Native Staking: Solana vs. Other Blockchains

The Solana network has recently emerged as the blockchain of choice.

Known for its speed and low costs, over 3 million daily active users rely on Solana (SOL) for trading, transfers, and decentralized finance. Stakers also use native and liquid staking to invest in Solana and earn long-term rewards.

But how does native SOL staking compare to other blockchains like Ethereum, and what advantages does it offer?

In this blog, we’ll explore the following topics:

- What is Solana native staking

- How is native staking is different from liquid staking and restaking

- How Solana staking differs from other blockchains

- The advantages of staking SOL and

- The opportunities for maximizing rewards on Solana.

Read on to learn more about Solana.

How Does Native Staking Solana Work?

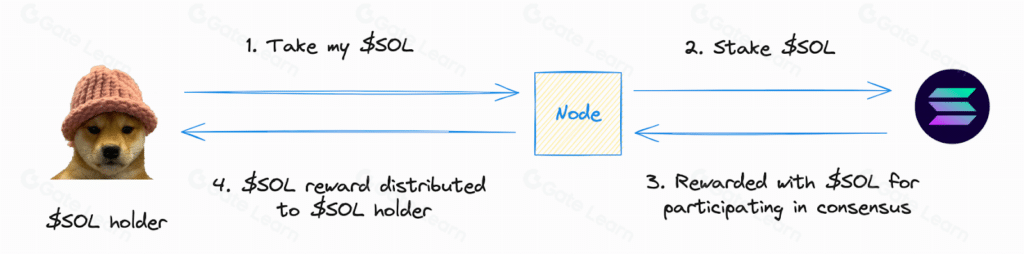

Native staking is staking SOL directly on the Solana network via its Delegated Proof-of-Stake (DPoS) consensus mechanism.

Here’s a breakdown of SOL staking:

- Delegation: SOL holders select a validator node and delegate their tokens to it.

- Validation: Validators process transactions, contribute to network security, and produce new blocks.

- Rewards: Validators and delegators earn rewards in native SOL tokens.

- Unbonding: When users decide to unstake their tokens, they must wait two to four days before accessing their assets.

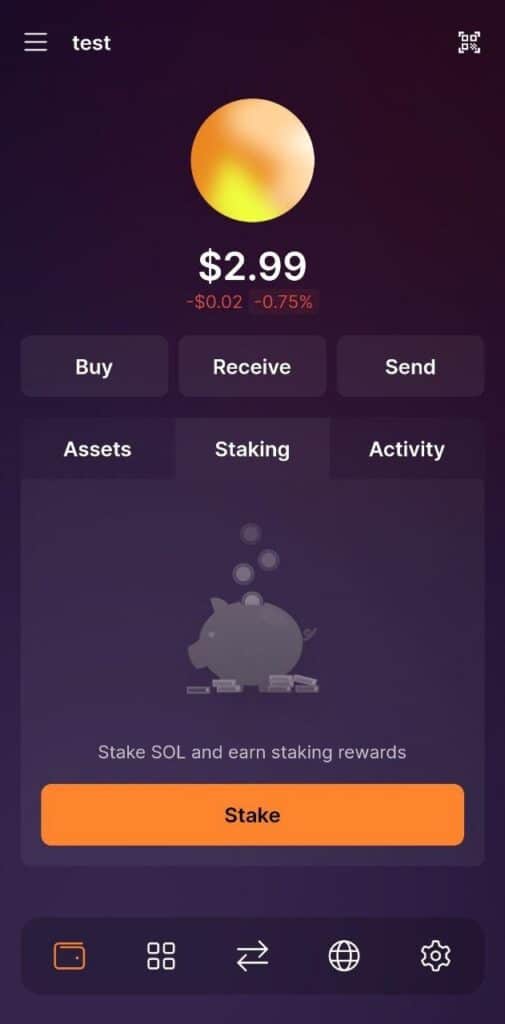

You can easily access Solana native staking through a crypto wallet such as Phantom or Solflare. SOL holders love these wallets for their seamless user interfaces. Stakers can see details such as staked SOL, annual percentage yield (APY), and validator uptime.

For Solflare, click the Staking tab from the wallet interface, then click Stake. This will automatically delegate your tokens to the Solflare validator. Your staked assets will then earn rewards.

