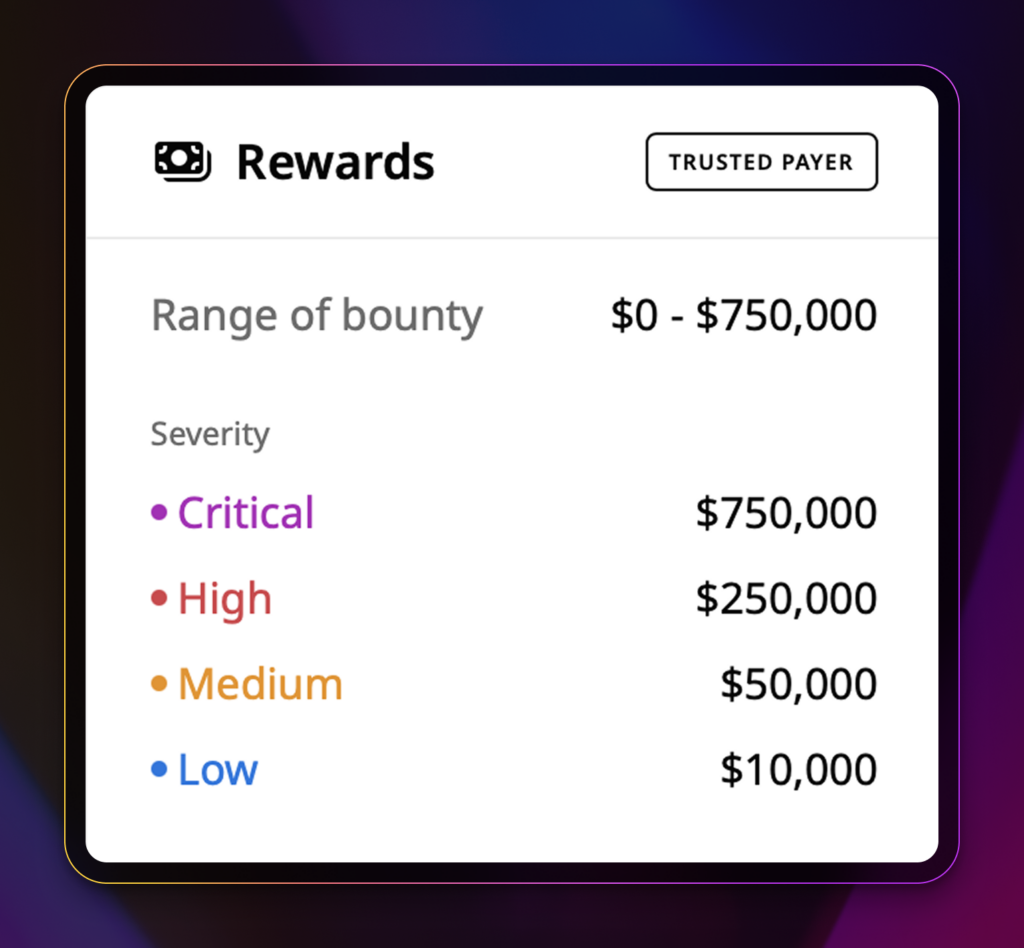

You can check security websites like ImmuneFi and HackenProof for a list of crypto projects and their respective bug bounty programs.

Celestia has a bounty program of up to $750,000 on HackenProof.

Best Staking Platforms with High APY

Cosmos allows users to stake natively and boost APY through liquid staking and optimization. Below, we break down three key categories of high-yield opportunities in Cosmos staking.

Low-Commission Validators on Native Staking

The most straightforward way to earn staking rewards is to stake directly with a validator. They receive a portion of the network’s rewards and take a small commission.

With AtomScan, you can quickly sort the top validators and remove those who take a high commission from your staked Atom.

Staking natively is straightforward, but rewards are tied to Cosmos’ base staking yield of 19% APY. However, by choosing a low-commission validator, you can keep your staking yield close to the network’s yield.

Optimized Artificial Intelligence (AI) Staking

AI-powered yield optimization is taking Cosmos by storm. This new staking innovation boosts native staking yields to a much higher level.

