What is NFT Staking and How to Earn Passive Income From NFTs?

Non-fungible tokens (NFTs) are digital assets that use blockchain technology to represent ownership or authenticity of items. They are indivisible and distinguishable (hence termed non-fungible) and commonly used for digital art, music, virtual collectibles, and more.

NFTs have gained popularity in recent years, allowing direct transactions between creators and collectors.

With the industry’s constant innovation, NFT collections have also supported staking. NFT holders can stake an NFT and earn passive income or other exclusive rewards.

Here’s a short guide on how NFT staking works.

What is NFT Staking?

NFT staking refers to using non-fungible tokens (NFTs) to participate in a staking mechanism. NFT collectors lock their digital assets on an NFT staking platform and earn rewards through crypto tokens and physical merchandise.

While NFT staking also uses staking terminology, it should not be confused with cryptocurrency staking, such as Proof of Stake (POS) or Decentralized Proof of Stake (DPoS). Crypto staking is a consensus mechanism for verifying transactions on a blockchain network, supporting its operations and security.

NFT collections engage in staking to encourage NFT holders to delist their NFTs from marketplaces. With less asset supply and fewer people selling NFTs, projects can support a higher floor price (lowest listed price). At the same time, NFT holders stake NFTs to earn rewards.

The staking period determines the amount of rewards in both NFT staking and staking cryptocurrencies.

NFT Collections Available for Staking

NFT staking is a recent development; only some NFT projects support the technology. Here’s a short list of the more popular staking NFTs.

Blastopians NFT Staking

The Blastopians NFT collection, comprising 5,000-pixel art pieces, aims to represent Polygon and Blast. It was one of the first artworks launched on Blast, Blur’s Layer-2 network.

Blastopians offer an NFT staking experience tied to the Blast airdrop. Through the Blastopians website, a holder can connect their wallet and deposit their Blastopians NFT into the smart contract.

Each staked NFT earns points as a measure of your contribution to the Blastopian and Blur community. Like crypto staking, the more NFTs staked and the longer the duration, the higher the points.

On a bi-weekly basis, stakers receive Blast Gold.

Aside from earning Blast Gold, holders also earn Wasabi Points from Wasabi Protocol, an upcoming platform on Blast.

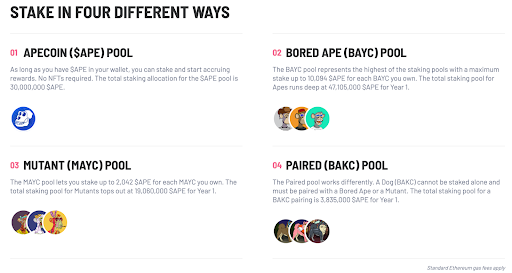

ApeCoin Staking Platform

Apecoin is the native token of Yuga Labs, a metaverse company behind big names like Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Cryptopunks. Initially an airdrop to various Yuga Labs NFTs holders, the cryptocurrency aims to be the ecosystem token for all things tied to the Yugaverse (Yuga Labs ecosystem).

While anyone possessing Apecoin can earn tokens and rewards for staking, holding an NFT gives access to higher rewards.

Currently, Apecoin staking yields over 15% annual percentage yield (APY). Meanwhile, holding 1 Bored Ape Yacht Club yields 64% APY subject to a cap of 10,094 Apecoins per BAYC. These staked NFTs have been efficient in removing supply from the market. According to NFT marketplace Blur, holders have listed only 286 NFTs or 2.86% of the total supply.

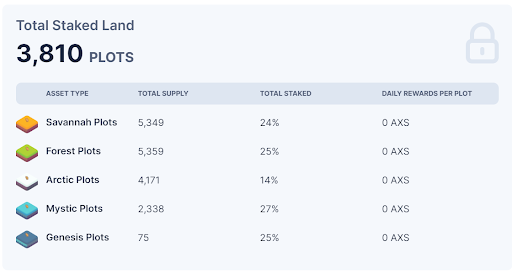

Axie Land NFT Staking

Axie Infinity: Homeland, inspired by the highly popular Axie Infinity card-based battler, launched its alpha gameplay last December 2022. Players design and decorate their Axie land NFTs. In the future, the players will use the land to trade and craft in-game items.

