Diversify and Earn: Understanding Multi-Asset Staking in the Crypto Market

Crypto investors have witnessed the evolution of staking and decentralized finance (DeFi). Now, there’s a new player in town – Multi-Asset Staking (MAS).

Unlike traditional staking, MAS involves staking one digital asset and receiving rewards in another. Participants diversify their assets and get early access to new tokens.

With this growing new DeFi sector, it’s time for a discussion on understanding multi-asset staking in the crypto market.

What is Multi-Asset Staking?

Picture MAS as placing your money in a U.S. Dollar savings or time deposit account. However, instead of receiving U.S. Dollars in interest, you receive another currency such as the Euro in return.

If this sounds foreign to you, that’s because this concept is quite new. It belongs as a subset of the bigger DeFi industry.

How Does Multi-Asset Staking Work?

A user deposits crypto asset X but receives rewards in cryptocurrency Y, which gives it the multi-asset terminology.

MAS works as a DeFi protocol offering. In some instances, DeFi protocols offer multi-asset rewards as incentives for using their new platforms. Some new protocol tokens can only be received through early user incentives.

How Does Multi-Asset Staking Differ From Regular Staking?

While the staking term is involved, MAS should not be confused with regular staking.

Staking supports the infrastructure, operations, and security of the blockchain as a form of consensus mechanism.

The staker connects to the network, deposits the required crypto, and validates transactions. In return, the staker receives crypto rewards in the staked protocol’s native token, determined by the amount and duration of the tokens staked.

Large blockchain networks such as Ethereum and Solana utilize staking consensus mechanisms such as Proof of Stake (PoS) and Delegated Proof of Stake (DPoS). Meanwhile, DeFi protocols offer MAS as a way for crypto investors to earn passive income.

Benefits of Multi-Asset Staking for Crypto Investors

While multi-asset staking has yet to take off as a major DeFi activity, interested parties should consider it in their staking strategies.

Investors can capitalize on varying staking rewards, optimizing the overall return on investment. Furthermore, MAS contributes to a more resilient and balanced investment portfolio.

Diversification

MAS diversifies peoples’ cryptocurrency portfolios by offering varied digital assets.

A well-diversified portfolio can protect parties from loss by spreading the investment across different assets. Furthermore, investors can capture returns from exposure to the volatility of multiple cryptocurrencies.

Early Access

Crypto participants can get first in line on new protocol tokens and participate in governance activities. This provides access to new tokens during staking incentive campaigns.

Maximize Staking Rewards

Users can earn outsized returns especially if the rewards are of newer tokens.

Jito Network, the largest liquid staking platform for Solana (SOL), offered their native token JTO for those who staked SOL on their platform. Thus, users received multiple crypto assets in SOL and JTO tokens.

As a promising token, JTO has a high potential to list on major crypto exchanges. Users who have earned JTO could experience significant returns as token interest increases with exchange listing.

Recommended platforms or tools for multi-asset staking

Crypto players must choose the right platform to maximize their investments. Many multi-asset staking pools are new and don’t have the same security as larger DeFi platforms such as Lido Finance or Rocket Pool.

Yieldy Finance, once a popular MAS platform on the Algorand network, folded after the DeFi peak in 2021-2022. If investors are not careful, they can suffer similar losses on their funds.

With sufficient due diligence, however, there could be investment opportunities that participants can take advantage of.

