Demystifying Lava Staking: A Beginner’s Guide

Millions of people navigate bustling city roads every day. While some take familiar routes, others rely on apps to find the quickest route to their destination.

In the blockchain world, decentralized applications (DApps), NFT marketplaces, and crypto wallets operate similarly, requiring communication pathways with blockchains such as Ethereum and Solana. RPC (Remote Procedure Call) nodes function as these pathways, ensuring seamless communication between apps and blockchains.

Lava Network is a novel decentralized infrastructure that powers and incentivizes these RPC nodes, ensuring that the blockchain world stays connected.

In this guide, we’ll explore:

- What the Lava Network is

- The different players in Lava

- How Lava Network functions

- How staking and restaking play a role in Lava

- How to perform Lava staking and restaking

…and much more.

What is the Lava Network?

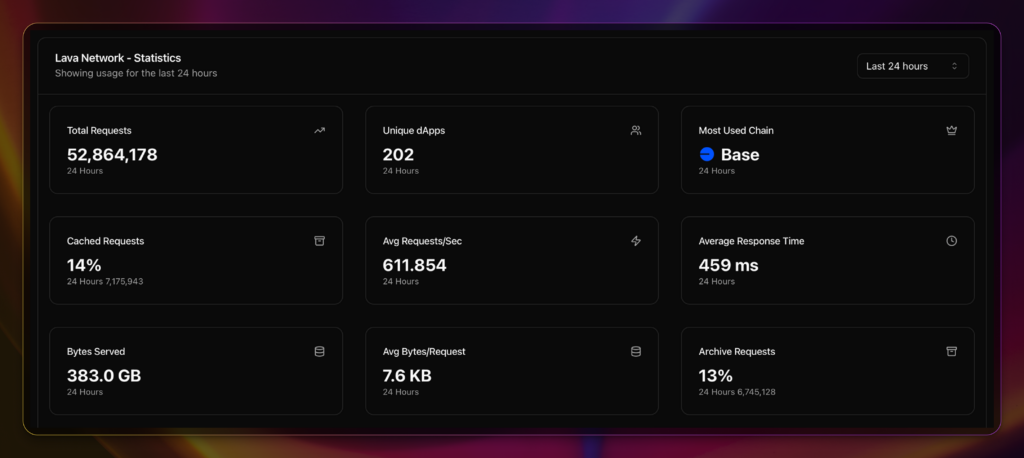

Lava is a Cosmos-based protocol that manages traffic for multiple blockchains. It supports over 40 chains and facilitates interactions for millions of daily users and thousands of applications. When you use a crypto wallet or interact with a DApp, you might unknowingly use Lava’s partner RPC providers to connect to the blockchain.

Lava optimizes blockchain communication by aggregating and routing requests through high-performing RPC nodes. Lava network creates more reliable and scalable access for blockchain developers and users.

What is an RPC Node?

RPC, or Remote Procedure Call, enables programs to communicate with each other across different computers.

If you check your balance on Keplr Wallet, the wallet sends an RPC request to a blockchain node to retrieve your balance. Lava network ensures that this communication is smooth and uninterrupted.

Key Players in the Lava Ecosystem

Understanding the Lava Network requires familiarity with its main participants:

- Lava Validators: These entities validate transactions and secure the Lava Network through a Delegated Proof-of-Stake (DPoS) consensus mechanism.

- Lava Token Holders: Users who delegate their Lava tokens to validators contribute to the network’s security and earn rewards.

- Networks: Blockchains and rollups that utilize Lava to manage their RPC traffic.

- RPC or Data Providers: Providers handle blockchain data requests from users and apps, ensuring reliable communication.

- Developers and Apps: The primary users of the Lava Provider infrastructure.

How Does Lava Work?

Users and developers face disruptions when relying on unreliable RPC providers. Problems such as failed transactions during operations may occur. For instance, your transaction could fail when swapping from one crypto to another.

