Maximizing Your Earnings: A Guide to Cosmos Staking Rewards

Cosmos is a decentralized ecosystem of independent blockchains that can interact with each other. This interconnectivity enhances the scalability, usability, and interoperability of each network.

Like other blockchains, Cosmos offers investors passive income opportunities through Cosmos staking. By participating in staking, token holders help maintain the decentralized infrastructure of the Cosmos Hub.

In this guide, we’ll teach you how to maximize your Cosmos Staking Rewards:

- How does staking work in the Cosmos Network

- How are staking rewards distributed

- What are the benefits and risks of staking your Cosmos assets

- How investors can maximize their earnings through Cosmos staking

…and many more.

Continue reading to learn more!

How Does Cosmos Staking Work?

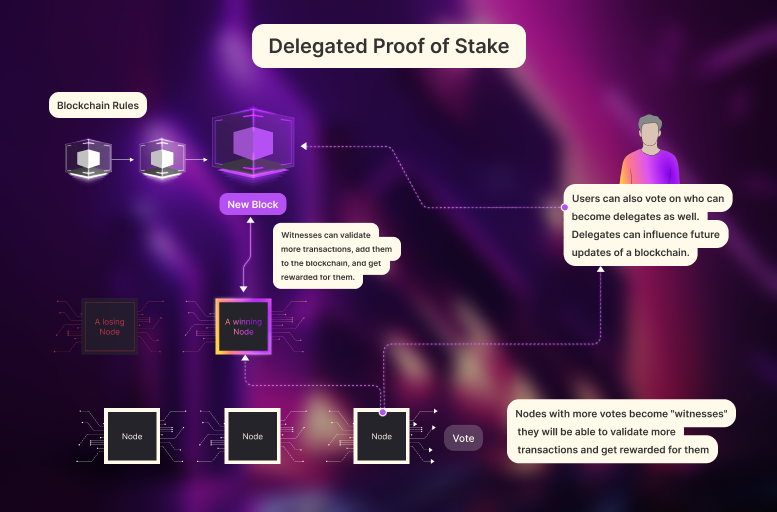

The Cosmos staking program follows a Delegated Proof-of-Stake (DPoS) system.

Token holders (delegators) delegate their ATOM (the native token of the Cosmos Hub) to trusted validators who verify transactions. In exchange, validators share the rewards they earn with their delegators. Validators’ performance and network participation determine the net staking rewards. Validators also deduct a percentage rate as commission.

While it is possible to set up your validator, you would need the technical know-how and financial resources to make this feasible. Cosmos currently has 180 validators. You must attract sufficient delegates (voting power) to become an official validator.

You would need approximately 10,600 ATOM tokens, nearly to $50,000 as of the time of writing, This amount of ATOM will enable you to reach the top 180 validators.

Cosmos can increase the validator cap through a governance process; however, the validator cap hasn’t changed in a few years.

How are Cosmos Staking Rewards Distributed?

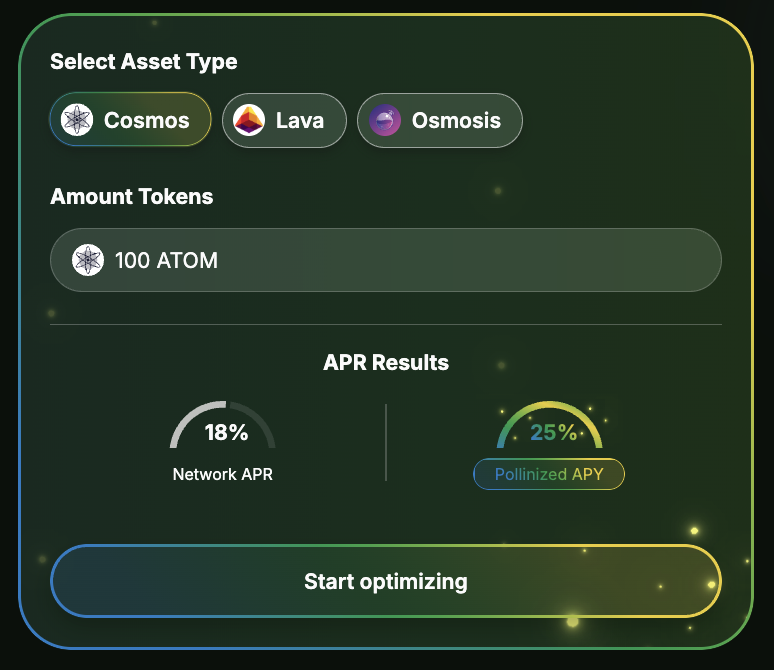

The current Cosmos staking rewards rate is around 18% APR. You receive staking rewards every 6 to 7 seconds. This waiting period is the time it takes to process a new block.

