Streamline Your Staking Strategy with a Staking Dashboard

With over $125 Billion of crypto locked into the ecosystem, cryptocurrency staking is a popular strategy for earning passive income. However, managing multiple staking activities across different networks can be complex.

To maximize the experience, you should approach staking with a business-like mindset and get dirty with the numbers.

Staking dashboards enables you to professionalize your staking experience. Dashboards offer you a platform to track your crypto investments and earned staking rewards.

Dive into our guide and learn about:

- Why you should use a dashboard

- What features to look for in a dashboard

- What are the best free staking dashboards

…and more. Happy Staking!

Why a Staking Dashboard is Important for Crypto Investors

At first glance, cryptocurrency staking seems like a simple concept. You deposit crypto assets into a network to become a validator. You then help verify transactions and keep the network secure.

However, many nuances depend on the staking network and whether you are solo staking or delegated staking.

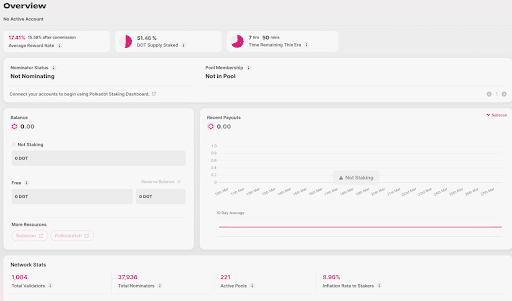

Let’s use a Polkadot staking dashboard as an example.

Polkadot (DOT) is one of the top 50 blockchains in market capitalization. The network uses delegated staking, where users join nomination pools that will select validators. In Polkadot staking, many factors affect your staking rewards:

- Nomination Pools: Developed by (DOT), nomination pools allow you to pool your DOT with other participants to select network validators. The pools allow anyone with as little as 1 DOT to participate in staking.

- Total Supply Staked: The ratio calculates the percentage of total staked DOT tokens. The higher the staking ratio, the greater the participation and the less rewards.

- Inflation Rate: Some networks, such as DOT, do not have a hard limit on the token supply. Depending on the network parameters, an inflation rate can diminish staking returns.

These are just some of the many factors that affect staking returns. When taken together, staking and tracking returns are not as straightforward as they seem.

Why You Should Use a Dashboard

A staking dashboard is a centralized platform that provides a comprehensive overview of your activities.

It allows you to monitor your staked assets, track rewards, and analyze staking performance. With this information, you can make informed decisions about your staking strategy.

Here’s why a staking dashboard is crucial for investors:

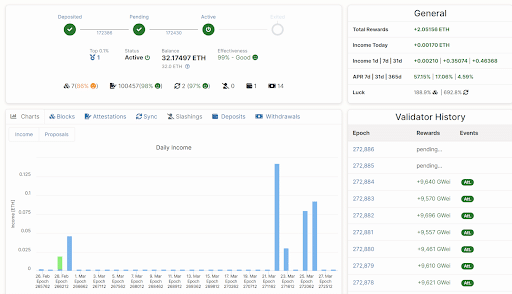

Efficient Monitoring

Especially in the case of ETH solo staking, you need to monitor your validator’s performance. Someone must keep validators running 24/7. The hardware must also stay in top condition, as overheating can lead to downtime.

If your validator is offline for a prolonged period, you may experience penalization in the form of slashing. If a participant attempts to attack the network, they risk losing a portion of their stake in “slashing.”

Maximize Staking Rewards

A staking dashboard provides valuable insights into staking rewards, including historical data and projected earnings. By analyzing this information, you can optimize your staking strategy to maximize your rewards potential.

Risk Management

A staking dashboard centralizes staking data and performance metrics, enabling more effective risk assessment and mitigation. Features include monitoring network health and overall validator performance.

The Solana network experienced an outage in February 2024. Stakers could have seen the network deteriorate through a staking dashboard.

Features to Look for in a Staking Dashboard

When choosing a staking dashboard, consider the type of staking you will conduct. The staking activities for ETH solo staking, delegated staking, and liquid staking requires different dashboard features.

