The Power of Compounding Staking Rewards

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it,” – Albert Einstein.

Generating extra returns in the crypto landscape can be challenging. You can leverage trade, yield farm, or receive airdrops, which require additional time and knowledge.

But not everyone is built for active portfolio management.

Fortunately, you can passively earn additional rewards by compounding your staked crypto assets.

In this article, you’ll learn about:

- Compound interest

- Compounded staking returns versus traditional interest

- How to compound staking rewards

- How to take advantage

Read on to increase your knowledge of staking!

What is Compound Interest?

Compound interest is interest earned on both the initial principal and accumulated interest. It’s “interest on interest.”

The power of compounding lies in its exponential growth potential, making it a powerful tool for long-term investments.

Let’s say you have $1,000, which you invest in a bank’s high-yield savings account (HISA) with a net annual interest rate of 5%:

- You earn $50 in interest in the first year.

- In total, your balance has grown to $1,050.

- Assume you do not withdraw the interest earned.

- In the second year, the interest is calculated on the new total of $1,050, leading to $52.50 in interest earnings, and so on.

Over time, the growth of your investment accelerates.

How Does Staking Compound?

In the crypto market, staking involves locking up your assets in a network to help maintain its operations in return for rewards.

Staking is the consensus mechanism for Proof-of-Stake (PoS) and Delegated-Proof-of-Stake (DPoS) networks such as Ethereum and Solana.

Staking compounding involves reinvesting staking rewards to generate additional yield over time.

Let’s pretend you have 10 ETH, the native token of Ethereum, which has a staking reward rate of ~3% per year:

- You’ll earn 0.3 ETH at the end of the first year.

- Your total ETH balance is now 10.3 ETH.

- Assume you restake the rewards earned.

- Next year’s rewards are computed on 10.3 ETH, yielding 0.309 ETH in returns, and so on.

- Had you not restaked the rewards, you would continue to earn 0.3 ETH.

While this sounds like traditional finance’s compound interest terminology, there are key differences, which we’ll explain in the next section.

How Staking Differs from Traditional Finance

While the mathematical concept of compounding remains the same in traditional finance and staking, the mechanisms differ.

Compound Frequency

Traditional investments compound annually, quarterly, or monthly. Ideally, you receive a daily interest payout because the more frequently you compound, the higher your annual return.

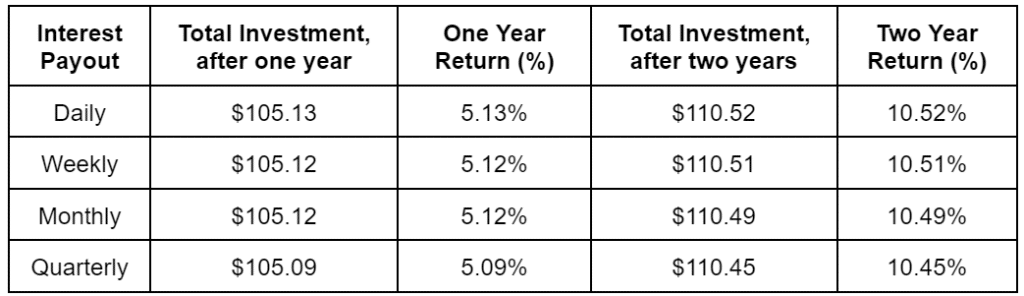

Here’s a table to show the difference, given a $100 investment at a 5% annual interest rate:

For crypto staking, rewards may compound, but payouts can fall on odd-numbered days due to each network’s processes. Depending on the platform you’re staking on, rewards may be paid differently.

