Digital Asset Treasury Companies: Wall Street’s Crypto Bet

Have you ever read a headline about publicly listed companies investing in cryptocurrency?

Dubbed Digital Asset Treasury (DAT) companies, these firms rewrite corporate finance playbooks by holding cryptocurrencies, such as Bitcoin and Ethereum, on their balance sheets.

Crypto is no longer the domain of individual investors or hedge funds; it has now become part of boardroom strategy.

This institutional sentiment shift is not just a trend, but a strategic move: corporations are increasingly treating Bitcoin and digital assets as long-term stores of value and even competitive differentiators.

In today’s article, we explore the following:

- What are digital asset treasury (DAT) companies?

- Which are the most popular DATs?

- The Financial Alchemy of DATs

- How DATs affect crypto staking

…and much more!

What is a Digital Asset Treasury (DAT) Company?

A Digital Asset Treasury (DAT) company allocates a portion of its corporate treasury reserves into digital currencies such as Bitcoin or Ethereum. This investment strategy allows the company to capture volatility and upside in digital assets.

DATs trade on the New York Stock Exchange or other global exchanges.

Some DATs may have operated initially in other industries. However, they have chosen to focus solely on crypto for their new operations.

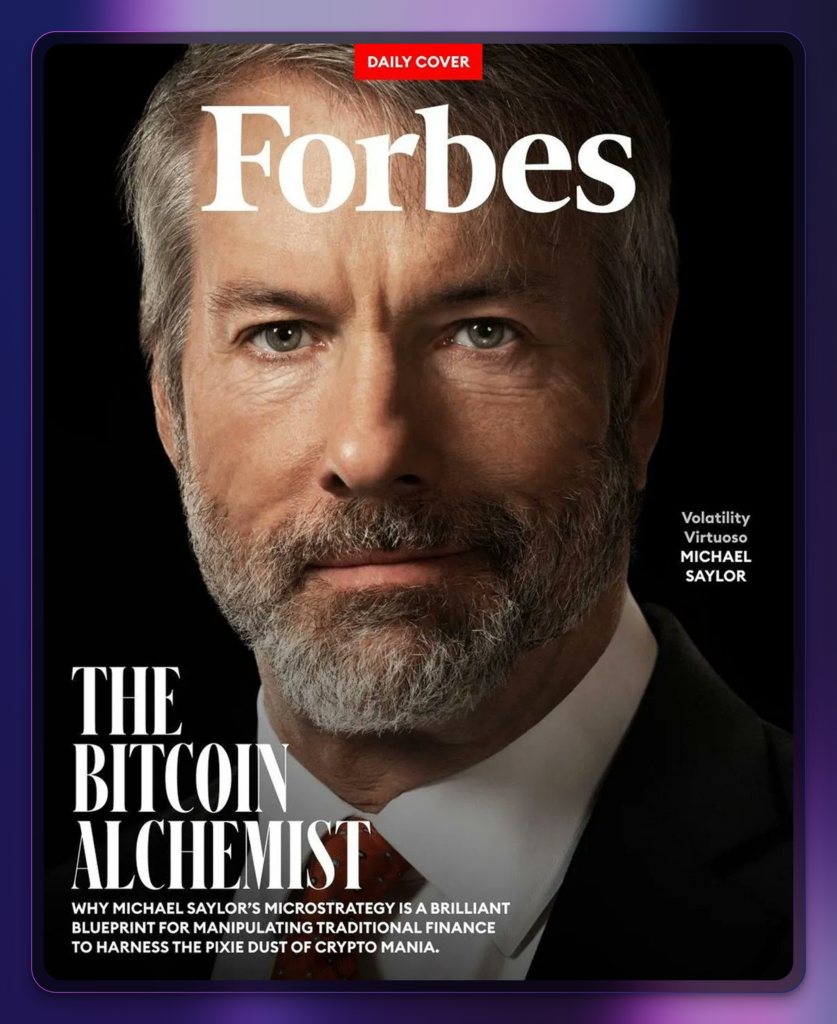

Strategy (formerly Microstrategy) is the largest DAT as of writing. Michael Saylor founded the company in 1989 as a software company. Around 2020, the company’s shares were traded as a Bitcoin proxy due to their enormous exposure to crypto.

