The Benefits of Diversifying Your Crypto Portfolio

Imagine this. You put all your savings into a single crypto token. Your crypto portfolio skyrockets over the next few months, and you will feel like a genius. A month later, the market shifts, wiping out 90% of your token’s value. Just like that, your investment is gone.

This chance of complete loss is why diversification matters.

The classic financial proverb, “Don’t put all your eggs in one basket,” applies even more in the crypto market, where volatility is extreme. By spreading your investments across multiple crypto investments, you allow yourself to keep playing the crypto market while capturing those homerun investments.

In this guide, we’ll cover:

- How crypto portfolio diversification works

- How it helps mitigate volatility

- The benefits of a diversified crypto portfolio

- Strategies to diversify effectively

…and much more!

What is Diversification in Crypto?

Diversification means spreading investments across different assets to balance risk and reward.

Instead of betting everything on one cryptocurrency, you allocate funds across multiple tokens or investment strategies.

Let’s say you invest equally in four digital assets: Ethereum (ETH), Solana (SOL), Cosmos (ATOM), and Terra Luna (LUNA). Let’s pretend a hacker drains Terra Luna’s reserves, causing its price to be zero.

While a 25% loss sounds painful, if you had put 100% of your crypto portfolio into LUNA, you’d lose everything. But with a diversified approach, your total loss is limited to 25% instead of 100%.

The Math Behind Portfolio Diversification

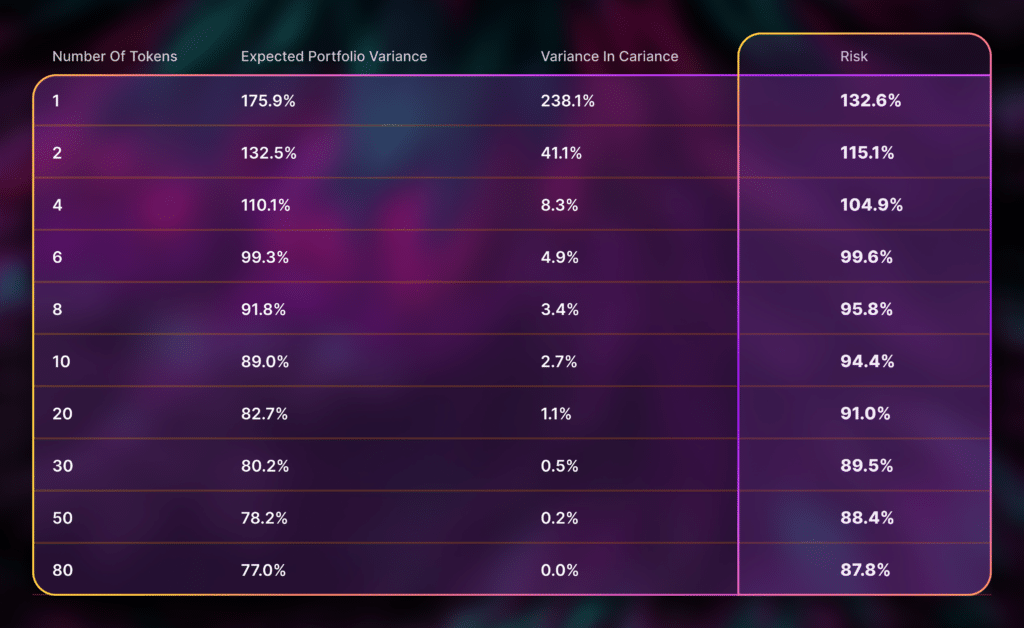

In 1977, finance professors Edwin Elton and Martin Gruber studied how diversification reduces risk. Their research, Risk Reduction and Portfolio Size, showed that holding 50 stocks captures the most risk-reduction benefits.

The same diversification strategies apply to crypto.

A study by Fyde Treasury, an AI-driven crypto portfolio management firm, found that having 20–30 tokens in a crypto portfolio significantly reduces volatility while maintaining high return potential.

Even major modern-day funds, Cathie Wood’s ARK Innovation ETF, typically hold 35–55 assets to balance risk. Crypto investors can apply similar principles by spreading their holdings across different blockchain ecosystems, sectors, and timeframes.

How to Achieve a Diversified Crypto Portfolio

Aside from selecting a basket of tokens, you can diversify your crypto assets by selecting different time frames and asset classes.

Mix Short Term and Long Term Timeframes

Not all crypto assets behave the same way.

Some tokens, like memecoins, can generate quick profits but are highly speculative. These tokens provide no inherent utility. Others, like Bitcoin, require a long-term mindset but have historically delivered strong returns.

Many memecoins like WIF and MooDeng from 2023–2024 surged in value but dropped 90%+ in the last quarter of 2024. Investors who only held memecoins and did not cash out saw their portfolios wiped out.

In contrast, Bitcoin, despite multiple 90% crashes, has grown thousands of percent over the last 15 years.

A diversified approach means allocating part of your portfolio to long-term, solid assets while keeping a smaller percentage in speculative plays.

Engage in Staking and Earn Cross-Chain Rewards

Diversification isn’t just about holding different tokens; it’s also about earning yield from them through crypto staking or other decentralized finance (DeFi) primitives, like yield farming.