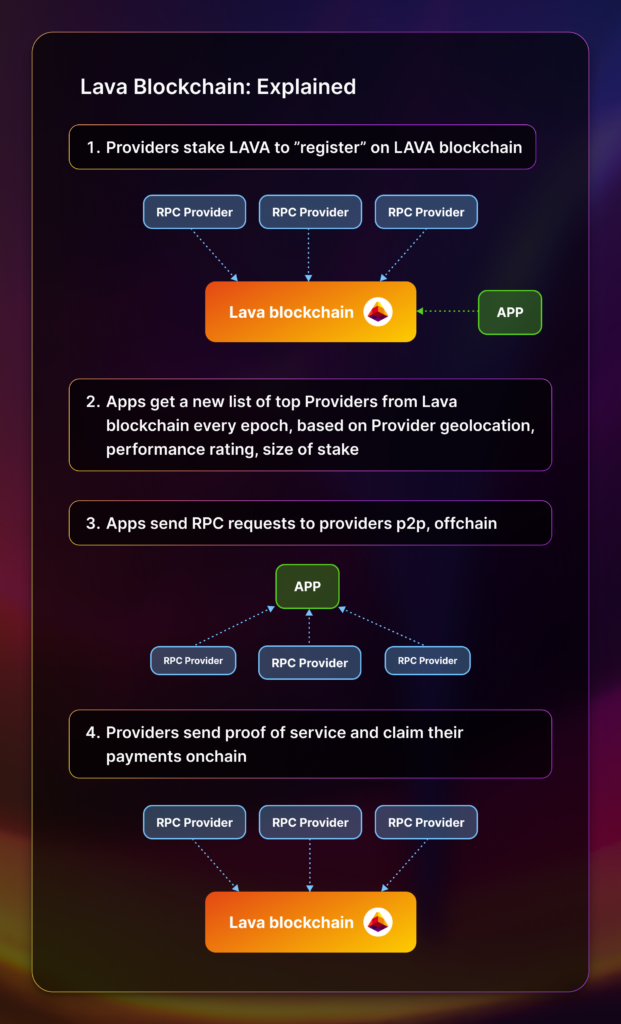

Lava Network addresses this challenge with a robust data provider incentive and routing system.

Establishing Incentives

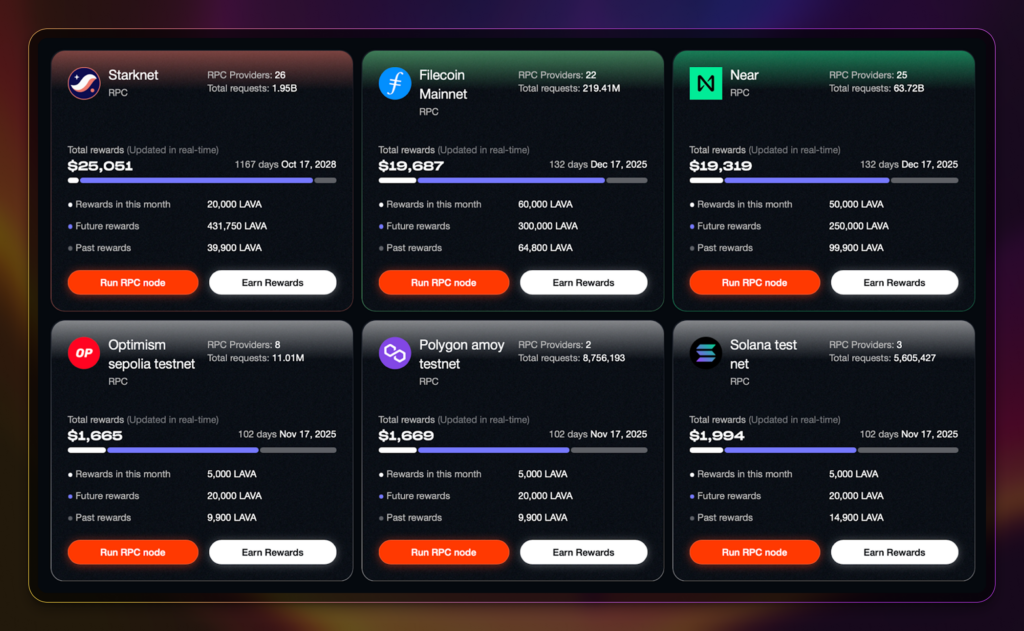

Blockchains create incentive pools on Lava, which are funded with native tokens or alternative assets, such as stablecoins and memecoins. For instance, a blockchain like Cosmos Hub may set up an ATOM token pool to reward providers for their services.

Data providers join Lava to handle blockchain data requests, earning monthly rewards from these pools. Their payouts depend on two factors:

- Service Quality: Providers with higher performance metrics receive larger rewards.