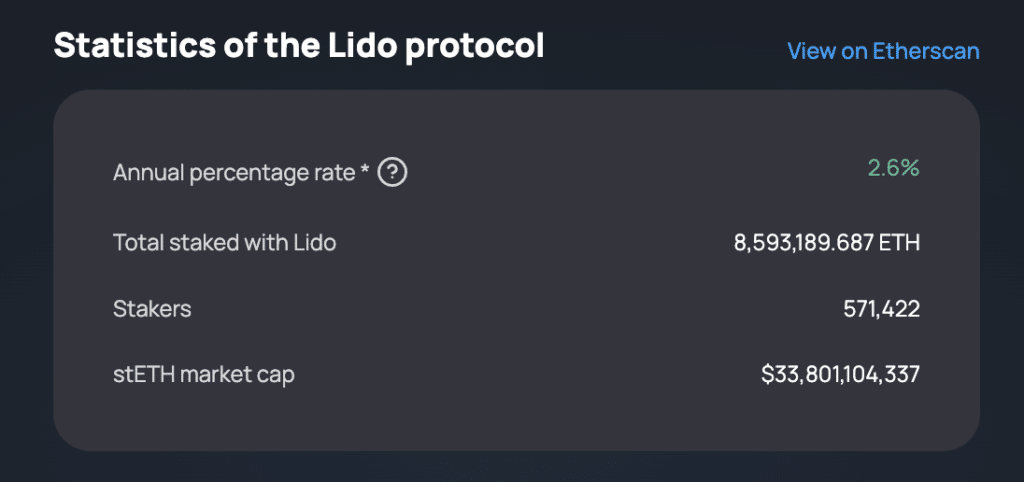

Lido Finance, the highly popular liquid staking and decentralized finance (DeFi) platform, offers daily rewards for ETH staking. Meanwhile, Coinbase distributes ETH staking rewards every 3 days.

The difference in annual returns, however, would be minuscule.

$ Value of Rewards and Principal

Traditional investments like stocks, bonds, and high-yield savings accounts pay investors in U.S. dollars or in the fiat currency in which they operate.

Crypto staking rewards pay investors in the native tokens of the underlying blockchain. The dollar value of these rewards, including your staked principal balance, can fluctuate.

Let’s say you purchased 1 ETH and staked it for 3% per annum. At the time of purchase, 1 ETH was valued at $3,000. If the price stayed the same, you would earn 0.03 ETH after one year or $90.

However, what happens if the price of ETH falls to $1,500?

Instead of earning $90 worth of staking rewards, you earned $45. Not only that, but your principal fell by 50%.

It goes without saying that crypto is a high-risk investment.

Interest Rate Volatility

Cryptocurrencies move more wildly than traditional assets, not just in asset prices but also in their stated returns.

If you invest in a bank time deposit or savings account, you are promised an annual interest rate. The financial institution cannot change this stated rate until your deposit matures.

If you’re investing in equities, the company is more likely to maintain a stable dividend policy to satisfy shareholders.

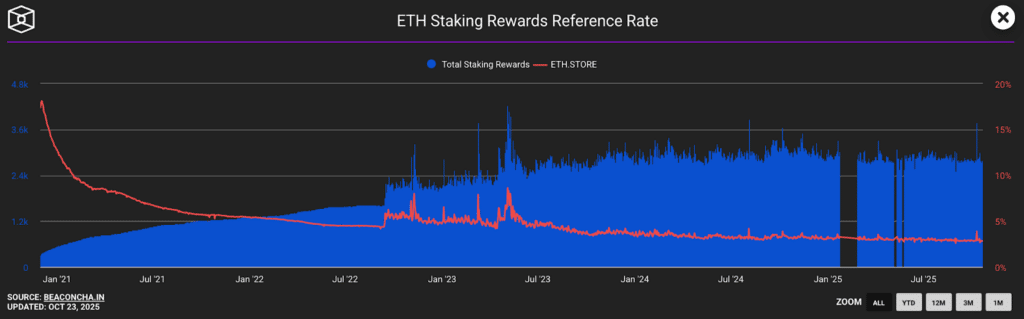

Crypto staking rewards decline as the network grows and more stakers join.

Ethereum, the largest and most stable blockchain to stake on, has offered fewer rewards. Staking rewards fell from over 5% last July 2023 to just above 3% as of writing.

How to Compound Staking Rewards

Depending on which network, staking method, and platform you’re using, staking rewards can compound in a few ways:

Manual Compounding

If automatic compounding is unavailable, make it a habit to claim and restake your rewards regularly. This practice applies to networks that don’t support auto-compounding.