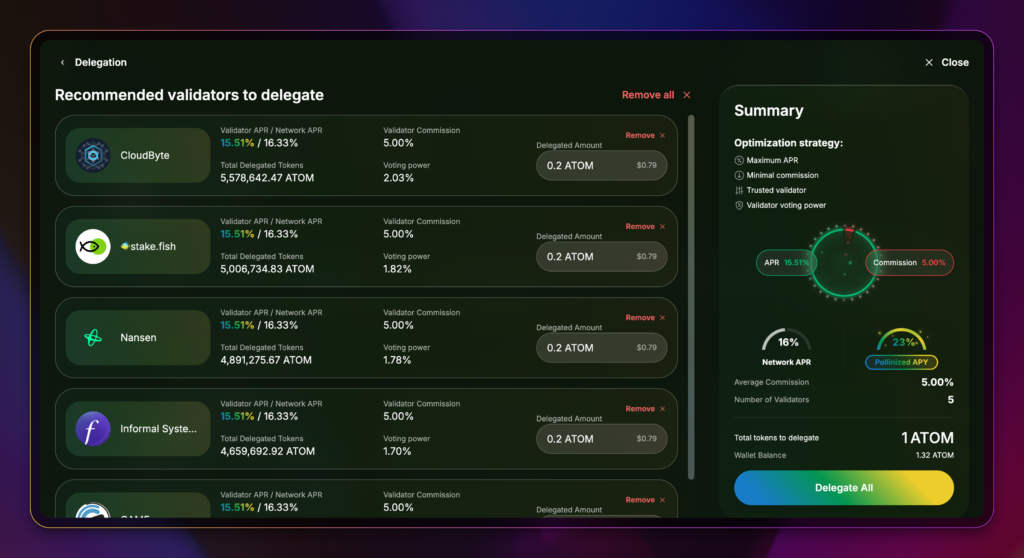

Polli.co is a staking yield optimization platform that utilizes AI models to allocate staked assets automatically. The platform supports both Cosmos and Lava Network staking. Their AI agents automate your staking, from auto-compounding staking rewards to redelegation to validators.

Polli’s AI agent suggests which validators you should delegate your ATOM to.

The platform is ideal for users who want to maximize returns with minimal effort. With their optimization, you earn above-market returns.

This type of automated staking is beneficial for passive investors who want to stay within the Cosmos security model without getting involved in decentralized finance (DeFi).

Liquid Staking and Liquidity Pools

For users who wish to boost their yield, they can deposit their ATOM into liquid staking platforms, such as Stride.Zone and Drop. You stake your ATOM and receive a liquid staking token (LST) representing your staked assets.

You can then take the LST and engage in DeFi protocols for farming, lending, or trading.

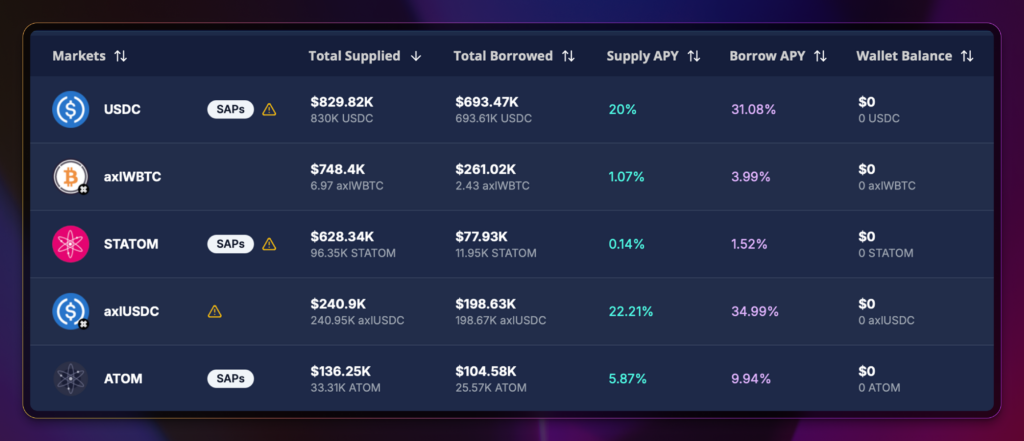

Let’s say you’ve staked your ATOM on Stride and received ATOM, the platform’s LST. You’re earning staking rewards while maintaining liquidity. You then take your ATOM to UX, a Cosmos-based lending and borrowing marketplace.

On UX, you can deposit your stATOM into a liquidity pool and earn an additional 0.14% APY. The deposited assets support their lending operations.

Frequently Asked Questions

Which Staking Platform is Right for You?

The right platform depends on your priorities. If you value simplicity and security, native staking with a low-commission validator is a great start. If you’re looking to optimize your natively staked assets without constant monitoring, an AI-powered platform like Polli.co makes sense.

Is High APY Staking Risky?

Higher APYs usually come with higher risk.

As you move away from native staking, you expose your assets to vulnerabilities in smart contracts and platform hacks. Always assess platform security, audit history, and community reputation before committing your ATOM.

Does Nexo Cosmos Staking Offer a High APY?

Nexo often comes up as a centralized option for staking rewards. It’s a longstanding wealth platform for crypto assets. Nexo offers staking rewards through its “Savings” programs, as well as crypto swaps and a crypto debit card.

Regarding ATOM staking, Nexo offers 8% and 11% on its no-lock-up (short-term) and long-term Savings programs, respectively. The APY is lower than native Cosmos staking, as the platform most likely takes a commission for operational costs.

Final Thoughts on High-Yield Cosmos Staking

Earning high APY for Cosmos staking isn’t just about chasing numbers. It’s about finding the right balance between reward and risk.

Cosmos offers a wide range of opportunities to grow your ATOM holdings. You can delegate to low-commission validators, explore AI-powered optimization, or dive into DeFi through liquid staking. The key is to match your staking strategy with your risk tolerance, time commitment, and technical comfort.

By selecting platforms with strong teams and security practices, you can optimize your staking returns while mitigating potential downsides.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

June 25, 2025

September 3, 2025