- LAVA Staked: The more Lava tokens a provider stakes, the greater their chance of being selected to service a network, thus earning more rewards.

Optimized Request Routing

Lava aggregates these providers and intelligently directs RPC, optimizing routing based on provider performance and user geolocation. The Lava network assures users of 24/7 access to blockchains with minimal downtime.

Benefits for Users and Developers:

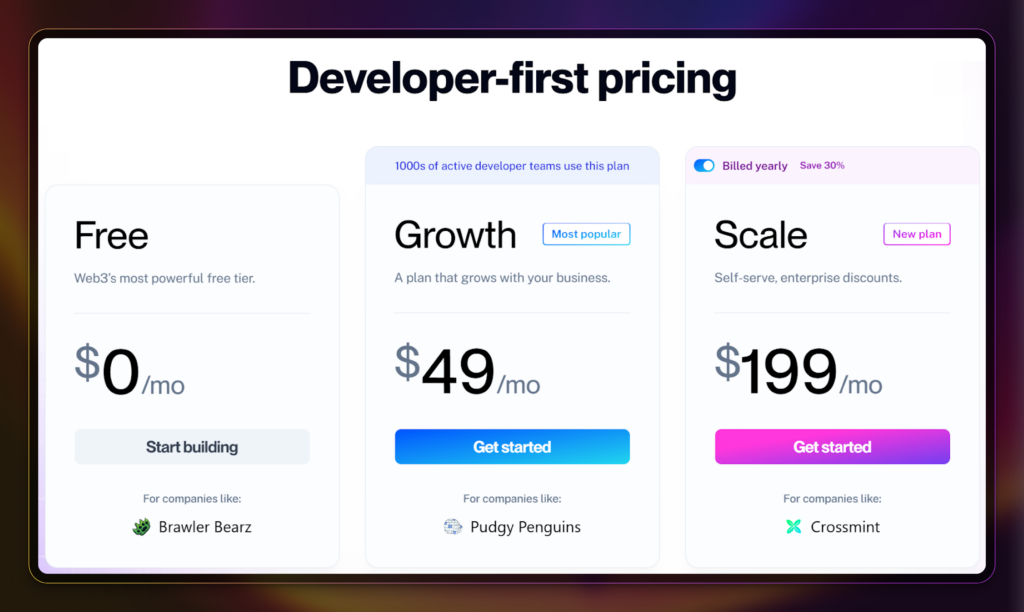

Traditionally, users and developers have had to pay RPC Providers to use their services.

Alchemy, one of the leading blockchain RPC nodes, charges up to $199 monthly. While there are free public RPC nodes, these are primarily used for testing purposes and have unreliable connections.

With Lava staking, users and developers gain free access to RPC services, while blockchains benefit from improved ecosystems and reliable, cost-effective infrastructure.

Lava Network Restaking

Lava supports restaking or redelegation, similar to EigenLayer, an Ethereum restaking protocol.

With restaking, you can redelegate your staked LAVA tokens to an RPC provider. Providers that accumulate the most Lava tokens secure partnerships with blockchains and earn their respective network rewards.

How to Stake and Restake Lava

Lava’s Delegated Proof-of-Stake model enables users to delegate Lava tokens to a validator, thereby supporting the network’s operations and security.

Stakers can choose from supported wallets such as Leap and staking partners like Polli..

You can delegate LAVA tokens either as a staker or Data Provider.

For this guide we will be staking LAVA using Polli. Here’s a step-by-step guide:

Step 1: Select Lava Network

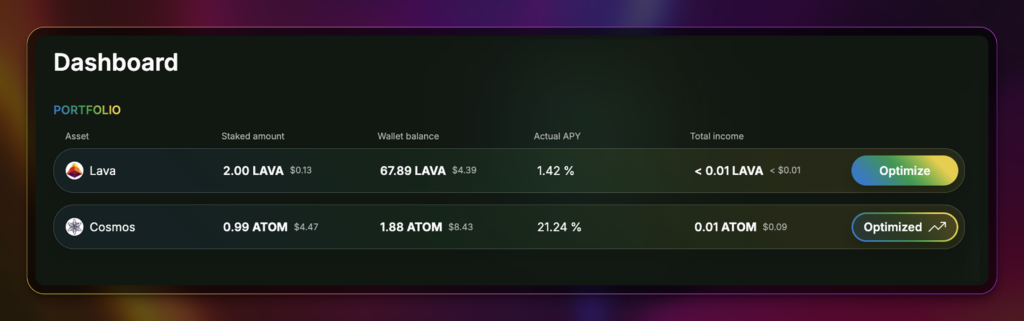

Head to Polli.co and connect with a supported wallet such as Keplr or Leap. Once at the portfolio Dashboard, search for Lava and click the token icon.