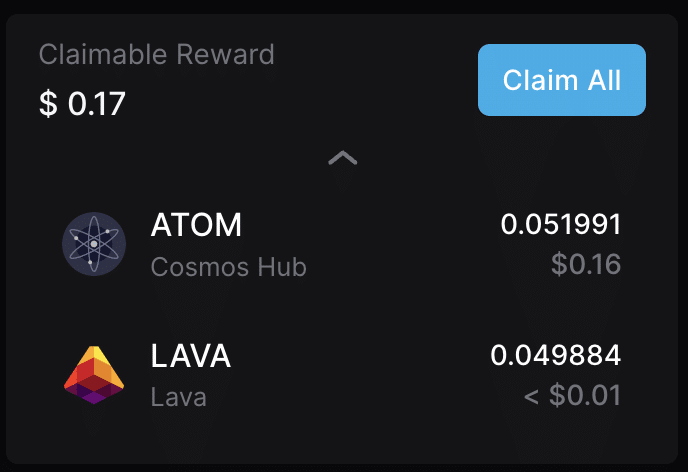

Cosmos is a popular Delegated-Proof-of-Stake network that lacks auto-compounding. The network pays rewards daily.

Cosmos staking is fairly easy as you can stake directly from a Cosmos-enabled wallet like Keplr.

However, you would have to claim the rewards manually and decide whether or not to stake them.

If you get busy and have other things to do, you could forget to claim and stake your rewards. These lapses affect the compounding potential.

Automatic Compounding

Some staking platforms or wallets automatically reinvest your rewards.

For example, if a platform offers daily rewards, those rewards are automatically added to your staked amount, and future rewards are calculated based on the new total.