Lunacia, the home of the Axies, is divided into 90,601 tokenized assets. Players and collectors can easily trade these digital assets.

Previously, the game encouraged owners to stake NFTs. Owners then earn Axie Infinity Shards (AXS), the game’s ecosystem token. The tokenized land carries rarity classes, and the higher the tier, the higher the staking reward APY.

Currently, the Axie Infinity team has paused land staking as rewards have been transferred to the new Axie Infinity game called Homeland.

NFT Staking Platforms

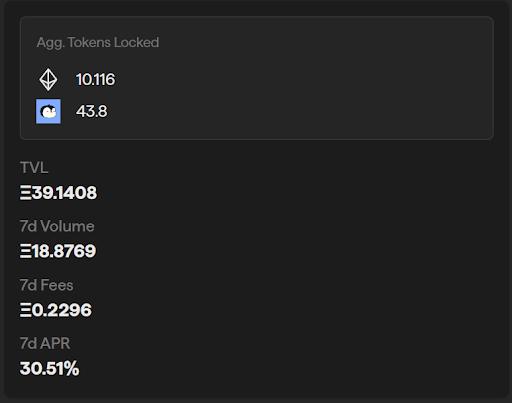

Aside from individual NFT collections and blockchain games that host staking, a handful of platforms also provide NFT staking.

NFTX.io is an NFT staking platform for making cryptocurrencies backed by NFT projects. Users deposit their NFTs into the platform vault and receive an ERC20 (Ethereum-based) token in return. The token represents their claim on an asset inside the vault. This staking functionality works similarly to a Liquid Staking platform.

Users can deposit these tokens into the platform’s staking pools and earn rewards.

NFTX.io supports over a dozen NFTs, from famous Yuga Labs NFTs to smaller NFT collections. Note that platform liquidity may be on the smaller side of decentralized finance (DeFi). Regarding total value locked, the platform holds less than $15 million.

How Much Does It Cost to Stake an NFT?

While most NFT staking platforms and projects provide the service for free, users must have the required NFT and enough cryptocurrency to pay the gas fee (network transaction fee).

A Blastopian NFT costs around $100 while. Meanwhile, network transaction fees can range from $5 to $20, depending on the blockchain network.

Risks Associated with Staking NFTs

While NFT staking presents massive opportunities to generate passive income and earn rewards, it remains a relatively new technology. The potential risks associated with NFT staking mirror those of crypto staking and the overall cryptocurrency industry.

NFT’s High Volatility

The use cases for NFTs at the moment are minimal. The NFT market is highly speculative.

NFT staking requires a user to deposit their NFT for a specific period for the potential to earn passive income and rewards. Should the NFT lose value in this time frame, a holder will experience high capital losses, which will most likely outweigh the staking rewards.

Unregulated Industry

It is common for NFT projects and NFT platforms to either disappear overnight or slowly fail to deliver on rewards (also called a slow rug).

Unlike the broader cryptocurrency industry, which governments have begun to regulate, the NFT market is unregulated. Many malicious actors prowl this space as little stands in the way of their negative behavior.

Is Staking NFTs Worth It?

NFT investors can earn rewards with NFT Staking. Rather than idly park your assets on a decentralized wallet, you can stake your NFTs. However, please remember that NFT staking holds risks as the space remains unregulated.

At the time of this writing, NFT prices have fallen to all-time lows. As such, the potential capital losses more than outweigh the staking rewards. Similarly, NFT founders and developers may quickly abandon their projects, passing on the burden to the community.

Perform due diligence on the NFT and staking platform before depositing money to purchase these digital assets.

Editor’s Note: This article was originally published in February 2024 but has been updated with new information

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

June 25, 2024

September 13, 2024