Everything You Need to Know About Ledger Staking

Crypto investors lost over $9.9 billion in cryptocurrency scams in 2024, almost double the amount lost in 2023. Whether scammers pose as job recruiters or hackers spread malicious links, crypto participants are left searching for solutions to manage their crypto assets.

Staking with a Ledger device lets crypto holders engage in crypto staking services from their offline wallets. It’s a popular method for generating returns on crypto holdings while maintaining high-security standards.

This guide breaks down everything you need to know:

- Background on Ledger

- How does Ledger device staking work

- Which crypto you can stake

- Potential benefits and risks

Let’s start staking with Ledger!

What is Ledger?

Founded in 2014 and based in Paris, Ledger is a leading crypto security company specializing in hardware wallets and solutions safeguarding cryptocurrency assets. In 2023, the company raised $108 million in a Series C round, bringing its valuation to over $1 billion.

Ledger’s products, like the Nano S and Nano X, offer a physical method for storing cryptocurrencies, keeping them more safe from online threats and hacks.

Ledger’s devices are known as cold wallets because they store private keys offline, reducing the risk of unauthorized online access. Cold wallets differ from hot wallets like Phantom Wallet, which are installed on your browser and regularly connected to the internet.

For you to manage your crypto inside the hardware wallet, you need two things:

- Ledger Live: A computer application that enables you to access, manage, and monitor your crypto assets.

- Ledger Wallet: The physical wallet you connect to your computer. Actions through Ledger Live will require confirmation from your physical wallet.

While hardware wallets like Ledger have grown in popularity, they do not offer a 100% safety guarantee. You’ll still need to secure your seed phrase and avoid signing malicious transactions. Taking a digital picture or storing your seed phrase online can lead to losses.

How Can I Start Staking With Ledger?

Staking with Ledger involves using a physical wallet and software application. Ledger is a secure location to hold staked coins, while Ledger Live provides a streamlined interface to manage and monitor staking activities.

Here’s how to start:

Set Up Your Ledger

The first step is to get your own Ledger. Visit the official Ledger Shop and order a physical wallet priced between 65 and 332 euros.

Once the Ledger arrives, set it up on your computer using the USB port. Remember to write down your seed phrase and store it in a secure location. You will also have to download Ledger Live.

Download the Blockchain Application

To deposit cryptocurrency like Ethereum, Solana, or Cosmos, you must install a network application into your hardware wallet. Ethereum requires a separate installation from Solana and other blockchains.

If you purchase the starter hardware wallet, the device will have limited storage space, so only install the networks that you need.

Fund Your Wallet

Transfer eligible cryptocurrency to your wallet. Ensure you have enough balance for the required staking minimums and transaction fees.

For safety reasons, you must confirm that the address shown on the screen in Ledger Live is the same as that in your hardware wallet.

Once you have funded your account with crypto, it’s time to stake.

Navigate to the Staking Section

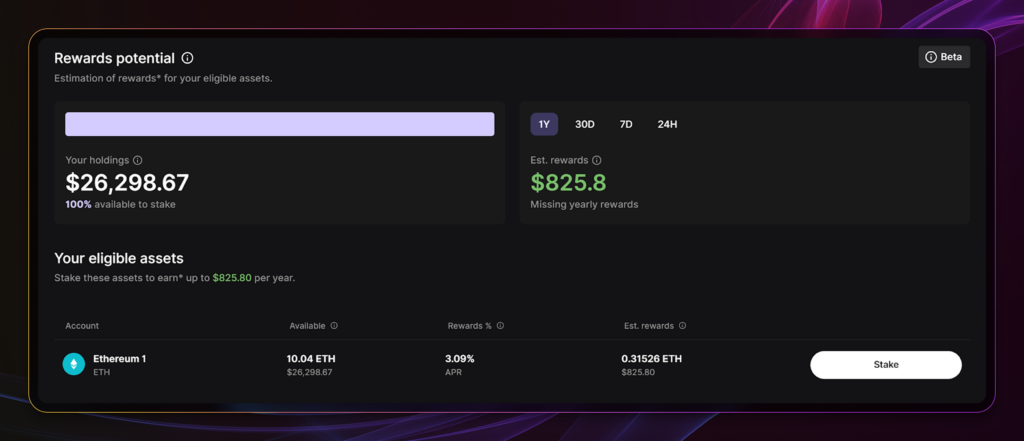

The Earn dashboard comes with a static staking calculator that estimates your potential yearly staking rewards. This calculation is helpful for quick comparisons, especially for those with multiple idle cryptocurrencies available.

Let’s say you’re eligible to stake ETH, the native token of Ethereum.

