Single Chain vs. Multi-Chain Staking: Which Strategy Suits Your Investment Goals?

Blockchain technology has grown into an environment with multiple chains and networks – from older and battle-tested blockchains like Ethereum and Cosmos to newer blockchain networks like Arbitrum and Optimism.

To participate and secure these blockchains, one can engage in staking activities and earn passive income.

However, with hundreds of networks available to choose from, it is easy to get lost in all the options.

Fortunately, there’s a way to participate in several of these blockchains through a multi-chain ecosystem. You can allocate your resources across various networks and take advantage of each one’s income-generating opportunities and mechanism design.

Time to deep dive on single-chain vs multi-chain staking models!

Understanding Single Chain Staking

Single-chain staking refers to the traditional solo staking process.

A staker locks up a certain amount of cryptocurrency on a single blockchain to support its operations and validate transactions. Participants, often called validators, are rewarded with native tokens for maintaining network security and integrity.

Proof-of-Stake networks Ethereum and Delegated-Proof-of-Stake blockchain Cosmos remain popular choices for solo staking.

The Cons of Solo Staking

Solo staking is lauded for its simplicity and opportunities for stakers to secure a network and earn passive income. Investors only need to focus on one blockchain, making managing and monitoring their staking activities easier.

However, it also comes with drawbacks.

Lack of Diversification

Investors are exposed to the risks associated with a single blockchain network. Any vulnerabilities or security breaches within that network could result in the potential loss of staked assets.

In early February 2024, the Solana network experienced a 5-hour-long outage. Users were unable to execute any transactions throughout this time. Similarly, Solana stakers were unable to monitor their digital assets.

While the network was eventually brought back online, this shows how a lack of diversification can have negative consequences on an investor’s portfolio.

Vulnerability to Network-Specific Issues

Solo staking exposes you to risks that are specific to the network you are staking on.

These issues could include network congestion, governance disputes, or even regulatory challenges. A powerful government regime could rule a network as illegal and mandate internet providers to block access to this network.

If any of these issues arise, they could affect the stability and security of the network, potentially impacting your staked assets.

Exploring Multi-Chain Staking

Given the risks of solo staking, investors must adapt and search for other passive income opportunities within the blockchain space.

Multi-chain staking presents opportunities. However, investors must first get familiar with the concept before committing any digital assets.

Multi-chain Staking for Dummies

Imagine you are a farmer who wants to invest in agricultural projects to generate additional income. You have two options: single-crop farming and multi-crop farming.

You can focus all your resources on cultivating a single crop type, such as corn. You can streamline your operations by specializing in one crop and potentially achieve higher yields.

However, you are also exposed to risks associated with weather conditions and market fluctuations that can affect your chosen crop.

On the other hand, multi-crop farming allows you to diversify your investments by cultivating different types of crops on the same piece of land. While multi-crop farming requires more planning and management, it offers resilience against unforeseen challenges and may result in more stable returns over time.

These insights appear in the discussion of solo staking versus multi-chain staking.

Multi-chain staking does not exist in the strictest sense (e.g., simultaneously staking assets across multiple blockchain networks). However, investors can diversify risk and maximize potential returns by spreading investments across a multi-chain ecosystem.

Enabling a Multi-Chain Ecosystem

To enable a multi-chain approach, decentralized applications create multiple individual versions on each blockchain. These instances have no connection to the other decentralized applications on other networks.