Solana Native Staking vs Liquid Staking vs Restaking

There are three options for staking SOL: native, liquid, and restaking. These methods allow you to earn rewards for helping secure the Solana network, but differ in flexibility, usability, and risk.

Native Staking SOL

Native staking involves delegating your SOL directly to a validator, such as Solflare. Your SOL remains in your wallet but is locked and inactive until you manually unstake it.

Here’s a breakdown of native staking:

- Secure and straightforward: Ideal for long-term holders who want to earn passive income with minimal risk.

- Locked tokens: You cannot use or transfer your SOL while staked.

- Earn standard APY: You receive regular staking rewards, generally around 7–8%, depending on the validator.

Liquid Staking

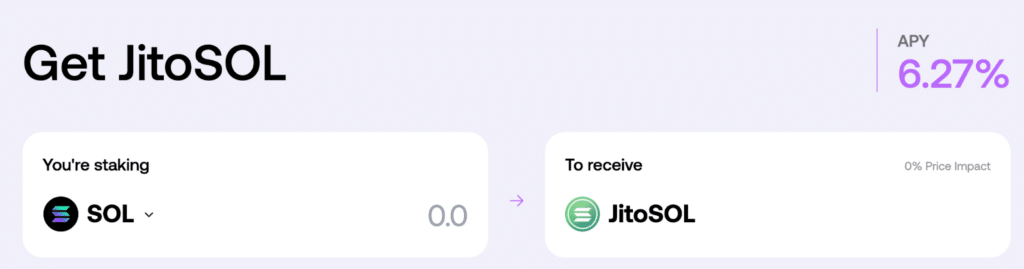

In liquid staking, you deposit native tokens like SOL and receive a liquid staking token (LST) representing your staked SOL.

Jito is the top Solana liquid staking protocol. When you deposit Solana, you receive the LST JitoSOL. You can hold the token to earn rewards or use it in decentralized finance (DeFi) protocols.

Here’s why some stakers prefer liquid staking:

- Flexible: Your staked SOL remains productive while your liquid staking token can be traded or used across DeFi platforms.

- Additional yield opportunities: Besides staking rewards, you can earn extra returns by lending or farming with your liquid staking tokens.

Note that liquid staking introduces additional risk through smart contracts and third-party protocols.

How to Earn Additional Yield with Liquid Staking

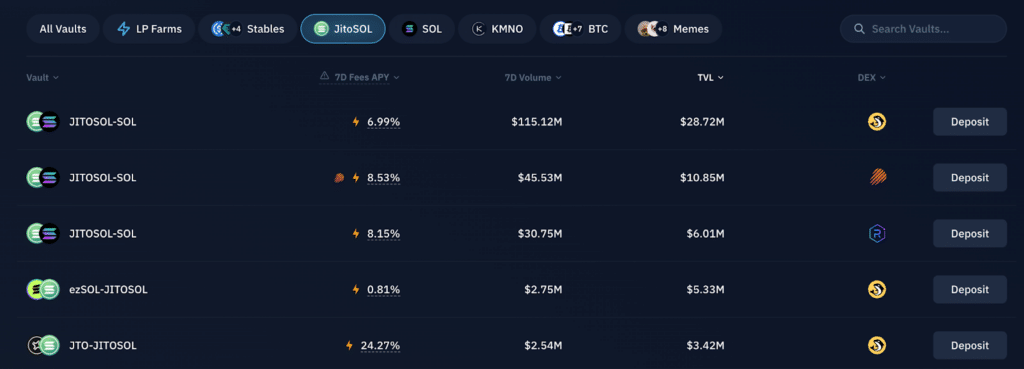

Let’s pretend that you’ve used Jito and received JitoSOL. You can head to Kamino Finance and deposit the tokens into their liquidity pools.

Restaking

Restaking means redeploying your staked assets to secure additional crypto projects and networks.

