A Beginner’s Guide to Solana Staking on Binance

Validator, wallets, and slashing?

Staking crypto is often marketed as a way to earn passive income. But oftentimes it feels complicated.

The great thing is, if you already hold tokens on a crypto exchange like Binance, you’re closer to earning staking rewards than you might think.

Similarly, major blockchains offer great staking opportunities. Top networks like Solana attract billions of dollars in staked assets, with 69% of all tokens staked.

A crypto exchange allows you to stake without dealing with the technicalities. But convenience comes with trade-offs.

Understanding how Binance staking works is key before committing your Solana tokens (SOL).

This guide walks you through the basics:

- What Binance is

- How Solana staking works

- How to stake SOL on Binance

- Risks and rewards of staking on an exchange

…and many more.

By the end of this article, you should be able to make an informed decision on whether or not to stake your SOL on Binance.

A Brief Introduction to Binance

Binance is the world’s largest cryptocurrency exchange by trading volume.

Changpeng Zhao (commonly known as “CZ”) founded the exchange in 2017. Binance has quickly risen to the top by offering a wide range of crypto products with relatively low fees.

Binance serves over 300 million registered users and offers services across spot trading, perpetual futures, staking, and more.

Core Products by Binance

Binance is more than just a place to buy and sell crypto. Its ecosystem includes:

- Spot and Futures Trading: Buy, sell, and trade hundreds of cryptocurrencies and commodities with leverage.

- Earn Products: Earn a yield on your crypto through staking, savings, and other yield-generating products.

- Launchpad & Launchpool: Get early access to new tokens by pledging your BNB and other applicable tokens.

- Web3 Wallet: Take custody of your crypto through a wallet integrated into Binance

- NFT Marketplace: Minting and trading NFTs on the platform.

- Pay: Quickly send, receive, and pay with your crypto.

If you’re holding cryptocurrency long-term on Binance, you might as well earn yield on those tokens through staking and other earn products.

What Is Solana?

Solana (SOL), Explained in Under 4 Minutes

Solana is a high-performance Layer-1 blockchain. Known as the “Ethereum Killer,” it is designed for speed, scalability, and low transaction costs.

Launched in 2020, Solana is a go-to network for DeFi, NFTs, and memecoin trading.