Make sure you’ve already loaded your wallet with LAVA tokens as only eligible tokens will appear on the Dashboard.

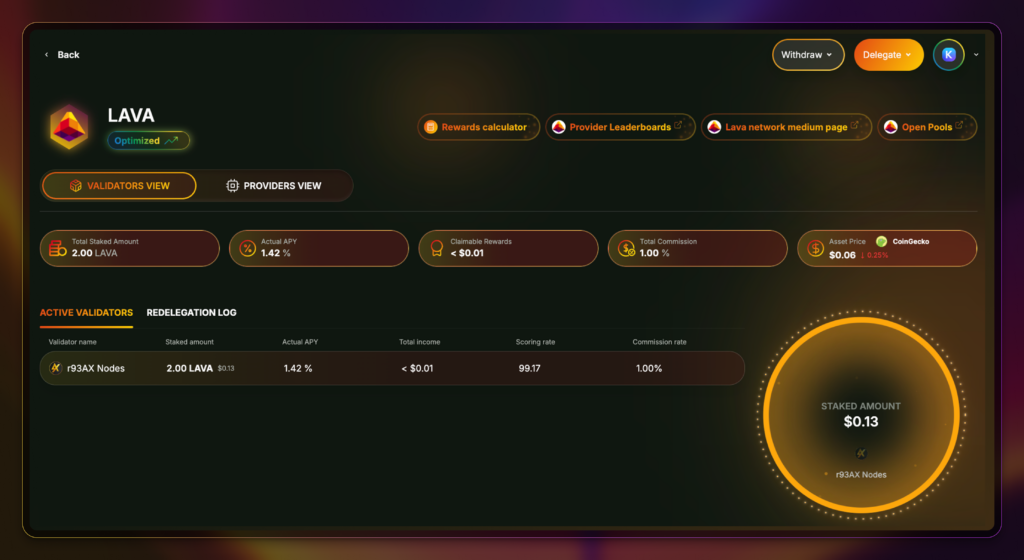

Once you’ve clicked the icon, you will land at Lava’s delegation page. You will find the delegate button on the upper right hand side.