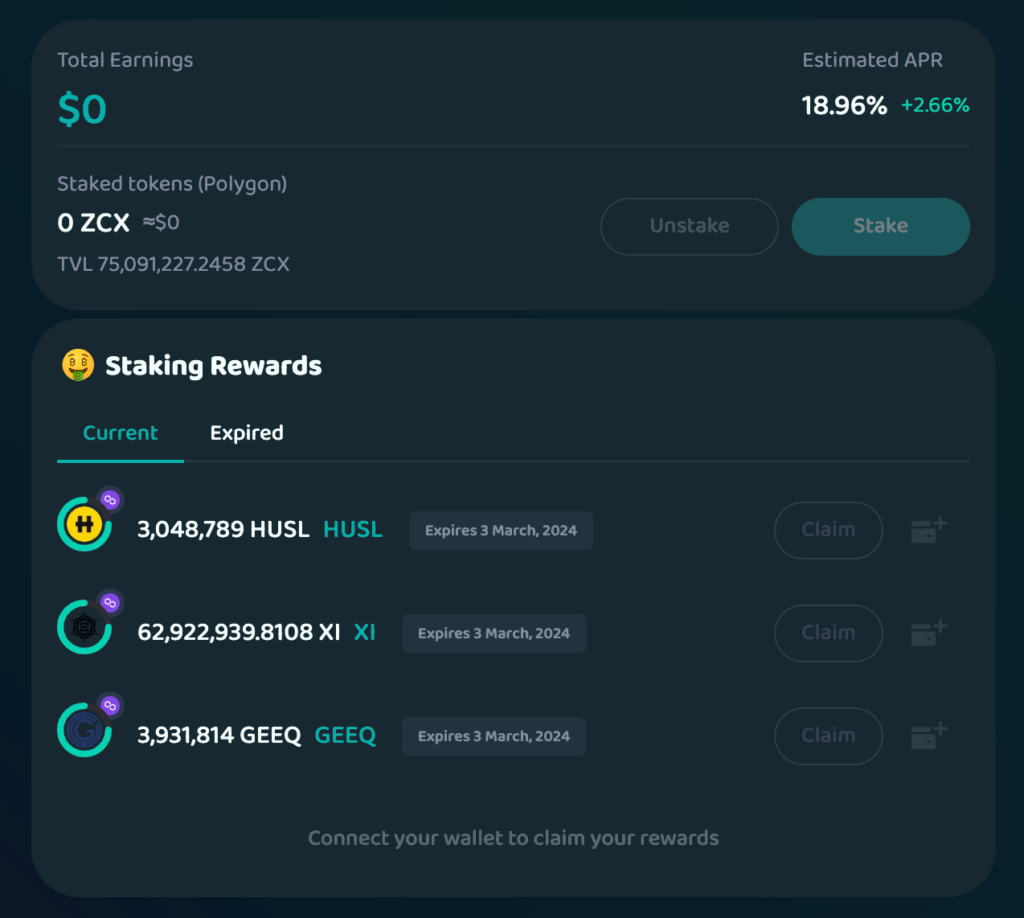

- Unizen – a custom-built, cross-chain-enabled decentralized exchange aggregator. Users can access other blockchains without going through bridges and illiquid exchanges.

The protocol offers ZCX staking (its native token) with multi-asset rewards. Investors earn rewards on new projects such as The Husl, Xi Token, and Geeq. Estimated returns reach over 18% per annum.

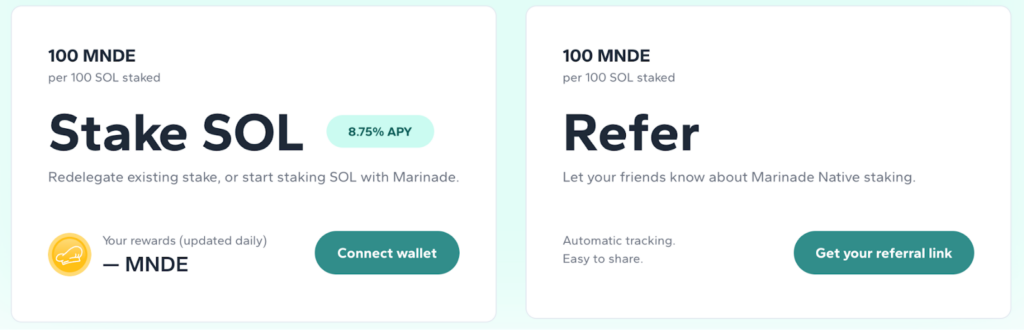

- Marinade Finance – a Solana-based liquid staking protocol. The platform monitors all Solana validators and delegates votes to the 100+ best-performing ones. Users have locked over $600 million worth of Solana tokens on the platform.

As an incentive campaign, stakers may also stake SOL for MNDE and earn the platform’s native token. Participants will earn 8.75% p.a. on the SOL/MNDE staking pool which is higher than the 8.71% offered on Marinade’s SOL native staking program.

- Mantra (previously Mantra Dao) – a vertically integrated blockchain ecosystem. Mantra products include Nodes, an infrastructure-as-a-service business that includes retail staking, institutional delegation, and node management. Mantra also has Mantra Finance, a DeFi platform.

Through its Vault product, Mantra Finance gives users exposure to multiple cryptos such as Polkadot, Kusama, and Near. Stakers deposit USDC into the platform which automatically converts these into the stated cryptocurrencies. At the end of the maturity, stakers receive back their USDC deposit plus USDC staking rewards. Note that this is not a capital-guaranteed venture. Should the value of the digital assets go down, a user shall receive less USDC in return.

Multi-Asset Statistics Guide 2023

Growth of multi-asset staking adoption in the past year

After suffering from the fall of Terra Luna in May 2022, the DeFi space hit a low of $46 billion in total value locked (TVL). As of writing, players have stepped in and grown the TVL to $77 billion.

While still a long way from its high of $189 billion in November 2021, The DeFi industry looks poised to recapture its previous glory days. Promising sectors such as liquid staking are leading the charge.

Meanwhile, multi-asset staking continues to remain a small part of the DeFi sector. Popular DeFi tracking tools such as DefiLlama have yet to track the sub-sector in isolation.

Should MAS gain more traction, the sector will be covered by more DeFi tracking platforms.

Staking rewards between single-asset and multi-asset staking strategies

Investors may find difficulty comparing rewards between single-asset and multi-asset staking.

While the estimated annual percentage yields (APY) are shown front and center, the rewards’ capital growth potential can interfere with the returns.

Going back to Marinade Finance as an example. Staking with MNDE rewards (8.75% p.a.) offers similar returns to single-asset staking with SOL rewards (8.71% p.a.). However, the capital appreciation of MNDE and SOL is nowhere close.

Since October 2023, the price of MNDE has outperformed SOL 1.5x. Thus, an investor on the SOL/MNDE staking pool would have earned much more than the stated annual returns. The converse applies. In a downmarket, smaller tokens tend to decline more leading to smaller returns on a multi-asset pairing.

Predictions for the future of multi-asset staking

It’s difficult to predict anything beyond 6 months in the crypto markets. In 2023 alone, regulatory bodies have turned against major crypto participants, dampening sentiment.

However, bright spots exist especially in the DeFi space. For example, liquid staking displays huge growth potential. An estimated $27 Billion is deposited in liquid staking protocols and the industry now accounts for 37% of the total value locked in DeFi.

Liquid staking is primarily centered on the Ethereum (ETH) network. It is not difficult to imagine a multi-asset staking protocol where ETH is staked and the rewards are another cryptocurrency.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

December 13, 2023

June 30, 2025