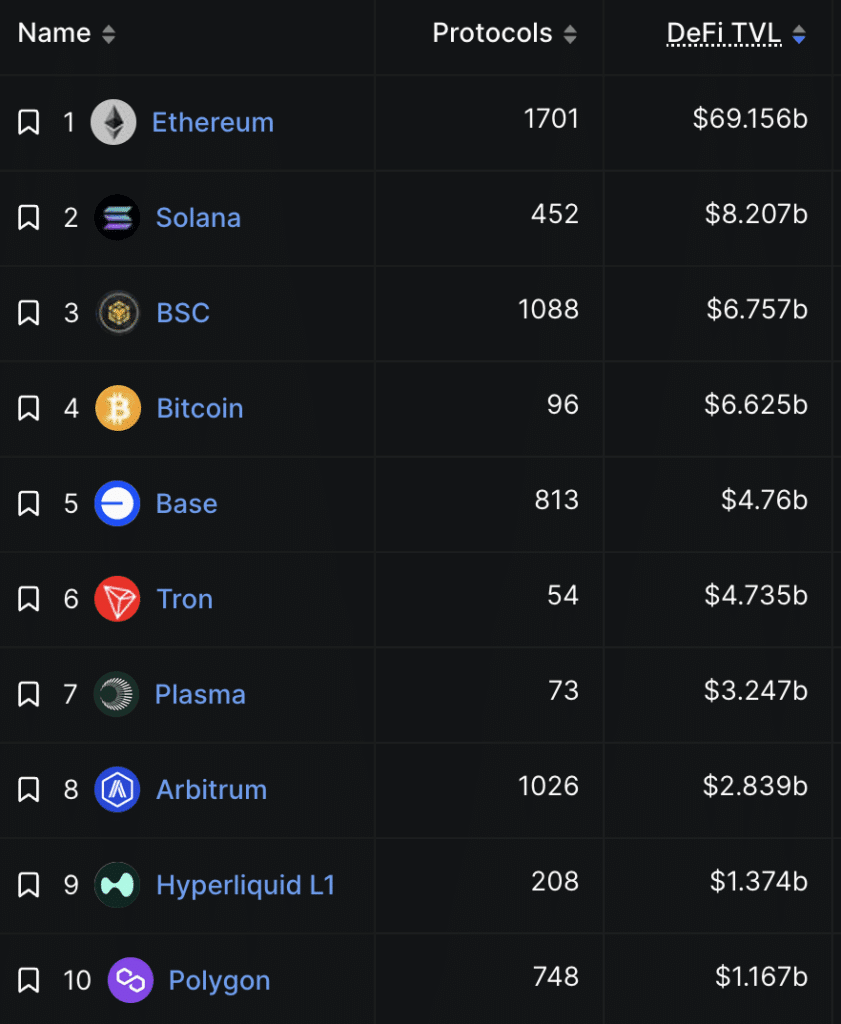

Solana ranks second to Ethereum in total value locked (TVL) for DeFi and seventh among protocols launched on the network.

Solana’s Delegated Proof-of-Stake (DPoS) Model

Solana uses a Delegated Proof-of-Stake (DPoS) consensus mechanism similar to networks like Cosmos.

Here’s how staking works:

- SOL holders delegate their tokens to validators

- Validators help secure the network and process transactions

- Stakers earn rewards based on network inflation, validator performance, and after deducting validator commission fees

How to Stake Solana on Binance

Binance offers a simplified staking experience. You don’t have to choose validators or secure your wallet. Binance does that on your behalf.

Here’s how to stake SOL on the exchange:

Step 1: Create and Verify a Binance Account

Start by creating a Binance account and completing identity verification (KYC).

Make sure to check whether or not Binance operates in your country.

Binance operates through a US entity (Binance U.S.) for American customers. Meanwhile, regulators have banned the exchange in Asian countries like Singapore and the Philippines. Note that the app may still be available in these countries despite regulators warnings.

Once verified, secure your account with two-factor authentication (2FA).

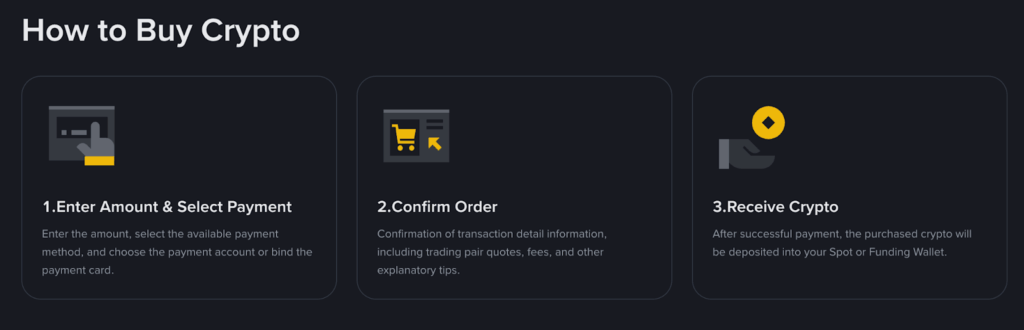

Step 2: Deposit or Buy SOL

You will need SOL in your Binance account.

Here’s how you can get some SOL:

- Externally: You can use your existing SOL held in your external wallet like Phantom Wallet.

- Internally: Use fiat, credit cards, stablecoins, or other crypto to purchase Solana within Binance.

Once the SOL lands in your account, you’re ready to stake.