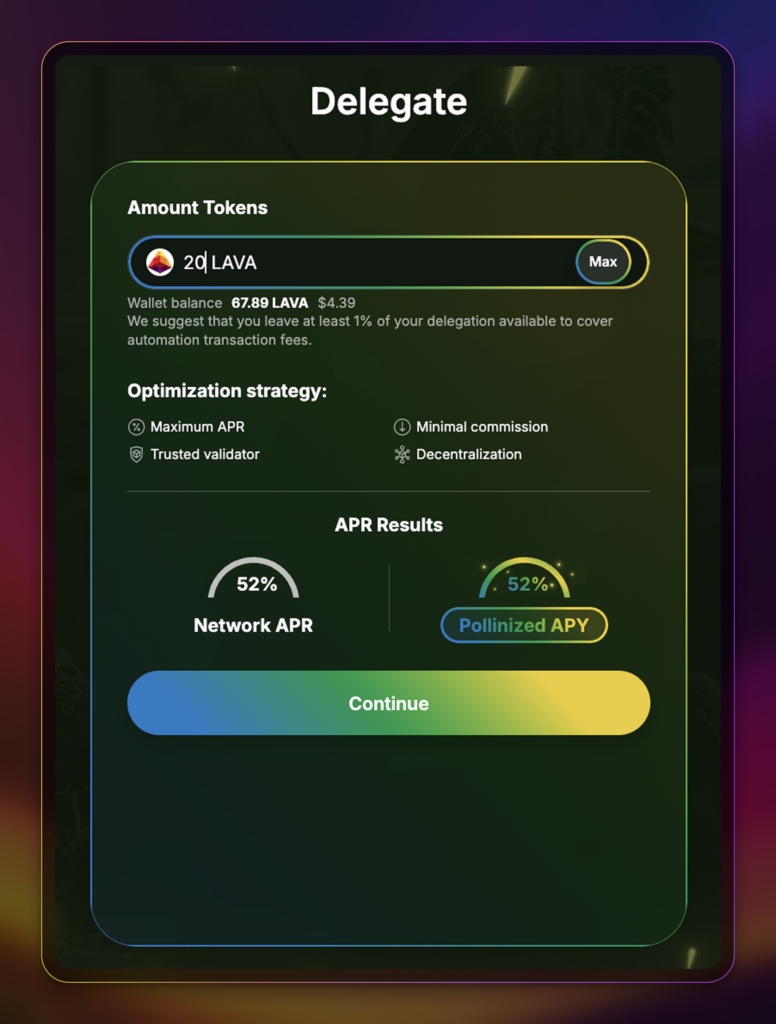

Step 2: Enter the Lava Token Amount

Enter the amount of Lava you’ll be staking. Polli will automatically select and optimize validators with the help of their AI Agents.

Polli’s AI agents will select validators based on four main components: maximum APR, minimal commission, validator trust, and network decentralization. This combination ensures high staking returns while keeping your assets and the network secure.

Step 3: Choose a the Validators and Providers

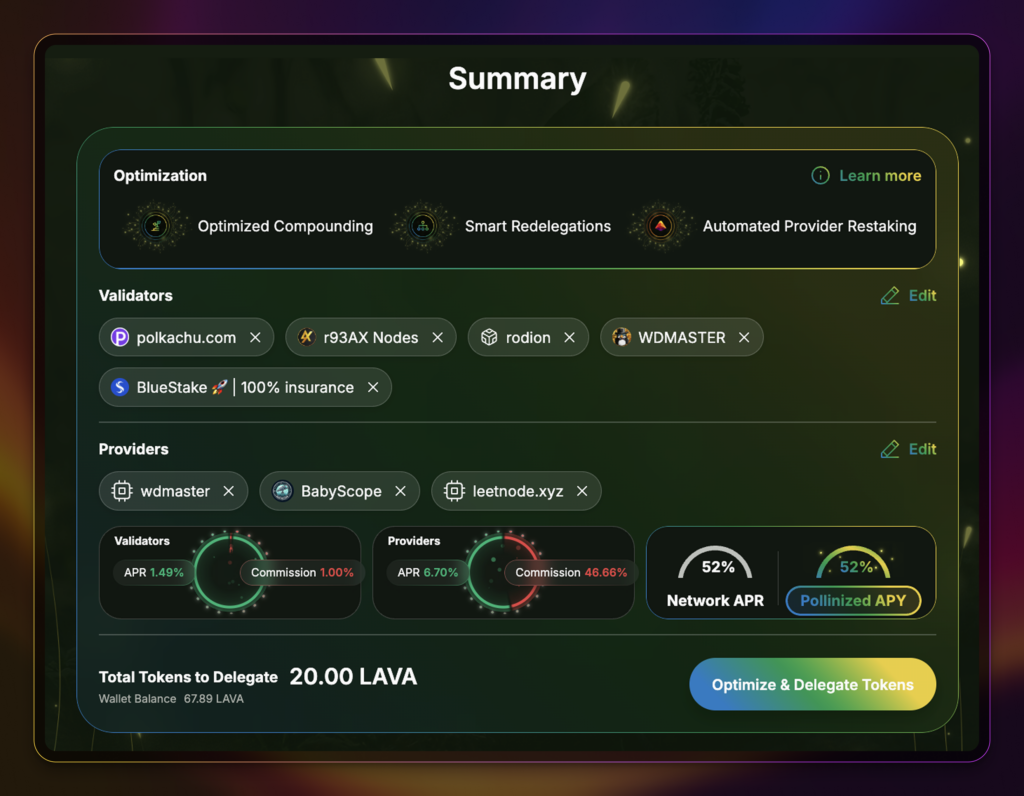

Polli has streamlined the staking and restaking process. On the next screen, Polli allows you to restake immediately.

You’ll find a page that summarizes both validators and providers which Polli has selected.

The Polli platform evenly distributes the tokens to the validators and providers. You can also manually adjust the number of validators and providers according to your preferences. You can do so by clicking the respective “Edit” buttons.

