Choosing the Right Staking Tool: A Pricing and Features Comparison

In today’s crypto market, staking has thrived with $178.55 billion worth of crypto staked. Users have flocked to the industry to earn passive income and maximize their cryptocurrency.

With such a promising staking future, platforms and products have surfaced to cater to users’ needs. Whether it be through reducing barriers to entry or tracking and optimizing rewards, staking tools can positively impact a user’s experience.

In this article, we will discuss…

- A brief overview of how staking works

- Types of staking tools

- Staking tools comparison

…and more. Time to dive in!

How Staking Works

Staking is a consensus mechanism to verify transactions on a blockchain network. It first emerged as an alternative to cryptocurrency mining, Bitcoin’s consensus mechanism which requires intensive hardware and electricity.

Participants (called stakers) build computer hardware that connects to the blockchain. These hardware (called nodes) contain a copy of the blockchain software and transactions. Once stakers deposit cryptocurrency (called stake), the nodes turn into validators which help verify transactions on the network. In return for their services, stakers receive tokens as rewards.

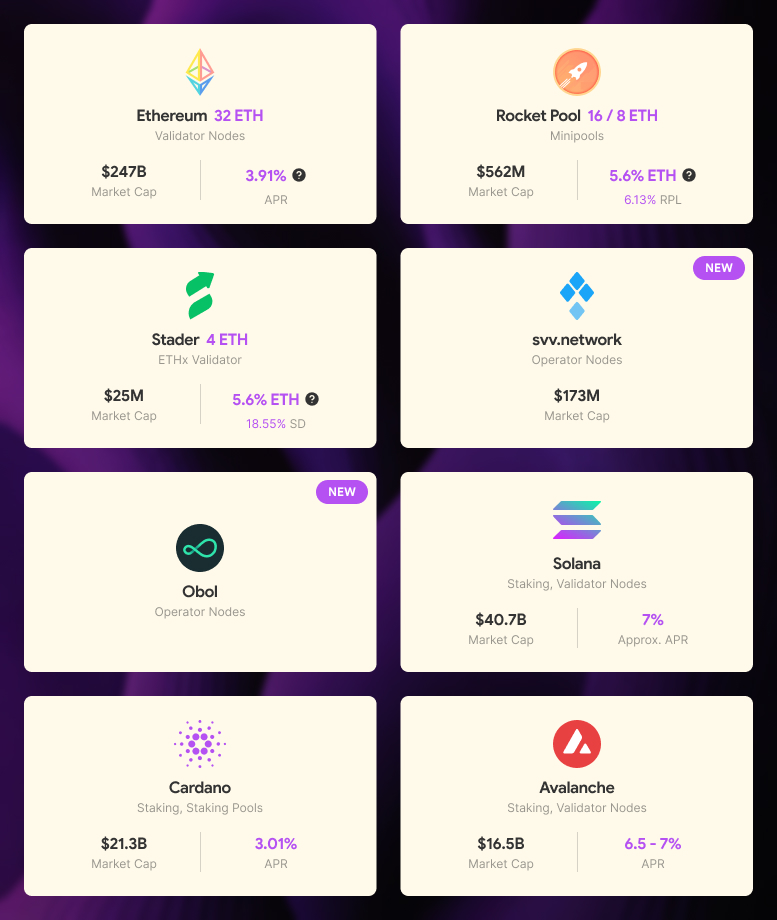

Proof of Stake (PoS) and Decentralized Proof of Stake (DPoS) networks such as Ethereum, Solana, and Cosmos utilize staking consensus mechanisms. The crypto market has come to embrace staking with many networks being built this way.

Beyond being a consensus mechanism, staking provides users with the opportunity to earn a yield on their digital assets. Ethereum staking, the most popular network for staking, offers stakers 3.7% APR (annual percentage rate).

The Different Staking Tools

While staking has become popular, it remains an expensive and highly technical endeavor.

Solo Staking (without relying on third parties) on the Ethereum network, demands users to put up thousands of dollars in equipment and stake 32ETH ($72,000 as of writing). Compounding the coding and technical knowledge to install the network software, solo staking can be too daunting for the majority of the crypto market.

Developers have created staking tools to solve these key issues.

Virtual Machine Providers (VM)

Stakers can opt to build and run a node and validators as solo stakers. But this process requires a lengthy technical process of assembling hardware, downloading blockchain software, and inputting code.

Participants can instead engage a professional virtual machine provider and off-load the technical work.

- Allnodes – one of the more popular providers, Allnodes caters to stakers with its cloud staking solutions. Customers may choose staking or node hosting services under Allnodes monthly subscriptions. The company offers its Bitcoin node at $100 per month.

- Blockdaemon – with over $207 million in funding, the company provides a suite of blockchain infrastructure tools. Blockdaemon provides cloud-based node infrastructure where clients can relax on the challenges of node management. Furthermore, the company offers white-label solutions for corporate clients.

