How to Maximize Staking Rewards with a Staking Calculator

With over $116 Billion in total value locked (TVL), crypto staking has emerged as a lucrative passive income opportunity.

You must arm yourself with tools and knowledge to maximize your returns and navigate the complexities of staking crypto. A staking calculator is an indispensable tool that gives you financial insights to make informed decisions.

With a staking calculator, you can estimate your returns and gauge how much crypto assets to invest.

In this article, we discuss all about crypto staking calculators:

- Why crypto staking calculators are essential

- How investors can maximize staking rewards

- Free crypto staking calculators

….and more.

Let’s get started!

What is a Crypto Staking Calculator?

A crypto staking calculator shows the potential returns you can earn by using various crypto assets.

It takes various factors into account, such as:

- Crypto asset’s price change

- Staking pool commission rates

- Initial setup investment and monthly costs (especially for solo stakers)

- MEV Boost rewards

…among many other factors.

The staking calculator then computes the growth in your assets and calculates your breakeven point.

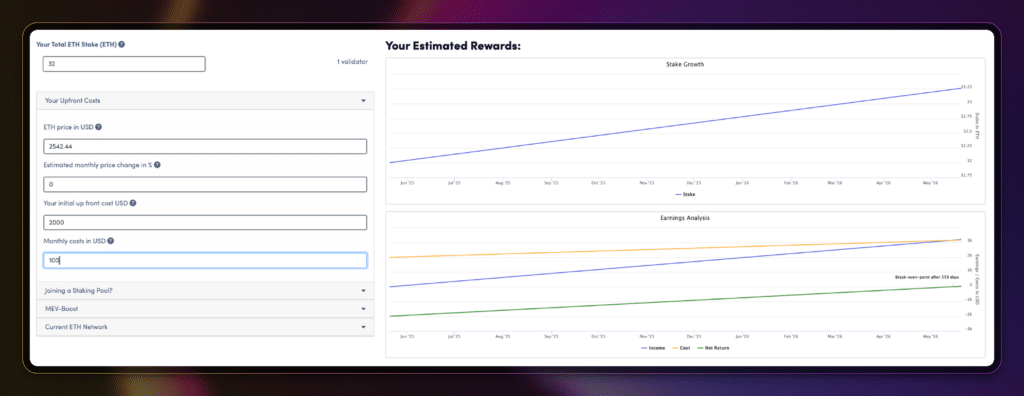

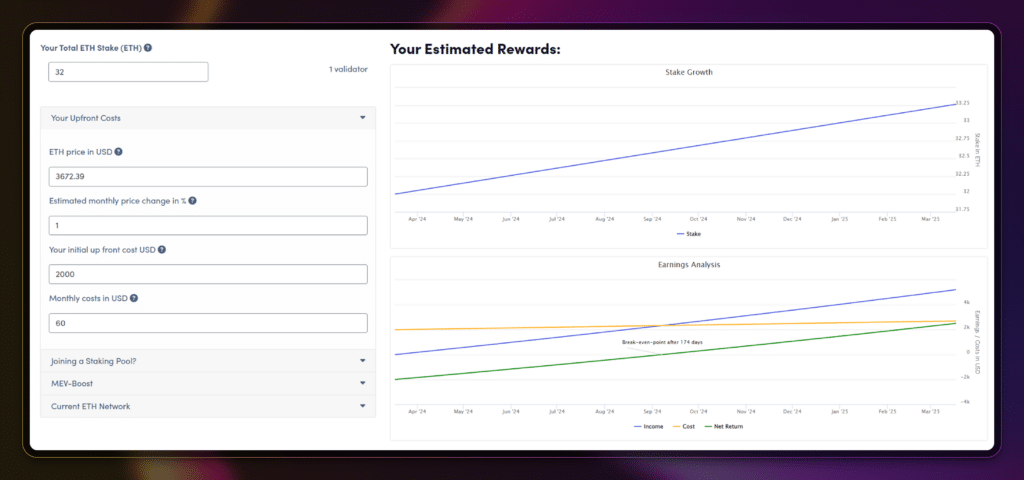

Here’s a crypto staking calculator from Blocknative, an Ethereum staking solutions company.

Users can experiment with various fixed and variable staking costs. The rewards calculator will then automatically display the corresponding break-even points for their investment.

Here’s an estimate if you assume the following:

- Ethereum Market Price: $2,542

- Monthly Price Appreciation: None

- Initial Upfront Cost: $2,000

- Monthly Operating Costs: $200

Given the above, you would break even on your staking investment in one year. If the Ethereum market price appreciates by 5% monthly, then you would break even in 217 days. The calculator allows you to play around with the variables.

