How to Become a Staker without Having a Staking Operation

Thousands of people are staking their crypto and generating crypto rewards while eating, sleeping, and working. However, having your staking operation can appear very daunting.

Beyond the computer rig and lines of code required, staking on your own has a high capital barrier. But worry not.

We are here to teach you how to become a staker without having a staking operation.

We are past the early days of cryptocurrency, and several avenues exist for you to take advantage of staking.

Continue reading to learn how to stake without hardware setup.

Different Types of Staking Operations

While solo staking on a Proof-of-Stake (PoS) network like Ethereum remains one of the most popular staking methods, other similar consensus mechanisms allow stakers to earn rewards more affordably.

Delegated proof-of-stake (DPoS) networks like Solana, Cardano, and Cosmos allow low-capital participants to get involved in staking.

Let’s define the different types of staking operations:

1. Proof of Stake (PoS):

In a PoS network like Ethereum, validators create new blocks and validate transactions based on the amount of crypto staked. By locking in crypto, these validators have skin in the game and refrain from performing malicious actions. Validators and stakers lose a portion of the staked coins through slashing.

Under PoS, certain factors influence the chance a validator gets picked. These can include the amount of crypto locked up and the duration staked. In reward for their services, validators receive newly minted native tokens.

PoS can limit the validation process to wealthier crypto users. If the amount staked counts as a factor in validator selection, then those with more have a higher chance of obtaining staking rewards more frequently.

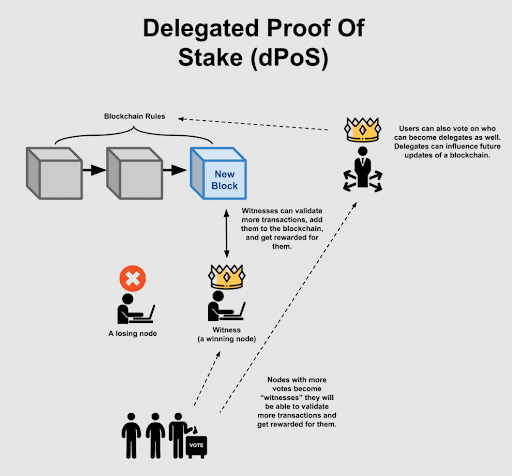

2. Delegated Proof of Stake (DPoS)

DPoS seeks to address some of PoS’ limitations by introducing democratic infrastructure and processes.

Under DPoS, stakers pool their tokens and assign them to a delegate. The delegate with the most tokens becomes the chosen validator (witness) and earns staking rewards. The network distributes rewards to the stakers based on each user’s stakes.

With this voting process, even a small player can still participate by placing their vote with a delegate.

Furthermore, network control remains with the stakers, who can withdraw their vote from one delegate and place it with another.

While DPoS solves the wealth centralization issue in PoS, it can lead to the centralization of validators.

Going back to Cosmos, the blockchain only has 180 validators. Should there be performance issues, these may disrupt network functionality. In contrast, Ethereum has over one million validators spread across 6,000 nodes throughout 80 countries.

3. Masternodes

Some blockchains operate on a masternode consensus mechanism. While staking is involved, one should distinguish masternodes from proof of stake as the former adds a layer to strengthen the network and combines with mining or staking.

Unlike nodes, which can become transaction validators, masternodes operate additional network services. PIVX, which uses staking (first layer) and masternodes (second layer), utilizes masternodes for instant transactions and voting purposes on PIVX DAO, the network’s Decentralized Autonomous Organization. While anyone can submit a proposal, only masternodes can vote, directly influencing the network’s future.

To start a PIVX masternode, one needs to stake 10,000 PIV (approx. USD1,900). While capital is higher than regular staking, rewards are also higher. A masternode earns 3 PIV, while staking returns 2 PIV per block.

Becoming a Staker without a Staking Operation

Individual players can benefit from their staked assets without having the technical know-how to set up a staking operation. Numerous platforms aim to cater to the non-technical crowd by providing a seamless experience that people can use with just a wallet or exchange account.

Delegated Proof of Stake

If you’re staking to a PoS network, all you need is a crypto wallet to start staking. Developers have also created staking optimization platforms to increase your overall staking returns.

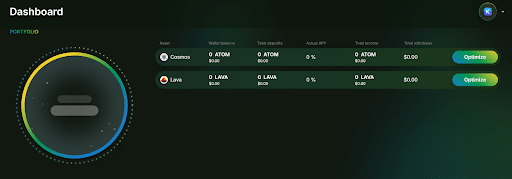

Polli.co is a staking optimization platform that offers users above-market staking returns. Through their ai powered platform, users can automate their entire staking experience from auto-compounding staking rewards to slashing prevention and validator optimization.

Polli currently supports Cosmos and Lava staking.