Click Stake beside your eligible asset to reveal the staking options.

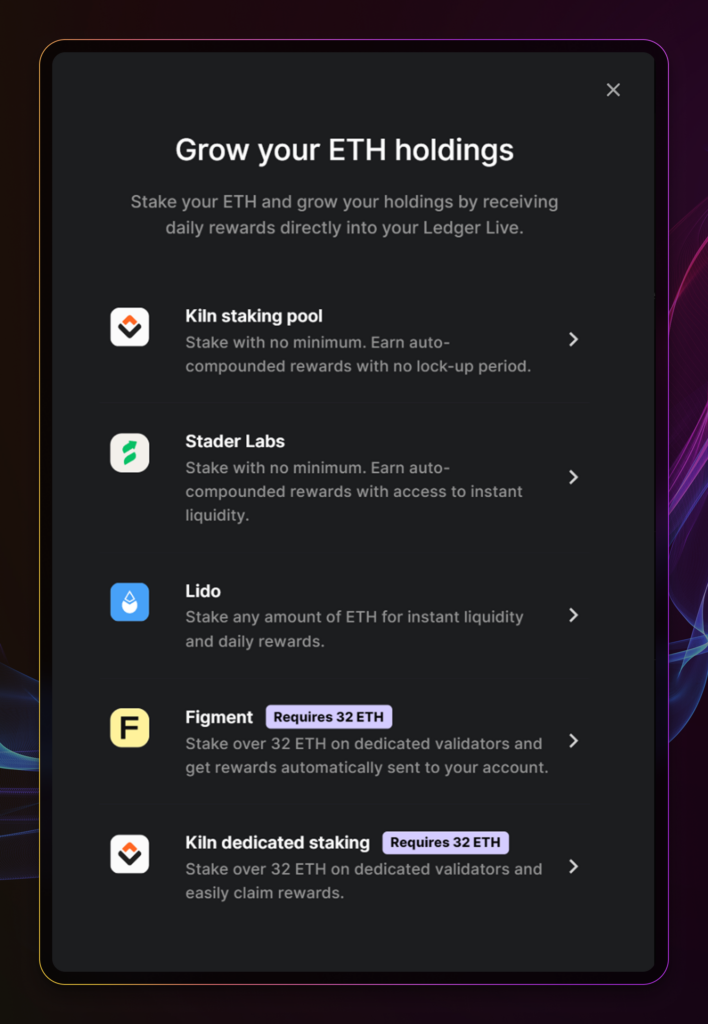

You can choose from staking pools (with no minimum required), liquid staking platforms like Lido, and Staking-as-a-Service providers such as Figment (32 ETH required). Read our Ethereum staking guides to compare each option’s pros and cons.

Once you’ve chosen the staking method, it’s time to start staking.

Start Staking

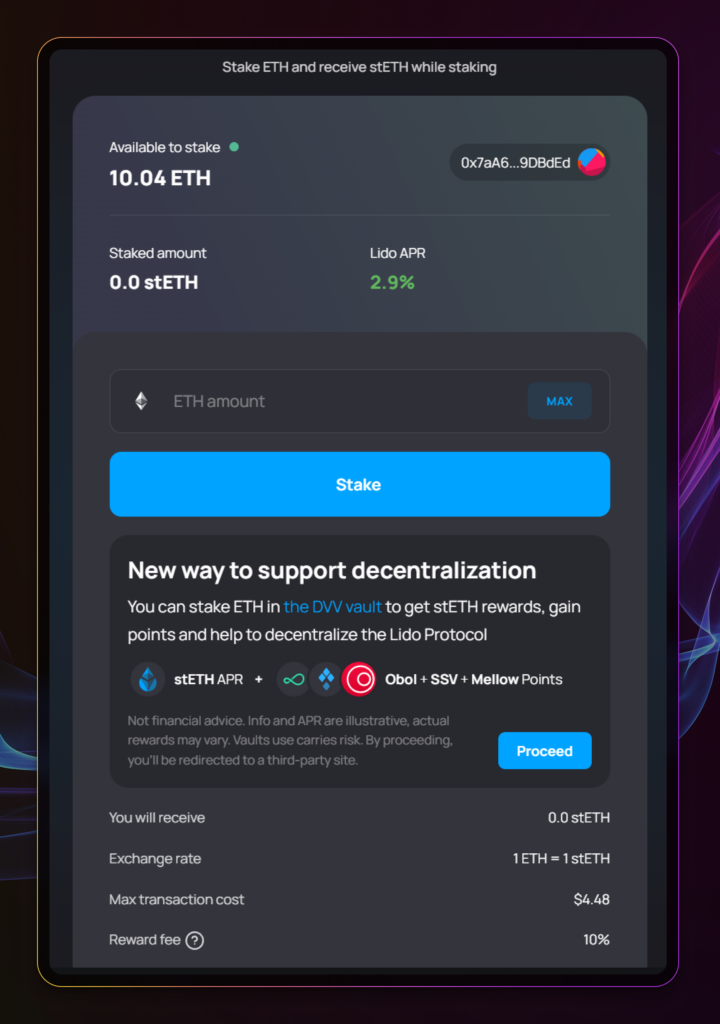

Let’s say you decided on Lido Finance. The staking interface on the Lido website is very similar.