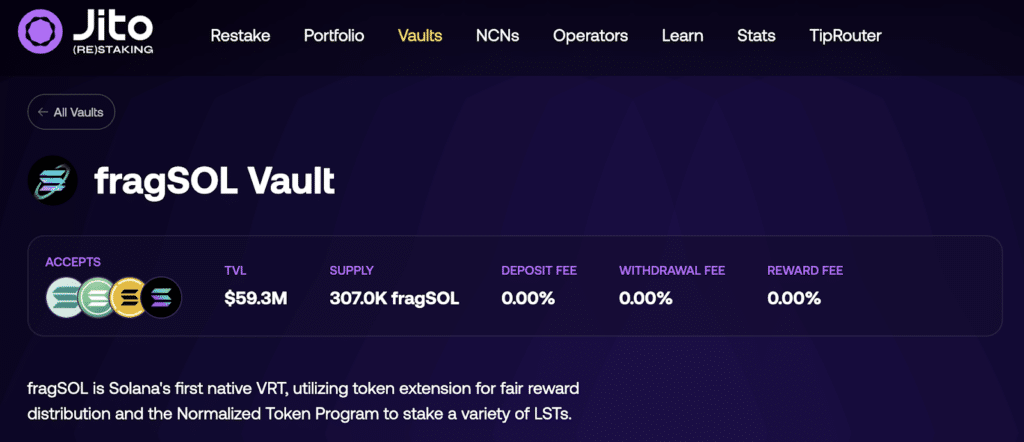

Jito Finance is also the leading Solana restaking protocol, where you can restake various liquid staking tokens for more rewards.

Solana Native Staking vs. Other Blockchains

Proof-of-Stake (Pos) and Delegated-Proof-of-Stake (DPoS) are the primary staking consensus mechanisms.

Other consensus mechanisms have been adopted, such as Nominated Proof-of-Stake (for Polkadot) and Ignite (for Cosmos); however, these are mainly variants of the two primary staking mechanisms. As such, they will be discussed as part of PoS or DPoS.

Delegated-Proof-of-Stake (DPoS)

Solana, Polkadot, and Cosmos operate under the DPoS consensus mechanism. Holders delegate their tokens to validators and receive staking rewards in the native network’s tokens.

This delegation process is critical because operating your standalone validator can cost hundreds of thousands. This high financial cost runs in addition to the technical complexity of creating a validator.

Most retail SOL token holders lack both the economic and technical resources to participate in staking.

Proof-of-Stake (PoS)

Ethereum is one of the few blockchains that support PoS and solo staking, also known as traditional staking.

Solo stakers set up their validator by assembling hardware and software and locking 32 ETH directly on Ethereum. While the technical barriers remain high, the financial costs are lower than those of other blockchains.

As of writing, 32 ETH costs over USD 100,000.

Pros of Staking on Solana

Staking on Solana has several advantages that make it appealing to investors. It’s a great long-term bet on the blockchain industry, reducing the risk that the SOL token will go to zero. Solana staking is also accessible to virtually anyone.

Here are a few reasons you should stake on Solana:

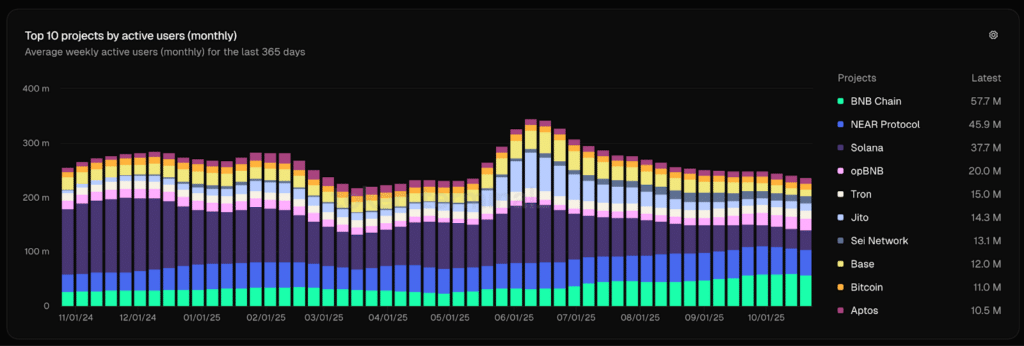

Wide-Adoption

According to Token Terminal, the Solana blockchain is the third-most-used network. It is known to process fast transactions at extremely low fees.

This efficiency also means that staking rewards can be distributed frequently and reliably without high transaction costs.

Low Entry Barrier

Solana’s DPoS system allows anyone to delegate their tokens with no minimum required. This makes staking accessible to smaller investors.