When people think of Strategy today, they think more about its Bitcoin holdings than its software operations.

Other DATs maintain a smaller exposure to crypto relative to their other assets. These companies maintain regular non-crypto operations but hold crypto to diversify exposure.

Tesla and Figma both hold Bitcoin on their balance sheets, but operate in the Electric Vehicle and Software Design industries, respectively. These companies hold digital assets for potential gains to their treasuries.

The Most Popular DATs and Their Holdings

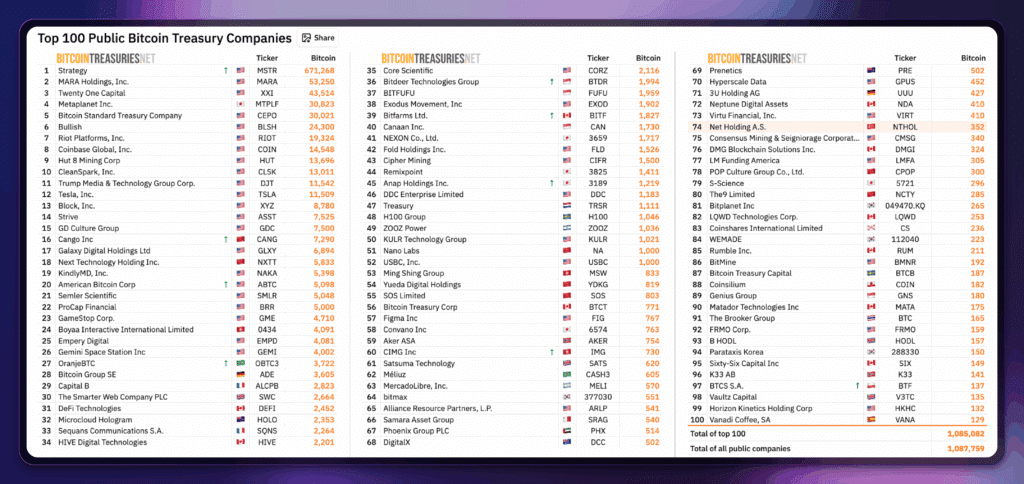

Hundreds of corporations own cryptocurrency on their balance sheets.

Bitcoin Treasuries tracks every publicly listed corporation holding Bitcoin. As of the time of writing, nearly 200 companies own Bitcoin. The list excludes companies storing Ethereum, Dogecoin, and other cryptocurrencies.

Here’s a short list of the most popular companies with crypto exposure as of December 2025:

Strategy

Strategy is the poster child of DATs.

Strategy holds over 670,000 BTC, the largest corporate treasury stash of Bitcoin in the world. The company owns over 3% of Bitcoin’s supply.

Given their massive holdings, the crypto world closely watches the company’s every move.

Tesla

Tesla, the electric vehicle manufacturer owned by Elon Musk, famously bought $1.5 billion worth of BTC in 2021. At the time, the purchase signalled to the world that institutions were willing to bet big on Bitcoin.

While Tesla later sold part of its Bitcoin position, Tesla remains a major corporate holder with 11,509 BTC. This amount is sufficient to place Tesla among the Top 15 companies that hold BTC.

Metaplanet

Metaplanet is a publicly listed Japanese company that previously operated a chain of budget hotels. The company pivoted to a Bitcoin treasury company and aims duplicate Strategy.

Metaplanet is the fourth-largest Bitcoin DAT.

BitMine

BitMine is the biggest Ethereum digital asset treasury. Led by money manager Tom Lee, the company holds 3% of the ETH supply.

The company is Ethereum’s equivalent of Strategy. ETH investors watch BitMine closely as it does, and what it says affects Ethereum’s price performance.

Forward Industries

Forward Industries is the most notable Solana DAT with over $1.5 billion invested in SOL.