Enter the ETH you’d like to stake, review the details, and confirm the transaction with your hardware wallet.

After completing these steps, you will have staked your crypto and begin earning staking rewards. The Ledger Live app monitors your staking balance and accrued rewards.

What Crypto Can I Stake in the Ledger Device?

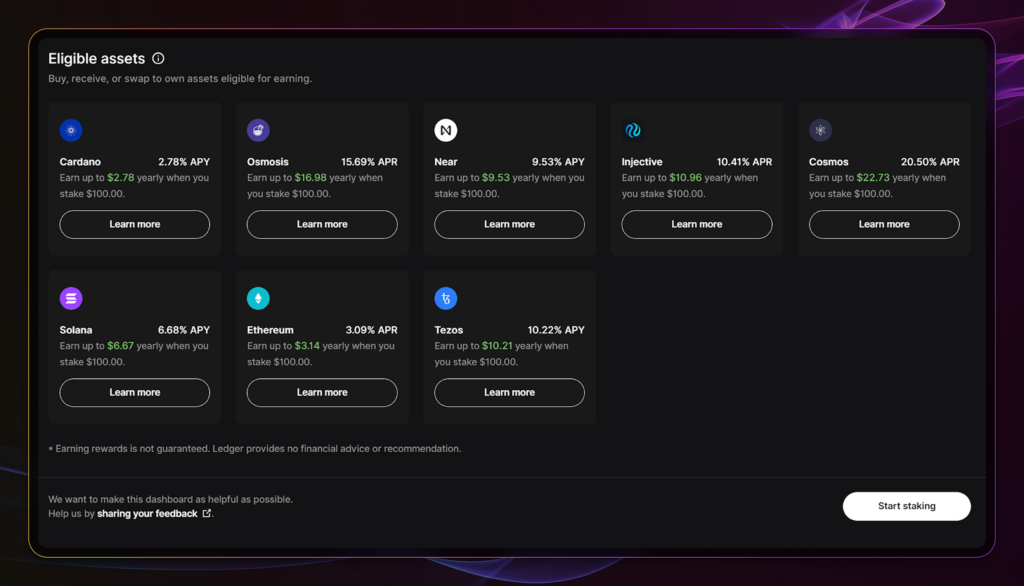

Ledger supports a handful of crypto from Proof-of-Stake and Delegated-Proof-of-Stake networks. To check the list, click Earn on Ledger Live.

There are a few more cryptos hidden from the list above. At the bottom of the Earn page, click Start Staking for the complete list. Other tokens include Osmosis and Persistence from the Cosmos ecosystem and Polkadot (DOT).

Where Else Can I Stake With Ledger?

You can also use Ledger to stake with apps outside of the Ledger Live application. To do so, you first need to install the corresponding blockchain application on your Ledger device.

Let’s take staking with Polli.co as an example.

Polli is a staking optimization platform that caters to Cosmos and Lava Network. The platform offers above-market staking returns through its auto-compound of staking rewards and redelegation to validators.

Install Cosmos on Your Ledger Device

Similar to setting up your Ledger, you’ll have to download the respective blockchain application. In this case, set up Cosmos.

Install the network in your hardware wallet and follow the steps to either import a wallet or create a new account.