This automated illustration enables investors to make easier and quicker decisions regarding staking.

With all the variables involved in staking, investors can misunderstand their investments’ returns. A staking calculator brings transparency to the process, enabling individuals to make informed decisions.

Understanding APY (Annual Percentage Yield)

Calculators provide clear and transparent APY estimates for various staking programs. The estimates allow you to compare and choose the most lucrative options.

APY, or Annual Percentage Yield, is the total interest you would earn from an interest-bearing investment in a year. In the case of crypto staking, the staking rewards rate substitutes the interest rate.

APY takes into account rewards compounding. This compounding process means you earn rewards on top of your original staked assets.

Comparing Different Programs

Are you exploring solo staking on a Proof-of-Stake network? What about liquid staking through a staking pool?

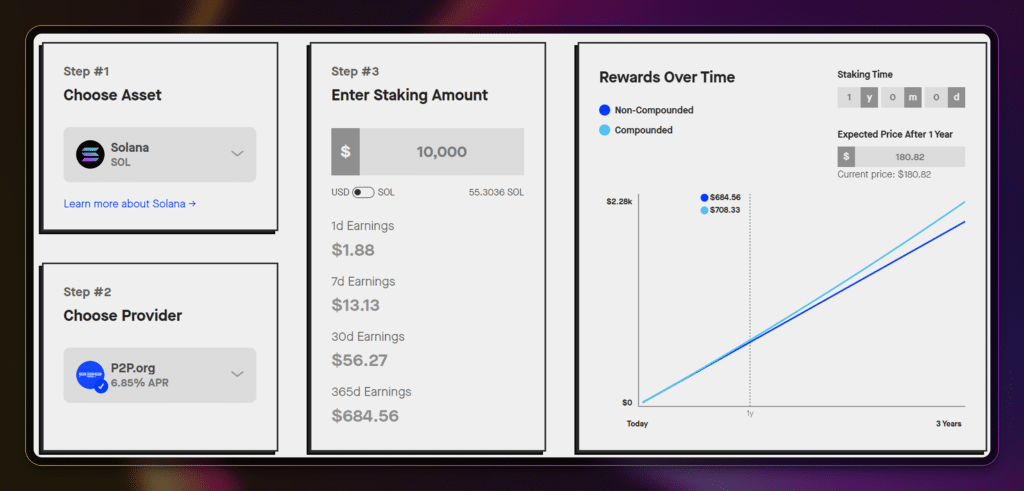

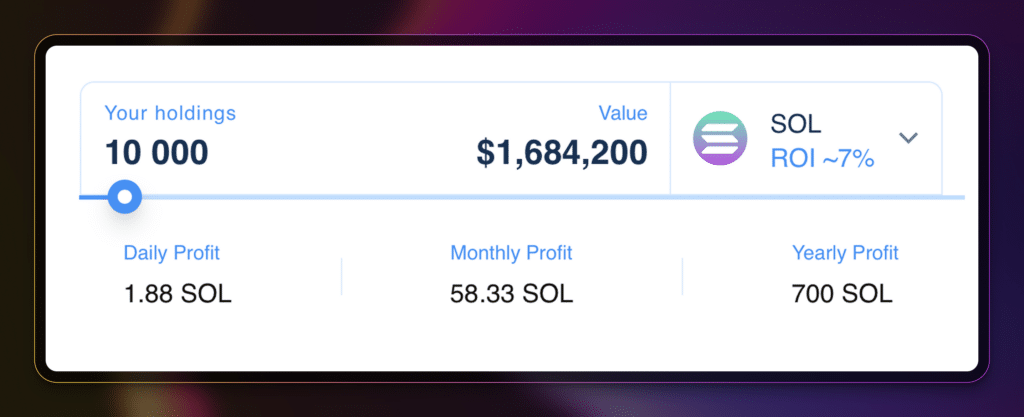

With a crypto staking calculator, you can compare different staking programs side-by-side. A rewards calculator can also go as far as showing you the returns of different Staking-as-a-Service platforms.

This free calculator from Staking Rewards lets users choose staking from over 50 cryptocurrencies regardless of the consensus mechanism. Prefer Delegated-Proof-of-Stake over Proof-of-Stake? How about Solana or Cosmos? This calculator has got you covered and displays the staking providers of each network.

Saving Time

The most significant benefit of a rewards calculator is that it saves you enormous time. A calculator is a valuable ally if you search for networks with the highest staking rewards.

