The Future of Staking: Trends to Watch for Crypto Passive Income

Holding cryptocurrencies is one of the most stressful things you can commit to. Crypto prices rise and fall quickly. Meanwhile, you may need funds and wonder how else you can earn from your digital assets.

With the growth of staking through popular networks like Ethereum, you now have a proven method to earn crypto passive income. You can liquidate these rewards to support your finances or stake them to compound your yields.

This article explores the current trends in staking crypto.

Throughout your reading, you’ll discover emerging narratives shaping staking and how to generate crypto passive income.

The Rise of Cryptocurrency Staking

Before staking, blockchains relied on a Proof-of-Work (PoW) consensus mechanism. Bitcoin, the most prominent blockchain, utilizes PoW and requires miners to solve complex equations to validate transactions. These miners assemble expensive hardware setups and consume high electricity.

Crypto staking, known as Proof-of-Stake (PoS), emerged as a counter to PoW. Instead of requiring you to set up high-end hardware, you must hold and lock up a certain amount of cryptocurrency.

Ethereum Beacon Chain and The Merge

Staking rose in popularity when Ethereum, the second-largest blockchain, shifted to a PoS model from PoW. Ethereum developers launched the Beacon Chain in December 2020 to test the Proof-of-Stake mechanism. Simultaneously, the Ethereum Mainnet continued to operate a PoW mechanism.

In September 2022, in what is known as The Merge, Beacon Chain and the Mainnet combined to transition Ethereum to a staking model fully. Since then, Ethereum staking has grown, with total staked ETH at $62 billion and 28.2% of all ETH staked.

Delegated-Proof-of-Stake (DPoS)

Proof-of-Stake, despite its upgrades from Proof-of-Work, still carries some criticisms. As a solo staker who sets up their staking hardware, you must possess some technical capabilities and the required 32 ETH. As of writing, 32 ETH amounts to approximately $60,000. This amount isn’t accessible to the regular crypto person.

With DPoS, you can delegate your stake to a validator. Institutions like Coinbase and Helius usually comprise these validators and possess the necessary technical and financial capacity. You can stake a minimal amount of a few dollars, opening the staking opportunity to virtually anyone.

Popular chains like Solana adopted a DPoS model and have grown in popularity. Solana’s staking market capitalization stands at $50 billion.

Emerging Staking Methods

While you can enjoy staking and its passive income potential, the yield-generating opportunities extend further. Crypto developers have invented ways to maximize staked assets, deploy them into the decentralized finance ecosystem, and validate other crypto projects.

Liquid Staking

Staking, whether PoS or DPoS, requires you to lock up your liquid assets for a fixed period. You can neither sell nor transfer your crypto assets while staked.

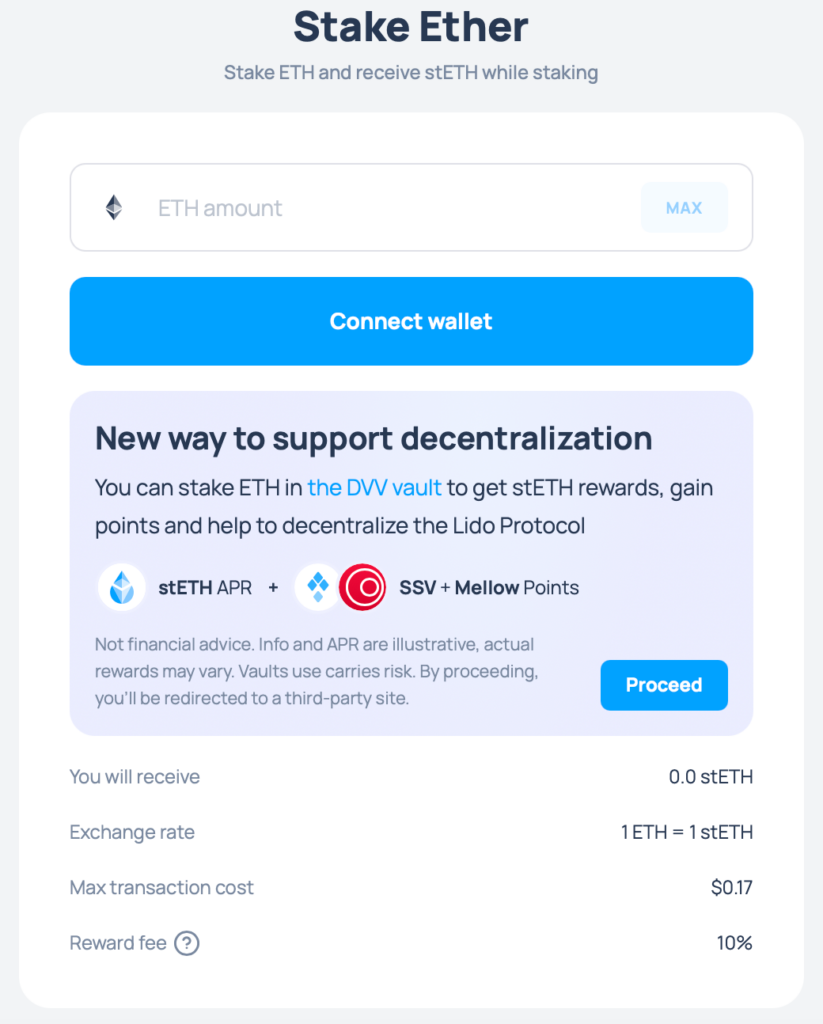

With liquid staking, you stake your crypto assets while retaining immediate access to your funds through liquid staking tokens (LSTs). You can trade or deploy these tokens in decentralized finance (DeFi) applications.