Install Keplr on Your Browser

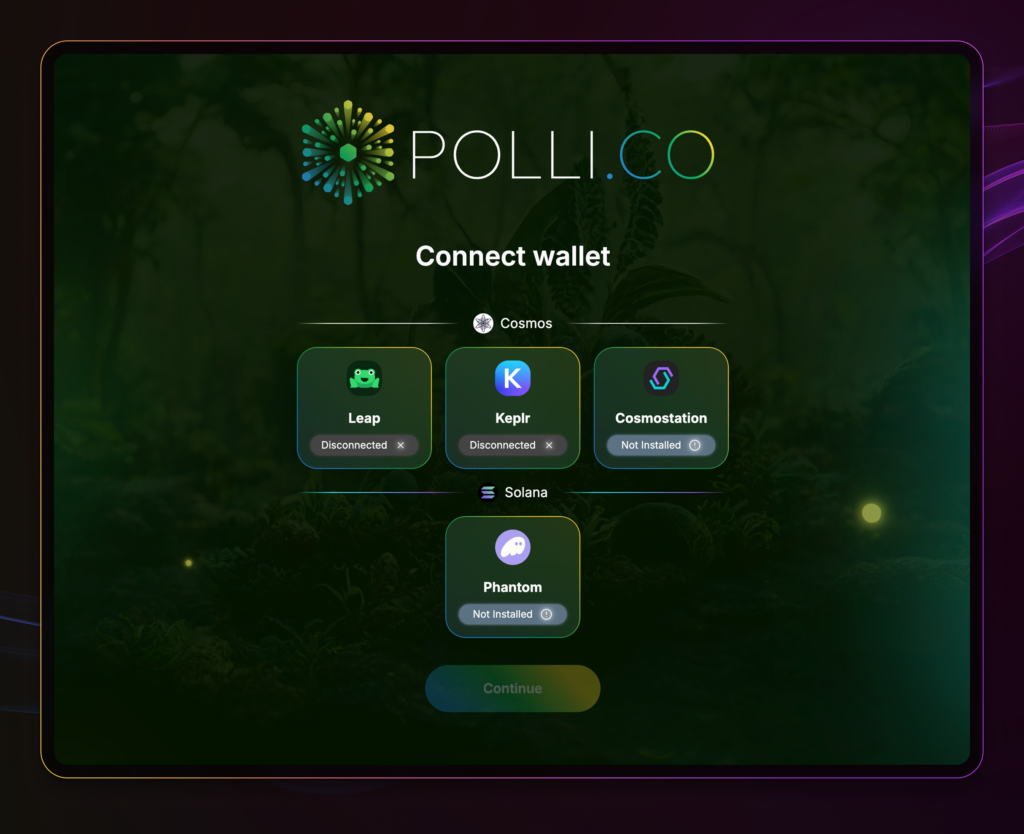

Polli supports three wallets: Leap, Keplr, and Cosmostation. Among these three, Keplr supports integration with Ledger.

Ledger recommends using Google Chrome for this process. Once you’ve installed Chrome, download the Keplr browser extension through this link.

Connect Your Ledger to Keplr

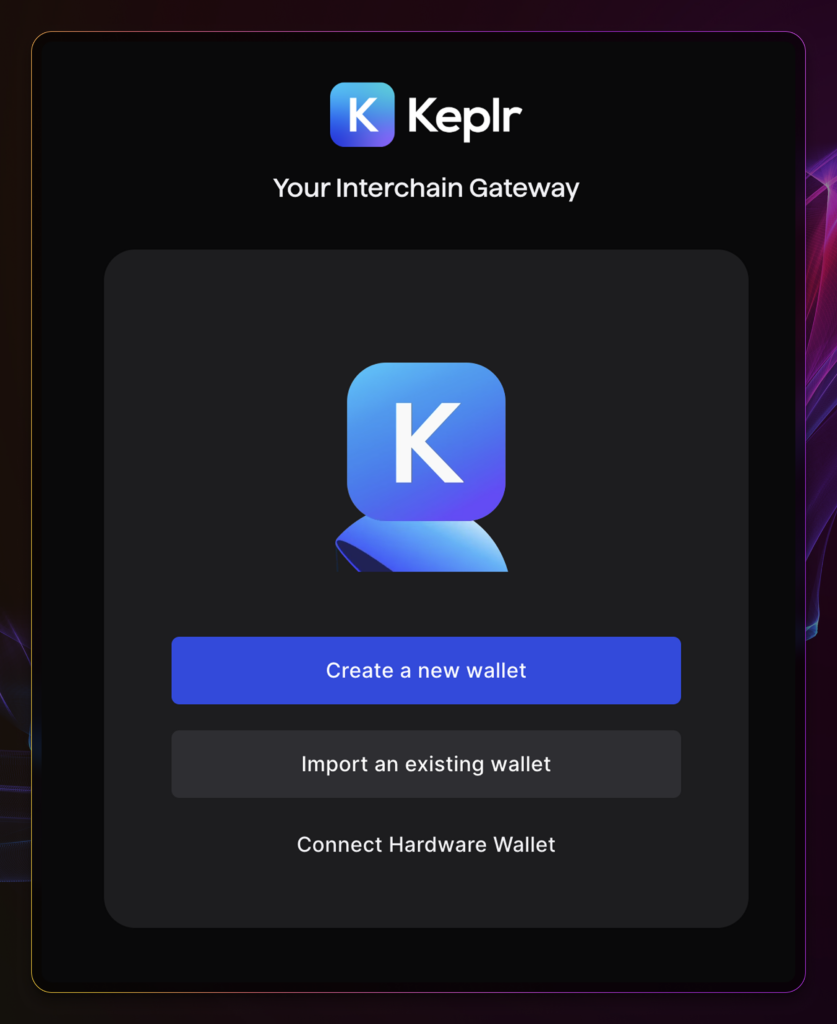

Once you’ve installed Keplr on your browser, connect your Ledger device to your computer. Then, open the Keplr browser extension.

