Understanding Crypto Staking Taxes

Crypto staking is often marketed as passive income.

But when tax season arrives, many stakers realize it’s anything but passive.

Whether you’re earning rewards in ETH, SOL, or ATOM, staking introduces a layer of tax complexity that many crypto holders overlook.

Are staking rewards taxable? Is crypto staking income taxed differently from trading?

The answer depends heavily on your tax jurisdiction.

In this guide, we break down the tax implications of crypto staking for our U.S. and Singapore readers. We explain:

- How staking is typically taxed

- What you should track to compute staking taxes

- What you need to know to stay compliant

Let’s jump in!

What are Crypto Staking Rewards?

Before anything, here’s a refresher.

Crypto staking is the process of locking your digital assets to support a blockchain’s operations by validating transactions and securing the network. Staking works in networks that utilize Proof-of-Stake and Delegated-Proof-of-Stake consensus mechanisms.

In return for supporting the network, you receive staking rewards in the form of the network’s native token.

Understanding the Tax Framework for Staking

Before diving into reporting, it’s essential to understand how crypto staking is taxed at a high level.

Both the U.S. and Singapore treat crypto staking rewards as taxable in some form. The two countries differ in how and when they are taxed.

Staking rewards are viewed as income when received and as capital assets when later sold or disposed of.

However, in some jurisdictions like Singapore, your status, whether an individual or professional investor, will dictate how much tax you owe.

United States: How Staking Is Taxed

In the U.S., the Internal Revenue Service (IRS) treats staking rewards as income when you gain control of the tokens. This means that:

- The government taxes the fair market value (USD) of your staking rewards at receipt

- You must report staking rewards even if you don’t sell them

- Income is taxed at your tax bracket

Later, if you sell or swap those rewards, you also owe capital gains tax based on the price change from when you received them.

Here’s an example:

- Irene receives $1,000 of Ethereum in staking rewards

- When Irene decides to sell, the value has risen to $1,200

- Irene recognizes $1,000 of income and $200 of capital gains

This “double-layer” taxation is one of the most important crypto staking tax implications for U.S. residents.

Singapore: How Staking Is Taxed

Singapore is a global crypto and financial hub with no capital gains tax for crypto investors. However, the country may tax your crypto and staking rewards depending on the context:

If staking is part of a business or profit-seeking activity, rewards are taxable. If staking is considered a personal investment activity, rewards aren’t taxed.

