From HODLing to Earning: A Guide to Crypto Passive Income Strategies

HODL – Hold on for Dear Life.

It’s the mantra of every experienced cryptocurrency investor.

If you had purchased 1 Bitcoin in early 2017, you would have seen it rise from $2,000 to $20,000 per bitcoin. A year later, in 2018, Bitcoin dropped to $3,000 per bitcoin. As of writing, it stands at $100,000.

A wild ride indeed.

But did you know that you could have been earning passive income while hodling your crypto assets?

If not, then this is your guide to crypto passive income strategies.

What is Crypto Passive Income and How Does It Work?

Passive income allows you to pull in income without active work.

In traditional finance, bonds that earn interest or stock portfolios that yield dividends earn investors passive income. Commercial and residential real estate, where landlords collect regular rent, generates passive income.

Crypto generates passive income and presents comparable opportunities.

In the past, participants could produce crypto passive income through mining, the Proof of Work (PoW) consensus mechanism of Bitcoin. An investor would set up hardware to validate transactions on the Bitcoin network, and in return, they would earn native tokens as a reward.

Nowadays, it’s possible to earn passive income from crypto investments without such complicated hardware. Investors can deposit cryptocurrency directly into the blockchain network or third-party decentralized finance (DeFi) applications that earn yield.

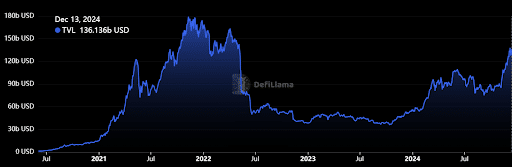

For example, DeFi has grown into a multi-billion dollar industry. Investors have invested $136.1 billion in platforms that yield passive income.

The Different Ways to Earn Passive Income Through Cryptocurrencies

You can pursue various crypto passive income methods depending on your goals and resources.

Some ways contribute to the overall strength and security of a blockchain network. Others are designed purely to generate income for users.

Crypto Mining to Generate Passive Income

Cryptocurrency investors first experienced passive income through Bitcoin mining.

More than a decade ago, you could gain Bitcoin from a laptop or simple computer. Students would mine Bitcoin from their dorm rooms. These days, companies set up warehouses of machines to mine a single Bitcoin.

Bitmain miner, as seen on Amazon

Mining has progressed from its early days, even when performed at home. Investors now require an application-specific integrated circuit (ASIC) computer specially built for mining purposes.

A single home-based mining setup can cost up to $3,500 with varying returns. Most miners will make their profit after selling Bitcoin during a significant price increase.

What is Staking?

Many blockchain networks operate on a proof-of-stake (PoS) consensus algorithm.

To quickly differentiate from mining, PoS validates transactions based on locking up cryptocurrency. This process is otherwise known as staking. While computers are still required, locking tokens onto the network does most of the job.

Stakers earn passive income based on the amount and duration staked.

Ethereum staking statistics from Ethereum.org

Ethereum (ETH), a proof-of-stake network, has attracted over 1,000,000 validators composed of individuals and institutional stakers. Investors have staked over $130 billion ETH to date.