Rewards calculators have already captured the most available networks and their respective staking providers in the blockchain space.

Then there’s calculating the rewards. Without readily available rewards calculators, most investors would spend days creating various Google Sheet-based calculators to account for all the networks and staking methods.

Calculators simplify the process of calculating staking returns, making it accessible to beginners and experienced investors.

Different Types of Staking Calculators

Not all types of staking activities are created equally. Depending on what type of staking activity you’re planning to engage in, the returns and investment required will be different.

Fortunately, various calculators exist for most staking types.

Simple Staking

Simple staking calculators present a straightforward calculation of how much staking rewards you stand to gain given over a period of time.

As the calculator does not take into account any compounding or other costs, this is best for stakers who want a simple view of their staking rewards.

Most staking platforms will include a simple calculator on their application.

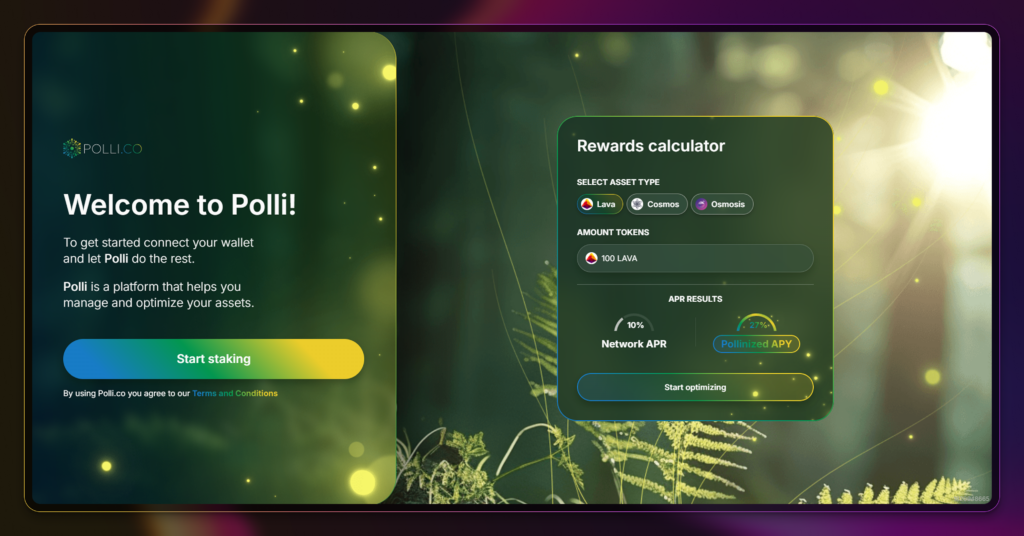

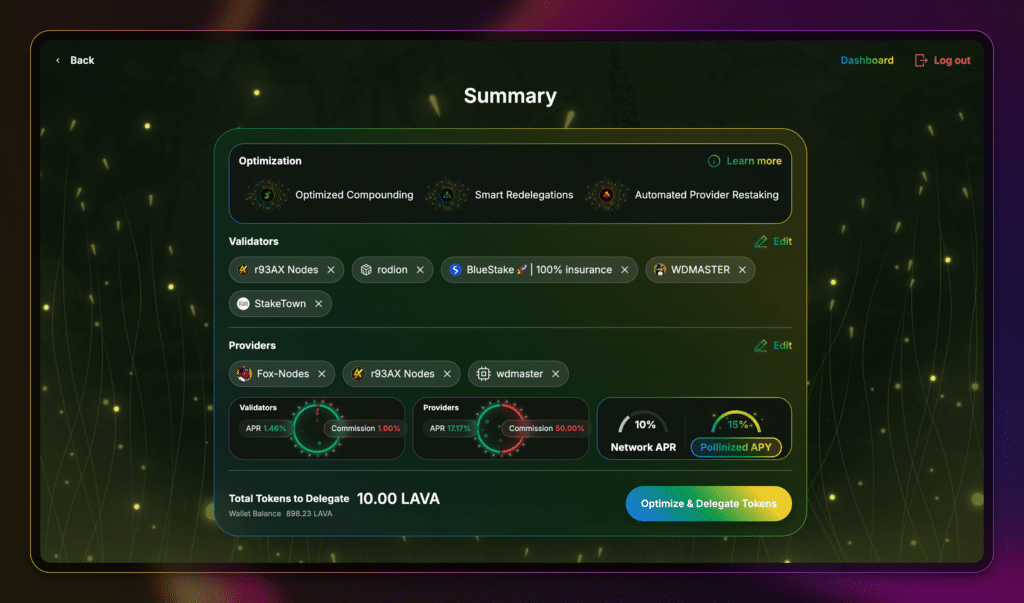

Polli.co is a staking optimization platform that caters to Cosmos and Lava Network. The platform offers above-market staking returns through its auto-compound of staking rewards and redelegation to validators.