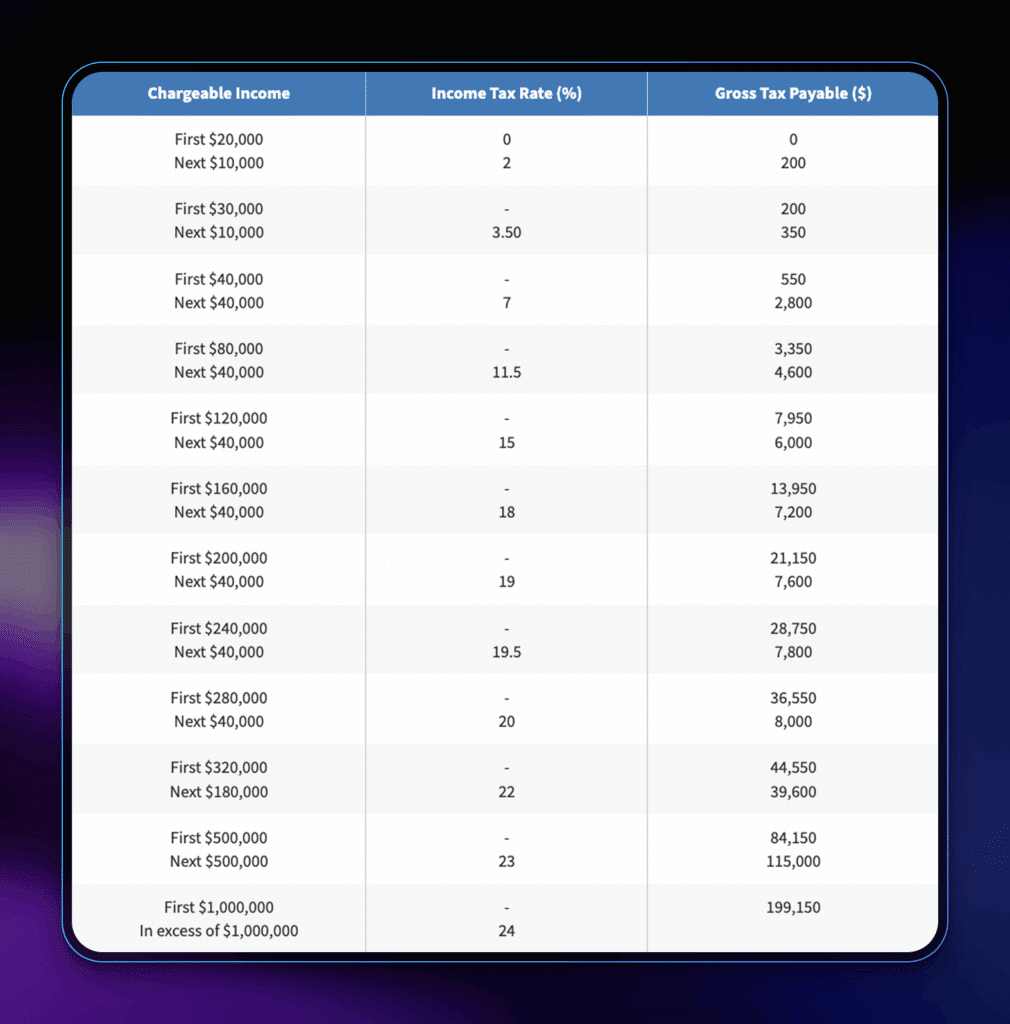

Let’s say you’re operating a large-scale crypto staking operation. This activity may be construed as a business activity and subject to income tax. The Inland Revenue Authority of Singapore (IRAS) will tax your staking rewards as follows:

This contextual tax rule makes Singapore more favorable for retail crypto participants.

How to Report Staking on Your Tax Return

Accurate crypto staking tax reporting starts with good records.

What You Should Track

Regardless of jurisdiction, you should track:

- Date staking rewards were received

- Token type and quantity

- Market price at receipt

- Wallet or platform used

- Transaction IDs

Using a crypto tax calculator or software can automate much of this process. This software is especially useful if you’re staking across multiple networks.

Top Crypto Tax Calculators

While there aren’t crypto tax calculators designed explicitly for crypto staking, you can still utilize them in recognizing your crypto capital gains.

- CoinLedger: a US-focused tax calculator that covers even NFTs and DeFi.

- Koinly: similar to CoinLedger, the platform focuses on IRS and state tax reporting.

- TokenTax: crypto tax software with in-house tax consultants.

Key Compliance Points

Staking has evolved beyond simple delegation. Understanding compliance risks is critical.

Frequency and Scale Matter

Occasional staking may be treated differently from high-frequency or institutional-scale activity, especially in Singapore. If you’re unsure about how your crypto and staking activities affect your taxes, consult a tax professional who is knowledgeable about crypto.

Platform Choice Doesn’t Eliminate Tax Obligations

Whether you stake through:

- Centralized exchanges such as Coinbase,

- Non-custodial wallets like Phantom

- Liquid staking protocols like Lido

Tax liability still applies.

Restaking and Liquid Staking Add Complexity

Newer innovations like restaking and liquid staking tokens may trigger additional reporting obligations depending on how rewards are structured. Consult with a tax professional to make sure.

Final Thoughts on Crypto Staking Taxes

Crypto staking is one of the most popular ways to earn yield in today’s market but it comes with real tax responsibilities.

Understanding whether crypto staking rewards are taxable, how staking income is classified, and how to properly report rewards can help you avoid surprises at tax time. As crypto tax guidelines continue to evolve, staying informed is just as important as optimizing yield.

When in doubt, document everything and consult a tax professional familiar with digital assets.

Frequently Asked Questions

Are crypto staking rewards taxable?

Yes. In the U.S., staking rewards are generally taxed as ordinary income when received. In Singapore, they may be taxable if considered part of a business or income-generating activity.

What are the tax benefits of crypto staking cryptocurrencies?

Staking can generate ongoing yield without selling your assets. In jurisdictions like Singapore, long-term holders may benefit from the absence of capital gains tax, depending on classification.

Do you pay capital gains tax on staking cryptocurrencies?

In the U.S., yes, capital gains tax may apply when you sell or swap staking rewards. In Singapore, capital gains tax generally does not apply.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

December 31, 2025

January 3, 2026