What is Chainlink? A Newbie’s Guide to Chainlink and Chainklink Staking

In 2022, the National Basketball Association launched The Association, a set of non-fungible token (NFT) digital player cards ahead of the 2022 NBA Playoffs. The digital card changed design whenever a player or the team accomplished pre-set goals during the Playoffs.

The Stephen Curry card displays the gold championship trophy on the right-hand side as the team won the NBA championship. Stephen Curry and Jayson Tatum cards display icons at the bottom based on player achievements such as steals, three points, and other factors.

Technology must connect the blockchain (NFTs) to real-world data like NBA statistics to make The Association NFTs come to life. That’s where Chainlink steps in.

In this article, we’ll discover what Chainlink is and how you can participate in this ecosystem through Chainlink staking.

How Does Chainlink Work?

Chainlink is a decentralized oracle network (DON) that connects blockchain-based applications to non-blockchain data. To illustrate this, imagine four parts:

- Real World: Where we interact daily. This could be in the physical or online, non-blockchain space.

- Real-World Data: Our interactions and environment generate data. Consider the weather, bank transactions, or financial markets.

- Oracle Network: Chainlink Node operators that run the Chainlink client software on computers. They retrieve Real World Data.

- Smart Contract: Self-executing code that runs when certain conditions are met.

Chainlink plays a crucial role by enabling smart contracts to connect securely to external data sources. Its decentralized oracle network ensures that data from off-chain sources (such as financial markets, weather data, or sports scores) is accurately and securely fed into blockchain-based applications.

What is Chainlink Token?

The Chainlink token, otherwise known as LINK, is the native cryptocurrency of the Chainlink network.

Here’s how LINK tokens are used within the Chainlink ecosystem:

Payment for Oracle Services

Data requestors pay Chalinlink node operators LINK to retrieve and supply off-chain data to smart contracts.

For example, a Decentralized Finance (DeFi) app requires real-time cryptocurrency price data. The developers must pay Chainlink node operators in LINK tokens to securely fetch and deliver this data.

Collateral in DeFi

LINK can also be used in decentralized finance (DeFi) protocols.

For example, users can lock up their LINK in lending platforms like Aave or Compound to borrow other assets or earn interest.

Incentivizing Node Operators

Chainlink node operators stake LINK tokens as collateral to ensure network security. If they provide insufficient data or engage in malicious activity, they risk losing some of their staked LINK.

This system incentivizes trustworthy behavior, as operators want to avoid being slashed and losing collateral.

In the next section, we discuss how all this ties into Chainlink staking.

What is Chainlink Staking?

Chainlink staking is a mechanism that allows LINK token holders and node operators to lock up or stake their tokens. It helps secure the network.

While Chailink staking may sound similar to Ethereum or Solana staking (as discussed in previous blogs), the two accomplish different goals.

Blockchain validators verify transactions and produce blocks. Staking ensures this, as a malicious validator could have their staked assets penalized. Chainlink staking or decentralized oracle network staking incentives accurate reporting of Real-World Data. Should a node report false data, then the staked LINK gets penalized.

By staking, participants support the reliability of the Chainlink network while earning rewards in the form of additional LINK tokens.

Chainlink Staking Program

To engage in the Chainlink Staking Program, visit the Chainlink Staking website and click Stake Link. Once on the staking page, you can connect your Ethereum wallets, such as MetaMask or Rabby Wallet, to stake your LINK tokens.