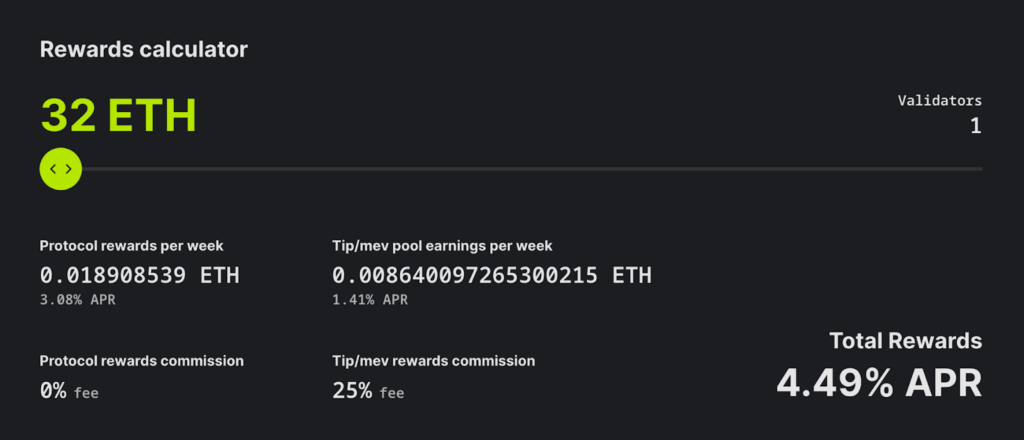

An ETH solo staker (one who sets up their validator) needs $1,000 in equipment and 32 ETH (over $100,000) to start staking. Once up and running, a validator earns a 3.2% ETH annual percent rate (APR).

In addition to being a solo staker, investors may explore other staking options with lower capital entry requirements and minimal hardware:

Delegated-Proof-of-Stake (DPoS)

DPoS is a consensus mechanism where participants delegate their staked crypto to third parties. The entities with the highest “votes” become validators.

Solana, a DPoS blockchain, offers 6-8% passive income annually.

Staking-as-a-Service (Saas)

SaaS is a model where an intermediary handles the hardware requirements of staking. An investor just needs to deposit the required cryptocurrency into the platform.

Stake.fish’s Ethereum staking calculator

Institutions such as Stake.fish offer staking across various crypto networks, such as Polkadot, Solana, and Polygon.

Returns vary depending on the network.

Staking Pools

Users combine their funds with other interested people through pooled staking. An operator manages the pool and maintains the validator. Meanwhile, rewards are handed out based on the amount and duration staked within the pool.

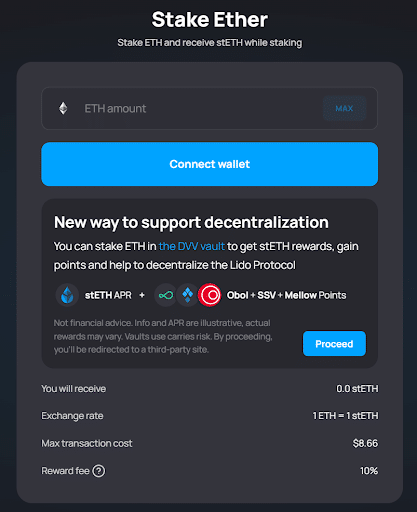

Frequently, staking pools will also offer what is termed liquid staking.

Stakers receive liquid staking tokens (LST) equivalent to their staking capital. These LSTs represent the staked assets in a blockchain network. Stakers can use the LST other protocols for further trading or yield generation.

Lido Finance, the largest liquid staking platform, offers an easy way to earn staking rewards. Investors do not face high capital requirements. In return, users receive stETH, the platform’s liquid staking token.

How Yield Farming Makes Passive Crypto Income

Investors deposit cryptocurrency into decentralized finance (DeFi) applications for yield farming. While the methods for generating yield vary from platform to platform, the approach is generally the same.

Investors (called yield farmers) will transfer platforms to maximize their profits. These farmers receive yield in the protocol’s native token or the crypto pool the investors deposit into.

While staking contributes to the strength and security of a blockchain network, yield farming supports the operations of a DeFi platform.

Liquidity Pools

In a traditional market, buyers and sellers offer different prices, creating supply and demand for a particular good. When buyers and sellers agree on a price, they execute a trade. The execution price becomes the asset’s market price.

Decentralized exchanges (DEXs) execute trades automatically. Instead of relying on a market of buyers and sellers, users trade against a liquidity pool. DEXs provide passive income to encourage investors to deposit cryptocurrency into the pool.

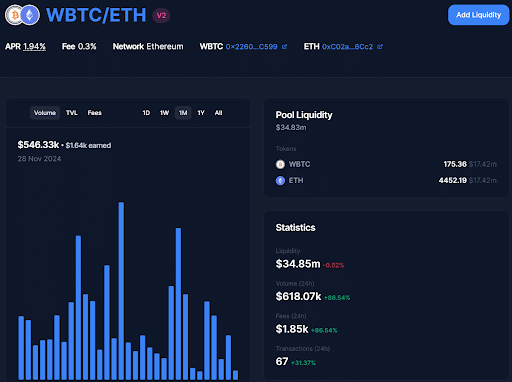

Sushi Swap, one of the largest DEXs, offers users a 1.94% annual rate for its WBTC/ETH pool.

