A Crypto Investor’s Guide to Solana Staking ETFs

For years, investing in crypto was like buying gold: you bought it, put it in a digital vault or wallet, and hoped the price went up. If the price didn’t move, your investment did nothing.

When Proof-of-Stake consensus mechanisms came around, you could then put your digital assets to work and earn a yield through staking rewards. However, you still had to navigate technical hurdles, including selecting a validator, monitoring, and taking self-custody of assets.

Fast-forward to 2026, and a new type of investment has changed how we conduct staking and earn yield.

Solana is helping drive this transformation through Solana Staking ETFs.

Through these staking Exchange Traded Funds (ETFs), crypto has transformed from a static asset into a productive one.

In this article, we discuss the following:

- How Solana staking ETFs work

- The ETF landscape in 2026

- Why Wall Street is jumping in

- Things to keep in mind

…and much more!

Let’s get into it.

Solana Staking ETF Mechanics

To understand how Solana Staking ETFs are a game-changer, let’s review what happens under the hood: ETFs, Solana, and staking.

What is an ETF?

An Exchange-Traded Fund (ETF) is a regulated financial product that pools investors’ money to purchase assets. These assets can include stocks, bonds, or even digital assets. A fund manager handles the ETF.

You can easily buy and sell ETFs through an equities brokerage, making them very accessible to retail and institutional investors.

A Quick Recap of Solana and Staking

Solana is one of the most widely used blockchains by protocol launches, total value locked, and users. Due to the network’s massive adoption, it has raised institutional interest.

It’s a blockchain that uses a Delegated Proof-of-Stake (DPoS) consensus mechanism.

To keep the network running properly, SOL token holders delegate their SOL to validators, the parties and computers that process transactions. These validators earn staking rewards for securing the network.

You can perform Solana staking in a variety of ways:

- Solo staking: The end-to-end process of setting up your own hardware, becoming a validator, acquiring delegations, earning staking rewards, and receiving a commission.

- Native staking: Delegating your SOL to a validator, earning staking rewards, and paying a commission fee to validators.

- Liquid staking: Depositing your SOL to a third-party platform, getting a liquid staking token (LST) representing your deposit, and unlocking immediate liquidity.

- Restaking: Depositing your already staked SOL to earn even more rewards.

Each method comes with its own pros and cons, and oftentimes, you’ll be doing these with unregulated entities.

The Magic Behind Staking ETFs

With a staking ETF, the fund manager uses the fund’s SOL holdings to delegate them to validators. Other fund managers may set up their own validators and perform solo staking, or use liquid staking and restaking platforms.

When you buy shares from a staking ETF, you remove the complexities of staking on your own, and you have the assurance of working with a regulated platform and/or institution.

2026 Solana Staking ETF Landscape

The first Solana Staking ETF appeared in 2025. As crypto ETFs are relatively new, only a handful of players are capturing investor interest.

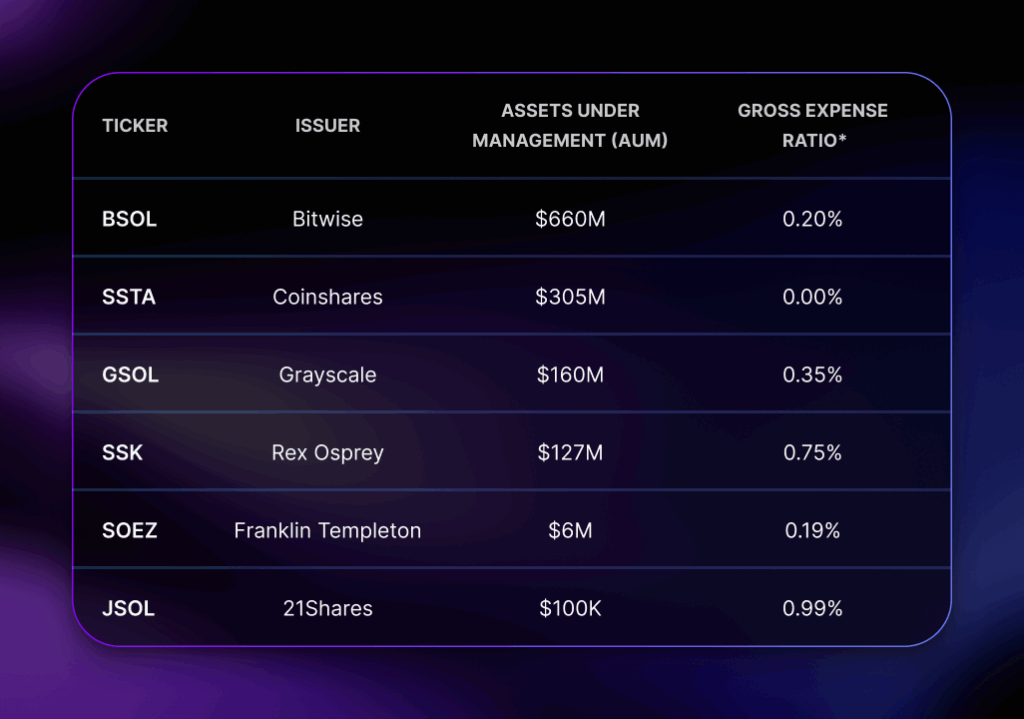

A few Solana Staking ETFs, such as BSOL, have amassed over $100M AUM. These ETFs have achieved this milestone either by being first to market or by leveraging their ETF issuer’s brand name.

Other ETFs, such as JSOL, are relatively new, having launched in January 2026. They have yet to attract significant investor funds.