Prior to delegating your tokens, Polli will give an estimate of its staking returns.

Solo Staking Calculators

While viewed as the purest form of PoS staking, Solo Staking can also come off as the most complex. With initial and monthly operating costs, calculating your return on investment can become hard to track.

It’s essential to choose a calculator that accounts for all these costs. In our discussion above, Blocknative provides a comprehensive calculator that even factors in MEV Boost, which can provide additional rewards in addition to the usual network rewards.

How to Maximize Staking Rewards With a Staking Calculator

A rewards calculator is a powerful tool for researching and comparing APY. However, finding the highest APY is not necessarily the most lucrative option. Make sure to consider other factors when utilizing the calculator.

Consider the Staking Time

Staking duration can be a powerful tool for growing your staking rewards.

As the saying goes, “It’s not time in the market, it’s timing the market.”

Compounding: By choosing a longer staking time, you allow the power of compounding to take effect. A staking calculator properly illustrates how the absolute value of staking rewards and the rewards rate potentially increase over time.

Capital Appreciation: High APY tends to distract investors from another source of increasing expected rewards—the capital appreciation on staked crypto. By prolonging the staking time, you give your investment time to grow, shortening the time it takes to recover your initial investments.

Market Volatility Hedge: Staking rewards can provide market volatility protection. The APY can offset drops in prices and help you ride through wild price swings. Staking rewards can serve as a quick liquidity boost that you can use for bills and necessities. This way, you don’t have to liquidate your crypto assets.

Utilize Additional Features

Not all calculators are created equal. Some will focus on single-asset staking rewards, while others specialize in solo staking. As the primary network for farming staking rewards, Ethereum has many third-party calculators.

These free calculators consider the initial cost of a validator and monthly costs tied to electricity and internet plans. Solo stakers should consider the staking rewards rate and the staking period required to break even on their investment.

Get Visual

Different people process and understand information in various ways.

Some investors would be content reading a long brier on why a particular blockchain is suitable for staking. On the other hand, some stakers would prefer visualizing the returns they would get from their investments.

Furthermore, staking calculators with beautiful user interfaces make the staking journey more interesting. It can get boring staring at numbers all day.

Free Staking Calculators Available

Staking solution providers usually provide free staking calculators on their websites. The tools serve as a marketing funnel that attracts investors to their main service. Some of the calculators are highly useful in their own right.

Here are other free staking calculators that may be worth looking at:

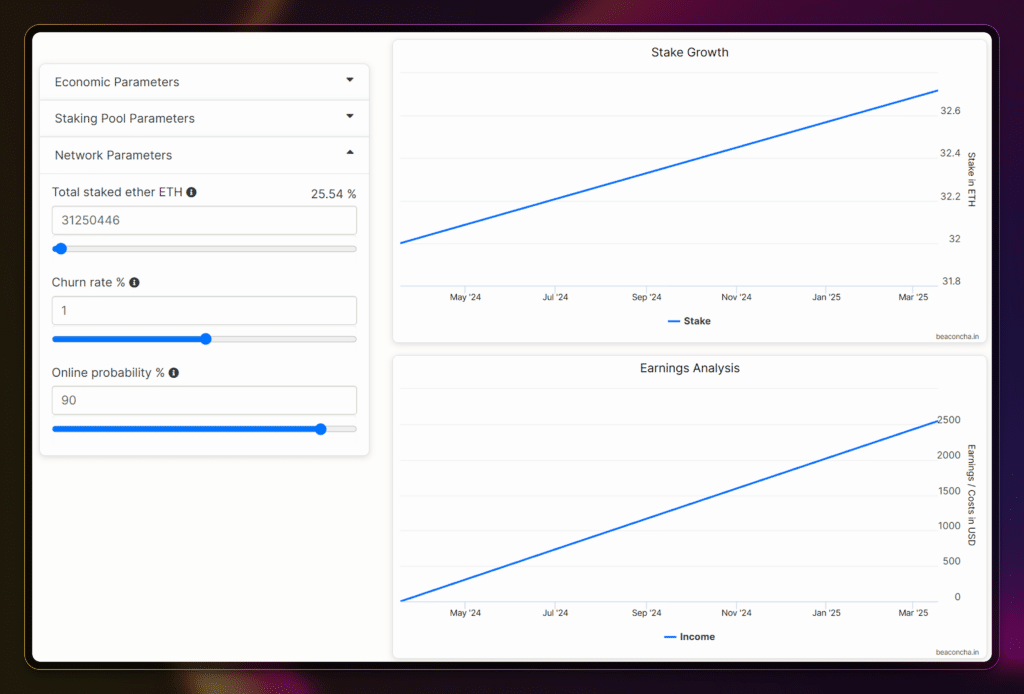

Beaconcha

The Beaconcha is an open-source Ethereum staking and validator monitoring website.

