How Crypto Staking Can Hedge Against Market Volatility

If you’ve ever held on to cryptocurrency for a few months, you would have experienced the market’s extreme volatility. Prices rapidly fluctuate within short timeframes. Similarly, your emotions swing from euphoria to depression.

These price swings can cause emotional stress for long-term investors. Focusing on long-term fundamentals over short-term price movements can be a healthier approach.

Crypto staking requires locking tokens, encouraging a long-term mindset. At the same time, staking rewards provide a potential buffer against market downturns. Unlike active trading, which requires constant market monitoring, staking offers a passive approach to earning yields.

In this article, let’s explore how crypto staking can help mitigate market volatility.

What is Price Volatility?

Price volatility refers to the degree to which the price of an asset such as stocks or cryptocurrencies, fluctuates over a given period. Volatility is characterized by significant and often unpredictable increases or decreases in value, as opposed to remaining stable.

Imagine you have a favorite token called Crypto A. Some days, it might cost $5 a per token, but then the next day, it jumps to $6, and later it drops to $3.

High volatility indicates substantial price swings, while low volatility suggests more consistent and gradual changes.

What Causes Crypto Price Volatility?

While no one knows the future and what would move price on a given day, volatility can stem from multiple factors:

- Economic Trends and Headlines: Market sentiment shifts from news, hype, or even fear. Tariff news has dominated 2025 with actions from the U.S. Government moving price seconds within an announcement.

- Low Liquidity: Where there are less participants buying and selling, big trades can jolt prices. Big actors can manipulate prices and cause pump and dumps.

- Adoption: When more participants use the chain, whether for development or trading, this can trigger demand for a certain cryptocurrency. This increased buying pressure causes prices to rise.

Crypto Staking as a Volatility Hedge

Staking serves as a financial and psychological volatility hedge.

By staking, investors earn consistent rewards while holding assets for longer periods, reducing the impact of price swings and accumulating additional tokens over time.

Staking Crypto for Consistent Income

It’s common for investors to liquidate financial assets due to economic realities. You might need funds for essentials such as groceries or sudden emergency costs.

As a crypto staker, you receive regular staking rewards, from daily to monthly. You can use these earnings to cover expenses while keeping your staked assets intact.

For example, if you invested $100,000 in Solana (SOL) at $150 per token and the price remained the same throughout the year:

- SOL Staking Annual Percentage Yield: 8.09%

- Validator Commission: 0%

- Monthly Staking Rewards: $674 (without compounding)

Staking rewards can help manage regular expenses without selling the staked assets.

Staking Rewards as a Counterbalance

When crypto prices fall, stakers continue earning rewards, reducing the impact of price drops. This is especially useful in bear markets, where holding assets without staking leads to greater unrealized losses.

Let’s say you invested $100,000 in Cosmos (ATOM) at $4 per token. After a year, the price dropped 25% to $3:

- Starting ATOM tokens: 25,000 ATOM

- ATOM Staking Annual Percentage Yield: 14.67%

- ATOM tokens after 1 year: 28,667 ATOM

- Value of ATOM tokens after 1 year: $86,001

By staking and earning more ATOM, your loss is reduced to 14%, compared to a 25% loss if you had only held the tokens without staking.

To add to your staking yield, you can maximize staking optimization platforms.

Polli.co is a staking optimization platform that automatically selects validators and compounds your staking rewards. Users earn above-market returns when using Polli. The platform is available for Cosmos and Lava Networks.

Time in the Market vs. Timing the Market

A well-known investment principle states that “time in the market” is more valuable than “timing the market.” This becomes clear in crypto staking, where consistent participation in staking activities can lead to compounded rewards over time.

Most traders try to time the market, but studies show that over 90% fail to do so profitably. Successful market timing is challenging, even for experienced traders.

Staking, on the other hand, rewards patience. By consistently earning yield regardless of daily price fluctuations, stakers benefit from steady growth without the stress of constant market monitoring. You could be staking for a year and benefit once the market rises.

Case Studies: Successful Staking During Market Downturns

Many investors have weathered bear markets by strategically staking their assets. Here are three notable examples that highlight the power of staking, even during turbulent times.

Ethereum Stakers Survive the 2022 Bear Market

In 2022, Ethereum holders who staked their ETH on the Beacon Chain continued to earn rewards despite a significant price decline. While the price of ETH dropped, staking provided a steady stream of income in ETH tokens.

Those who remained patient saw their rewards accumulate throughout the downturn. As ETH rebounded in 2023, these long-term stakers held more ETH at higher prices. Investors earned substantial returns once the market recovered.

Solana Stakers Ride the Market Recovery

Solana became one of the standout performers between 2023 and 2024, especially during the memecoin boom. The network’s low fees and high throughput made it a preferred chain for traders and developers alike.