Staking-as-a-Service Platforms (SaaS)

SaaS is a form of staking wherein an intermediary handles the hardware and software requirements. Third parties handle the node operations on behalf of the stakers for a fee.

No more thinking about buying computer parts, having a great internet connection, and watching for network updates. A staker locks up their desired cryptocurrency, chooses a validator, and receives block rewards. There’s a caveat, however.

While a staker maintains control of their staked crypto by possessing the withdrawal keys, a third party takes control of the validator keys.

SaaS does carry some risks. For example, your funds could be penalized if the third party does not properly maintain the node.

Different cryptocurrencies may require a minimum staked amount under a SaaS service. For Ethereum, it’s 32 ETH (USD 83,000), while for Polkadot, it’s 120 DOT (USD 480). Other cryptocurrencies do not require a minimum.

Established in 2018, Stakefish remains one of the most trusted and popular SaaS platforms, with over 758 thousand ETH staked throughout its history. Its user-friendly dashboard allows stakeholders to manage their validators, and its consistent uptime ensures maximum user rewards.

Staking Pools

Some users may combine their funds with other interested people through pooled staking. Many staking pools do not require a minimum staked crypto amount, making staking accessible to virtually anyone.

An operator or administrator manages the pool and maintains the validator node. Rewards are handed out based on the amount and duration staked within the pool.

Smart contracts run the pool in a trustless and automated environment.

A staker deposits funds into the smart contract from a non-custodial wallet such as Metamask and receives returns and the locked tokens when the staking period ends.

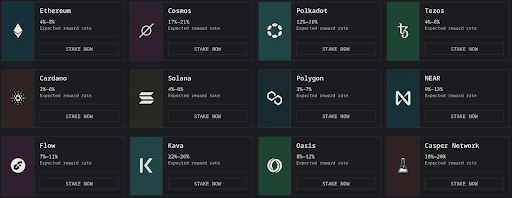

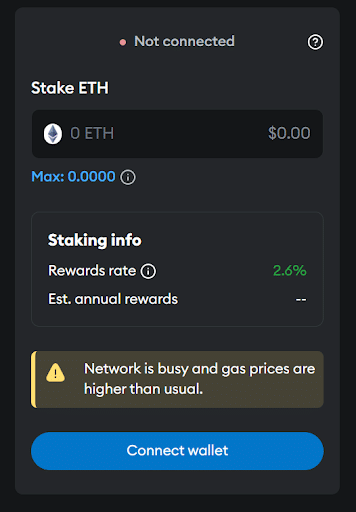

MetaMask’s Portfolio feature offers pooled staking on its pool. Users can deposit any amount of ETH and earn staking rewards directly into their MetaMask wallets.

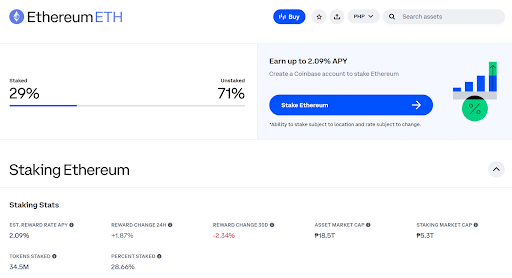

Centralized Exchange Staking

Many centralized exchanges, such as Kraken and Coinbase, have also created staking services for their customers. Like staking pools, users can place much smaller amounts than the regular 32ETH placement, and stakers don’t need to worry about the required hardware and software.

The difference lies in the custodial aspect of exchanges.

An exchange customer creates an account and deposits cryptocurrency into the platform. The individuals and organizations behind the exchange then manage the staked ETH. A user may lose access to the cryptocurrency if anything happens to the account or the exchange itself.

Coinbase offers Ethereum staking on its platform with no minimum placement. The exchange charges a 20% commission on the rewards as payment for the service.

Decentralized Finance Staking Options

For more adventurous stakers, the Decentralized Finance (DeFi) industry offers other options for staking. DeFi solutions rely on smart contracts and self-executing code rather than centralized platforms and services.

Liquid staking is when a staker deposits their tokens, such as ETH, and receives a liquid staking token (LST) of equivalent value in return. It unlocks liquidity for stakers who cannot access their staked funds. Users can deploy these LSTs across the DeFi ecosystem for additional yield.

Lido Finance is the most used DeFi staking platform in the crypto industry, with USD32 billion of ETH.

In Lido, you deposit ETH and receive the liquid token stETH, which can be used in trading and decentralized finance applications. While there is no minimum ETH placement, the platform takes a 10% reward fee.

Wrapping Up: Time to Stake

Earning and staking crypto doesn’t have to be too complex. Even without significant capital or hardware, you can earn passive income from your crypto through various platforms and methods, such as pooled staking and centralized platforms.

Make sure to perform your due diligence before committing any assets.

Happy Staking!

Editor’s Note: This article was originally published in November 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

January 31, 2025

August 4, 2025