How Restaking Works With EigenLayer

Did you know that it's possible to generate more income out of your staked tokens?

Staking emerged as a highly popular investment opportunity in 2021. Three years later, in 2024, Ethereum restaking has become the talk of the town. You can now maximize your staked ETH to validate and contribute to the operations of decentralized applications (DApps).

The world of cryptocurrency and decentralized finance (DeFi) truly moves at such a rapid pace!

In this article we deep dive into the restaking concept:

In the Ethereum solo staking process, you lock your crypto assets to validate transactions and secure the operations of a blockchain. In return, you earn staking rewards.

While staking activities rely on the amount and duration of crypto assets locked, the actual staked tokens themselves sit idle in the blockchain networks.

Restaking enables you to reuse your staked ETH to support other protocols and earn even more rewards. All this is performed without unstaking the original assets.

The restaking concept allows you to optimize a single pool of staked assets and earn multiple streams of income. Meanwhile, the beneficiary protocols leverage Ethereum's battle-tested and highly secure trust network.

Restaking protocols drive capital efficiency by saving the protocols from having to develop their own consensus mechanism and attract fresh stakers.

In the Ethereum solo staking process, you lock your crypto assets to validate transactions and secure the operations of a blockchain. In return, you earn staking rewards.

While staking activities rely on the amount and duration of crypto assets locked, the actual staked tokens themselves sit idle in the blockchain networks.

Restaking enables you to reuse your staked ETH to support other protocols and earn even more rewards. All this is performed without unstaking the original assets.

The restaking concept allows you to optimize a single pool of staked assets and earn multiple streams of income. Meanwhile, the beneficiary protocols leverage Ethereum's battle-tested and highly secure trust network.

Restaking protocols drive capital efficiency by saving the protocols from having to develop their own consensus mechanism and attract fresh stakers.