Galaxy Digital, Multicoin Capital, and Jump banded together to form the company.

What Cryptocurrencies Do DATs Acquire?

Most DATs focus heavily on Bitcoin, treating it as “digital gold.”

As the largest and longest-standing crypto by market capitalization, Bitcoin serves as a scarce, non-sovereign, inflation-resistant asset. Bitcoin’s fixed supply of 21 million coins makes it attractive for long-term treasury preservation.

Some younger DATs, however, have diversified into other assets:

- Ethereum (ETH): Viewed as the “programmable money” powering smart contracts and decentralized finance (DeFi).

- Other strategic crypto assets: Corporations may invest in Hyperliquid (HYPE), Solana (SOL), Worldcoin (WLD), or other projects aligned with their interests.

- Memecoins: As strange as it sounds, some DATs acquire memecoins. CleanCore aims to acquire 1 billion DOGE. These DATs may be acquiring memecoins primarily for the upside in price.

By and large, Bitcoin remains the crown jewel of digital asset treasuries.

Financial Alchemy Meets Bitcoin

When Strategy first entered Bitcoin, it wasn’t just about “buying and holding.”

Michael Saylor effectively transformed the company into a proxy Bitcoin exchange-traded fund (ETF) by using its balance sheet to fund Bitcoin acquisitions.

Here’s how the “financial alchemy” works:

Important Metrics:

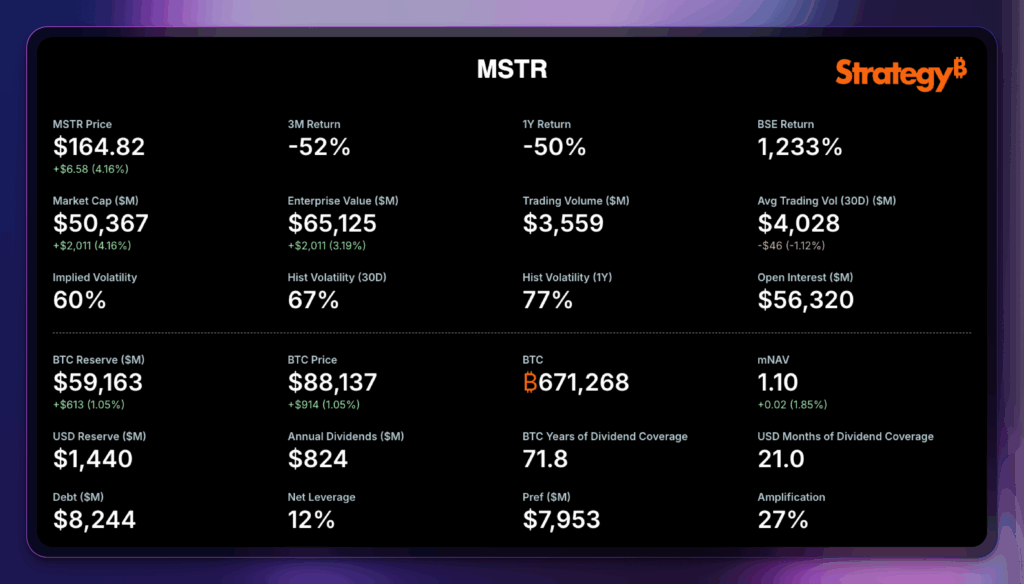

- Enterprise Value: The market capitalization of Strategy’s shares less cash balances.

- BTC Reserves: The market value of Strategy’s Bitcoin stack, computed by multiplying its BTC holdings by the current BTC price.

- Bitcoin Market NAV (mNAV): Investors began valuing the company through a new lens, heavily tied to the market value of its Bitcoin stack. Derived by dividing the Enterprise Value by BTC Holdings.

When Bitcoin’s price rose, Strategy’s mNAV increased significantly, as investors were willing to pay a premium for its Bitcoin holdings. This “premium” allows Strategy to deploy methods that will enable the company to raise more funds to buy even more Bitcoin.