As a side note, most of these ETFs waive the expense ratio for the first three months of the fund, or until they reach $1B in AUM. They use this zero-cost strategy to promote early investment.

Why Wall Street is Jumping In

Why did it take until 2025 for these products to go mainstream? It comes down to two major factors: Maturity and Rules.

Crypto Has Gone Mainstream

Cryptocurrency has existed for 15 years. Crypto is maturing.

The industry has seen its ups and downs and has fought for acceptance from the government and institutions. Now, that time has come.

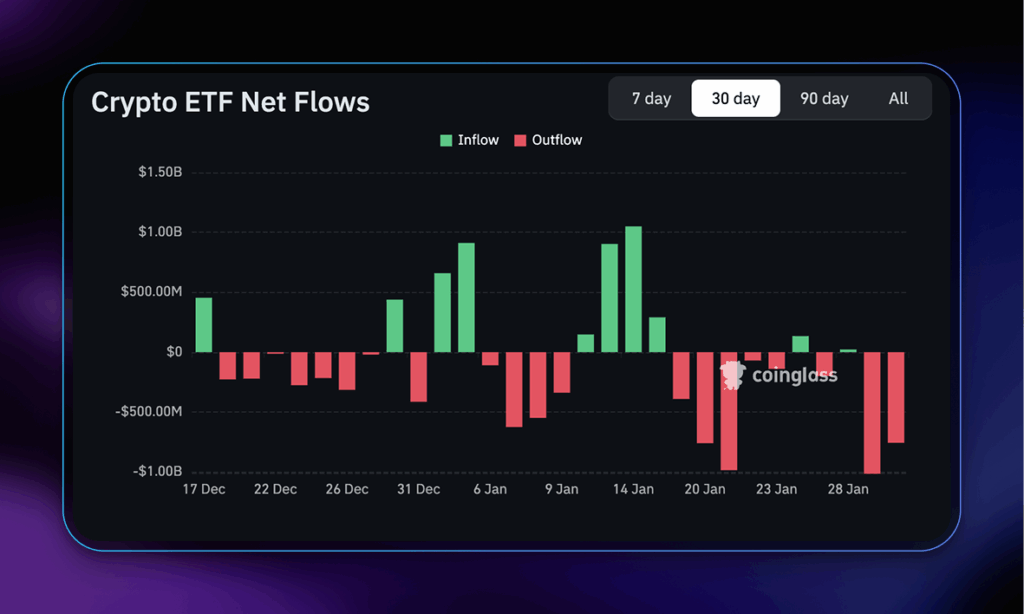

Crypto ETFs bring in up to $1B in a single day. It started with spot ETFs (pure buy-and-hold funds) for Bitcoin. Eventually, institutions transitioned to staking ETFs for relevant cryptocurrencies such as Ethereum and Solana.

Clearer Government Guidelines and Support

U.S. President Donald Trump won the 2024 presidential election, ushering in a pro-crypto administration. His win brought a wave of positive crypto developments:

- 1. The SEC stopped numerous investigations into crypto organizations

- 2. The government established a national strategic crypto reserve, and

- 3. U.S. regulators passed new crypto legislation.

This green light allowed financial institutions to recommend crypto and Solana ETFs to their clients without legal concerns.

Things to Keep in Mind

You may be thinking that staking ETFs is like a magic pill. They’re highly regulated and even give off “dividend” like returns through staking rewards.

However, cryptocurrency remains a highly volatile industry with risks that even regulated access cannot strip away.

Price Volatility

Even if you earn 6% from Solana staking rewards, if the price of Solana drops by 20%, you are still down overall.

From January 2025 to January 2026, Solana’s price fell from $250 per token to less than $120. That’s a 50% drop that staking rewards cannot compensate for.

Yield is not a guarantee of profitability.

Fees

As noted earlier, ETFs carry an expense ratio, otherwise known as their sponsor fees. While the fees may seem negligible at less than 1%, it’s important to understand how this works.

Let’s say you buy $10,000 shares of a Solana Staking ETF with the staking rate at 6% per year. The expense ratio is 0.75%. Price does not change after a year.

- You earn $600 SOL staking rewards after a year of staking.

- You now have $10,600 SOL.

- The expense ratio is paid on the fund value, or $10,600.

- The expense fee totals $79.50.

Compare this with natively staking Solana. Assume the same $10,000 SOL staked at a rate of 6% per year.

- You earn $600 SOL staking rewards after a year of staking.

- You now have $10,600 SOL.

- Several top validators charge 0% to 5% on the staking rewards.

- The commission comes out at $0 to $30

You can reduce the expenses by selecting ETFs with lower expense ratios. However, native staking also includes validators that charge no fees.

Are Staking ETFs the Future of Digital Asset Investing?

The Solana Staking ETF is a blueprint for the future of finance. It proves that you don’t have to do it yourself when taking advantage of crypto’s financial rewards. As we look toward 2026, the success of these funds will drive yield-bearing ETFs to other relevant blockchains.

But for now, Solana provides you and Wall Street investors a vehicle that grows in value while paying you to stay patient.

FAQs

Is There an ETF That Holds Solana?

Yes. Several ETFs now hold SOL directly and stake it on-chain, giving investors price exposure plus staking yield through a regulated product.

Is Solana Staking Profitable?

It can be. Solana staking typically yields around 5–7% annually, but overall profitability still depends on SOL’s price movement.

How Often is Solana Staking Paid Out?

Staking rewards accrue continuously and are distributed every epoch, roughly every 2–3 days, depending on the setup. For ETFs, the rewards may be reinvested directly into the fund’s value, increasing the price per share.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

February 10, 2026

February 10, 2026