Long-term holders who staked their SOL at 7–8% APY saw strong returns. They earned from price appreciation but from the additional tokens earned during the downturn. SOL bottomed out below $10 and surged to nearly $300 by January 2025, turning patient stakers into big winners.

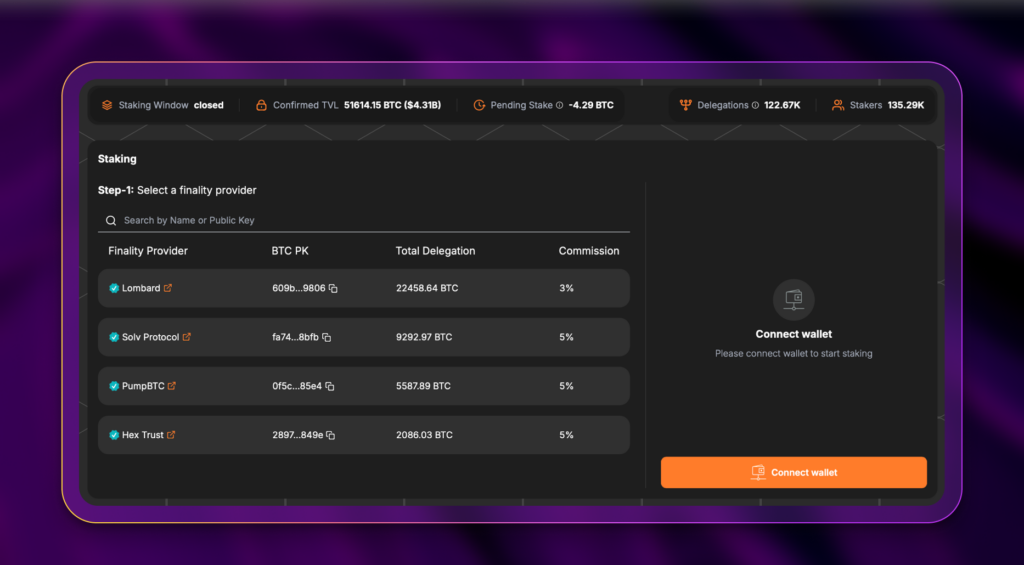

Bitcoin Restaking Gains Momentum

As the latest market correction unfolds, investors are turning to proven assets like Bitcoin. Traditionally a non-yielding asset, Bitcoin now offers passive income opportunities through restaking.

Restaking, staking an already staked asset, has been popular in the Ethereum and Cosmos ecosystems. Thanks to projects like Babylon Labs, Bitcoin holders can now tap into this strategy. By restaking BTC, investors can maintain exposure to the asset while earning yield, even in uncertain markets.

Risks and Limitations of Staking as a Hedge

While crypto staking can soften downside risk, it isn’t a silver bullet. You should be aware of the key risks and limitations when using staking as a hedge.

Price Volatility Risk

Staking rewards may not fully offset a sharp decline in token value.

For example, earning an 8% APY might seem attractive, until the asset drops 50% in value. Several staking-based cryptocurrencies that became in 2021 such as Polkadot and Cardano remain over 70% below their peak price. Depending on where you purchased the tokens, you could be in deep loss even with staking rewards.

Keeping this risk in mind, it’s best that you diversify your investments into several crypto tokens.

Regulatory Uncertainty

Governments worldwide are still defining their stance on crypto.

Staking services, especially those offered by centralized platforms, have already faced regulatory pressure. Crypto exchange Kraken shut down its U.S.-based staking services and paid fines of $30 million. While there’s no risk to the users, they do have to stop staking and search for alternatives.

While positive changes in government and regulator can happen, there’s no telling what could happen in other geographies.

Smart Contract and Platform Vulnerabilities

The worst thing that can happen while staking is that your token goes to zero. The second worst thing is that someone steals your crypto.

If you stake through decentralized finance protocols like liquid staking platform, your assets are only as safe as the smart contract that holds them. Bugs or exploits can lead to permanent loss of funds. Similarly, malicious hackers can attack the platform and drain the tokens.

Go with high-reputation platforms like Lido Finance, the leader in Ethereum liquid staking.

Final Thoughts

Crypto staking can be an effective strategy to hedge against greater volatility by providing a steady income stream through staking rewards. While staking cannot entirely eliminate risks, it offers you an alternative way to grow your assets during bear markets and downturns.

By adopting a long-term mindset and staking, your conviction could potentially pay-off when the market recovers. Not only will you benefit from price appreciation, but you’ll find yourself holding more tokens than when you set out on your staking journey.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

April 9, 2025

September 3, 2025