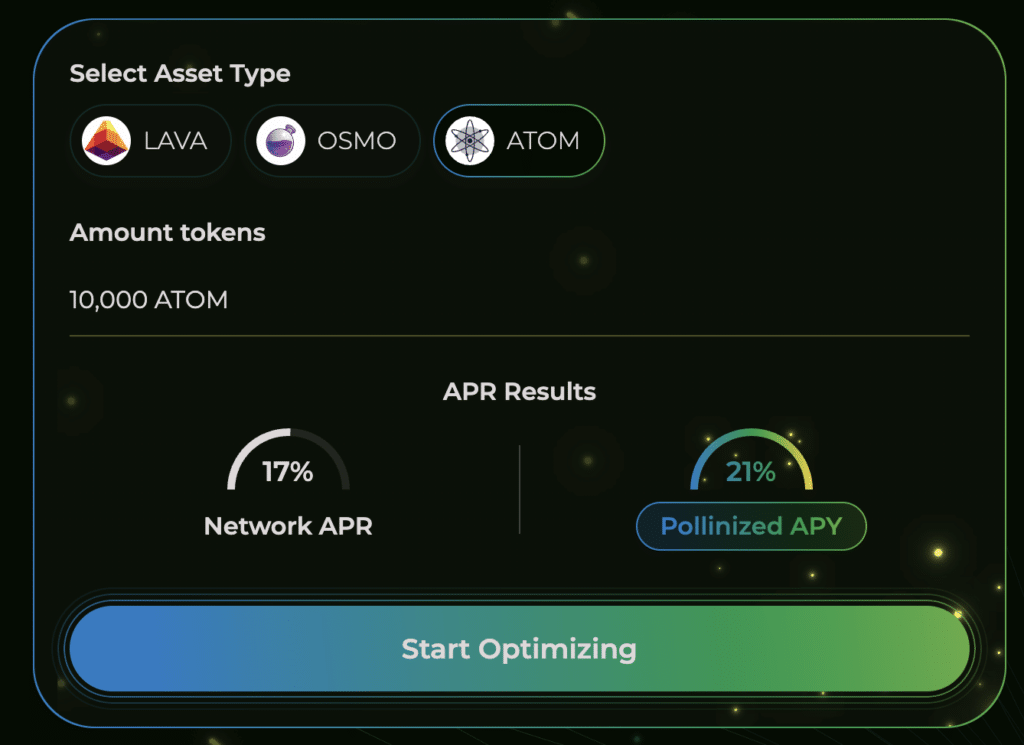

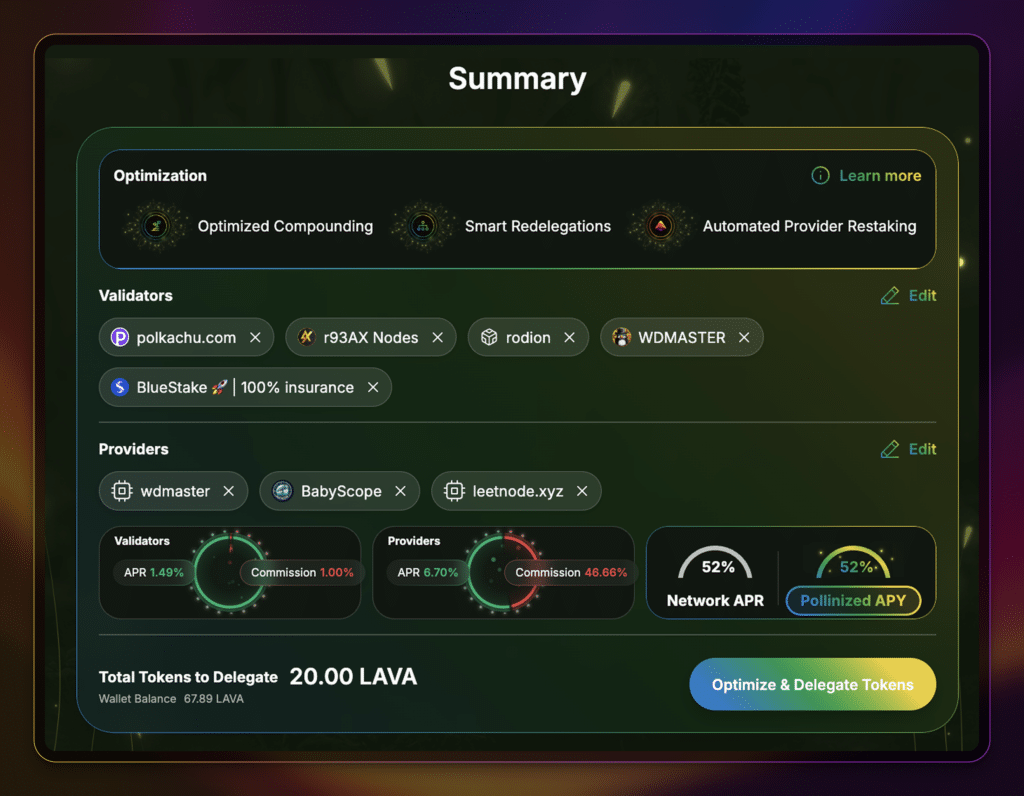

Going back to Cosmos staking, Polli.co is an AI-driven staking optimization platform that automatically stakes your rewards.

With the help of Polli’s optimizations, stakers earn above market rates, significantly higher than what the network offers.

How to Leverage Staking Compounding

You can leverage staking compounding in several ways to maximize earnings.

Choose Platforms with Automatic Compounding

Opt for staking platforms that offer automatic rewards compounding. These platforms ensure that your rewards are consistently reinvested without requiring manual intervention.

For Lido ETH liquid staking, the platform restakes the earned staking rewards daily. This subtle feature helps you compound your staking rewards with no effort.

Take Advantage of Restaking

Restaking is redeploying your staked assets to secure additional crypto projects and networks. This act can help you maximize compounding.

EigenLayer is the leading Ethereum restaking protocol which helped popularized restaking. However, with the speed of crypto innovation you can now perform restaking on other networks like Cosmos and Solana.

Lava Network is a Cosmos-based protocol that manages traffic for multiple blockchains. It has a native restaking feature, which allows you to restake your Lava tokens to its Data Providers.

Using platforms like Polli, you can restake your tokens to maximize your staking returns.

Frequently Asked Questions

How Often Do Staking Rewards Get Paid Out?

Staking rewards payment frequency depends on the network you’re staking on. The frequency can take anywhere from a few hours to a few days.

How Does Payout Frequency Affect Compounding?

The more frequent the payout, the higher the potential APY.

What Costs or Fees Can Reduce the Benefit of Compounding Staking Rewards?

Claiming and staking rewards incur gas or transaction fees. As these fees may have fixed costs (anywhere from a few cents to a few dollars), the more you transact, the more expenses you incur.

Take Advantage of the Eighth World Wonder

Understanding the power of compounding staking rewards can significantly enhance your earnings in the crypto market. By selecting the right platforms and strategies, investors can maximize their returns and capitalize on the exponential growth potential of compounded staking rewards.

Editor’s Note: This article was originally published in June 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

October 30, 2025

October 30, 2025