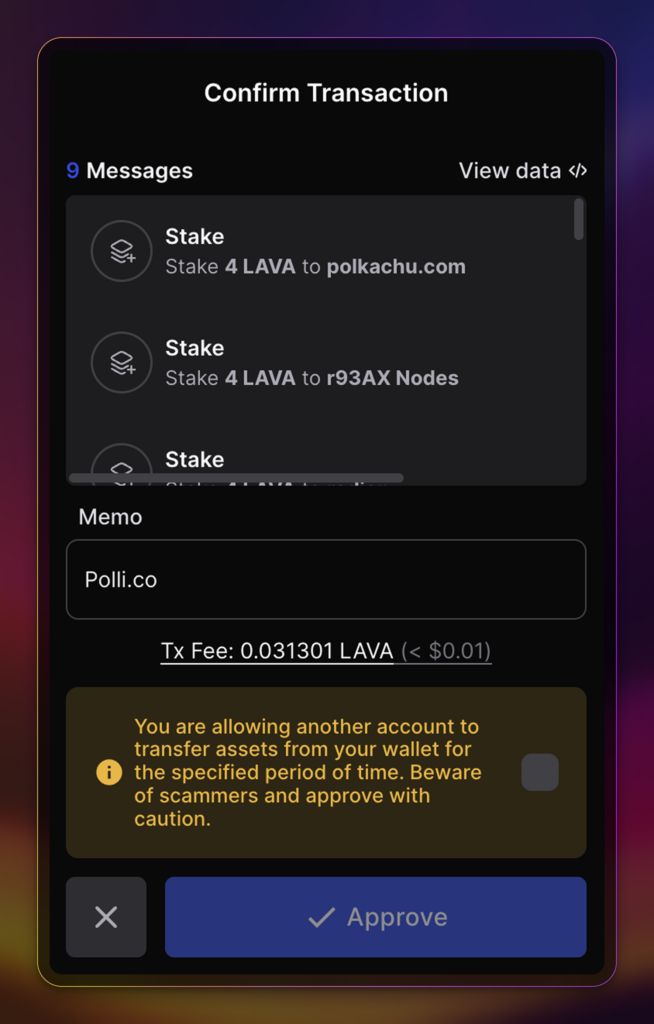

Step 4: Confirm the Transaction

As a last step, you will have to confirm the transactions. You can view the transaction message which will continue the staking to validators as well as restaking to providers.

Lava Staking Offerings

Lava has differentiated itself by not being just another blockchain. There are thousands of blockchains, hundreds launched periodically; Lava powers the infrastructure, keeping the blockchain industry moving smoothly.

Here are other risks to Lava staking and holding Lava tokens.

Diversified Rewards

You can restake your Lava tokens to earn from a basket of tokens like Near, Axelar, Evmos, and Solana, with more chains coming. Earning a diversified set of tokens allows you to mitigate some downside risks of holding one asset while capturing possible upside returns from a diversified portfolio.

On Polli.co, you can view these diversified rewards when you click the “Edit” providers button.

However, with the current Lava model, you can only get the basket of tokens that the specific provider has. You cannot choose tokens from the pool; you select a provider to restake to and earn a percentage of all the tokens in the provider’s basket. This limitation means that you may be earning rewards for networks that are new and untested.

Hard Slashing

Staking safeguards blockchains by reducing the amount of crypto staked. This penalization happens when a validator goes offline or acts maliciously. In Ethereum staking, where validators must stake 32 ETH (approximately $140,000 as of the time of writing), slashing reduces the amount by up to 1 ETH.

Lava’s model imposes harsher penalties. If a validator misbehaves, you could potentially forfeit your entire staked amount. This heavy penalty is why staking optimization platforms like Polli are so important. They filter and analyze the validators for you.

Liquidity Lock Up

Unlike liquid staking protocols, which grant you immediate liquidity through issuing a liquid staking token, staked LAVA tokens stay locked for 21 days. This unbonding period reduces your flexibility to trade during market fluctuations.

Final Thoughts on Lava Staking

Lava Network is not just another blockchain; it powers the infrastructure behind blockchain connectivity. This novelty differentiates it from the networks launching in today’s market.

By staking or restaking LAVA tokens, you earn rewards and support a reliable, scalable, and efficient blockchain ecosystem. Whether you’re a beginner or a seasoned crypto enthusiast, understanding and participating in Lava staking provides a way to engage in the blockchain industry in a new manner.

Editor’s Note: This article was originally published in January 2025 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

September 2, 2025

December 12, 2025