The Playbook

Strategy employs a series of methods to raise funds for purchasing Bitcoin.

The company can raise capital by issuing convertible notes and bonds, and then use the proceeds to purchase Bitcoin. It can also issue new shares, effectively using investor demand for Bitcoin exposure to fund further purchases.

The Alchemy

A dollar raised via debt or equity could be leveraged into a dollar or more of Bitcoin Holdings, as long as BTC appreciates.

Investors wanting Bitcoin exposure without custody risk treated MSTR as a publicly traded Bitcoin vehicle, paying a premium over its BTC NAV.

The above creates a feedback loop: higher Bitcoin → higher mNAV → higher MSTR stock → easier to issue more debt/equity → more Bitcoin purchases.

The Big Risk: When DATs Collapse

Given that DATs rely on the mNAV premium to raise capital, a deterioration in this metric would force them to sell digital assets to maintain their share price.

In October 2025, ETHZilla, an Ethereum treasury, sold $40 million in ETH to fund its share repurchase plan. In November 2025, Sequans, a French Bitcoin DAT, sold its Bitcoin to help pay off debt.

When a DAT trades below mNAV, companies face immense pressure to sell their crypto assets to fund share buybacks, in an attempt to stabilize the stock price. This forced selling adds further supply to an already weak crypto market, accelerating the price decline.

DATs also rely on leverage, funding purchases through bonds and other debt instruments. In November 2025, Metaplanet obtained a $100 million loan to buy more Bitcoin. The company utilized its existing Bitcoin holdings as collateral.

As DATs are a relatively new concept, we have yet to see how most of them will react in a prolonged crypto bear market. A significant drop in asset prices erodes the value of their collateral, potentially forcing them to sell their digital assets quickly.

How do DATs Affect Crypto Staking?

Every company aims to maximize returns from its cryptocurrency holdings. For DATs that acquire Proof-of-Stake (PoS) crypto like Ethereum, the answer lies in crypto staking.

SharpLink Gaming, the second-largest ETH DAT, publishes monthly reports on its ETH holdings and staking rewards. The company utilizes both native staking and liquid staking.

As of December 2025, SharpLink reported staking rewards totaling 9,241 ETH since the start of operations in June 2025.

For the staking industry, this increased institutional adoption signals a shift in sentiment.

Staking isn’t just for crypto natives; it’s for everyone who wants to get extra yield on their crypto assets. And every day, investors who want to gain similar exposure can simply purchase the publicly listed companies that are staking their holdings.

Closing Thoughts on DATs

Digital Asset Treasury companies represent the intersection of Wall Street and cryptocurrency innovation. By holding Bitcoin and other digital assets, these firms have reshaped corporate strategy, whether through MicroStrategy’s financial engineering, Tesla’s bold balance-sheet move, or Metaplanet’s regional leadership.

As more DATs experiment with Proof-of-Stake assets and staking rewards, they may become not just passive holders but active participants in crypto ecosystems.

For investors, watching DATs is no longer optional; it’s essential to understanding how institutions are shaping digital finance and how you can participate.

Frequently Asked Questions

What is DAT in Crypto?

A Digital Asset Treasury (DAT) company is a publicly listed firm that allocates a portion of its corporate reserves to cryptocurrencies, such as Bitcoin or Ethereum.

What is the Point of a Digital Asset Treasury Company?

DATs utilize crypto as a strategic asset, either as a long-term store of value, a hedge against inflation, or a means to provide investors with indirect exposure to digital assets.

Are ETH Treasury Companies Staking Digital Assets?

Yes, several ETH-focused DATs stake their holdings to earn additional rewards, with firms like SharpLink Gaming reporting regular staking yields.

What are Some Examples of Digital Asset Treasuries?

Popular DATs include MicroStrategy (Bitcoin), Tesla (Bitcoin), Metaplanet (Bitcoin), BitMine (Ethereum), and Forward Industries (Solana).

Editor’s Note: This article was originally published in September 2025 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

December 21, 2025

December 28, 2025