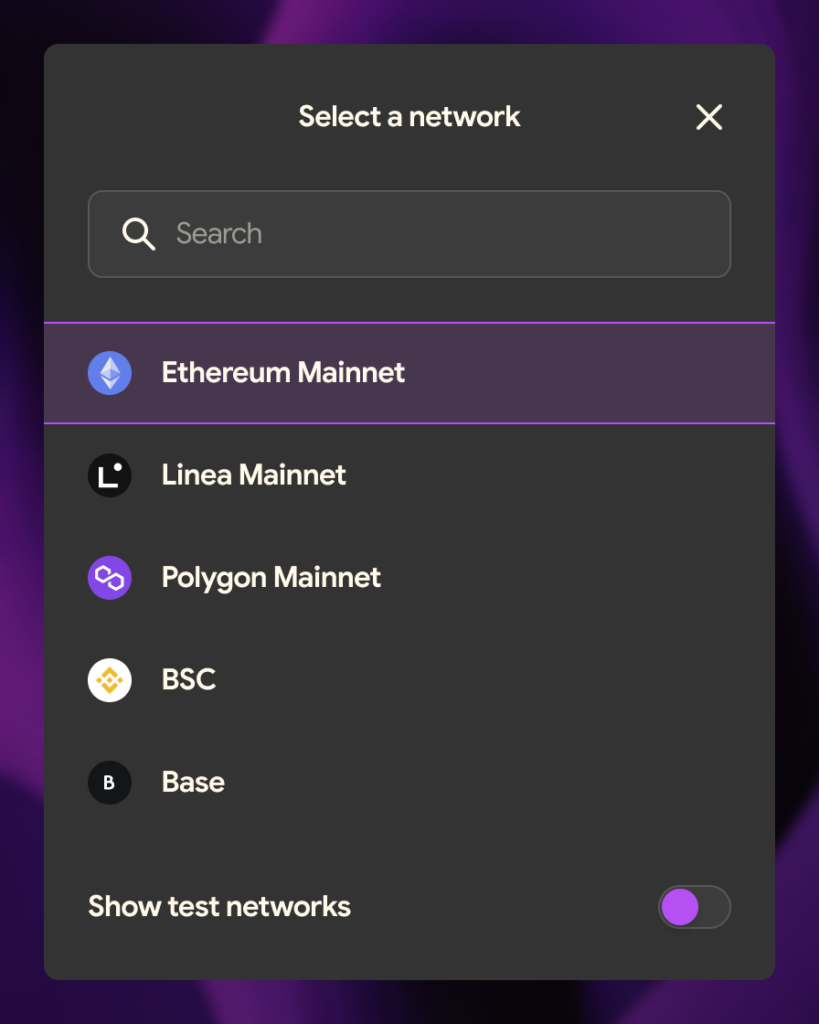

Picture the famous decentralized wallet MetaMask. While it has been known to be the go-to wallet for the Ethereum network, it supports multiple chains – from Polygon to Arbitrum.

Metamask allows users to switch between distinct networks and take advantage of income opportunities on multiple chains. At the same time, assets on one network are held entirely separate from the other, mitigating single ecosystem risks.

The heightened availability of smart contract platforms leads to a more efficient and decentralized blockchain space. The total aggregate throughput of the Decentralized Finance (DeFi) industry increases as users can maximize the cost efficiencies of other different blockchain networks.

However, a multi-chain environment does bring its own drawbacks. Isolated application deployments lead to decreased capital efficiency, as liquidity is fragmented between isolated decentralized applications, with no movement between them.