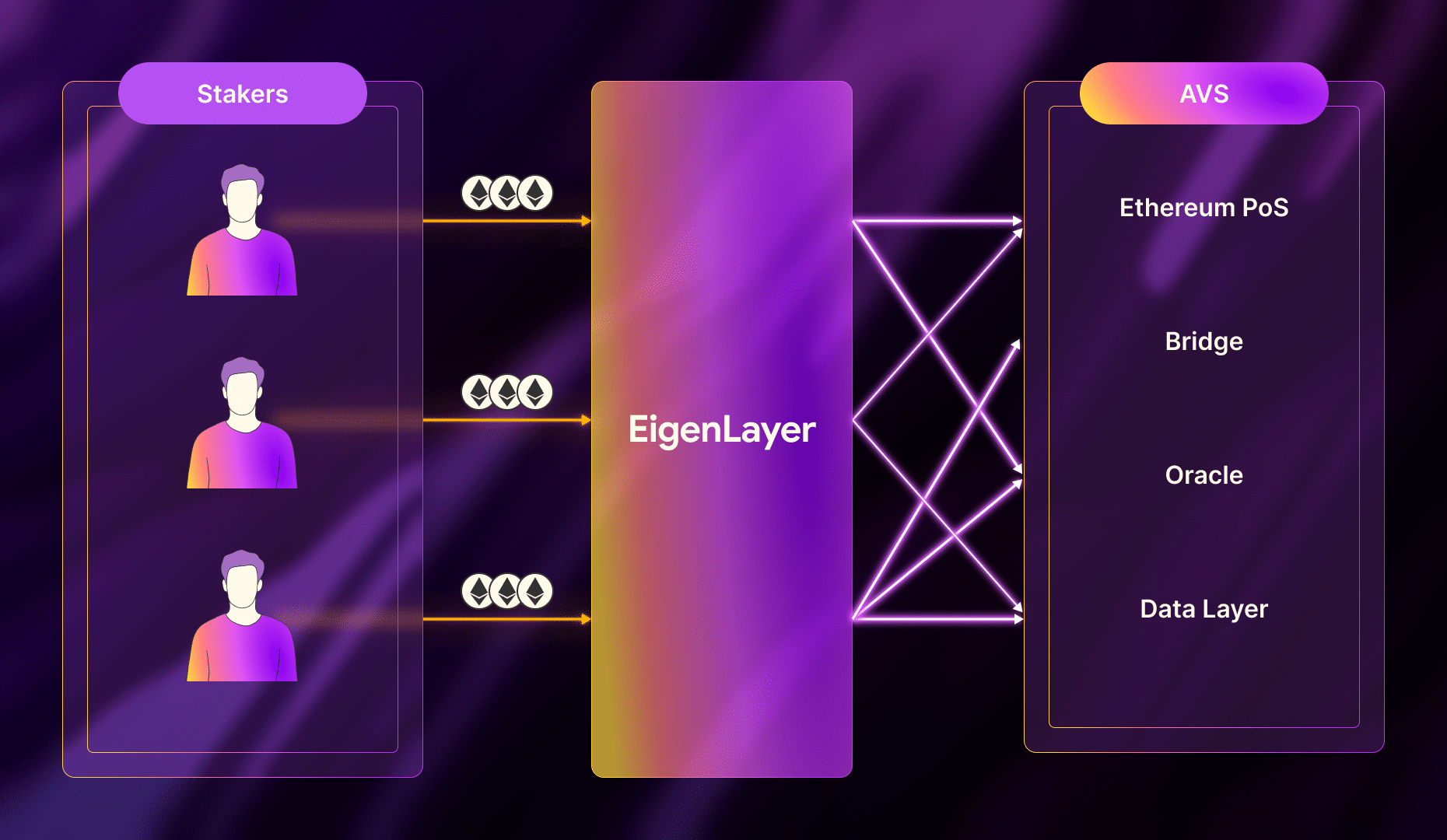

EigenLayer is a decentralized platform designed to enhance Ethereum's security and utility through restaking. The EigenLayer ecosystem allows stakers to reallocate their staked ETH to support AVS and earn additional rewards.

The platform acts as a middle layer, a marketplace that connects ETH stakers to protocols that need capital to operate their trust infrastructure.

Upon engaging with EigenLayer, ETH stakers choose which AVS to support and effectively become validators for those networks. A validator node earns additional staking rewards on top of what it already receives from ETH staking.

Similar to normal staking, validators are subject to checks and balances. Should a validator engage in malicious behavior towards an AVS, the staked assets get penalized through slashing.

EigenLayer is a decentralized platform designed to enhance Ethereum's security and utility through restaking. The EigenLayer ecosystem allows stakers to reallocate their staked ETH to support AVS and earn additional rewards.

The platform acts as a middle layer, a marketplace that connects ETH stakers to protocols that need capital to operate their trust infrastructure.

Upon engaging with EigenLayer, ETH stakers choose which AVS to support and effectively become validators for those networks. A validator node earns additional staking rewards on top of what it already receives from ETH staking.

Similar to normal staking, validators are subject to checks and balances. Should a validator engage in malicious behavior towards an AVS, the staked assets get penalized through slashing.

Consider the diagram. The current staking process is on the left, while restaking is on the right.

Consider the diagram. The current staking process is on the left, while restaking is on the right.

- Ethereum Restaking Definition

- Restaking with EigenLayer

- Restaking Benefits and Risks

- Restaking Options

What is Restaking?

In the Ethereum solo staking process, you lock your crypto assets to validate transactions and secure the operations of a blockchain. In return, you earn staking rewards.

While staking activities rely on the amount and duration of crypto assets locked, the actual staked tokens themselves sit idle in the blockchain networks.

Restaking enables you to reuse your staked ETH to support other protocols and earn even more rewards. All this is performed without unstaking the original assets.

The restaking concept allows you to optimize a single pool of staked assets and earn multiple streams of income. Meanwhile, the beneficiary protocols leverage Ethereum's battle-tested and highly secure trust network.

Restaking protocols drive capital efficiency by saving the protocols from having to develop their own consensus mechanism and attract fresh stakers.

In the Ethereum solo staking process, you lock your crypto assets to validate transactions and secure the operations of a blockchain. In return, you earn staking rewards.

While staking activities rely on the amount and duration of crypto assets locked, the actual staked tokens themselves sit idle in the blockchain networks.

Restaking enables you to reuse your staked ETH to support other protocols and earn even more rewards. All this is performed without unstaking the original assets.

The restaking concept allows you to optimize a single pool of staked assets and earn multiple streams of income. Meanwhile, the beneficiary protocols leverage Ethereum's battle-tested and highly secure trust network.

Restaking protocols drive capital efficiency by saving the protocols from having to develop their own consensus mechanism and attract fresh stakers.

EigenLayer: Restaking on Ethereum

EigenLayer is the first Ethereum restaking protocol and has attracted significant investor interest. Since emerging in early 2023, EigenLayer has grown into the second-largest DeFi platform with close to $19 billion in total value locked (TVL). For reference, Lido Finance, the highly popular liquid staking protocol and largest DeFi platform, has $36 billion TVL. However, it took them 3 years to reach this level.How EigenLayer Works

Before we discuss EigenLayer, let us first define some necessary terms:- DApps: Short for Decentralized Applications. DApps are software programs that run on the blockchain. Lido Finance is an example of a DApp that runs on Ethereum.

