Staking Finance: How to Maximize Returns from Staking

Crypto staking offers investors a pathway to engage with decentralized finance (DeFi) and enhances returns on their cryptocurrency assets.

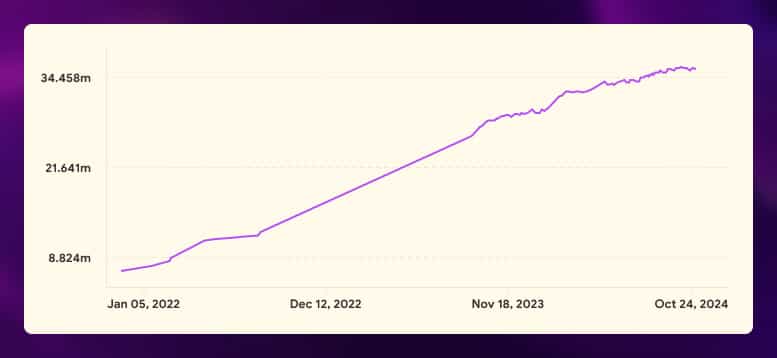

From barely any adoption in late 2018, staking has grown into a multibillion-dollar industry.

Large blockchains like Ethereum have seen their staked assets reach nearly $100 billion.

With the continued rising popularity of staking, this begs the question, how can stakers maximize these opportunities further?

This guide explores principles and strategies for maximizing returns from staking activities.

What Is Staking Finance?

Staking finance refers to how staking participants maximize their returns from staking.

Staking involves two sets of cryptocurrencies:

- Staked assets – the cryptocurrency deposited into a blockchain. Depending on the staking mechanism, platform, and blockchain network, it can be a minimal or large amount (over $50,000).

- Staking rewards – a percentage of cryptocurrency earned based on the staked digital assets. Large blockchain networks such as Solana, Sui, and Ethereum provide 3% to 7% per annum returns.

Cryptocurrency investors can boost returns by optimizing the initial investment and interest earned from staking cryptocurrencies.

The Crypto Staking Process

Staking refers to participating in the staking consensus algorithm for blockchain networks.

Popular staking consensus algorithms, such as Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS), rely on a staked (deposited) amount of cryptocurrency to validate transactions on the blockchain network.

Depending on the chosen staking consensus mechanism, a staker may have to set up computer hardware and run the necessary blockchain software (called solo staking). They connect to the network, deposit the required crypto, and validate transactions.

The staker receives crypto rewards, determined by the amount and duration of the coins staked.

The Role of Staking in the Cryptocurrency Ecosystem

Staking first gained popularity as an alternative to Proof-of-Work (mining) mechanisms to verify transactions on the network.

PoW requires significant hardware investment and electricity consumption. Mining operations have also fallen into the hands of a few players, defeating blockchain decentralization.

Beyond consensus mechanisms, staking has evolved and inspired a new range of use cases and innovation.

Passive Income Opportunities

Staking enables investors to earn passive income on their crypto holdings.

Without staking, investors would hold digital assets in their wallets or accounts with centralized cryptocurrency exchanges. This is fine in a bull market, where crypto prices can rise multiple times. However, inflation rates would eat into their investments in periods of price stability or decline.

As of this writing, Ethereum staking (the second-largest blockchain network by market capitalization) yields 3.1% p.a., which helps counter inflation.

Staking Platforms and Innovation

Only some people have the technical knowledge or staking capital required for solo staking. Developers have tackled these staking issues head-on and innovated various solutions:

- Liquid Staking: Stakers receive liquid staking tokens (LSTs), equivalent to their staking capital. The LSTs may be used on other protocols for trading or generating yield even further. Liquid staking removes barriers to entry for both staking hardware and capital requirements.

- Staking as a Service (SaaS): Staking wherein an intermediary handles the hardware and software requirements of staking. Meanwhile, an investor provides the required staked assets.

- Staking Pools: Users combine their funds with other staking participants. The staking platform operator manages the pool and maintains the hardware and software. Users receive staking rewards based on the amount and duration staked within the pool.

Increased Capital

Many staking platforms belong to the DeFi industry. This rising new sector has attracted fresh capital and interest.

In Q3 2023, the DeFi industry received $210 million in investor capital, defying the overall slump in cryptocurrency investments. A steady influx of capital inspires innovation, businesses, and, ultimately, more work opportunities.

Staking Strategies to Maximize Returns

Because of the amount of capital involved in crypto staking, participants constantly search for ways to maximize the staked funds and staking rewards.

Stakers look for yield optimization methods or ways to diversify and protect their investments.

1. Choose the Right Cryptocurrency

Staking involves three main financial components: 1) hardware, 2) staked assets, and 3) staking rewards.

While hardware costs are roughly the same across blockchain networks, the performance of staked funds varies widely between networks.

Staking returns depend mainly on the chosen cryptocurrency’s price growth and the staking mechanism’s annual percentage yield (APY).

Consider two cryptocurrencies, X and Y, both with a price of $100 per token.

Crypto X staking returns 20% p.a., while Crypto Y staking provides 3% p.a.

A staker may think that crypto X earns 6x more than crypto Y and chooses to stake in the former. After a year, crypto X has fallen to $5 per token while crypto Y has increased to $110.