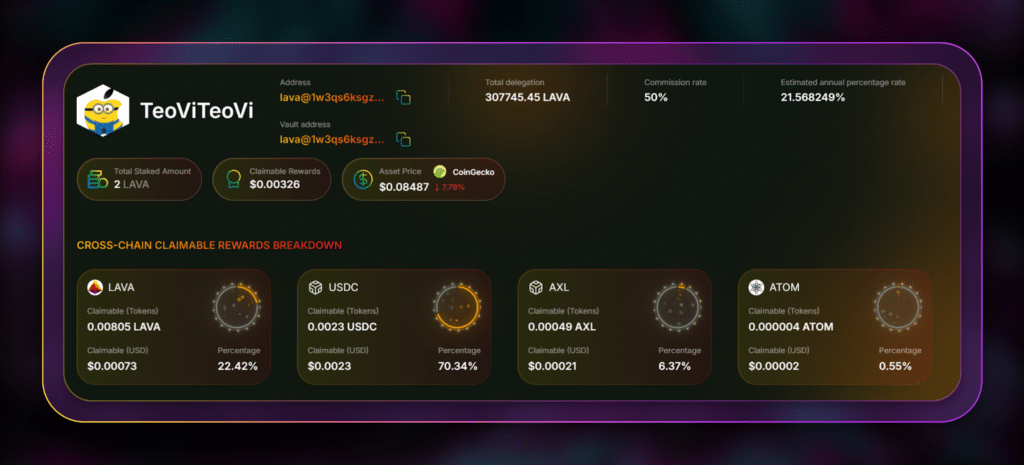

Traditionally, staking rewards investors in the native token. Staking Ethereum earns ETH rewards, and staking Solana earns SOL. But newer protocols like Lava Network allow cross-chain staking, meaning you can earn multiple tokens from a single staking position.

Using Polli.co, a staking optimization platform, you can restake Lava tokens to RPC providers and receive rewards in LAVA, USDC, Axelar (AXL), and Cosmos (ATOM). The platform spreads your yield exposure across multiple assets.

Balance Bitcoin vs Alternative Cryptocurrencies (Altcoins)

Bitcoin is the most established crypto asset, accounting for 60% of the market cap. While it’s relatively stable, its growth potential is lower than smaller altcoins.

By allocating a portion to strong altcoins, crypto investors gain exposure to potential high-growth opportunities while benefiting from Bitcoin’s stability.

During Ethereum’s early days, from 2016 to 2018, ETH massively outperformed BTC, giving investors higher returns. However, by 2019, ETH’s outperformance had faded. This underperformance highlights the importance of adjusting allocations over time.

Hedge With Non-Crypto Assets

Your asset allocation depends on age, risk appetite, and other personal factors. If you don’t have the risk tolerance to ride the volatility of the crypto market, you can diversify into traditional asset classes such as stocks, real estate, and cash.

Balance out your crypto holdings with low-risk positions in cash time deposits, government treasury bills, and bonds.

Spread Across Different Storage Solutions

Crypto portfolio diversification isn’t just about allocating to different crypto assets. The crypto market also carries significant counterparty and security risks.

Keeping all your funds on a centralized exchange means that if the exchange collapses, your crypto holdings could go with it. Similarly, you may store all your assets on a crypto wallet like Phantom or Solflare. However, a self-custody solution exposes you to bad actors who may target you through phishing or social engineering.

The Benefits of Crypto Portfolio Diversification

Diversifying your crypto portfolio isn’t just about avoiding losses. Diversification comes with benefits that can enhance your overall investment strategy:

Increasing Exposure to Growth Opportunities

New crypto sectors like Real-World Assets, AI-driven protocols, and memecoins are emerging rapidly. A diversified portfolio ensures you don’t miss out on high-growth opportunities.

Early adopters of Celestia in 2023 saw massive gains of up to 1,000%. Those who only held Bitcoin missed out on Celestia’s gigantic rally.

Generating Passive Income from Multiple Sources

You can earn rewards through multiple yield-generation strategies by holding different types of crypto assets.

- Staking rewards from PoS (PoS) and Delegated-Proof-of-Stake (DPoS) blockchains.

- Yield farming in decentralized finance protocols.

- Liquidity Pools where you farm rewards from two or more tokens.

Yield-generating activities encourage you to hold onto assets longer as you gain staking rewards, which you can then liquidate for expenses.

Avoiding the Risk of Ruin

The risk of ruin is the chance of losing all or a significant amount of your investment. The loss can become so severe that you have no more funds to invest in the markets.

By diversifying across different asset classes, such as low-risk assets like cash, you ensure you’ll always have a fund to deploy back into the market.

Tying It Together: Diversifying Smartly

A well-diversified crypto portfolio helps you navigate the market’s volatility while maximizing growth opportunities. By spreading investments across different assets, strategies, and timeframes, you reduce risk from sudden crashes, capture high-growth potential in emerging sectors, and generate passive income through staking and DeFi.

Instead of chasing quick gains or betting everything on one token, a balanced approach allows you to participate in the market’s upside while minimizing downside risks. A diversified strategy ensures you stay in the game, no matter what happens in the crypto space.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

March 6, 2025

August 5, 2025