- Actively Validated Services: Long form for AVS. Any DApp that has its own distributed consensus mechanism. For example, Chainlink connects off-chain information to the blockchain and maintains its own staking mechanism.

EigenLayer is a decentralized platform designed to enhance Ethereum's security and utility through restaking. The EigenLayer ecosystem allows stakers to reallocate their staked ETH to support AVS and earn additional rewards.

The platform acts as a middle layer, a marketplace that connects ETH stakers to protocols that need capital to operate their trust infrastructure.

Upon engaging with EigenLayer, ETH stakers choose which AVS to support and effectively become validators for those networks. A validator node earns additional staking rewards on top of what it already receives from ETH staking.

Similar to normal staking, validators are subject to checks and balances. Should a validator engage in malicious behavior towards an AVS, the staked assets get penalized through slashing.

EigenLayer is a decentralized platform designed to enhance Ethereum's security and utility through restaking. The EigenLayer ecosystem allows stakers to reallocate their staked ETH to support AVS and earn additional rewards.

The platform acts as a middle layer, a marketplace that connects ETH stakers to protocols that need capital to operate their trust infrastructure.

Upon engaging with EigenLayer, ETH stakers choose which AVS to support and effectively become validators for those networks. A validator node earns additional staking rewards on top of what it already receives from ETH staking.

Similar to normal staking, validators are subject to checks and balances. Should a validator engage in malicious behavior towards an AVS, the staked assets get penalized through slashing.