Here are some some essentials to look for in a staking dashboard:

Multi-Chain Support

With hundreds of networks available for staking, the dashboard should support multiple blockchain networks and staking protocols. A multi network view empowers investors to manage all their staking activities from a single platform.

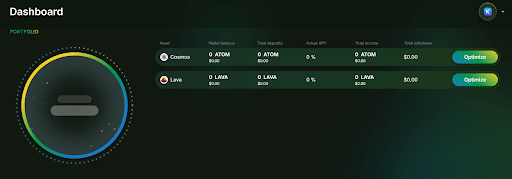

Polli.co is staking optimization platform that supports multiple chains such as Cosmos and Lava Network. You can connect to the website with a supported wallet such as Keplr or Leap. Once inside, Polli provides you with a multi-chain dashboard to monitor your holdings.

Real-Time Data Updates

The dashboard should provide real-time updates on staking rewards, node performance, and network status. This information lets you keep your staking operation up and running 24/7.

As a plus feature, dashboards may include customizable alerts and notifications that regularly alert solo stakers on Telegram or Discord. That way, you can monitor whether anything is wrong with your validator.

Wallet Integration

Seamless wallet integrations allow investors to manage their staked assets directly from the dashboard, withdraw rewards, and participate in staking activities.

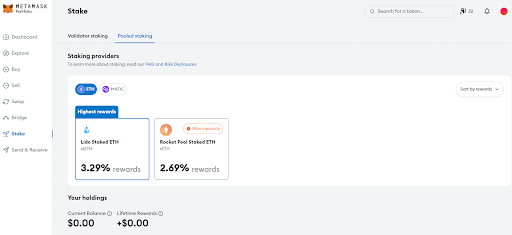

Metamask, a top non-custodial wallet,, has a built-in dashboard with staking functions. With just a few clicks, you can stake from your wallet directly. This wallet execution allows you to stake while maintaining control of your crypto.

The Best Free Staking Dashboards

In addition to the staking dashboards mentioned above, here are a few others that have become favorites in the blockchain community.

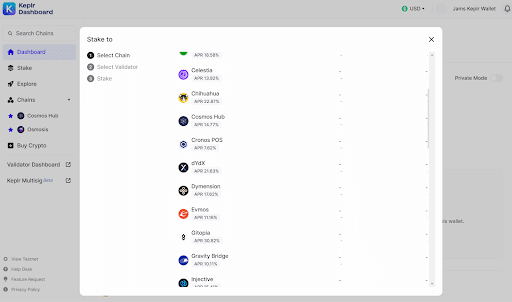

Keplr Dashboard

Keplr is a browser extension wallet application designed for the Cosmos Interchain ecosystem.

The wallet supports staking across popular networks such as Celestia, Injective, and Dymension. In addition, the dashboard allows you to connect to various decentralized applications for DeFi and NFTs.

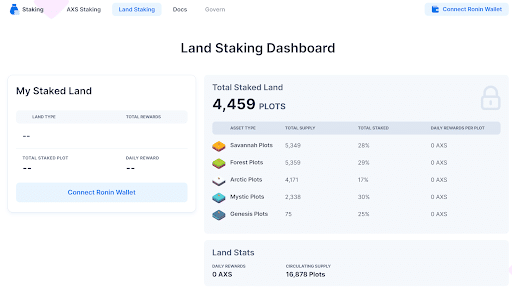

Axie Infinity (AXS) Dashboard

Axie Infinity (AXS), known for its turn-based card battler, has also expanded into virtual real estate called plots. The virtual land serves as the home of the Axies and is used for crafting and enchanting in-game items.

The AXS staking dashboard has an NFT staking component that allows plot holders to stake their land and monitor rewards.

Conclusion

A staking dashboard is a powerful tool for crypto investors looking to streamline their activities and maximize rewards.

By providing real-time data, performance analytics, and alert monitoring features, a staking dashboard empowers you to make informed decisions.

Whether you are a beginner or an experienced investor, leveraging a staking dashboard can significantly enhance your staking experience and contribute to your overall investment portfolio’s growth.

Editor’s Note: This article was originally published in May 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

February 3, 2025

August 4, 2025