Lido Finance is the largest liquid staking protocol with $18.0 billion in total value locked. You deposit ETH into the platform and receive StETH in return. You earn rewards (also in StETH) and you can use the LST throughout the DeFi landscape.

Increasing Yield With Restaking

Through restaking, you take the staked digital assets and stake them again to compound returns. With restaking, you can contribute to the security of other crypto projects, among other use cases.

Restaking can significantly enhance staking yields over time, leveraging the power of compounding to generate passive income.

Lava Network is a new protocol that is powering blockchain data infrastructure. When you stake LAVA, their native token, you secure the Lava blockchain. With staking optimization platforms like Polli.co, you can restake or redelegate your staked assets to support Lava’s partner data providers. By restaking, you gain extra yield.

Bitcoin Staking, aka Bitcoin Restaking

Crypto developers have also created ways to extend the staking innovation to Bitcoin holders.

Until recently, Bitcoin holders had no direct means to generate passive income from their tokens. To do so, you must bridge your BTC to the DeFi space, exposing yourself to smart contract risks.

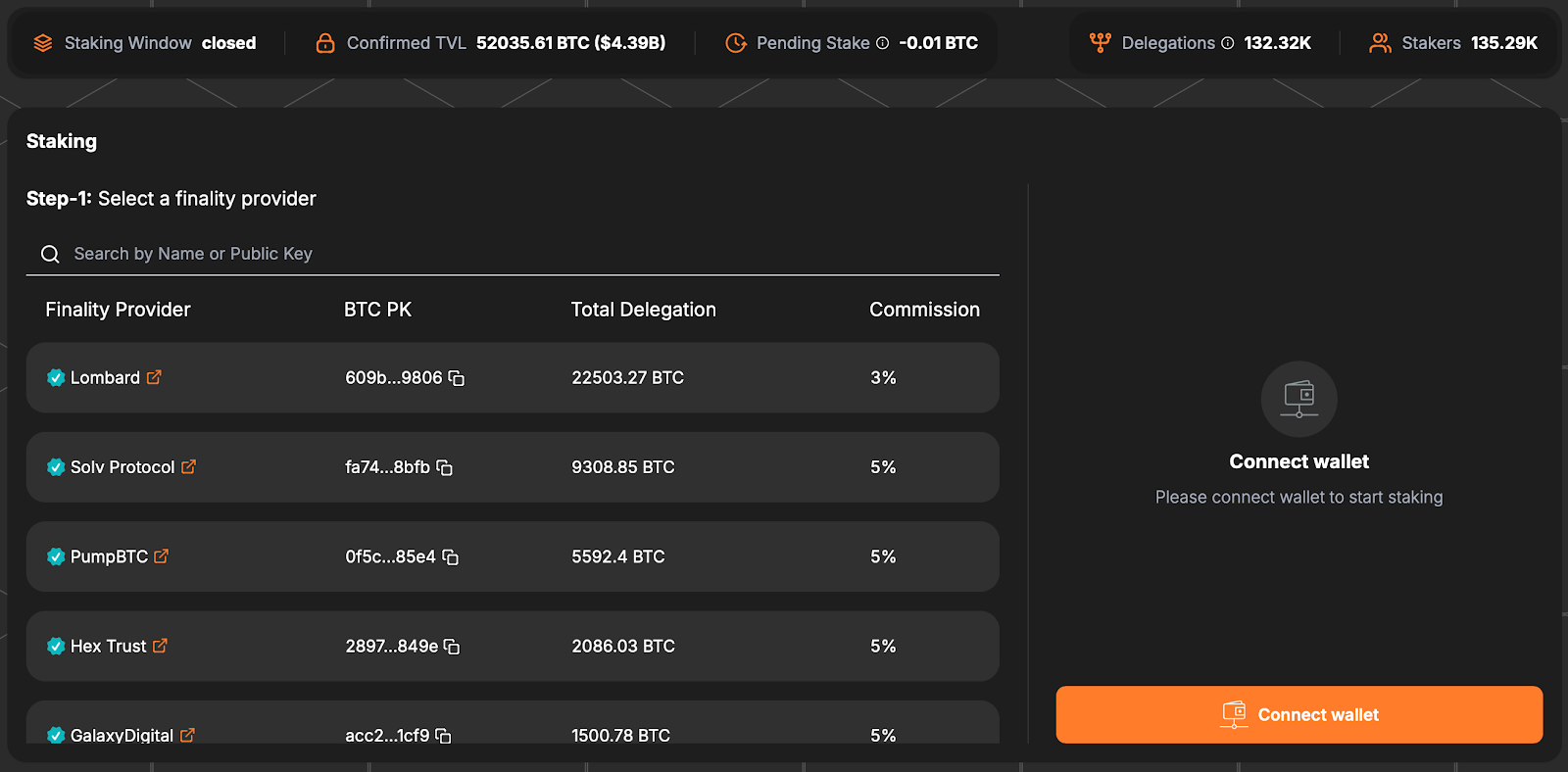

Through projects like Babylon, you can stake Bitcoin to provide security to PoS chains and earn rewards. Babylon has exploded in popularity since its launch in 2023, with the total value locked reaching $4.4 billion.