Its calculator sets itself apart by considering network parameters such as the:

- staking ratio.

- network churn rate.

- validator online probability.

These factors significantly affect the staking rewards rate.

For example, a high staking ratio increases the staking participants, resulting in lower expected rewards over time.

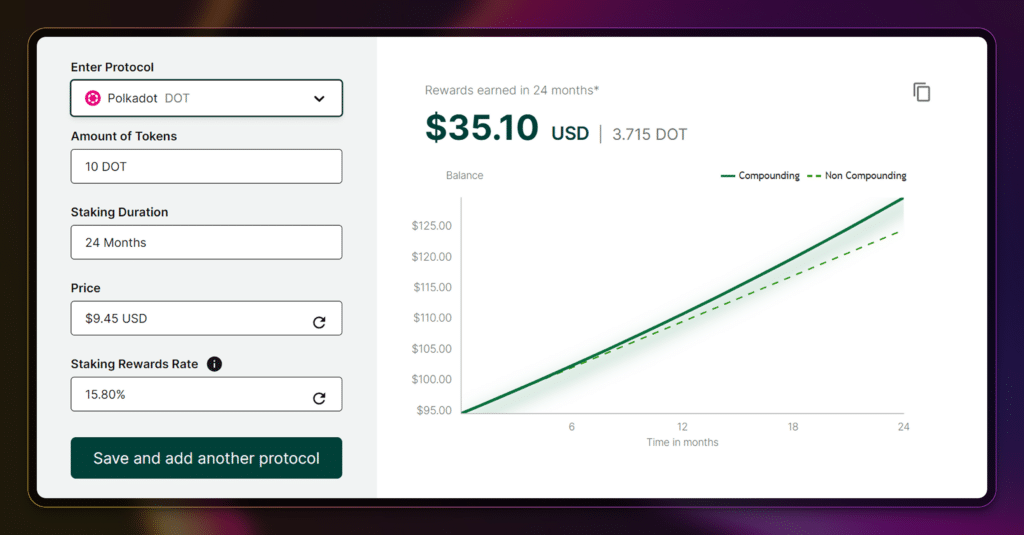

Figment

Figment provides enterprise-grade cross-chain staking infrastructure across multiple protocols.

Using the free calculator, investors can picture the difference between compounding and non-compounding rewards on the network. Furthermore, the calculator lets you save up to 4 different protocols, allowing for easy comparison.

Are Staking Calculators Accurate?

While staking calculators provide a great way of estimating staking rewards, they should not be taken as financial advice or expected to hold until the end of the staking period.

Each blockchain contains its own network parameters and staking data, which could impact your return on investment. While a staking calculator may be able to factor this in at the beginning, it would not be able to take into account changes during staking.

Here are some staking data which could impact your staking:

Token Price

In a stable or uptrend market, you can ignore this data point as the value of your initial investment and staking rewards increases.

However, in a downtrending market, this has a significant impact on your investment. This is especially true in solo staking. The initial cost for the staking setup and the monthly operational costs are paid in fiat, while the rewards are paid in Ethereum.

Validator Downtime

Calculators assume that the network or your validator runs 24/7 and does not get penalized or experience downtime. However, these are highly possible scenarios that would affect your staking returns.

Conclusion

The crypto staking market has been recovering and approaching all-time highs in total value locked.

Participants have been pouring interest and investments into this sector. However, with hundreds of networks and staking providers, investors must equip themselves with the proper knowledge and tools to maximize this opportunity.

A crypto staking calculator is a powerful tool that significantly reduces research and computation time. With a calculator, you can easily visualize how your rewards will take shape after considering factors such as compounding, staking duration, and initial costs.

Many staking calculators are available online for free. Use them to get the most out of your staking experience.

For more staking-related information, check out our various guides at Solo Stakers.

Editor’s Note: This article was originally published in April 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

May 20, 2024

August 7, 2025