Staking optimization platforms like Polli.co offer above-market rates. The platform makes these high staking rates possible through the use of innovations like AI agents, auto-compounding of rewards, and intelligent staking re-delegation.

Centralized exchanges such as Coinbase pay staking rewards every seven days. This prolonged payout frequency could have adverse effects on compounding your staking rewards.

Make sure to choose platforms wisely.

What are the Benefits of Staking Cosmos?

Cosmos staking enables you to generate rewards while contributing to the overall operations of a blockchain.

If you’re a long-term believer of Cosmos, you should maximize ATOM staking rewards.

Passive Income in Atom Rewards

Staking ATOM is a popular way to earn passive income through the Cosmos blockchain. By locking up ATOM tokens, you earn regular staking rewards. This passive income method is much better than leaving your ATOM tokens unutilized.

ATOM stakers may also earn airdrops of new tokens within the ecosystem. Airdrops can provide you with outsized returns should these new tokens get listed through a token genesis event (TGE).

Network Security for Cosmos

By staking your ATOM, you contribute to the security of the entire Cosmos Hub. By selectively choosing validators, you can also help check specific validators with a high percentage of staked ATOM.

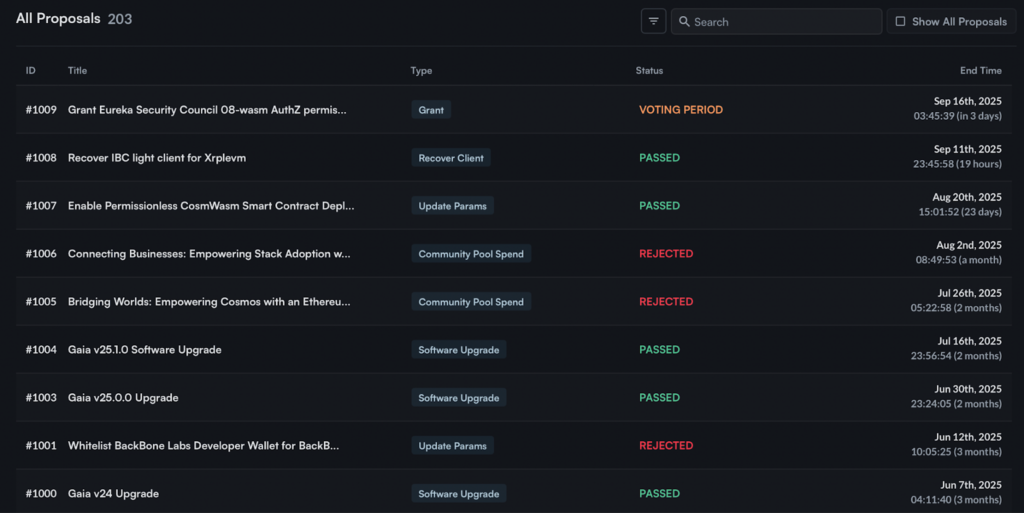

Governance Participation in Cosmos Ecosystem

ATOM stakers also have the privilege of participating in governance decisions. To qualify, you need to have staked at least 1 ATOM.

Cosmos operates as a community-driven ecosystem where token holders can vote on proposals that affect the development and direction of the blockchain. Whether it’s deciding on protocol upgrades, modifying economic parameters, or setting policies for validator behavior, stakers have a say.

It takes just a few clicks to stake ATOM and participate in the future for the chain.

Voting power is proportional to the number of tokens staked.

How to Maximize Cosmos Staking Rewards?

There are various ways to maximize your staking rewards. These may range from proper risk practices, such as diversification, to more complex techniques, such as engaging in decentralized finance (DeFi) operations.

Compounding Rewards

Cosmos staking does not natively offer auto-compounding of staking rewards. You will have to manually claim and stake the rewards.

Staking optimization platforms like Polli.co provide you such services, enabling you to earn above-market returns. Instead of withdrawing staking rewards, Polli determines the best time to claim the rewards and stake them.

Over time, this compounding effect can significantly enhance overall returns.

Delegate to Multiple Validators

Diversifying your delegation across several validators can help reduce risk and improve reward stability. While infrequent among the top validators, validators can go offline or experience slashing that would reduce your rewards and principal investment.

Regularly check the performance and reputation of your chosen validators to ensure continued profitability.