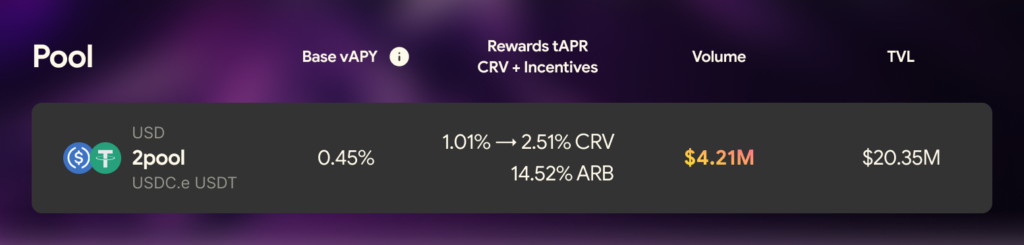

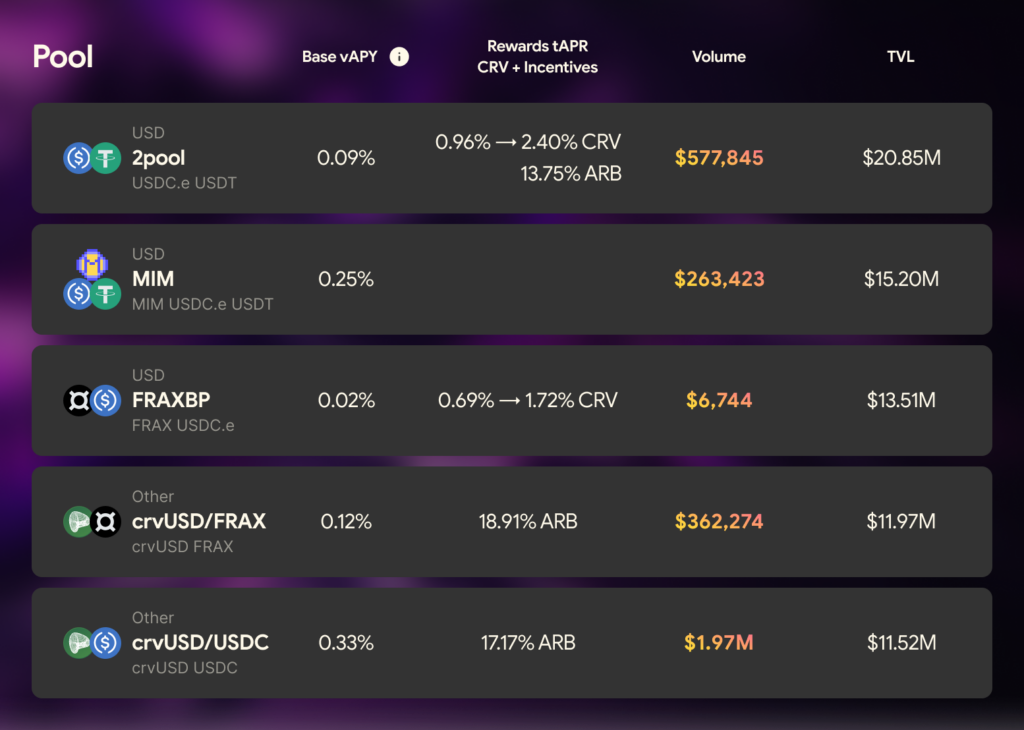

Take, for example, Curve Finance, a decentralized application with multi-chain technology. The platform enables the seamless transfer between different blockchains such as Arbitrum, Ethereum, and Avalanche.

Curve’s top liquidity pool on the Ethereum network has attracted $231.50 Million in total value locked (TVL), while the most popular pool on Arbitrum has garnered only USD 20.46 Million in TVL.

These digital assets exist on different chains, and one would have to transfer from one chain to another to combine the assets.

A Trade-off of Security and Scalability

The solo-chain and multi-chain discussion highlights the trade-off between security and scalability for blockchain technology.

Single-chain approach:

- Simpler to manage.

- Offers higher security within a single network.

- May be more susceptible to network-specific issues.

Multi-chain technology:

- Provides diversification benefits.

- Requires care to ensure the security of assets across multiple networks.

- Adapts to changing market conditions.

Which Staking Model Offers Higher Returns on Investment?

Multiple blockchains offer high returns. While stakers could take advantage of each, the choice depends on various factors, including individual risk tolerance, investment goals, and market conditions.

Solo chain staking may suit investors seeking simplicity and security within a specific blockchain ecosystem. Investors would not need to hop from one network to another or engage with smart contracts.

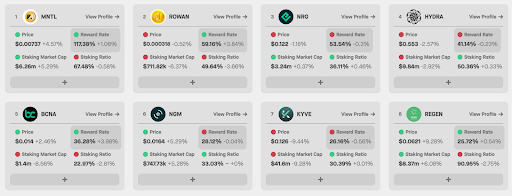

Multiple blockchains, such as Asset Mantle and Rowan Network, offer staking returns above 50% per annum. However, these smaller networks carry more technology risk and price volatility.

Bigger blockchain technologies such as Ethereum and Solana provide staking returns in the single digits but these are more stable.

Curve Finance’s liquidity pools offer base single-digit returns but allow users to use multi-chain technology. Users can utilize the smart contracts to farm stablecoins and liquid staking tokens. Furthermore, when combining CRV (Curve’s native token) and multi-chain incentives (from Arbitrum), yield increases to nearly 20%.

Multi-chain technology appeals to those looking to diversify holdings and explore opportunities across multiple networks.

Which Cryptocurrencies and Platforms Support Multi-chain Models?