From a technical standpoint, anyone can stake with their Solana crypto wallet. There is no need to understand coding or hardware setup.

Short Unbonding Period

Solana is a strong contender for investors seeking decent staking rewards with flexibility.

Solana’s staking rewards are at 6.55% APY. This staking yield is lower than the double-digit returns of its competitors, such as Cosmos (17% APY) and Polkadot (12% APY). However, Solana makes up for it with one of the shortest unbonding periods at 2-4 days.

You have quicker access to funds when unstaking SOL than when unstaking Cosmos or Polkadot at 21 and 28 days, respectively.

How to Maximize Native Staking Rewards on Solana

To maximize staking rewards on Solana, investors can adopt several strategies. These don’t have to be complicated, like engaging in decentralized finance or liquid staking. You can make simple moves that will go a long way.

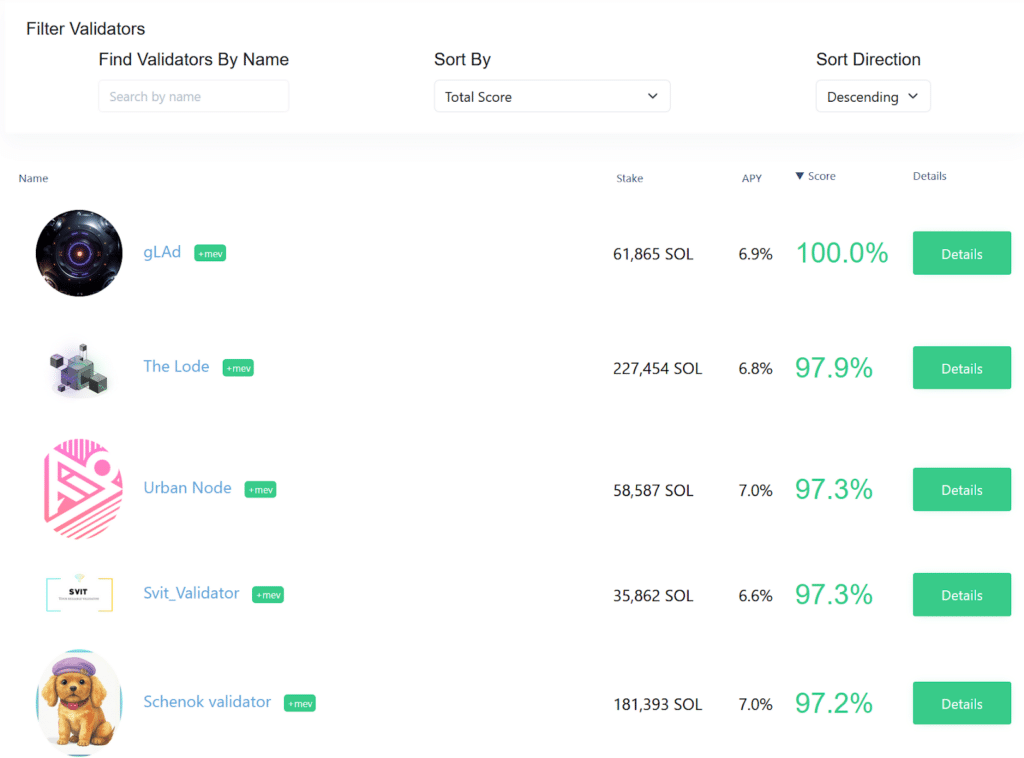

Delegate to Reliable Validators

Quick Google searches of the validator can reveal a lot of information. Free sites such as Solana Compass also provide a score.

Compound Rewards

Resist the temptation to withdraw the stake rewards. Reinvest these to benefit from compounding returns. If the

Many wallets and platforms support automatic compounding of rewards, which can significantly boost earnings over time.

Solana Network Statistics

Take note of these critical statistics that can impact your staked SOL.

Total Active Stake (Staking Market Cap)

Like market capitalization, the total value of all Solana tokens, the staking market cap indicates market confidence. Investors perceive large market capitalization positively, with the network showing price stability.

The ratio of staked SOL to total market capitalization also indicates the level of participation among token holders. The following section will discuss this further.

Staking Participation Rate

Solana’s staking participation rate is 66%, 2x higher than Ethereum’s.