Restaking Benefits

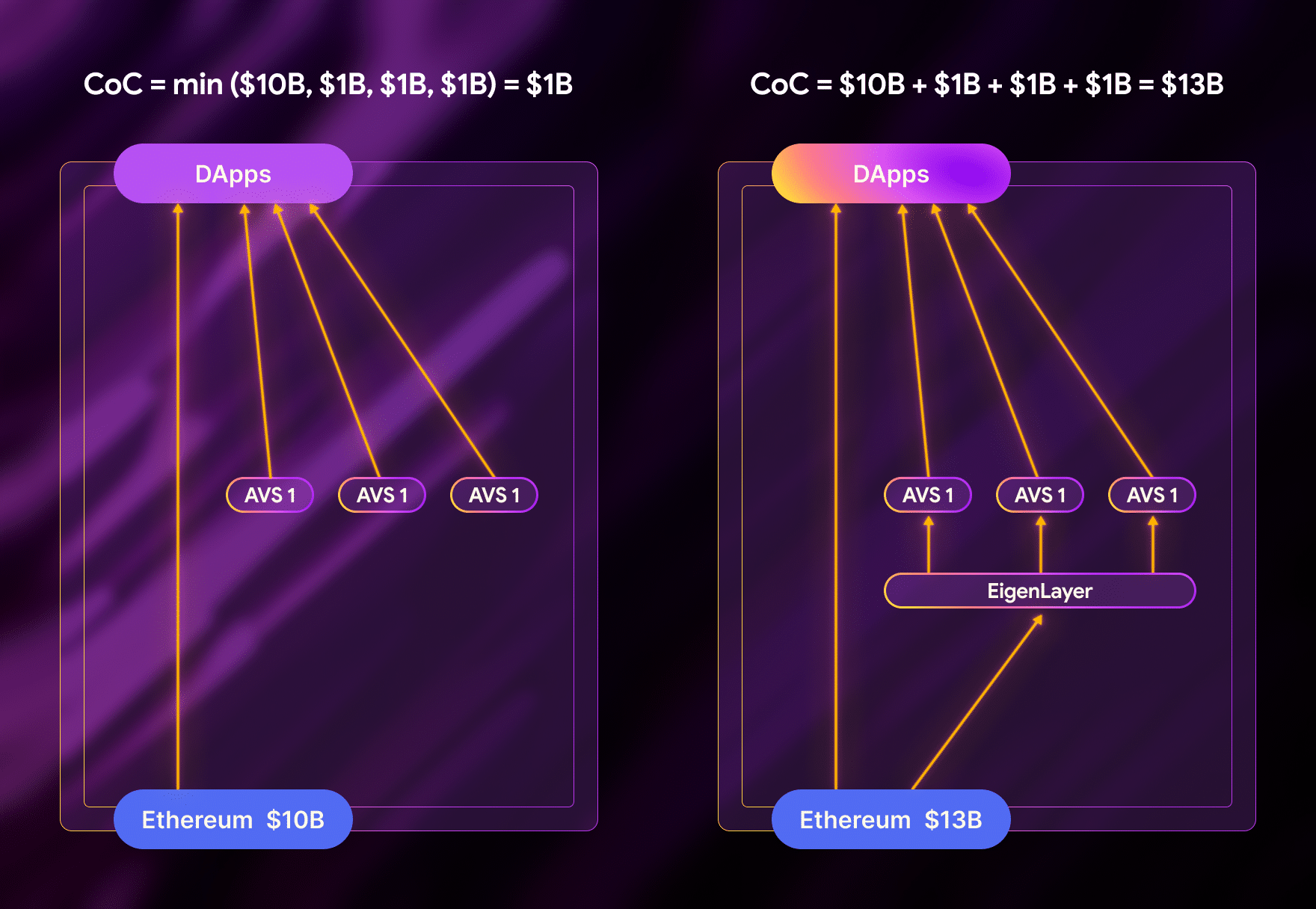

As an Eigenlayer restaker, you earn additional rewards from your staked ETH. For actively validated services, the benefits allow them to scale their operations more efficiently. Consider the diagram. The current staking process is on the left, while restaking is on the right.

Consider the diagram. The current staking process is on the left, while restaking is on the right.

Current Staking

Let’s say Group A, composed of several individuals, has $13 Billion worth of cryptocurrency to invest. $10 Billion worth of ETH gets staked on Ethereum. At the same time, Group A wants to support three DApps by staking on each one of them. The Group splits its remaining $3 Billion in capital and stakes $1 Billion in each AVS AVS would only receive a small share of possible staked assets, and it would have to incentivize demand for more staking activities.Ethereum Restaking

In this scenario, Group A stakes all its $13 billion on the Ethereum network. As it stakes more ETH, it further enhances network security and decentralization. Group A then restakes all $13 billion on EigenLayer. They then allocate this staked amount equally among each AVS, resulting in $4.33 billion each. Now, each AVS receives four times more than in the current staking regime. Platforms like EigenLayer improve the overall crypto industry by allowing protocols to leverage on the trust and security of Ethereum.Types of Restaking

Restaking on EigenLayer can take several forms, allowing millions of individuals across the Ethereum decentralized finance ecosystem to participate. These restaking strategies cater to all kinds of stakers from native staking participants to liquid staking adopters.Native Restaking

Ethereum validators can restake their ETH on EigenLayer by pointing their withdrawal credentials to the platform via the latter’s smart contracts. For example, a solo staker restaking their ETH on EigenLayer.Liquid Restaking

Validators can restake using their liquid staking tokens (LSTs), ETH token representations received from liquid staking protocols. EigenLayer has partnered with several reputable liquid staking players, such as Lido, Rocketpool, and Coinbase.LP Restaking

LP tokens, short for liquidity pool tokens, are what you receive by yield farming and depositing token pairs into a decentralized finance platform. As an example, Curve Finance operates an ETH and stETH pool, with the latter token being the LST of Lido Finance. Validators can either restake the ETH or liquid staking tokens LP on EigenLayer.Potential Risks of Restaking

It’s important to consider that restaking is a highly nascent industry. While the technology has been in development and discussion for a year, most investments and adoptions have taken place just in the past six months. Investors need to consider the unknowns.Compounded Slashing Risk

From a user perspective, slashing represents a major risk of using EigenLayer. Users will be well experienced with this design on Ethereum staking. With restaking, users stand exposed to the slashing conditions of the AVS, amplifying penalties. If a participant attempts to attack the Ethereum network, they risk losing a portion of their stake in a process called “slashing.” A solo staker on Ethereum must stake 32 ETH to qualify as a validator. Slashing automatically reduces the stake by 1/32 or 1 ETH. With restaking, an investor is exposed to the slashing mechanism of the AVS. Let’s say DApp XYZ has a slashing mechanism of 1/32 ETH as well. Now a staker is exposed to 2 ETH of possible penalties.Centralization Risk

Like any large DeFi platform like Lido, EigenLayer carries a centralization risk. ETH stakers might redirect their withdrawal credentials en masse to EigenLayer to chase higher yields. This creates systemic risk for the Ethereum network should EigenLayer be exploited. Ethereum and any AVS adopting EigenLayer would be heavily affected.Wrapping Up

Restaking represents an exciting twist to Ethereum staking by enhancing returns on staked assets. By leveraging platforms like EigenLayer, crypto investors can maximize their rewards without the need to unstake their initial investments. This innovation not only boosts individual gains but also strengthens the overall efficiency and utility of the Ethereum network. While it’s impossible to predict how the restaking technology will progress from here, the initial adoptions and investments signal that it will play a major role in the near future. Curious to learn more about how you can maximize your crypto investments through staking? Check out our other articles on solo staking on the blog.The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

Sign Up To Our Newsletter

Curious about deepening your staking knowledge? Explore related content on Solostakers.com and join our community of enthusiasts. Together, we can shape the future of PoS staking.