Lending Platforms

In a regular bank, institutions gather deposits to lend to borrowers. Depositors receive a portion of the loan interest and fees, and the bank keeps the spread as profit.

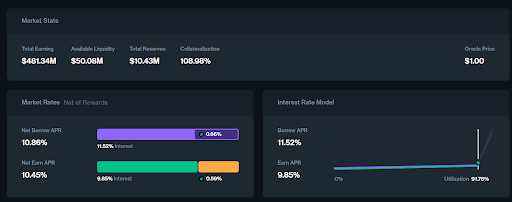

Lending platforms generate passive income for investors by operating in a bank-like model. However, they utilize smart contracts to operate automatically instead of having a centralized lending authority.

USDC lending on Compound Finance

Compound Finance is one of the largest crypto lending platforms, with $3 billion worth of crypto locked onto the platform. With its USDC lending product, deposits can earn 10.45% per annum in passive income.

How Crypto Games Bring Passive Income

The most intriguing way to earn passive income is by playing games.

Players treat gaming tokens as passive income as games are fun to play. The monetary incentive comes secondary.

Blockchain games reward players with in-game cryptocurrency. Players gain these rewards through winning matches or completing quests. At the same time, in-game assets carry financial value if traded on internal and external marketplaces.

In 2021, thousands of players earned $10-$50 a day while playing Axie Infinity. While the in-game economy ultimately collapsed, other game developers have launched their crypto games.

Pixels, a blockchain game

Pixels has attracted thousands of players to play and complete in-game quests. Players earn income through $PIXEL, the in-game currency. While the earnings are nothing compared to the heyday of Axie Infinity, the game does provide players with income-generating opportunities.

Passive Income with Real World Assets (RWA)

Real World Assets (RWAs) are tangible assets institutions can tokenize and bring into the digital crypto world.

Financial assets include bonds, blue-chip artwork, and expensive real estate. Because these assets are costly and highly regulated, many individual investors cannot participate. Turning them into Real-World Assets improves their accessibility and liquidity, enabling institutional and individual investors to participate.

Consider a hotel valued at $10 billion. It’s an active earning asset with hotel operations, guests, and events. Most people would be unable to buy this hotel in their lifetimes. But what if the hotel owner tokenized it and split it into 10 billion pieces called $hotel?

Retail investors could purchase a few thousand dollars of $hotel and earn income from the hotel operations.

The Aspen St. Regis, a ski resort in Aspen, Colorado, tokenized a portion of their hotel equity. While token holders do not earn passive income yet, they earn special rebates on hotel services.

Crypto Statistics 2024

Crypto DeFi has become a multi-billion dollar industry.

While the current $95 billion total value is still significantly below its peak of $190 billion in March 2022, the industry displays high growth potential.

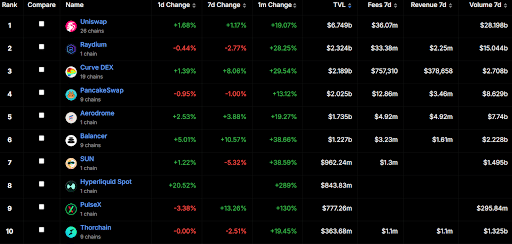

Total Value Locked in DEXs

Top 10 DEX by total value locked, from DefiLlama

DEX platforms hold approximately $26 billion of the $136 billion total value in DeFi.

With the collapse of centralized exchanges (CEX) such as FTX, individuals may look towards DEXs to fulfill their trading needs.