- Figment.io – the company supplies comprehensive staking services to over 250 institutional clients, counting Robinhood, Binance, and Bitgo, amongst its partners.It’s white-label validator service allows institutions to market the validators as their own.

Virtual Machine Benefits

Aside from offloading technical requirements from users, VM providers offer a wide range of benefits.

Customer Service

The crypto market has promoted decentralization, having no intermediaries and central authority governing processes. Instead, smart contracts (self-executing code) run operations. However, this poses a challenge when it comes to troubleshooting.

A VM provider possesses dedicated customer service teams. Users can email the platform for assistance.

Safety & Security

Professional VMs service retail users and institutional clients such as cryptocurrency exchanges. As such, they’re subject to strict security audits and standards.

For example, Allnodes works with major enterprise clients like OKX and Crypto.com. The former possesses top-notch security.

Cloud Hosting Services

For those looking to set up their own validator, they will encounter the challenges of running their validator node 24/7. Aside from power redundancy, stakers consume over 2TB of internet per month.

Given the heavy requirements, stakers may choose to run a node from a personal cloud hosting account. Make sure to stick to the well-known ones for best service.

- Amazon Web Service Marketplace – called Launchnodes, AWS guarantees 100% uptime for this service for the Ethereum client. The product is perfect for solo stakers who want to run a validator node. Pricing is quite friendly at $240 per year.

- Google Cloud – available either thru API or through the cloud console, Google offers a Blockchain Node Engine. It takes about 30 minutes to create a blockchain node, though achieving a full sync with the network can take hours.

Cloud Hosting Benefits

Cloud hosting brings a wide range of benefits. No wonder that ~ 50% of all nodes operate through a cloud hosting service. Here’s a short list of what cloud hosting can do for stakers:

Affordability

Because cloud hosting services charge monthly subscriptions, solo stakers can reduce their initial costs. They can skip the setup costs, deposits, and lock-up periods of building an on-premise operation.

Guaranteed Up-time

When validators go off-line, stakers run the risk of having their cryptocurrency deposit slashed. This penalization incentives operators to have their staking operation running full time. For users that live in areas with unstable connections, a cloud hosting service guarantees 100% up-time.

Dashboards for Node and Validator Monitoring

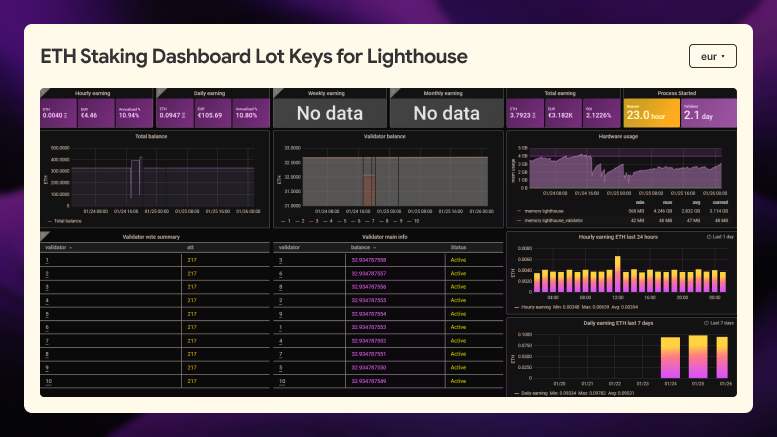

For stakers determined to pursue solo staking, they will have to monitor the performance of their validators. This could range from tracking users’ rewards and earnings to measuring electrical consumption and infrastructure runtime.

Online and open-source tools offer users with dashboards to monitor almost everything about their validators.

With dashboards, users can see the financial performance of their staked tokens:

- Total crypto balance

- Annual rewards rate

- Claimed rewards and,

- Hardware usage

Open-source dashboards also come with bots that automatically message users across Telegram and Discord. With these tools, users are kept up to date with their investments.

Dashboard Benefits

If users are aiming to run their staking operations as a business, then a platform for measuring performance is key. Users need to see how their validator performs in order to maximize their earnings.

Dashboards feed users with essential data to run their staking operations:

Multi-Validator Monitoring

Multiple validators can become increasingly difficult to track. Users can link their validators together to see an overview of their staking operations. Financial dashboards show total earnings over various time periods as well as hardware usage statistics.

Real-time Alerts

Dashboards also act as a network operations center. Through various integrations with messaging platforms, stakers can get real-time updates on their staking operations. This becomes helpful especially when nodes and validators go offline. Users can act quickly to remediate the situation.

Conclusion

Staking continues to play an integral part in crypto market operations and doesn’t seem to be slowing down any time soon. It’s important for investors and stakers alike to equip themselves with the right tools to maximize these staking opportunities in the market.

Whether it’s to reduce capital entry requirements or data analytics to keep track of validators, stakers can find numerous platforms and offerings.

Keep up to date with the various happenings in the crypto market with Solo Stakers!

At the very least, reflect on your personal risk tolerance.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

March 11, 2024

July 3, 2025