20% interest earned on an asset that has fallen 95% is a considerable loss.

Unfortunately, these scenarios happen often in the crypto industry. At DeFi’s height in 2021, new crypto projects offered insane returns of over 100%, many of which are no longer around.

2. Take Advantage of Compound Interest

A staker can redeploy their staking rewards to increase their returns. This is the mathematical concept of compounding.

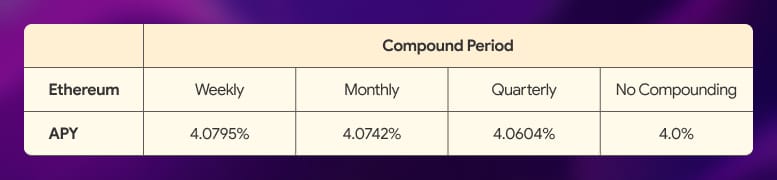

Here’s the effect of compounding on Ethereum stakings’ annual percentage yield (APY):

The more frequently earned rewards are compounded, the higher the APY.

While the differences appear small, they have a significant impact on large crypto portfolios. Remember, high-net-worth individuals (HNWIs) and institutional investors would be staking millions of U.S. dollars.

3. Diversify Staking Portfolio

Crypto prices can go to zero, resulting in a complete capital loss for stakers. It makes sense for individuals to divide capital across several cryptocurrencies.

Stakers can utilize various crypto-staking methods, such as liquid staking and staking pools, to achieve diversification. Staking platforms often require minimal staked assets.

Staking on Ethereum, specifically solo staking, requires hardware that costs $1,000 upwards and 32ETH capital staked (over $60,000 as of writing).

Instead of deploying $60,000 on a single cryptocurrency, a staker can use liquid staking on Lido Finance. Investors can stake on Lido Finance with no minimum amount, allowing staking across other cryptocurrencies such as Polygon.

Frequently Asked Questions (FAQs) on Staking

1. How much can I earn from staking?

It’s difficult to tell what the value of a crypto portfolio will be a year from now as it depends on several factors, such as market conditions. However, an investor can earn staking rewards with a generally known APY.

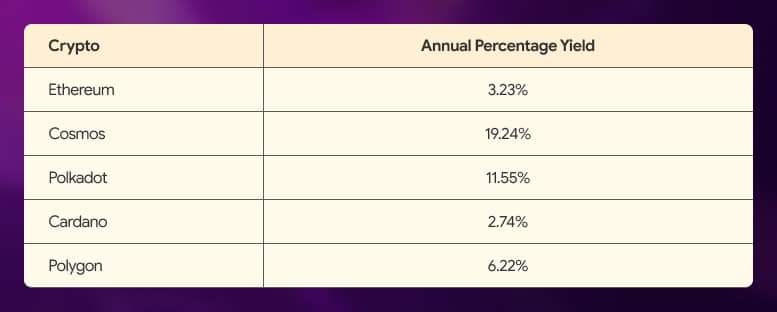

APY obtained from Staking Rewards as of October 24, 2024

Investors can earn varied passive income rates depending on the blockchain network.

2. Is staking safe?

Cryptocurrency investors can make informed decisions before engaging in staking options.

- Proven Track Record: Note the development team’s track records for the DeFi staking platforms and the blockchain network. Research the investors backing the team and network security.

- Risks Involved: Staking crypto has risks. From capital loss due to malicious actors stealing the staked assets to volatile crypto markets. Make sure to evaluate these risks.

- Diversification: By allocating across various cryptocurrencies and DeFi staking platforms, an investor mitigates the risk of losing all of his or her capital when the crypto or platform goes under.

The word safe is highly relative to the risk-taker. What one investor considers a safe investment may be high risk for another. Make sure to do due diligence before investing.

3. How do I start staking?

In general, research the blockchain network on which you will stake. This determines many things, from the capital required to the staking consensus mechanisms involved.

Make sure to check out our staking guides.

4. Can I unstake my assets at any time?

Termed unbonding period, unstaking time is highly dependent on the blockchain network, staking platform, and staking method used.

Blockchains utilize staked assets for their security and network operations. Unstaked assets must be processed.

Networks such as Solana and Near take 48 hours to unbond, while Polkadot and Cosmos take 3 to 4 weeks.

Staking is the Future

Less than 10% of the cryptocurrency market value is involved in staking and DeFi activities. There is enormous growth potential.

Over the years, more participants will invest in digital assets, from everyday mom-and-pop investors to institutional funds managing others’ money.

Rather than let their crypto assets sit idly, staking allows them to earn passive income.

Staking only gets better from here.

Editor’s Note: This article was originally published in December 2023 but has been updated with new information.

The content of solostakers.com is for informational purposes only and should not be considered financial advice. It represents the personal views and opinions of the author(s) and is not endorsed by any financial institution or regulatory body. Cryptocurrency and staking investments carry inherent risks and readers should conduct their own research and consult with a financial professional before making any investment decisions. The owner and author(s) of solostakers.com will not be liable for any losses, damages, or consequences arising from the use of the information on this site. By accessing solostakers.com, you agree to bear full responsibility for your investment decisions.

October 24, 2024

August 4, 2025