The staking participation rate is the percentage of a network’s tokens staked on the network. The metric shows the level of engagement among investors and token holders, as well as the network’s overall health and security.

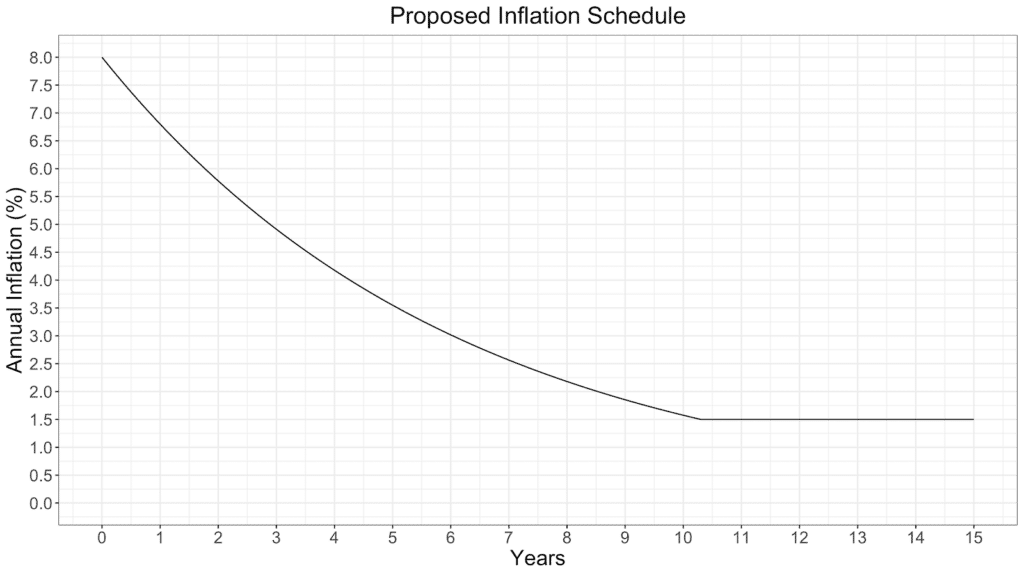

Inflation Schedule

The SOL staking yield incentivizes validators and token holders to engage in network security. Being a validator costs money. This staking yield is the primary driver of network inflation, as additional SOL tokens are printed over time.

The initial inflation rate is 8%, while the target long-term inflation rate is 1.5%. Knowing how this drives down staking yields is essential for a long-term investor.

FAQs about Staking Solana

Here are some of the frequently asked questions regarding Solana:

What is the native token on Solana?

SOL is the native token on Solana. You can use SOL for a variety of purposes, including trading, staking, and decentralized finance. The SOL token price has ranged from $95 to $297 in 2025.

Is Solana staking safe for beginners?

Solana staking is relatively beginner-friendly. Under the DPoS consensus, you can stake as little as 0.01 SOL (less than $3 at the time of writing). You can also access staking through a wide range of crypto wallets and centralized exchange services.

How long does it take to unstake SOL?

You can unbond (unstake) your SOL in as fast as 2 days. The quick unstaking period makes Solana a favorite among those who need liquidity quickly.

Can I Use or Transfer My SOL While It’s Natively Staked on Solana?

You will be unable to use your natively staked SOL. To maximize your Solana, you’ll have to engage in other staking methods like liquid staking or restaking.

What Happens to My Staked Tokens If the Validator I Choose Gets Penalised?

Unlike Ethereum, Solana does not have a straightforward approach to slashing. As of writing, no validators have been penalized.

Is Solana Staking Worth It?

The SOL price has rebounded in 2025. SOL hit as low as $95, but it’s back to $195. Depending on where you bought, you could have benefited from price appreciation with staking rewards adding to your gains.

Start Staking Solana Today

Solana is one of the top blockchains in 2025 and has amassed millions of users with its high-performing network. If you are looking to invest in blockchain for the long term, Solana is a network with staying power.

For long-term Solana investors, taking advantage of staking opportunities will boost their returns on their crypto assets. However, do remember that blockchain is a volatile industry and that specific projects can fail no matter how solid they are.

Editor’s Note: This article was originally published in October 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

October 30, 2025

October 30, 2025