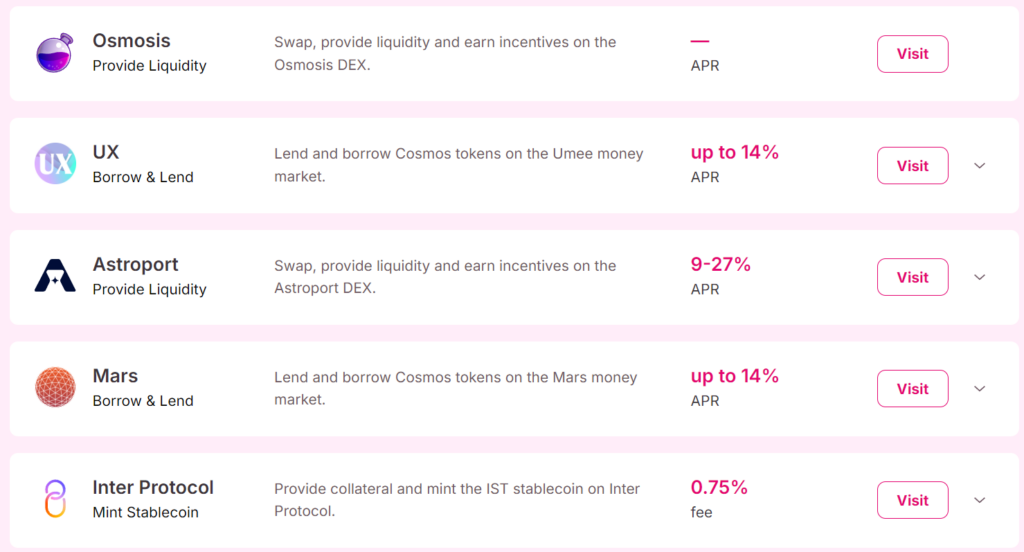

Decentralized Finance Opportunities

In regular staking, you delegate to a validator and earn ATOM tokens. In liquid staking, you can stake on a liquid staking platform like Stride and earn stATOM, the liquid staking token representing your ATOM tokens.

You can further deploy your stATOM tokens in the Cosmos DeFi ecosystem to boost your staking rewards. DeFi platforms such as Osmosis and Mars allow you to provide liquidity or lend your stATOM.

Risks Associated With Staking in the Cosmos Network

Staking ATOM offers an opportunity to earn passive income, but it also comes with several risks that you should consider.

Risks such as slashing to the overall market volatility of ATOM token prices can impact the value of your earnings. Understanding these risks is crucial to making informed decisions when staking on the Cosmos network.

Slashing

Slashing is a penalty imposed on validators for malicious behavior or failing to meet performance standards, such as a prolonged downtime.

A validator loses a portion of its staked ATOM if it gets slashed. This penalty also applies to the ATOM tokens staked by delegators to that validator.

Slashing incentivizes validators to act honestly, ensuring the network remains secure. However, for delegators, choosing a reliable validator is crucial. Slashing penalties range from 0.01% to 5% of staked ATOM, depending on the infractions.

Liquidity Risk

When you unstake your ATOM tokens, they are locked in the network for an unbonding period of 21 days. During this time, you cannot transfer or sell your staked tokens.

If the market experiences significant fluctuations, you won’t be able to capitalize on favorable price movements or mitigate losses during a downturn. This lack of immediate liquidity has led others to explore liquid staking opportunities.

Market Volatility

Staking Cosmos generates rewards in ATOM tokens. Those rewards’ fiat value (when converted to USD or another real-world currency) can fluctuate based on ATOM’s price movements.

Over the past three years, the ATOM token price has fluctuated from $3.75 to $17 per token. As of the time of writing, the token price has settled at $6.50.

Most likely, you purchased your staked ATOM at a higher price and would be at a loss if converted to fiat. Unfortunately, the staking rewards wouldn’t be sufficient to cover the capital loss.

Frequently Asked Questions

Interested to learn more about Cosmos staking? Here are some commonly asked questions:

How do I Stake Cosmos?

You can stake ATOM in a variety of ways, from native staking to liquid staking, and optimization platforms like Polli.

Regardless of where you stake, you must have a Cosmos-supported browser wallet like Keplr and Leap, or a hardware wallet like Ledger.

Should You Invest in Cosmos Staking?

Staking is a long-term game. So answering whether or not you should perform Cosmos staking depends on your belief in the ecosystem.

If you’re willing to hold the ATOM tokens long-term, then staking makes sense.

However, if you’re only looking to hold for a few days or weeks, you might want to evaluate if staking is right for you. Cosmos has a 21 day unbonding period which would tie up your capital for some time.

How Much APY Does Cosmos Staking Offer?

You can get around 17% natively staking ATOM through a wallet like Keplr. With staking optimization platforms the rate can go higher to 25% APY.

Conclusion

Staking ATOM is an excellent way for long-term investors to earn passive income while supporting the network’s operations and governance.

With staking rewards rates in the double-digit APY range, there are significant opportunities to grow your holdings. However, the process isn’t without risks. Slashing, liquidity constraints, and market volatility can impact your earnings. By choosing reliable validators and understanding the risks, you can maximize your staking rewards while mitigating potential downsides.

Happy Staking!

Editor’s Note: This article was originally published in September 2024 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

September 27, 2025

December 12, 2025