Other Passive Income Strategies

While staking is the largest method for earning crypto passive income, several alternative strategies have gained traction:

Liquidity Pool (LP) Farming to Earn Passive Income

Also known as yield farming, LP farming supplies crypto to decentralized exchanges (DEXs) or lending platforms to facilitate trading and lending activities. When you provide liquidity, you earn a portion of the transaction fees.

A liquidity pool can consist of two tokens, like Bitcoin and Ethereum, or a single token pool, like a stablecoin.

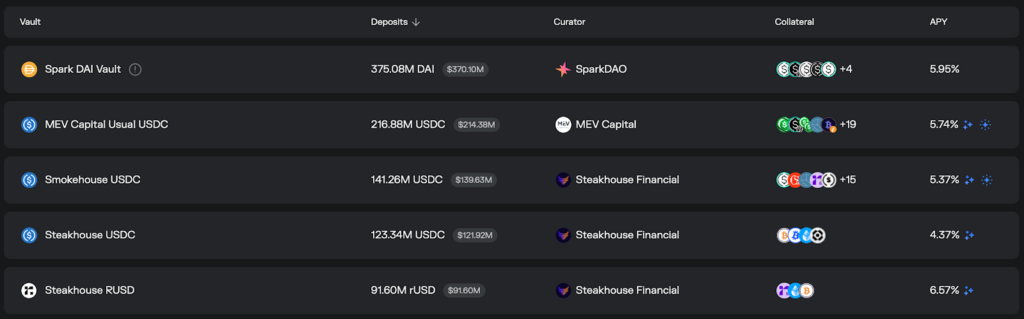

Morpho is an emerging crypto-lending protocol. You can borrow crypto and pay an interest fee or provide liquidity to earn passive income.

Playing Crypto Games for Crypto Income

Crypto-based games offer players opportunities to earn passive income through gameplay. You can accumulate rewards, which can increase over time.

Onchain Heroes is a crypto-backed idle role-playing game that became popular in early 2025. Several players reported earning hundreds of dollars in passive income every day.

Risk Management in the Passive Income Ecosystem

While the potential for earning passive income through staking and related strategies is appealing, it is essential to consider and manage associated risks. Nothing in this world is risk-free.

Decrease in Staking Rewards

Developers design staking rewards to incentivize stakers and validators early in the network’s lifecycle. Once the network stabilizes and more stakers join, these staking rewards decrease. Ethereum stakers witnessed the staking rewards drop from 15% to 3% yearly.

Additionally, some networks have mechanisms that reduce rewards over time to control token inflation.

Stay informed about the reward structures of the networks and adjust your passive income strategy accordingly.

Drop in Crypto Prices

Cryptocurrency price volatility can impact the value of staked assets and passive income.

Most staking programs return up to 20% per annum. However, crypto prices can drop 50% to 90% during a downturn. While you may be earning passive income through staking, the return would not be sufficient to cover the loss in staked assets.

For the reason above, some investors may choose alternative passive income methods like yield farming as they can perform this with stablecoins.

Security Risks Involved

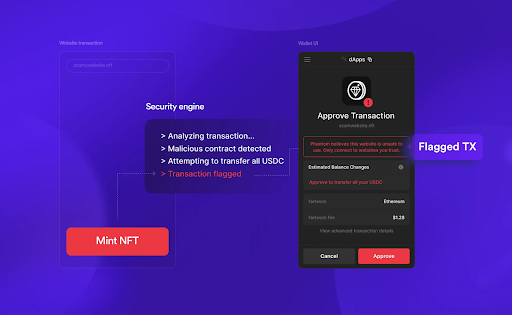

Whether you’re staking or exploring other passive income strategies, you must be careful of bad actors in the space. Cyberattacks and malicious actors are out to steal your cryptocurrency, and they are on the rise.

Double-check the DeFi websites that you visit and think before signing any transactions, as these could drain your crypto wallet.

Pay attention to the message in your crypto wallet to determine if it is a suspicious website or a malicious transaction. A wallet like Phantom or Solflare can perform most staking and DeFi activities and has built-in security features.

Final Thoughts: How Investors Can Adapt to Passive Income Trends

While staking and DeFi appear here to stay, they continuously evolve. Liquid staking and restaking have recently emerged as ways to earn passive income. Meanwhile, crypto lending and liquidity farming continue to grow in adoption.

To navigate these environments, you should stay informed about emerging trends and assess their risks before making significant investments. Most importantly, you should gain exposure to these passive income strategies. By doing so, you can position yourself to capitalize on future developments in the crypto market.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

April 4, 2025

September 3, 2025