Aside from Curve Finance, numerous DeFi applications have begun supporting multi-chain technology to capture a broader audience and user base.

Here are some popular smart contract platforms to name a few:

Pendle Finance for Multi-Chain Yield on Stablecoins

Pendle Finance is an up-and-coming decentralized application pioneering in yield tokenization. The platform supports different chains from Ethereum to Arbitrum and specializes primarily around yield generation for stablecoins and Ethereum.

Users have embraced Pendle’s multi-chain approach and deposited over $1.0 Billion onto the platform.

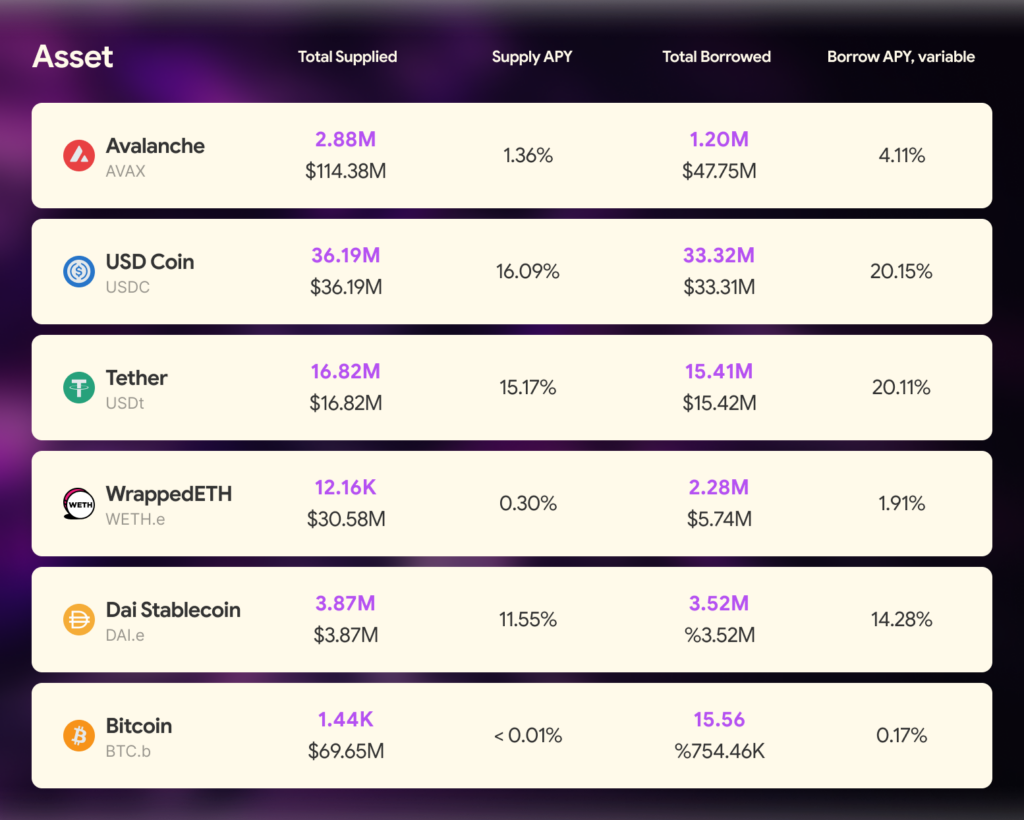

AAVE for Multi-Chain Liquidity

AAVE is an open source liquidity platform where users can earn interest, lend, and borrow digital assets. The platform supports multiple different blockchains from Avalanche to BNB Smart Chain.

AAVE’s Avalanche smart contracts empower users to earn double-digit yields on stablecoins. This is quite lucrative, given the relative price stability of the said cryptocurrency.

Choosing the Right Staking Model for Your Needs

As you consider your investment goals, it’s essential to weigh the benefits and drawbacks of both solo staking and multi-chain strategies.

By understanding their features and risks, you can make informed decisions that align with your objectives and risk tolerance. Whether you are a digital investor navigating the cryptocurrency landscape or a staker choosing the right blockchain to support, determining the right strategy can help you achieve your financial goals effectively.

At the very least, reflect on your personal risk tolerance.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

March 18, 2024

July 3, 2025