Step 3: Head to Binance Earn

Navigate to Binance earn from the Dashboard:

1. Click “Earn” in the top menu

2. Select “Simple Earn” (naming may vary depending on region)

3. Search for Solana (SOL)

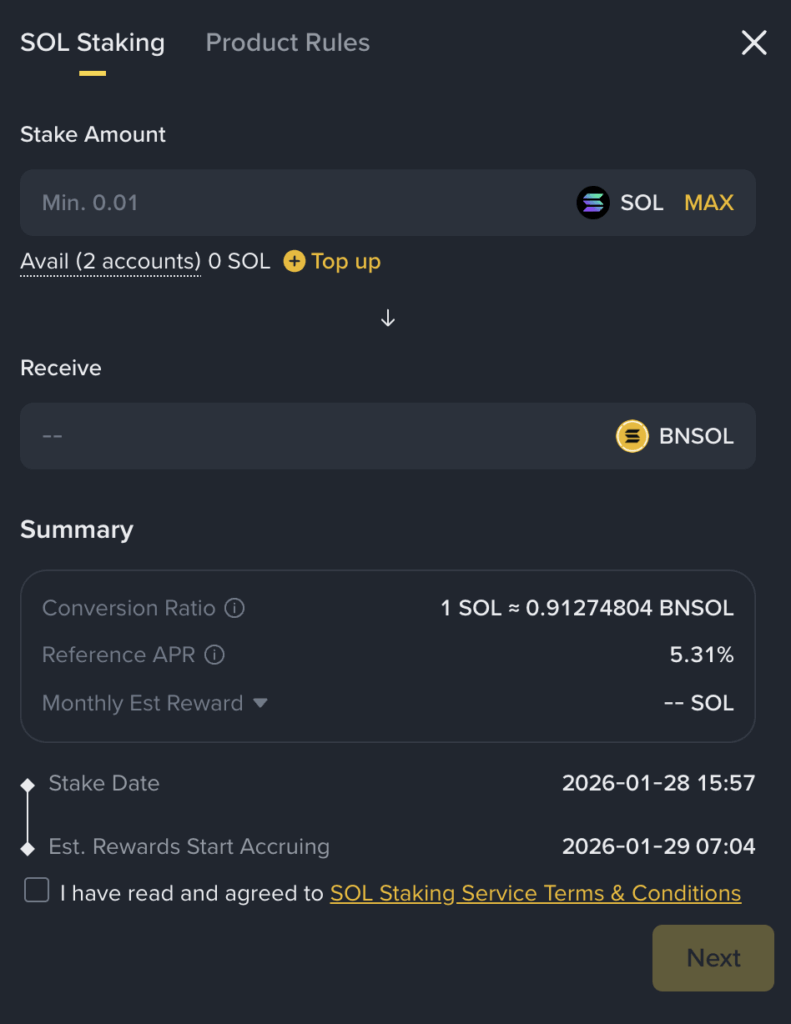

By default, Binance offers liquid staking in its Solana staking product.

When you deposit your SOL for staking, you receive BNSOL, a liquid staking token (LST) representing your staked Solana. You can use BNSOL for trading or engaging in other DeFi applications.

Step 4: Subscribe and Start Staking

Enter the amount of SOL you wish to stake. There is a 0.01 SOL minimum required to stake, making it very accessible.

Make sure to check the details, such as the APR and Product Rules.

Pros and Cons of Staking SOL on Binance

Staking SOL on Binance sounds like a dream come true. It’s easy to open an account and simple to earn from its staking service.

However, like any financial transaction, there are pros and cons to staking on Binance,

Pro: Extremely Beginner-Friendly

There is no need for you to manage validators or wallets.

You don’t have to think about losing your crypto because you signed a malicious transaction or clicked on a bad link. At the same time, you don’t have to monitor whether the validator you delegated to went offline.

Staking on Binance is as simple as creating an account and hitting that Earn button.