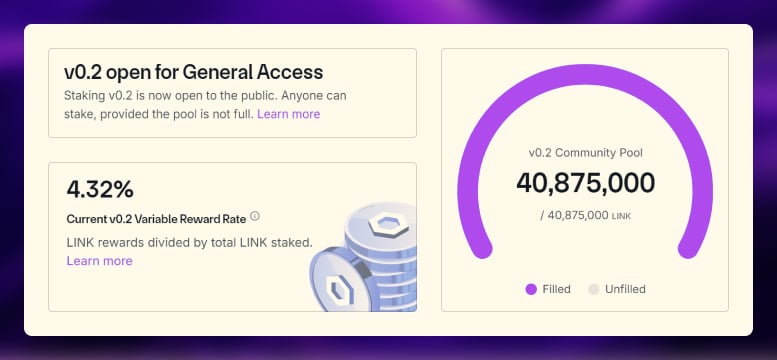

The current program, Chainlink Staking v0.2, was a huge success. When the last Chainlink community pool opened last December 2023, stakers filled out the pool in 6 hours.

As such, Chainlink staking is currently unavailable as the staking pool is fully occupied. Keep an eye out for when they decide to launch an expanded pool size.

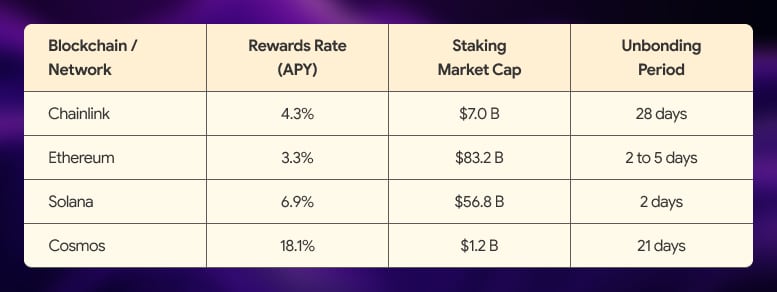

Staking Chainlink Compared to Other Cryptocurrencies

At Solo Stakers, we’ve covered staking across several networks, such as Ethereum, Solana, and Cosmos. This allows us to make a cross-network comparison.

Staking link tokens provide relatively low staking rewards at 4.3% APY while requiring a long unbonding period of 28 days.

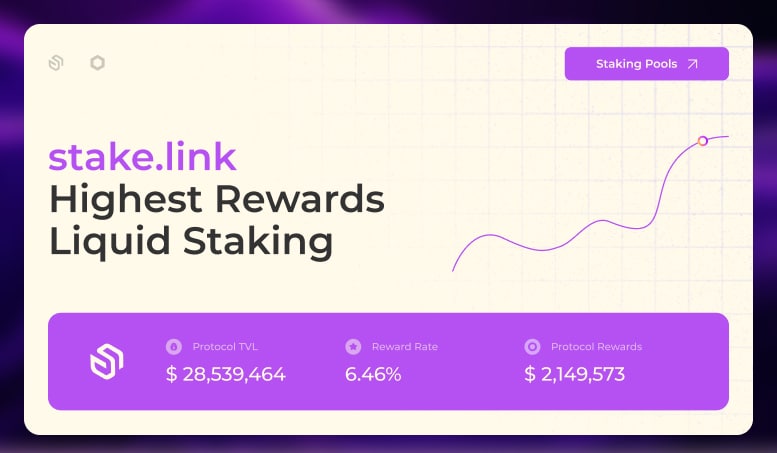

Liquid staking offers an alternative versus staking directly on a network, bypassing these long unbonding rates.

Stake.Link (SDL) is a liquid staking platform that offers even better staking rewards at 6.35% APY. This Chainlink staking platform provides a dynamic rewards mechanism and allows you to earn SDL, its native protocol token.

Link stakers have deposited over $30 million into the platform.

With the current cap on the Chainlink community pool, there’s plenty of room for ecosystem participants to build staking solutions.

Chainlink Staking: Is it worth it?

If we look at standard metrics such as rewards rate and unbonding period only, it would be difficult to recommend Chainlink staking versus other network staking programs.

However, it’s best to remember Chainlink is not a blockchain but a decentralized oracle network that enables real-world data to transform into blockchain data.

As blockchain gains more adoption and real-world applications enter the industry, Chainlink will adoption will also increase. This could potentially lead to more staking programs and higher incentives as seen in other networks.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

October 10, 2024

August 4, 2025