Keplr should display an option to connect your hardware wallet. Note that if you use other browsers like Firefox, you won’t see the “Connect Hardware Wallet” option.

Follow the steps and your Keplr wallet should display the Cosmos assets as found in your Ledger Live.

Now you’re ready to stake with Polli and other decentralized applications.

Benefits of Hardware Device Staking Over Other Methods

Beyond the fancy dashboard and branded hardware wallet, Ledger provides a few key security benefits.

Enhanced Security

Ledger staking keeps funds in a highly secure offline environment. When staking your hot wallet, your assets are stored online in “hot” wallets, which are more vulnerable to cyberattacks.

Let’s say someone has installed malware and remote hacking software on your computer. As your browser wallet is accessible through a password, hackers could store this through a keylogger and access it. Online wallets do not require any more security confirmation after logging in with the password.

In contrast, Ledger requires access and confirmation from the wallet. This extra layer of protection reduces the risks associated with online staking and gives users peace of mind that their funds are safe.

User Control

As the famous quote goes, “Not your keys. Not your crypto.”

Staking directly from a Ledger wallet means you retain complete control over your private keys and your crypto assets funds.

When staking on centralized exchanges, users must relinquish control over their keys, as exchanges typically hold these on behalf of users. By keeping control of your keys, Ledger staking enables asset ownership and minimizes dependency on third parties.

Risks Associated with Ledger Staking

While Ledger offers a more secure method of interacting with the blockchain, it is not immune to all security risks. Ensure that your seed phrase is safely stored offline and that you guard against malicious links.

Ledger staking also sacrifices the speed and flexibility offered by hot wallets.

Lack of Options

You’re limited to staking with the cryptocurrencies and providers in the Ledger Live application. If your desired network is not included in Ledger’s list, you must wait for the company to add support.

You may also need more memory space in your wallet, preventing you from downloading the necessary applications for staking.

Security Risks

In December 2023, hackers stole around $500 thousand of crypto from users’ Ledger wallets.

A hacker targeted a former Ledger employee with a phishing attack and was able to insert malicious code into the company’s Connect Kit software, which interacts with decentralized applications (Dapps).

While the attack did not compromise the hardware wallets, it shows how a cybersecurity company can still be a cyberattack victim.

FAQs About Ledger Staking

Interested to know more about Staking with Ledger? Here are some commonly asked questions:

What is Ledger Staking and How Does it Work?

Ledger staking means engaging in staking through your Ledger Live application and hardware wallet. Staking this way is more secure than staking with your browser wallet.

Whenever you stake with Ledger Live, you must connect your hardware wallet to your computer and confirm the transaction. This process adds more security layers as you need to have the Ledger hardware wallet and password on hand.

How to Stake with a Ledger?

Once you’ve installed the necessary blockchain applications on your Ledger, staking comes easy. Open your Ledger Live application, select the Staking tab on the left. Choose your staking provider and you’re all set.

What Assets Can You Stake on a Ledger?

Ledger supports over a dozen crypto assets for staking. You can choose from major crypto such as Ethereum and Solana, to smaller ones such as Injective (INJ) and Persistence (XRPT).

How Long Does it Take to Activate Staking on Ledger?

Setting up your Ledger device takes thirty minutes to an hour. Once you’ve completed that, staking with Ledger happens in minutes.

Get Staking With Ledger

Ledger staking offers a highly secure way to earn rewards by staking crypto directly from your Ledger wallet. By staking with Ledger, investors benefit from the advanced security of an offline hardware wallet while retaining complete control over their assets.

Despite a few limitations, like the available crypto assets or potential memory space, Ledger provides a streamlined staking experience that is precious for users who prioritize security and autonomy.

Ledger delivers peace of mind for those with significant crypto holdings, making it a top choice in hardware wallet options. Whether you’re a new or experienced investor, Ledger offers a way to expand your staking activities safely within a secure environment.

Editor’s Note: This article was originally published in October 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

May 30, 2025

December 12, 2025