The Crypto Lending Market

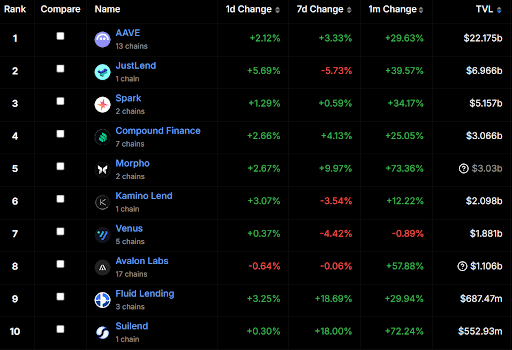

Top 10 lending platforms by total value locked, from DefiLlama

Investors have locked $54 billion of digital assets on crypto lending platforms.

It’s no surprise how lending platforms have attracted users. Traditional bank financing can be complex with its numerous documents and stringent requirements.

Crypto Games Players Count

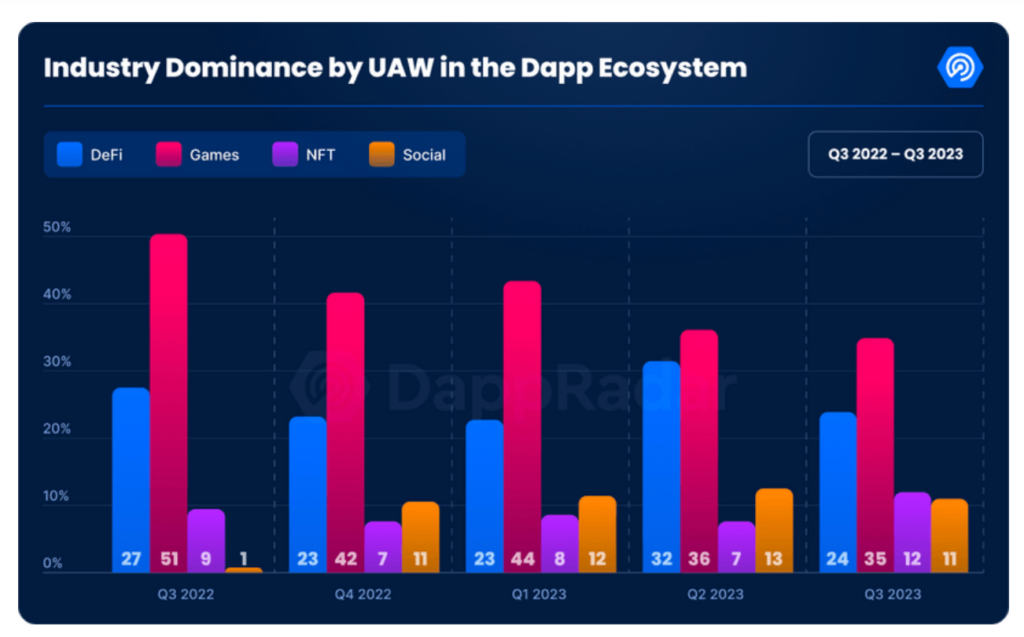

While crypto games don’t bring in substantial total value locked on their platforms, they do bring in the players.

Crypto games account for 35% of unique active wallets in the decentralized application ecosystem, translating to over 1 million users.

Can You Make $100 a Day With Crypto Passive Income?

If you stake a million dollars worth of Ethereum onto a platform, it would earn around 3.5% yearly, translating to $100 daily. This passive income is a significant amount that people can live on.

Of course, reaching a million dollars is much easier said than done. Numerous factors also affect the annual returns.

When more stakers enter a blockchain, the staking returns typically drop. Ethereum staking returns have fallen by over 50% since ETH staking started. Asset prices also play a crucial role in passive income returns. If ETH prices fall by 50%, keeping returns constant, you’d need to double your staking capital to meet the $100 daily goal.

Is Crypto Passive Income For You?

Generating passive income is a game-changer for any digital asset investor. However, you should conduct due diligence before deploying digital assets on passive income platforms.

Each platform and method carries its own set of risks. You could lose all your capital due to a rug pull or an attack on the platform. As this is all very early, it’s impossible to tell how governments will regulate these passive income strategies.

At the very least, reflect on your personal risk tolerance.

Editor’s Note: This article was originally published in July 2024 but has been updated with new information

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

December 18, 2024

August 4, 2025