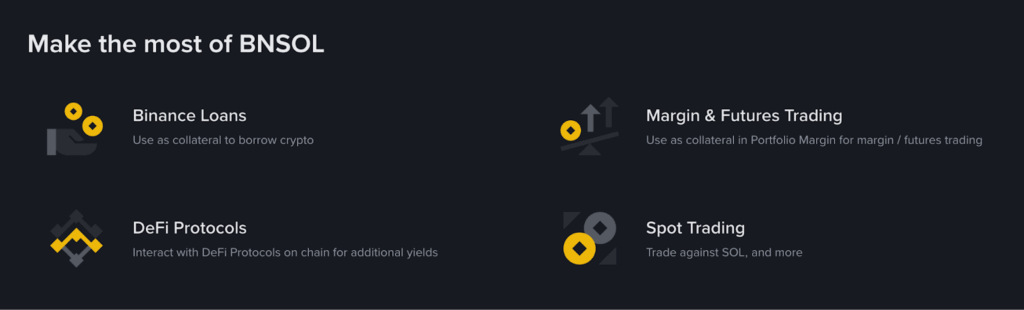

Pro: Integrated with Other Binance Products

After staking your SOL on Binance, the next question becomes how to maximize the liquid staking token that you’ve received.

In other liquid staking platforms, you’d have to take your LST to a third-party decentralized finance platform. With Binance, you don’t need to exit the platform.

You can engage in loans, trading, and other services leveraging your BNSOL.

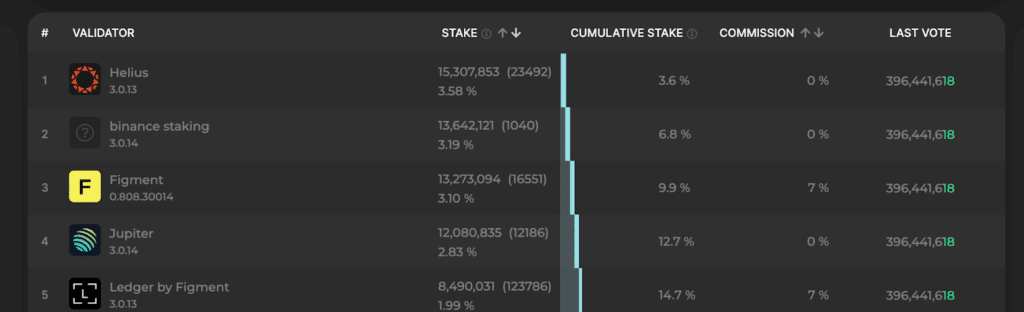

Con: Validator Centralization

As Binance continues to grow and acquire more customers, naturally, those staking on Binance increase as well. This pattern can lead to validator centralization.

The Binance validator currently ranks 2nd in terms of staked assets. Together with the top 19 validators, Binance forms a superminority.

A superminority means that the top 19 validators have enough staked SOL to collude and act maliciously. This negative outcome is unlikely; however, centralization runs counter to the blockchain’s decentralized ethos.

Con: High Commission

Binance SOL staking offers an APR of 5.3%. This rate is lower than what native staking or other liquid staking platforms provide.

Jito, the top Solana liquid staking platform, offers an APY of 5.88%. Meanwhile, native staking on Solana yields returns of over 6%.

While you may benefit from the convenience of staking on an exchange, you sacrifice some gains.

Should You Stake SOL on Binance?

If you’re already comfortable with centralized exchanges, you might as well maximize your digital assets held on the platform. Staking SOL on Binance lets you earn passive rewards.

That said, staking through Binance is not the same as staking directly on Solana.

You’re trading autonomy for comfortability.

For beginners and retail stakers, Binance provides a low-friction entry point. However, for more advanced stakers, you may be more interested in keeping a larger share of staking rewards.

At the end of the day, the best staking strategy for you is the one you understand and feel comfortable using.

Frequently Asked Questions

Can I Stake Solana on Binance?

Yes. You can stake SOL on Binance through the exchange’s Earn feature. Binance executes Solana staking via liquid staking, where you receive BNSOL while earning rewards.

Is Solana Staking Profitable?

Yes, for long-term holders. SOL staking yields 6% annually. You’ll earn less with Binance due to commission, but you’ll still come away with 5% per year.

How can I earn $10 daily on Binance Without Investment?

Occasional rewards exist, but consistent daily earnings require capital and risk.

Can I Lose Solana by Staking?

Loss is unlikely but possible. Binance could go bankrupt, as FTX did in 2022.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

January 29, 2026

February 10, 2026